Markets Pro

MATIC attack: How smart crypto traders “got out” before a 35% price drop

Disparities in information access and data analytics technology are what give institutional players an edge over regular retail investors in the digital asset space. The core idea behind Markets Pro, Cointelegraph’s crypto-intelligence platform powered by data analytics firm The Tie, is to equalize the information asymmetries present in the cryptocurrency market. Markets Pro bridges the gap of these asymmetries with its world-class functionality: the quant-style VORTECS™ Score. The VORTECS™ Score is an algorithmic comparison of several key market metrics for each coin utilizing years of historical data that assesses whether the outlook for an asset is bullish, bearish or neutral at any given moment based on the historical record of price action. The VORTECS™ Score is d...

Markets are weak, but ALGO, FXS and HNT book a 20%+ rally — Here’s why

Large-cap cryptocurrency continue to slump as investors await comments from the Federal Open Markets Committee regarding the exact size of the next interest rate hike. There are, however, a few bright spots in the market and select altcoins managed to post double-digit gains in trading on May 3, thanks to a big-time partnership announcement and cross-protocol collaborations that led to a spike in demand. Data from Cointelegraph Markets Pro and TradingView shows that three of the biggest gainers over the past 24-hours were Algorand (ALGO), Frax Share (FXS) and Helium (HNT). Algorand The pure proof-of-stake blockchain network had, perhaps, one of the most notable partnership deals for a crypto project in recent months after this week’s announcement that it had been selected as the offi...

Markets are weak, but ALGO, FXS and HNT book a 20%+ rally — Here’s why

Large-cap cryptocurrency continue to slump as investors await comments from the Federal Open Markets Committee regarding the exact size of the next interest rate hike. There are, however, a few bright spots in the market and select altcoins managed to post double-digit gains in trading on May 3, thanks to a big-time partnership announcement and cross-protocol collaborations that led to a spike in demand. Data from Cointelegraph Markets Pro and TradingView shows that three of the biggest gainers over the past 24-hours were Algorand (ALGO), Frax Share (FXS) and Helium (HNT). Algorand The pure proof-of-stake blockchain network had, perhaps, one of the most notable partnership deals for a crypto project in recent months after this week’s announcement that it had been selected as the offi...

