Merge

Institutional investor sentiment about ETH improves as Merge approaches

Ethereum prices may have dipped again today, but there are signs that professional investors are warming to the asset as the highly anticipated Merge draws closer. In its digital asset fund flows weekly report, fund manager CoinShares reported that Ethereum-based products saw inflows for the third consecutive week. There was an inflow of $7.6 million for institutional Ethereum funds, whereas those for Bitcoin continued to outflow with a loss of $1.7 million. Referring to the Ethereum funds CoinShares stated: “The inflows suggest a modest turnaround in sentiment, having endured 11 consecutive weeks of outflows that brought 2022 outflows to a peak of US$460M.” It added that the change in sentiment may be due to the increasing probability of the Merge happening later this year. The Merge is a...

Ethereum eyes fresh yearly lows vs. Bitcoin as bulls snub successful ‘Merge’ rehearsal

Ethereum’s native token Ether (ETH) resumed its decline against Bitcoin (BTC) two days after a successful rehearsal of its proof-of-stake (PoS) algorithm on its longest-running testnet “Ropsten.” The ETH/BTC fell by 2.5% to 0.0586 on June 10. The pair’s downside move came as a part of a correction that had started a day before when it reached a local peak of 0.0598, hinting at weaker bullish sentiment despite the optimistic “Merge” update. ETH/BTC four-hour price chart. Source: TradingView Interestingly, the selloff occurred near ETH/BTC’s 50-4H exponential moving average (50-4H EMA; the red wave) around 0.06. This technical resistance has been capping the pair’s bullish attempts since May 12, as shown in the chart above. Staked Ether behind ...

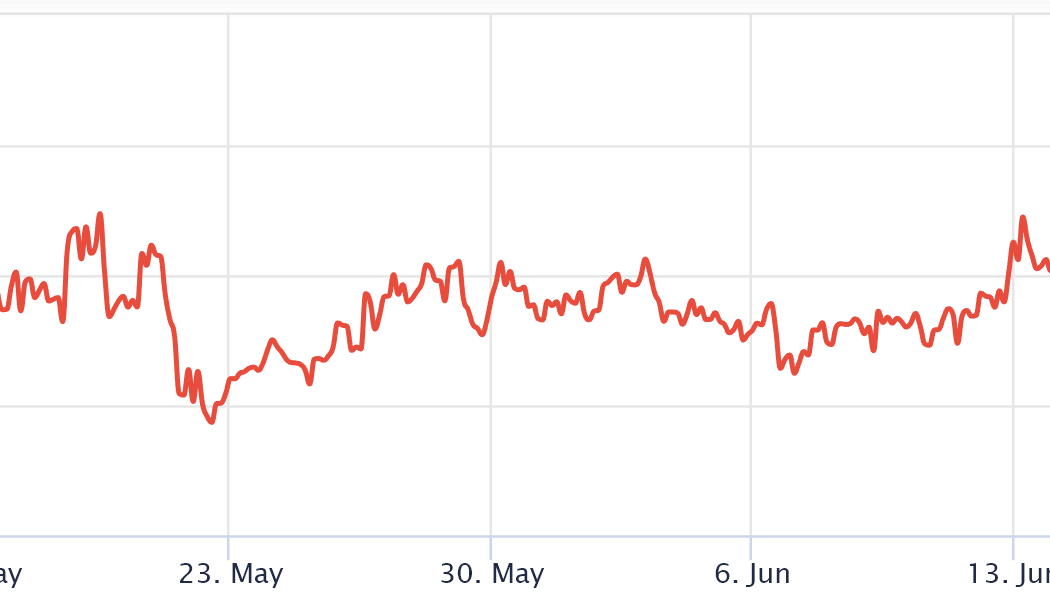

Ethereum price ‘bear flag’ could sink ETH to $2K after 20% decline in three weeks

Ethereum’s native token Ether (ETH) has dropped by nearly 20% in the last three weeks, hitting monthly lows near $2,900 on April 19. But despite rebounding above $3,000 since, technicals suggest more downside is possible in the near term, according to a classic bearish pattern. Ethereum price ‘bear flag’ setup activated Dubbed “bear flag,” the bearish continuation signal appears as the price consolidates higher inside an ascending parallel channel after a strong downward move (called the flagpole). It resolves after the price breaks out of the channel to drop further. ETH’s price turned lower after testing its bear flag’s upper trendline on April 4 and now eyes an extended decline towards its lower trendline near $2,700. If the pattern pans out as ...

