Mining

Record hash rates may see Big Oil become a major BTC mining player

Surging Bitcoin (BTC) network hash rates are causing problems for mining companies but might be rolling out the red carpet for energy giants. The Bitcoin hash rate, the amount of computing power given to the blockchain through mining, has reached another record peak. According to Blockchain.com, the metric hit an all-time high of 267 exahashes per second (EH/s) on Nov. 1 after increasing almost 60% since the beginning of the year. Commenting on the new peak, Capriole Fund founder Charles Edwards speculated that highly efficient government and oil company enterprises were entering the mining game at scale. New Bitcoin hash rate world record! 9% higher than the prior all time high set just a few days ago. I have no doubt that we have serious, highly efficient government & oil company ent...

Core Scientific may consider bankruptcy following uncertain financial condition: Report

Bitcoin mining firm Core Scientific is reportedly considering a potential bankruptcy amid a group of its convertible bondholders consulting restructuring lawyers. According to a Nov. 1 report from Bloomberg Law, the Core Scientific bondholders worked with legal firm Paul Hastings following a United States Securities and Exchange Commission filing suggesting financial distress. The Oct. 26 filing indicated that the mining company was unable to meet its financial obligations in late October and early November, citing the low price of Bitcoin (BTC), rising costs of electricity, an increase in the global BTC hash rate and legal issues with crypto lending firm Celsius. Core Scientific claimed in an Oct. 19 court filing that Celsius owed the firm more than $2.1 million for post-petition charges,...

Ethereum flashes a classic bullish pattern in its Bitcoin pair, hinting at 50% upside

Ethereum’s native token, Ether (ETH), looks poised to log a major price rally versus its top rival, Bitcoin (BTC), in the days leading toward early 2023. Ether has a 61% chance of breaking out versus Bitcoin The bullish cues emerge primarily from a classic technical setup dubbed a “cup-and-handle” pattern. It forms when the price undergoes a U-shaped recovery (cup) followed by a slight downward shift (handle) — all while maintaining a common resistance level (neckline). Traditional analysts perceive the cup and handle as a bullish setup, with veteran Tom Bulkowski noting that the pattern meets its profit target 61% of all time. Theoretically, a cup-and-handle pattern’s profit target is measured by adding the distance between its neckline and lowest point to the neckline level. The Ether-to...

Bitcoin price due sub-$20K dip, traders warn amid claim miners ‘capitulating’

Bitcoin (BTC) climbed back to $20,500 at the Oct. 28 Wall Street open as United States equities sought a stronger finish to the week. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bets that $20,000 will fail as support increase Data from Cointelegraph Markets Pro and TradingView showed BTC/USD capitalizing on renewed optimism as markets began trading. The atmosphere was volatile after tech stocks suffered a major out-of-hours rout, with Bitcoin managing to avoid sustaining knock-on losses to the same extent. At the time of writing, the S&P 500 and Nasdaq Composite Index were both up around 1.3%. “In this current range bound phase after a prolonged downtrend,” popular trader CryptoYoddha summarized to Twitter followers. “Smart money/Institutional players aim to build up or...

