Mining

CleanSpark acquires mining facility in Georgia for $33 million

Crypto mining firm CleanSpark announced an agreement on Friday to acquire Mawson’s Bitcoin mining facility in Sandersville, Georgia for $33 million. The deal is anticipated to increase CleanSpark’s hash rate by 1.4 exahashes per second (EH/s) in the next few months, and to 7.0 EH/s by the end of next year. As part of the agreement, 6,468 last-generation mining ASICs will be purchased for $9.5 million, or $17 per terahash. “These machines, already operating at the acquired site, will add over 558 petahashes per second (PH/s) of computing power immediately upon closing,” the company explains. For the facility and miners, CleanSpark will pay up to $42.5 million, including up to $11 million in CleanSpark stocks and $4.5 million in earn-out commitments. The site in Georg...

White House science office looks at crypto’s effect on climate, despite scarce data

The White House Office of Science and Technology Policy (OSTP) has weighed in on the environmental and energy impact of crypto assets in the United States, finding that crypto makes a significant contribution to energy usage and greenhouse gas (GHG) emissions. It recommends monitoring and regulation in response. The report, released Sept. 8, was the latest to come out of the U.S. President Joe Biden’s March executive order (EO) on the development of digital assets. The EO charged the OSTP with investigating the energy usage associated with digital assets, comparing that usage with other energy outlays, investigating uses of blockchain technology to support climate protection and making recommendations to minimize or mitigate the environmental impact of digital assets. The study found that ...

Hive Blockchain explores new mineable coins ahead of Ethereum merge

Cryptocurrency miner Hive Blockchain has been working to replace the mining of Ether (ETH) with other coins in the event of Ethereum’s upcoming transition to proof-of-stake, or PoS. The Canadian crypto mining firm has been analyzing options for mining with its GPU stash ahead of the Ethereum Merge, Hive said in its latest production update on Tuesday. According to the update, Hive started implementing beta-testing of various GPU-mineable coins this week as the Ethereum Merge PoS is expected to occur in mid-September. Hive’s technical division is specifically implementing a strategy to optimize its Ethereum mining capacity, which amounts to 6.5 terahashes per second. “The company acknowledges the potential Ethereum Merge to Proof of Stake,” Hive said in the update. It noted that it sees a c...

Ethereum Classic books 12% rally as mining support for ETC gains pace

Ethereum Classic (ETC) price rallied on Sept. 5 on back-to-back positive reports concerning its adoption among crypto miners. Top mining pool supports Ethereum Classic On the daily chart, ETC’s price surged 14.5% to nearly $37.25 per token. Its massive gains came days after BTC.com, a blockchain explorer and crypto mining pool, launched a specialized Ethereum Classic pool with “zero-fee” mining for three months. ETC/USD daily price chart. Source: TradingView The announcement appeared after “the Merge,” a long-awaited network update that would switch Ethereum’s energy-intensive proof-of-work (PoW) protocol to a “cost-efficient” and scalable alternative, the proof-of-stake (PoS), on Sept. 19 or before. But the switch to PoS will make Ether...

The Bitcoin bottom — Are we there yet? Analysts discuss the factors impacting BTC price

When Bitcoin was trading above $60,000, the smartest analysts and financial-minded folk told investors that BTC price would never fall below its previous all time high. These same individuals also said $50,000 was a buy the dip opportunity, and then they said $35,000 was a generational buy opportunity. Later on, they also suggested that BTC would never fall under $20,000. Of course, “now” is a great time to buy the dip, and one would think that buying BTC at or under $10,000 would also be the purchase of a lifetime. But by now, all the so-called “experts” have fallen quiet and are nowhere to be seen or heard. So, investors are left to their own devices and thoughts to contemplate whether or not the bottom is in. Should one be patient and wait for the forecast “drop to $10,000” ...

President of Paraguay vetoes crypto regulation law

Paraguay’s president, Mario Abdo Benítez, vetoed a bill that sought to recognize cryptocurrency mining as an industrial activity on Monday. He reasoned that mining’s high electricity consumption could hinder the expansion of a sustainable national industry. The decree stated that crypto mining uses intensive capital with low manpower usage, and therefore would not generate added value on par with other industrial activities. Around the world, cryptocurrency is one of the largest job creators. The LinkedIn’s Economic Graph shows that crypto and blockchain jobs listing rose 615% in 2021 compared to 2020 in the United States. In accordance with the bill’s sponsor, Senator Fernando Silva Facetti, the law aimed to promote crypto mining through the use of surplus el...

Bear market uncertainty is the perfect time to build and learn, says Sato exec

The decisions made by companies during bear markets play a pivotal role in determining their longevity in the crypto ecosystem. Representing Canadian Bitcoin (BTC) mining firm Sato Technologies, COO Fanny Philip revealed what it takes to survive the bearish loom as the market prepares for the next bull run. Speaking to Cointelegraph during the Surfin’ Bitcoin 2022 event in France about the impact of bear markets on business, Philip said now is the time for mining companies to build and learn. Sato is a digital assets mining company, publicly traded on the Toronto Stock Exchange (TSXV) since Sept. 2021 and mines both Bitcoin (BTC) and Ether (ETH). Philip further told Cointelegraph about the initial challenges of setting up in the industry despite entering the space during a bull marke...