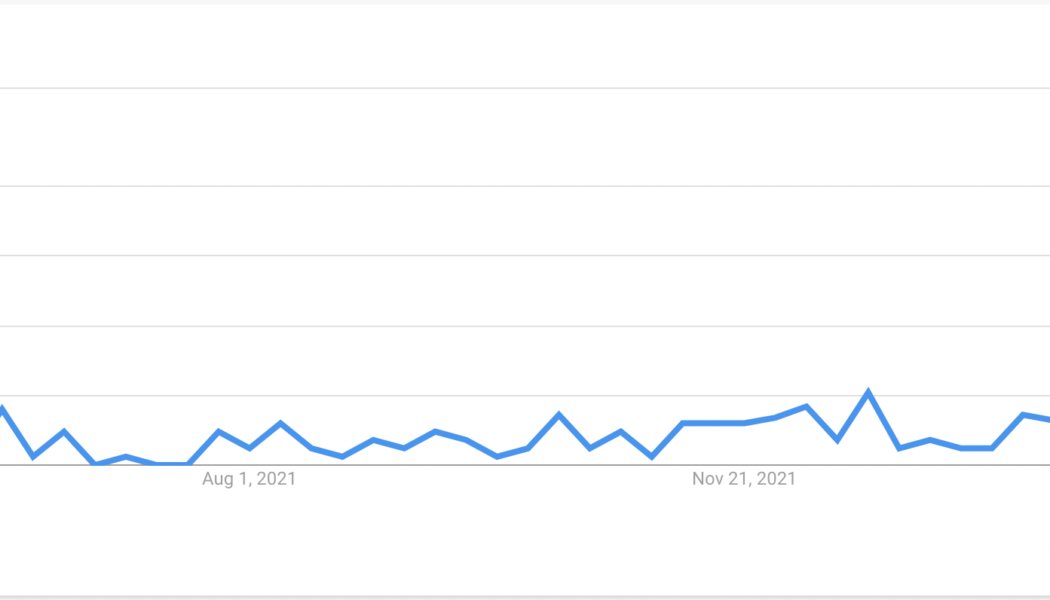

3 reasons why Ethereum price can hit $4K in April

Three market catalysts suggest that Ethereum’s native token Ether (ETH) is well-positioned to reach $4,000 this month. Google searches for “Ethereum merge” spike Internet users’ interest in Ethereum’s upcoming network upgrade, dubbed “the Merge,” surged substantially in the week ending April 2, Google Trends’ data shows. Searches for the keyword “Ethereum Merge” reached a perfect Google Trends score of 100 on a 12-month timeframe with most traffic coming from the U.S., Singapore, Canada, and Australia. Internet trend score for the keyword ‘Ethereum Merge.’ Source: Google Trends Merge, also called ETH 2.0, refers to the Ethereum network’s full transition to Proof-of-Stake (PoS) from Proof-of-Work (PoW),...

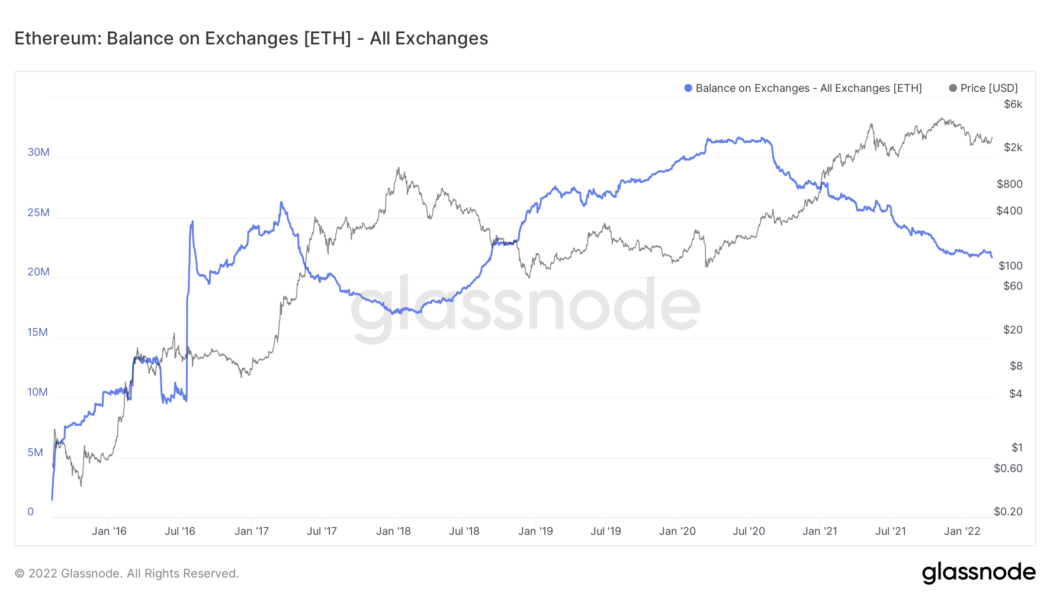

Ethereum balance on crypto exchanges falls to lowest levels since 2018

The amount of Ethereum‘s native token Ether (ETH) kept with crypto exchanges has fallen to its lowest levels since September 2018, signaling traders‘ intention to hold the tokens in hopes of a price rally in 2022. Notably, nearly 550,000 ETH — worth around $1.61 billion — have left centralized trading platforms year-to-date, according to data provided by Glassnode. The massive outflow has reduced the exchanges‘ net-Ether balance to 21.72 million ETH, down from its record high of 31.68 million ETH in June 2020. Ethereum balance on all exchanges as of March 18, 2022. Source: Glassnode Biggest weekly ETH outflow since October 2021 Interestingly, over 30% of all Ether‘s withdrawals from exchanges witnessed in 2022 appeared earlier this week, data from IntoTheBlock shows. In detail, over 180,00...