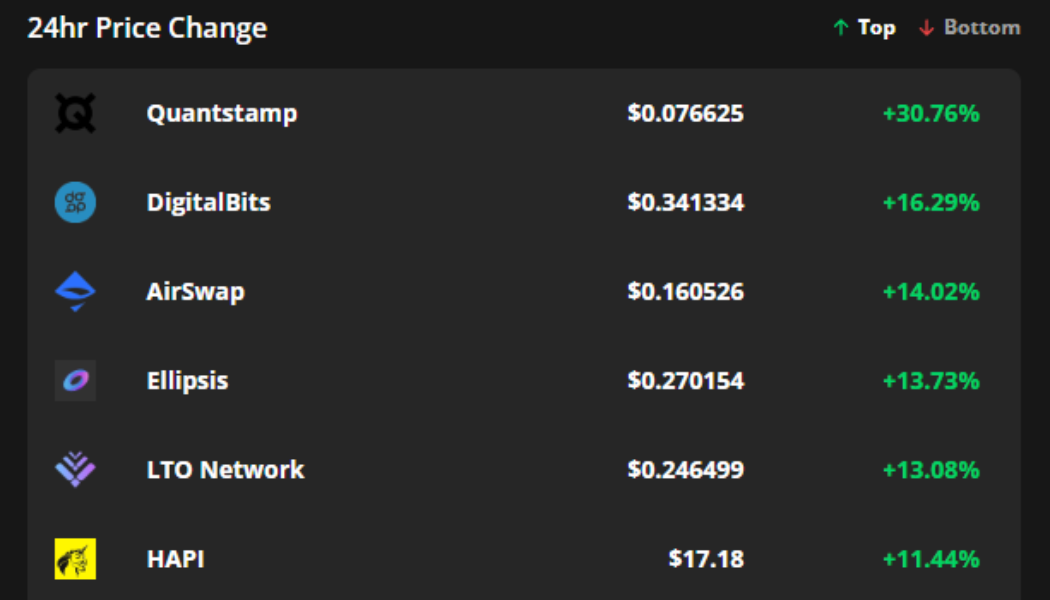

QSP, XDB and AST post double-digit gains amid sideways moving market

Activity across the cryptocurrency market has been largely subdued on April 15 as traders in the United States have taken an early weekend thanks to the closure of financial markets for the observance of Good Friday. A survey of the top 20 tokens indicates a relatively flat trading day, with Bitcoin (BTC) clinging to support above $40,000. Several lower-ranking altcoins managed to post double-digit gains on the back of recent protocol developments. Top 7 coins with the highest 24-hour price change. Source: Cointelegraph Markets Pro Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were Quantstamp (QSP), DigitalBits (XDB) and AirSwap (AST). Quantstamp launches NFT Combinator Blockchain security and code audit provider Quantstamp l...

Here’s why Chiliz (CHZ) multi-team NFL partnership and Web3 expansion plan could be bullish

One of the biggest challenges cryptocurrency projects face is finding the right type of real-world integration and a use case that can spark a new waves of adoption. Integrating blockchain and cryptocurrency with professional sports has been the expected “next wave” for some time and Chiliz (CHZ), a protocol focused on creating a fan engagement platform for various sports leagues, made headlines for its new developments this week. Data from Cointelegraph Markets Pro and TradingView shows that the price of CHZ has increased 69% from its 2022 low of $0.144 to hit a daily high of $0.256 on April 13. CHZ/USDT 1-day chart. Source: TradingView CHZ price has been building momentum and a new partnership between the Socios.com fan engagement platform and thirteen National Football Leagu...

Kava turns bullish as Ethereum Co-Chain launch initiates push toward EVM compatibility

Protocols in the Cosmos ecosystem have seen a significant amount of growth in 2022 due to the intensifying focus on blockchain interoperability and compatibility with the Ethereum network. One protocol that has seen a buildup in momentum since the middle of March is Kava, a project that is developing a co-chain architecture for the Cosmos and Ethereum network. Data from Cointelegraph Markets Pro and TradingView shows that the price of Kava’s native token KAVA has climbed 72.3% after hitting a low of $2.92 on March 13 to establish a daily high of $5.03 on April 8. KAVA/USDT 1-day chart. Source: TradingView Three reasons for the increase in price and momentum for KAVA include the Ethereum Co-Chain beta launch, the launch of a $750 million developer incentive program and a series o...

