M-PESA Kenya

The Role of Mobile Money in Kenya’s Tech Surge

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Minors Won’t Get Access to Loan Services in M-Pesa Junior Accounts

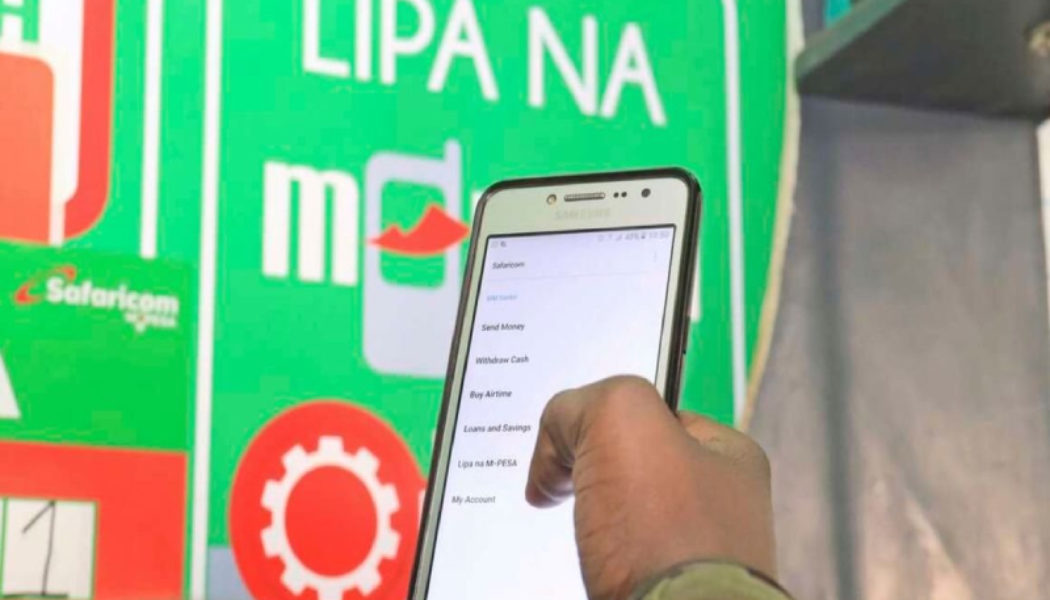

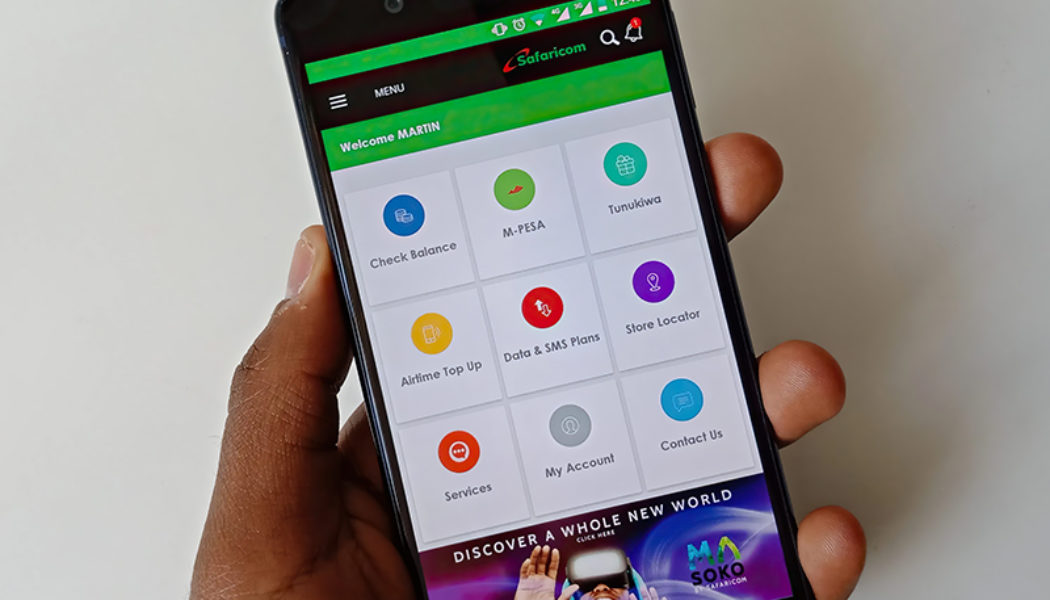

Image sourced from Kansas Discovery. Safaricom, a telecommunications provider in Kenya, confirmed that minors will not get access to loan services like M-Shwari and Fuliza. The Kenyan telco announced on Friday that it is introducing M-PESA Junior Accounts for individuals between the age of 10 and 18 years old. The company said that the minors will have access to the network via SIM cards registered under their guardians or parents. “We plan to soon launch an M-PESA Junior Product for our children who may have access to mobile phones,” Safaricom CEO Peter Ndegwa said. According to Techweez, M-Pesa makes the most money for the company, hence it wants to expand the scope of its M-Pesa services. It recorded a 30.3% YoY growth to KES 107.69 billion ($926.2-million). The total M-PESA transaction...

Safaricom Hires Managing Director of Citibank

Managing Director of Citi Bank, Michael Mutiga, now part of Safaricom. Image sourced from Shava TV. Safaricom, a Kenyan telecommunications service provider, has hired the managing director of Citibank to be in charge of strategy and acquisitions. The telco is currently seeking regulatory approvals to launch insurance, unit trust, and savings products in an endeavour to compete with larger financial services and expand its mobile money platform M-Pesa. Michael Mutiga, MD of Citibank and head of corporate finance for sub-Saharan Africa from 2019 will be the new chief business development and strategy officer, according to an internal memo that was first seen by Business Daily. Mutiga will be replacing former Safaricom’s chief of special projects and acting chief business development and stra...

O-CITY Drives Contactless Bus Payment Initiative in Kenya

O-CITY is driving contactless payments across bus services in Nairobi, Kenya. The pilot initiatve, designed to reduce the use of cash in response to the COVID-19 pandemic, was launched in partnership with transport savings and credit specialists, NikoDigi, and Kenyan payments firm, Tracom, to accelerate the deployment of cashless fare collection. Used by 70% of the population in Kenya, Matatu buses are a dominant transport mode across the country whereby passengers traditionally pay in cash. O-CITY’s automated fare collection platform leverages the M-Pesa mobile wallet, which is used by 90% of the population in Kenya. Passengers enter a code on their phone and a debit is made on their wallet, which can be instantly seen by drivers to grant access to ride. The platform removes unnecessary t...