Ethereum Merge testing on Kiln mostly successful, save for one minor bug

On Tuesday, Ethereum (ETH) developer Tim Beiko tweeted that Kiln successfully passed the Ethereum Merge, with validators producing post-merge blocks containing transactions. Kiln will be the last Merge testnet (formerly Ethereum 2.0) before existing public testnets are upgraded. “Merge” involves taking Ethereum’s Execution Layer from the existing Proof of Work layer and merging it with the Consensus Layer from the Beacon chain, turning the blockchain into a proof-of-stake network. The Foundation writes: “This merge signals the culmination of six years of research and development in Ethereum and will result in a more secure network, predictable block times, and a 99.98%+ reduction in power use when it is released on mainnet later in 2022.” However, it app...

Ethereum ‘Merge’ edging closer with final Kiln testnet launch

The much-anticipated ‘Merge’ on the Ethereum network is another step closer to becoming a reality after the final public testnet Kiln launched to put it through its paces. On March 14, the Ethereum Foundation urged network stakeholders to run tests using Kiln “to ensure a smooth transition on existing public testnets.” “We strongly recommend that developers run through a full testing & deployment cycle on Kiln and report any issues with tools or dependencies to those projects’ maintainers.” Ethereum developer Tim Beiko confirmed that Kiln has gone live and will soon be ready to merge with the Beacon Chain in a March 14 tweet. The testnet launched late last week in proof-of-work mode only. Kiln, the next iteration of Ethereum merge testnets, is now live Highly recommended that node oper...

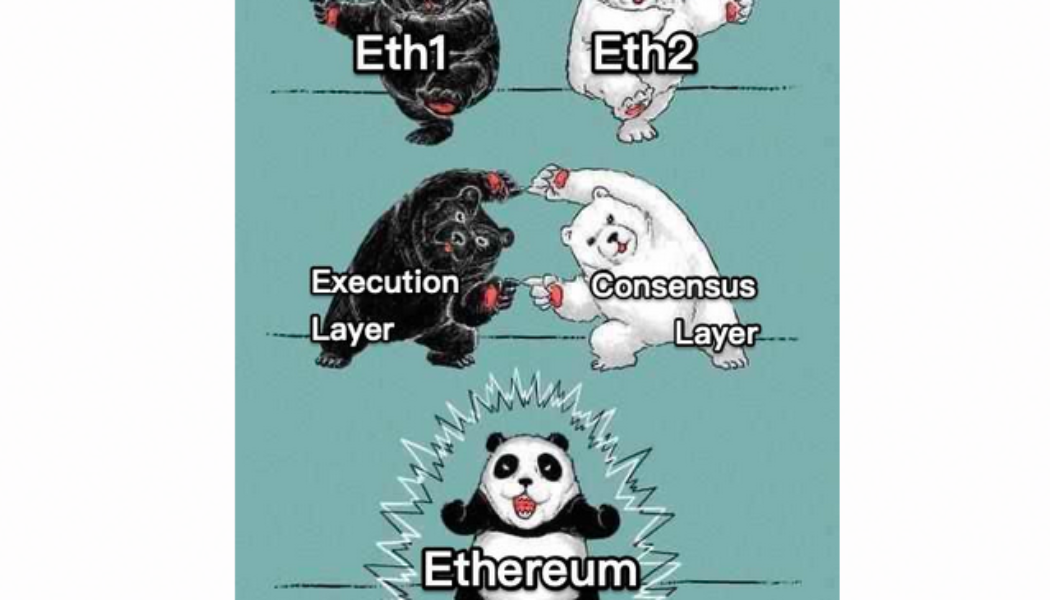

Eth2 is no more after Ethereum Foundation ditches name in rebrand

The Ethereum Foundation has removed all references to Eth1 and Eth2 in favor of calling the original blockchain the “execution layer” and the upgraded Proof of Stake chain the “consensus layer.” Ethereum’s long-awaited transition from a Proof-of-work mining model to a Proof-of-Stake (PoS) consensus mechanism is expected to go live around in the second or third quarter of this year. Announcing the change the foundation cited a number of rationales including a “broken mental model for new users,” scam prevention, inclusivity and staking clarity. In a Jan.24 blog post, the Ethereum Foundation noted that the branding of Eth2 failed to concisely capture what was happening to the network via its series of upgrades: “One major problem with the Eth2 branding is that it creates a broken mental mode...