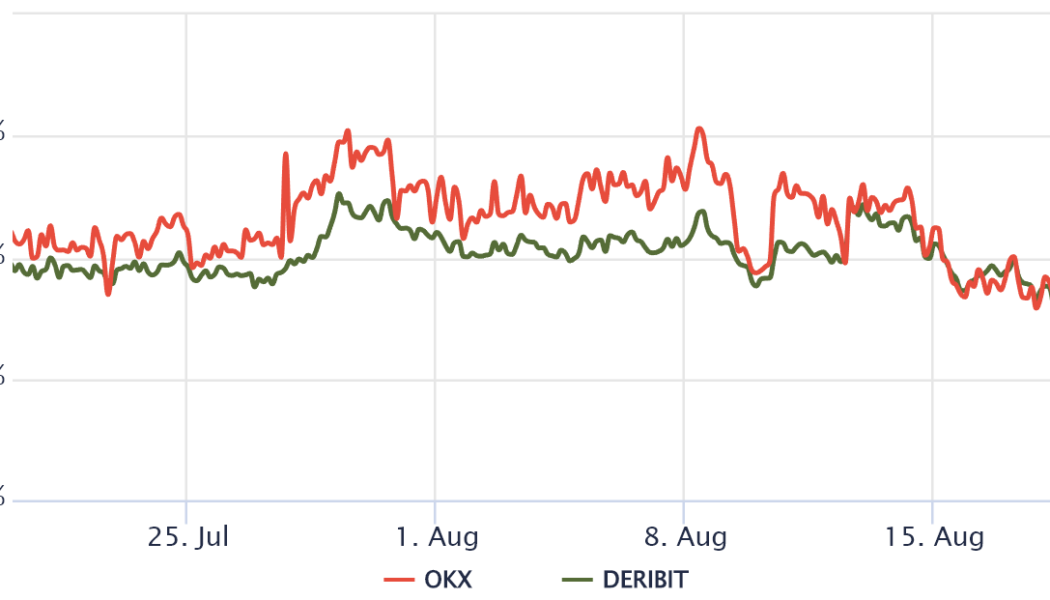

3 reasons why Bitcoin’s drop to $21K and the market-wide sell-off could be worse than you think

On Friday, August 19, the total crypto market capitalization dropped by 9.1%, but more importantly, the all-important $1 trillion psychological support was tapped. The market’s latest venture below this just three weeks ago, meaning investors were pretty confident that the $780 billion total market-cap low on June 18 was a mere distant memory. Regulatory uncertainty increased on Aug. 17 after the United States House Committee on Energy and Commerce announced that they were “deeply concerned” that proof-of-work mining could increase demand for fossil fuels. As a result, U.S. lawmakers requested the crypto mining companies to provide information on energy consumption and average costs. Typically, sell-offs have a greater impact on cryptocurrencies outside of the top 5 asset...

SBI lost 40% of hash rate after stopping mining in Russia: Data

Japanese financial giant SBI Holdings has partly terminated cryptocurrency mining in Russia due to geopolitical uncertainty and the crypto winter. SBI Holdings suspended mining operations in Russia’s crypto mining-rich region of Siberia, citing reasons like Russia-Ukraine conflict and the ongoing bear market, Bloomberg reported on Thursday. The Japanese online brokerage shut down the Siberian mining operations shortly after Russia started a military intervention in Ukraine on Feb. 24, a spokesperson for the firm reportedly said. The termination contributed to SBI’s crypto asset business reporting a pretax loss of 9.7 billion yen ($71 million) in Q2 202. As a result, the Sumitomo Mitsui Financial Group-backed group recorded a 2.4 billion yen ($17.5 million) in net losses, reportedly posting...

Chinese mining giant Canaan doubles profits despite the blanket crypto ban

Major Chinese cryptocurrency miner manufacturer Canaan appears to have no issues with the local ban on crypto, as the company’s overall performance has continued to grow in 2022. Canaan officially announced its financial results for the second quarter of 2022 on Thursday, reporting a 117% increase in gross profit from the same period of 2021. According to the firm, the Q2 profits amounted to 930 million renminbi (RMB), or nearly $139 million. The company’s Q2 net income was 608 million RMB, or $91 million, or a 149% increase from 425 million RMB in the same period last year. Canaan noted that foreign currency translation adjustment in Q2 was an income compared to previous losses due to the U.S. dollar appreciation against RMB during Q2. Despite posting significant profits, Canaan has ...

