Maker

MakerDAO co-founder recommends DAI-USD depegging to limit attack surface

In light of the recent discussions around depegging its native token from USD Coin (USDC) amid sanctioning of Tornado Cash, MakerDAO co-founder Rune Christensen reached out to the community explaining why free-floating DAI may be the only choice for the decentralized autonomous organization (DAO). In his blog post, “The Path of Compliance and the Path of Decentralization: Why Maker has no choice but to prepare to free float Dai,” Christensen disclosed miscalculating the risks related to risk-weighted assets (RWA). He stated: “Physical crackdown against crypto can occur with no advance notice and with no possibility of recovery even for legitimate, innocent users. This violates two core assumption that we used to understand RWA risk, making the authoritarian threat a lot more serious.” Whil...

Top 5 cryptocurrencies to watch this week: BTC, FLOW, THETA, QNT, MKR

The United States jobs data on Aug. 5 was above market expectations, indicating that inflation has not cooled down. The strong numbers reduce the possibility that the U.S. Federal Reserve will slow down its aggressive pace of rate hikes. After the release, the likelihood of a 75 basis points hike in September has risen to 68%, according to CME Group data. However, analysts at Fundstrat Global Advisors have a different view. They highlighted that three out of six times, the S&P 500 bottomed out six months before the Fed’s last rate hike. Therefore, the firm anticipates the S&P 500 to witness a strong rally to 4,800 in the second half of the year. Crypto market data daily view. Source: Coin360 If the tight correlation between the equities markets and the cryptocurrency markets mainta...

Celsius pays down 143M in DAI loans since July 1

Celsius (CEL) has repaid a substantial amount of its outstanding debt to Maker (MKR) protocol since the beginning of the month, signaling that the troubled crypto lending platform was trying to stave off a complete collapse amid credible rumors of insolvency. Since July 1, Celsius has repaid $142.8 million worth of Dai (DAI) stablecoins across four separate transactions, according to data from DeFi Explorer. The crypto lender still has $82 million in outstanding debt owed to Maker. Out of $1.8 billion in lifetime investments, the firm’s losses currently stand at $667.2 million. With the loan repayments, Celsius’ liquidation price on its Wrapped Bitcoin (wBTC) loan has dropped to $4,966.99 Bitcoin (BTC). The liquidation price reportedly fell by nearly half since Celsius posted a...

MakerDAO price rebounds as DAI holds its peg and investors search for stablecoin security

Its been a rough couple of weeks for the cryptocurrency market. Bitcoin (BTC) price is nowhere near the price estimates of most analysts, multiple stablecoins lost their peg and the demise of one of the top decentralized finance (DeFi) platforms sparked an event that resulted in $900 billion vanishing from the total crypto market capitalization. In the midst of the widespread fallout, MakerDAO (MKR) managed to turn crisis into opportunity and the collapse of TerraUSD (UST) has brought renewed attention to DAI, the longest-running decentralized stablecoin. Data from Cointelegraph Markets Pro and TradingView shows that as the collapse of Terra (LUNA) price accelerated from May 9 to May 12, MKR climbed 66.2% from a low of $952 on May 12 to its current value of $1,587. MKR/USDT 1-da...

Here are 3 ways hodlers can profit during bull and bear markets

For years, cryptocurrency advocates have touted the world-changing capability of digital currency and blockchain technology. Yet with the passing of each market cycle, new projects come and go, and the promised utility of these “real-world use case” projects fails to satisfy. While a majority of tokens promise to solve real-world problems, only a few achieve this, and the others are mere speculative investments. Here’s a look at the three things cryptocurrency investors can actually “do” with their coins. Lending Perhaps the simplest use case offered to cryptocurrency holders is also one of the oldest monetary applications in finance: lending. Ever since the decentralized finance (DeFi) sector took off in 2020, the opportunities available for crypto holders to lend out their tokens in exch...

Altcoin Roundup: DeFi token prices are down, but utility is on the rise

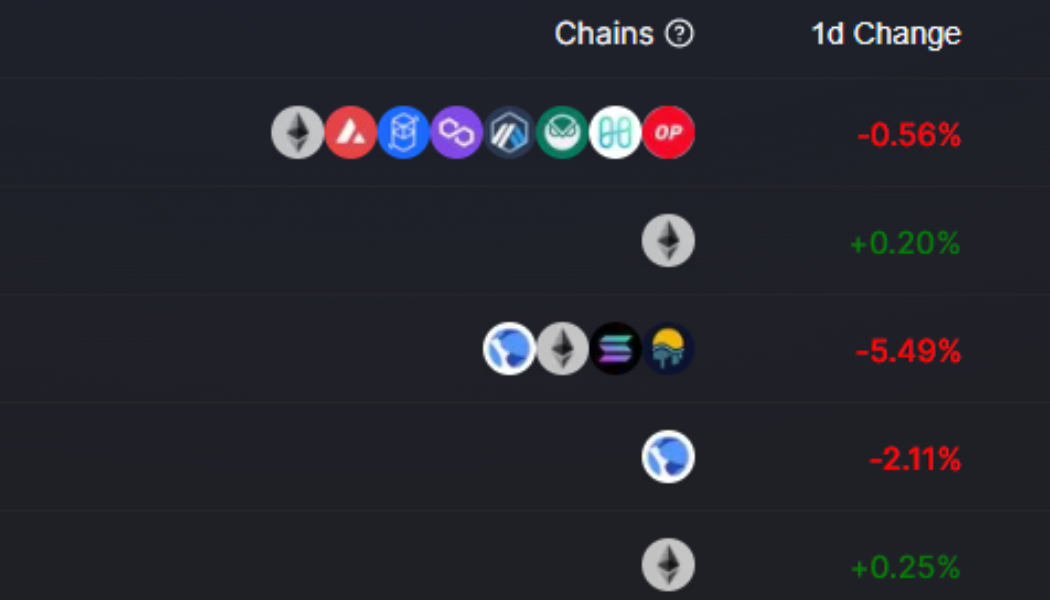

The decentralized finance (DeFi) sector has been sitting in the backseat since whipping up a frenzy in the summer of 2020 through the first quarter of 2021. Currently, investors are debating whether the crypto sector is in a bull or bear market, meaning, it’s a good time to check in on the state of DeFi and identify which protocols might be setting new trends. Here’s a look at the top-ranking DeFi protocols and a review of the strategies used by users of these protocols. Stablecoins are the foundation of DeFi Stablecoin-related DeFi protocols are the cornerstone of the DeFi ecosystem and Curve is till the go-to protocol when it comes to staking stalbecoins. Top 5 protocols by total value locked. Source: Defi Llama Data from Defi Llama shows four out of the top five protocols in terms of to...

D’banj set to unveil new female signee

Popular Nigerian singer, Dapo Oyebanjo, fondly known as D’banj, has revealed plans to unveil a new female signee to his record label, DB records. The self-acclaimed ‘Koko Master’ made the announcement on Thursday via his verified Instagram page, where he uploaded a poster showing the female signee but with a covered face. The poster read, “New artiste unveiling by DB records.” In the caption section, D’banj wrote, “Ladies and gentlemen, @dbrecordsofficial has a first lady. Guess who she is!” The singer launched his record label, DB records, in 2012, D’Banj, after leaving the defunct Mo-hits Records, which he co-owned with popular Nigerian beat maker, Don Jazzy. He signed his younger brother, KaySwitch, alongside two producers, Jaysleek and Deevee. He later signed brothers, MossKriss and Ra...