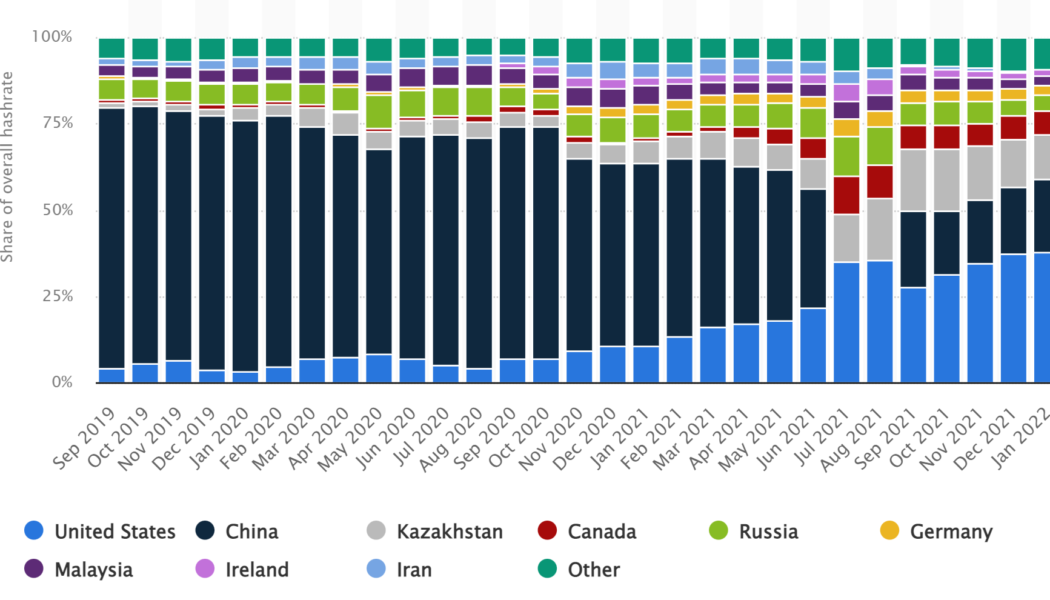

Kazakhstan among top 3 Bitcoin mining destinations after US and China

For over a year, the oil-rich Central Asian country of Kazakhstan has maintained its position as the third-biggest contributor to Bitcoin (BTC) mining after surpassing Russia back in February 2021. As of January 2022, Kazakhstan contributed to 13.22% of the total Bitcoin hash rate, positioned right after the historical leaders the United States (37.84%) and China (21.11%), as shown below. Along similar timelines, Cambridge Centre for Alternative Finance data estimated that Kazakhstan’s absolute hash rate contribution (monthly average) was 24.8 exahashes per second (Eh/s). Meanwhile, the US and China contributed 71 Eh/s and 39.6 Eh/s, respectively. The International Energy Agency (IEA), which is co-funded by the European Union, highlighted Kazakhstan’s heavy reliance on non-renewable ...

Celsius Network defaults on payments to Core Scientific, causing financial unrest

Crypto lender Celsius Network’s legal journey has gained another chapter as Bitcoin (BTC) miner Core Scientific accused the company of refusing to pay its bills since filing for Chapter 11 bankruptcy, according to court papers filed on Oct. 19. Core Scientific, which is one of the largest publicly traded crypto companies, claims the default on payments is threatening its financial stability, already hurt by crypto winter and high energy costs. In the court filings, Celsius alleges that Core Scientific delayed mining rig deployment and supplied them with less power than required under their contract. Celsius is reportedly seeking a court order holding Core in contempt and ordering it to fulfill its obligations. Meanwhile, Core requested the court to compel Celsius to pay pa...

Researchers allege Bitcoin’s climate impact closer to ‘digital crude’ than gold

The Bitcoin (BTC) bashing has continued unabated even in the depths of a bear market with more research questioning its energy usage and impact on the environment. The latest paper by researchers at the department of economics at the University of New Mexico, published on Sept. 29, alleges that from a climate-damage perspective, Bitcoin operates more like “digital crude” than “digital gold.” The research attempts to estimate the energy-related climate damage caused by proof-of-work Bitcoin mining and make comparisons to other industries. It alleges that between 2016 and 2021, on average each $1 in BTC market value created was responsible for $0.35 in global “climate damages,” adding: “Which as a share of market value is in the range between beef production and crude oil burned as gasoline,...