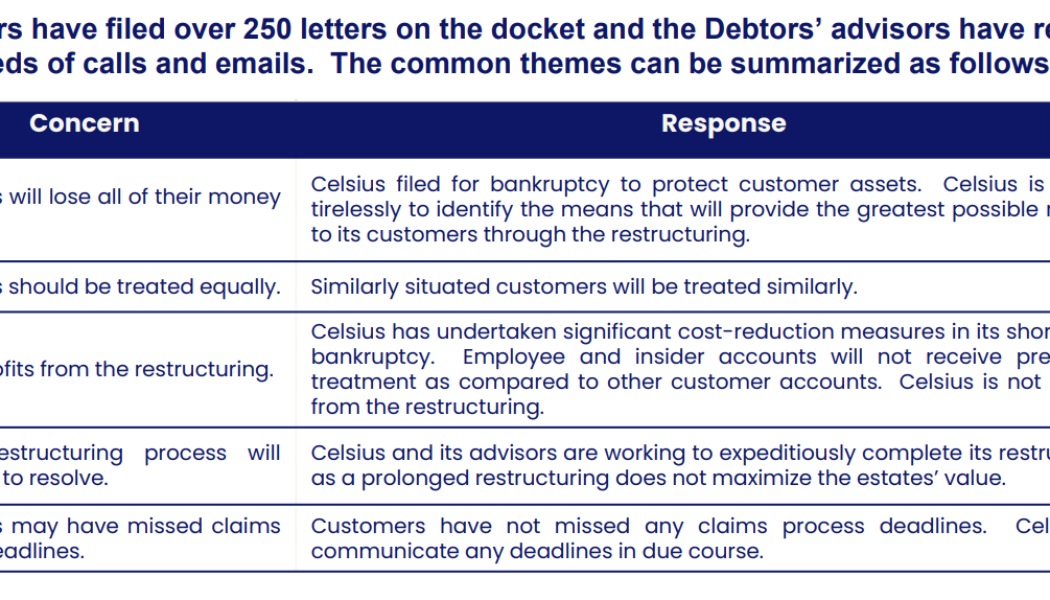

For greater good: NY judge allows Celsius to mine, sell Bitcoin

Not even 24 hours after revealing a three-month cash flow forecast that threatens total exhaustion of funds, a New York judge allowed crypto lender Celsius Network to mine and sell Bitcoin (BTC) during its bankruptcy. Since July 2022, Celsius Networks stands at the crosshair of United States officials after reports of bankruptcy surfaced, which risks losing the live savings of numerous crypto investors. Last week many got very upset with me as I said @CelsiusNetwork would run out of money & solutions needed to be acted upon faster. I was told I don’t understand Chapter 11. They have now confirmed they run out of money by October. https://t.co/CyzjgKpId7 pic.twitter.com/vBIRIGEmG2 — Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) August 15, 2022 During the second day of the case h...

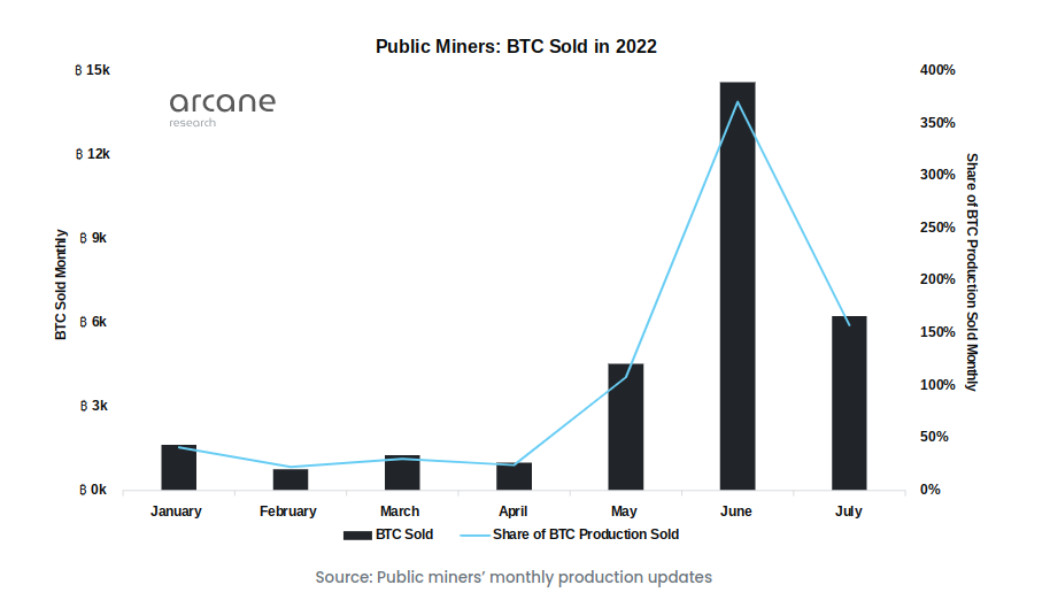

Bitcoin miners hodl 27% less BTC after 3 months of major selling

According to a fresh prediction from crypto analysis firm Arcane Research, miners will continue to sell more BTC than they earn. Miners sold nearly 30% of record BTC stash since May The trip to $25,000 this month decreased pressure on a Bitcoin mining sector which has struggled throughout 2022. At one point, fears abounded that miners’ production cost was far higher than the Bitcoin spot price, and that heavy sales would result in order for miners to stay in business. Worse still, many may have to retire altogether due to their activities no longer being financially viable. Data from the period since May appeared to confirm that major upheaval was taking place. As Arcane notes, one public miner alone — Core Scientific — sold around 12,000 BTC in the period from May to July. While the trend...