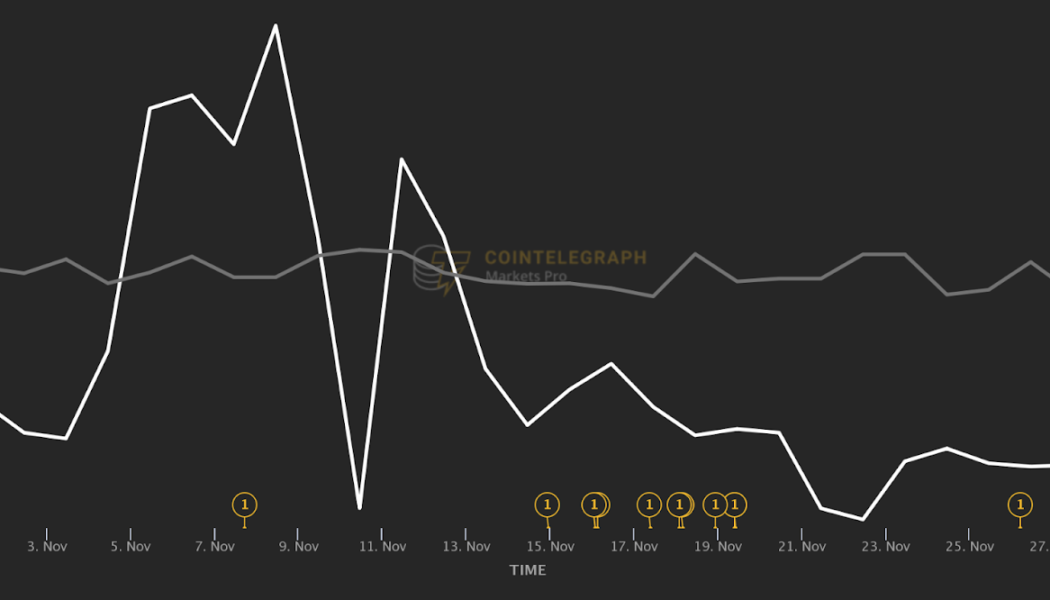

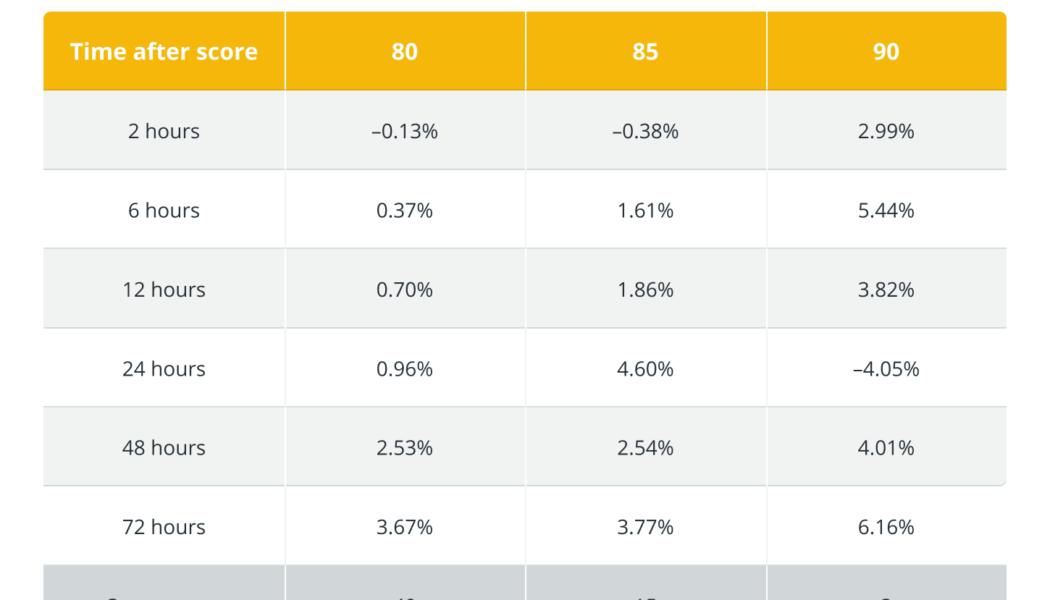

Here is how studying tokens’ price history helps patient traders enjoy consistent average gains.

Whether you consider cryptocurrency trading as art, science or a game of skill, one thing is beyond dispute: Those who excel at it are not the traders who maintain the longest series of lucky one-offs but those who establish sustainable trading processes yielding consistent returns. Ask a sample of seasoned pros if they would prefer to catch one obscure token’s 300%-in-a-day brush with fame or learn a strategy that systematically generates a 3% return on investment. You will be surprised how many of them (likely close to 100% of the sample) prefer modest yet systematic profits. How does one make their trading processes more systematic? One way is to rely on automated data analytics tools with a proven track record of consistent performance. One such tool is the VORTECS™ Score, an ar...

Loopring (LRC) price surges by 50% after GameStop NFT marketplace integration

Filling multiple needs within the cryptocurrency community is one way a project can set itself apart from the competition and new attract users and liquidity to its ecosystem. Loopring aims to do exactly this by aiming to offer a EVM-based solution with low fees where DeFi and NFT developers and investors can transact. The layer-two (L2) scaling solution utilizes zk-Rollups to provide fast, low-cost transactions and the project has been gaining traction throughout the month of March. Data from Cointelegraph Markets Pro and TradingView shows that the price of LRC gained 57% between March 21 and March 23 as its price increased from $0.78 to $1.23 amidst a spike in its 24-hour trading volume to $2.75 billion. LRC/USDT 4-hour chart. Source: TradingView Three developments that have helped...

Fetch.ai (FET) gains 43% after $150M development fund and Cosmos IBC announcement

Development across the cryptocurrency ecosystem continues to move forward despite the day-to-day whipsaw price movements and this progress is furthering the public’s awareness of Web3 and the value of blockchain technology. One project that has been climbing the charts amid a marketing push to develop better brand recognition is Fetch.ai, a protocol focused on building a token-based decentralized machine learning network capable of supporting the smart infrastructure being built around the digital economy. Data from Cointelegraph Markets Pro and TradingView shows that the price of FET has climbed 43.13% over the past two days, rallying from a low of $0.322 on March 21 to an intraday high at $0.46 on March 23 as its 24-hour trading volume underwent a five-fold increase. FET/USDT 4-hou...