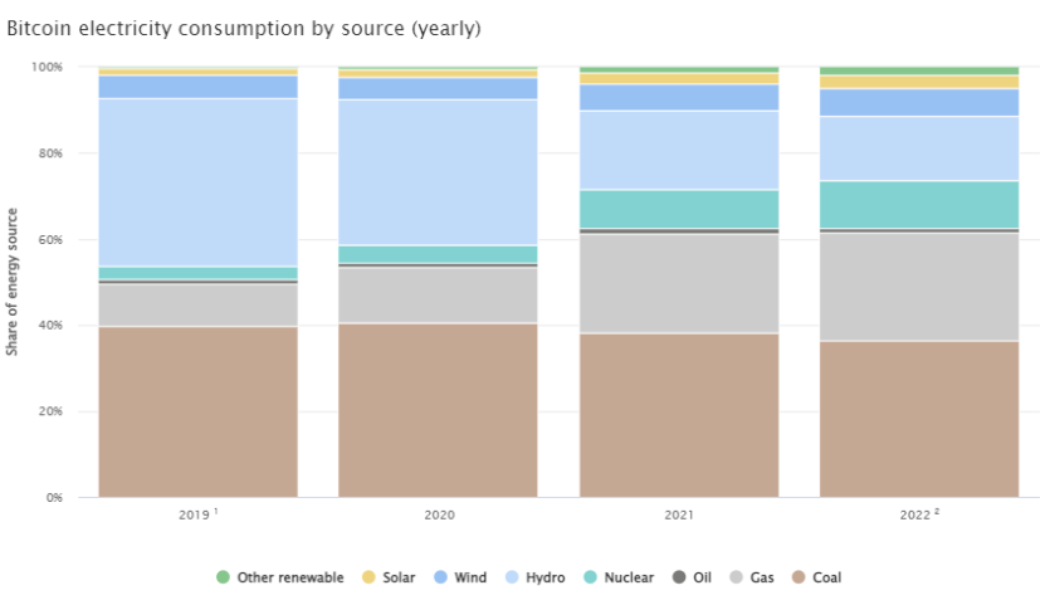

Nuclear and gas fastest growing energy sources for Bitcoin mining: Data

The electricity mix of Bitcoin (BTC) has drastically changed over the past few years, with nuclear energy and natural gas becoming the fastest growing energy sources powering Bitcoin mining, according to new data. The Cambridge Centre for Alternative Finance (CCAF) on Tuesday released a major update to its Bitcoin mining-dedicated data source, the Cambridge Bitcoin Electricity Consumption Index (CBECI). According to the data from Cambridge, fossil fuels like coal and natural gas made up almost two-thirds of Bitcoin’s total electricity mix as of January 2022, accounting for more than 62%. As such, the share of sustainable energy sources in the BTC energy mix amounted to 38%. The new study suggests that coal alone accounted for nearly 37% of Bitcoin’s total electricity consumption as of earl...

Is post-Merge Ethereum PoS a threat to Bitcoin’s dominance?

While Ethereum (ETH) fans are enthusiastic about the successful Merge, Swan Bitcoin CEO Cory Klippsten believes the upgrade will lead Ethereum into a “slow slide to irrelevance and eventual death.” [embedded content] According to Klippsten, the Ethereum community picked the wrong moment for detaching the protocol from its reliance on energy. As many parts of the world are experiencing severe energy shortages, he believed the environmental narrative is taking the back seat. In an exclusive interview with Cointelegraph, Klippsten said “I think the world is just waking up to reality and Ethereum just went way off into Fantasyland at the exact wrong time.” “It is just really bad timing to roll out that narrative. It just looks stupid.” According to some predictions, institutional capital...

B. Riley may purchase up to $100M stake in Bitcoin miner Iris Energy

Australia-based crypto mining firm Iris Energy has signed a deal with B. Riley giving the capital market company the option to purchase up to 25 million of its shares. According to a Friday filing with the United States Securities and Exchange Commission, Iris Energy inked an agreement with B. Riley Principal Capital II related to the “potential offer and sale” of up to 25 million of the Bitcoin (BTC) mining firm’s ordinary shares, worth $100 million. The filing states B. Riley has a 24-month timeframe to complete the purchase starting “as soon as practicable” after the effective date of the registration statement. Because Iris Energy qualifies as a “foreign private issuer” under U.S. securities laws, the firm said it intended to follow “most Nasdaq corporate governance listing standards” ...

JPMorgan CEO calls crypto ‘decentralized Ponzi schemes’

While testifying before United States (U.S.) lawmakers, JPMorgan Chase CEO Jamie Dimon referred to himself as a “major skeptic” on “crypto tokens that you call currency like Bitcoin,” labeling them as “decentralized Ponzi schemes.” Dimon was asked what keeps him from being more active in the crypto space during an oversight hearing held by the House Financial Services Committee on Sept. 21. Dimon emphasized that he sees value in blockchain, decentralized finance (DeFi), ledgers, smart contracts, and “tokens that do something,” but then proceeded to lambast crypto tokens that identify as currencies. Asked for his thoughts about the draft U.S. stablecoin bill, Dimon said he believes that there is nothing wrong with stablecoins that are properly regulated and that the regulation sh...

Flashbots build over 82% relay blocks, adding to Ethereum centralization

Following the completion of The Merge upgrade, Ethereum (ETH) transitioned into a proof-of-stake (PoS) consensus mechanism, helping the blockchain become energy efficient and secure. However, mining data reveals Ethereum’s heavy reliance on Flashbots — a single server — for building blocks, raising concerns over a single point of failure for the ecosystem. Flashbots is a centralized entity dedicated to transparent and efficient Maximal Extractable Value (MEV) extraction, which acts as a relay for delivering Ethereum blocks. Data from mevboost.org show that there are six active relays currently delivering at least one block in Ethereum, namely Flashbots, BloXroute Max Profit, BloXroute Ethical, BloXroute Regulated, Blocknative and Eden. Relays sorted by number of delivered blocks. Source:&n...