Liquidation

Bitcoin price can’t find its footing, but BTC fundamentals inspire confidence in traders

Bitcoin’s (BTC) sudden crash on Jan. 10 caused the price to trade below $40,000 for the first time in 110 days and this was a wake-up call to leveraged traders. $1.9 billion worth of long (buy) futures contracts were liquidated that week, causing the morale among traders to plunge. The crypto “Fear & Greed” index, which ranges from 0 “extreme fear” to 100 “greed” reached 10 on Jan. 10, the lowest level it has been since the Mar. 2020 crash. The indicator measures traders’ sentiment using historical volatility, market momentum, volume, Bitcoin dominance and social media. As usual, the panic turned out to be a buying opportunity because the total crypto market capitalization rose by 13.5%, going from a $1.85 trillion bottom to $2.1 trillion in le...

Data suggests traders view $46,000 as Bitcoin’s final line in the sand

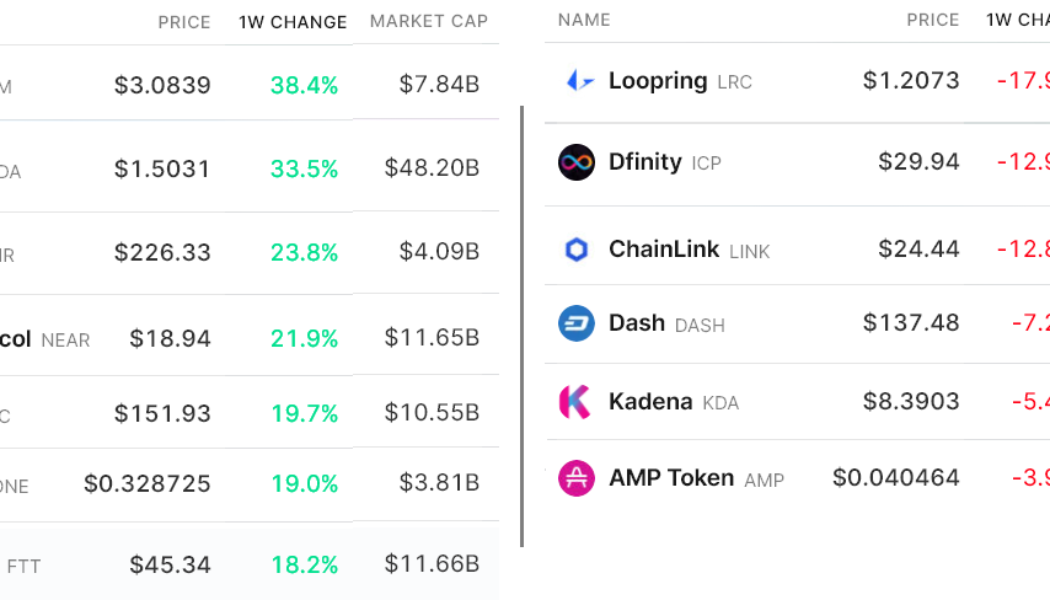

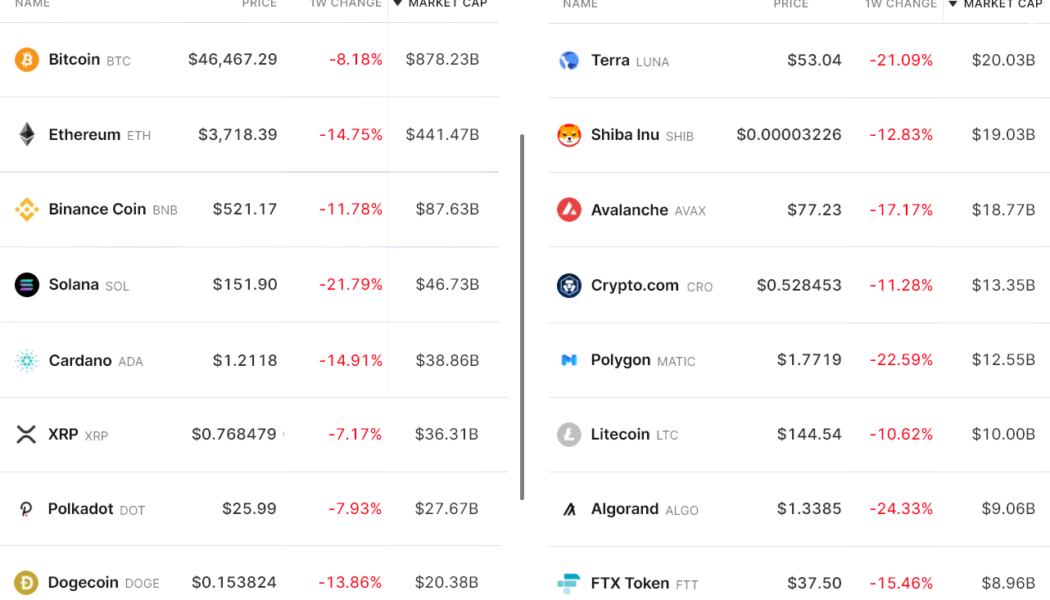

Dec. 13 will likely be remembered as a “bloody Monday” after Bitcoin (BTC) price lost the $47,000 support, and altcoin prices dropped by as much as 25% within a matter of moments. When the move occurred, analysts quickly reasoned that Bitcoin’s 8.5% correction was directly connected to the Federal Open Market Committee (FOMC) meeting, which starts on Dec. 15. Investors are afraid that the Federal Reserve will eventually start tapering, which simply put, is a reduction of the Federal Reserve’s bond repurchasing program. The logic is that a revision of the current monetary policy would negatively impact riskier assets. While there’s no way to ascertain such a hypothesis, Bitcoin had a 67% year-to-date gain until Dec. 12. Therefore, it makes sense for investors to pocket those profits a...

Norwegian Air furloughs staff, pleads for help to survive in 2021

Norwegian Air’s cash crisis could force the debt-laden budget airline to halt operations early next year, the company warned as it issued another plea for rescue funding after reporting quarterly results on Tuesday. The rapid expansion of the pioneer in low-fare transatlantic flights has left it with heavy debts and problems that have been compounded by the COVID-19 pandemic. It is now serving domestic routes only, with just six of its 140 aircraft flying. “Norwegian is dependent on additional working capital in order to continue operating through the first quarter of 2021 and beyond,” the carrier said. The company held cash and cash equivalents of 3.4 billion kroner ($380m) at the end of September, down from 4.98 billion kroner ($550m) three months earlier. Its latest plea comes after Nor...

- 1

- 2