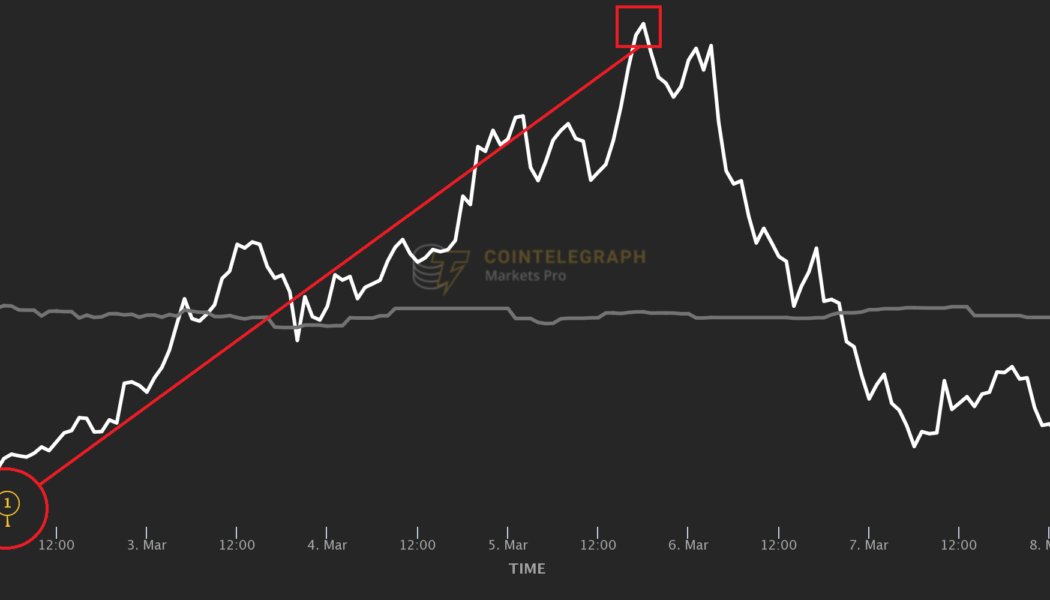

3 times in March that savvy crypto traders bought breaking news for the price of a rumor

As an old saying goes: Buy the rumor, sell the news. As a digital-native asset class, the prices of cryptocurrencies are clearly susceptible to market-moving news developments that instantly spread on the internet. Staying on top of bullish announcements can help crypto traders reap huge gains, but navigating the crypto news landscape can be daunting. Two major roadblocks get in the way: the abundance of potentially relevant information and the difficulty of making sure one is always among the first to learn the news that really matters. Extensive research shows that three types of crypto-related developments move digital asset prices most consistently: listings, staking announcements and big partnerships. This insight somewhat narrows down the scope of the developments that will most inte...

Immutable X (IMX) gains 50% following the close of a $200M fundraising round

Non-fungible token (NFT) projects have been hard hit by the price decline across the cryptocurrency ecosystem and the current bearish conditions have spared few tokens from a price collapse. One project that is attempting to get back on solid footing is Immutable X (IMX), an NFT-focused layer-2 (L2) scaling solution for the Ethereum (ETH) network designed to offer near-instant transactions and zero gas fees for minting and trading. Data from Cointelegraph Markets Pro and TradingView shows that the price of IMX has climbed 69.6% since hitting a low of $1.09 on March 7 to hit a daily high of $1.86 on March 11. IMX/USDT 4-hour chart. Source: TradingView Three reasons for the reversal in IMX include the completion of a $200 million Series C funding round, the launch of new projects on the plat...

REN price gains 65% after Catalog launch brings a cross-chain DEX to its blockchain

Decentralized finance projects like Ren pumped in 2021, only to finish the year right back where they started as high fees on Ethereum (ETH) led to decreased activity for many protocols and DeFi took a backseat to more popular sectors like nonfungible tokens (NFTs). Now, it appears as though that downtrend is in the process of reversing course after recent global events highlighted the benefits of DeFi and holding assets outside the traditional financial system. This week REN price climbed 69% from a low of $0.247 on Feb. 24 to a daily high of $0.418 on March 3. REN/USDT 4-hour chart. Source: TradingView Three reasons for the potential price reversal in REN are the launch of its first layer-one application Catalog, the launch of VarenX on Polygon and several new partnerships and inte...