Mining

Bitcoin mining revenue jumps 68.6% from the lowest-earning day of 2022

The Bitcoin (BTC) mining industry endured immense financial stress throughout the year 2022 as a prolonged bear market directly impacted their earnings when translated to the U.S. dollar. However, miners resilient to the year’s lowest mining revenue day, June 13, witnessed a 68.63% increase in mining revenue within a month. Over the year, revenue from Bitcoin mining dropped due to a multitude of factors centered around investor sentiment — driven by tensions arising from market crashes, ecosystem collapses and loss-making investments. Cutting through the noise, the Bitcoin ecosystem recovered across numerous determinants, including miners’ revenue in dollars, network difficulty and hash rate. Total miners revenue over time. Source: blockchain.com Data from blockchain.com confirms that BTC ...

Blockchain’s environmental impact and how it can be used for carbon removal

Climate change has become an important issue over the years due to concerns over environmental changes caused by the emission of greenhouse gasses into the atmosphere. Conversations have even reached the crypto space, and blockchain technology is being considered a potential tool to reduce carbon emissions. Cryptocurrencies like Bitcoin (BTC) and Ether (ETH) that use the proof-of-work (PoW) mining algorithm have come under scrutiny due to their alleged energy expenditure. To see where this scrutiny comes from, it first needs to be known how much energy is used when mining PoW cryptocurrencies. Unfortunately, estimating the amount of energy necessary to mine Bitcoin and other PoW cryptocurrencies cannot be calculated directly. Instead, it can be estimated by looking at the network’s ha...

Argo Blockchain keeps cashing out BTC to pay the debt to Galaxy Digital

Cryptocurrency mining firm Argo Blockchain continues to sell its Bitcoin (BTC) holdings to cut its debt to Michael Novogratz’s crypto investment firm Galaxy Digital. Argo sold another 887 Bitcoin in July to reduce obligations under a BTC-backed loan agreement with Galaxy Digital, the firm announced on Friday. With the average BTC price of $22,670, the sales totaled $20.1 million, accounting for a significant part of the maximum outstanding loan balance of $50 million in Q2 2022. As of July 31, 2022, Argo held an outstanding balance of just $6.72 million under the BTC-backed loan, the announcement notes. The latest sale comes shortly after Argo sold another 637 BTC in June 2022 for $15.6 million. The firm reported that by the end of June 30, Argo had an outstanding balance of $22 million on...

Amid miner capitulation, Hut 8 maintained BTC ‘HODL strategy’ in July

Canadian Bitcoin (BTC) miner Hut 8 Mining Corp. added to its massive BTC reserves in July, as the firm maintained its long-term “HODL strategy” in the face of market volatility. The Alberta-based company generated 330 Bitcoin in July at an average production rate of 10.61 BTC per day, bringing its total reserves to 7,736 BTC. Its monthly production rate was equivalent to 113.01 BTC per exahash, the company disclosed Friday. Hut 8, which trades on the Nasdaq and Toronto stock exchanges, is one of the largest public holders of Bitcoin, according to industry data. As part of its ongoing HODL strategy, Hut 8 deposited all of its self-mined Bitcoin into custody, bucking the growing industry trend of miners selling portions of their reserves during the bear market. As Cointelegraph reported, Tex...

Riot Blockchain’s Bitcoin mining productivity dropped 28% YOY amid record Texas heat

Crypto mining firm Riot Blockchain reported it produced fewer Bitcoin (BTC) in July 2022 than that in July 2021 after scaling down operations at its Texas facility. In a Wednesday announcement, Riot said its miners had produced 318 Bitcoin in July, more than 28% less than the 443 BTC the firm reported generating in July 2021. According to Riot CEO Jason Les, the firm curtailed operations by 11,717 megawatt-hours in July in response to increasing demand on Texas’ energy grid. Many parts of the Lone Star State experienced several days with temperatures over 100 degrees Fahrenheit, requiring additional power for air conditioners. “As energy demand in [Electric Reliability Council of Texas, or ERCOT] reached all-time highs this past month, the company voluntarily curtailed its energy...

Crypto miner Digihost plans to move rigs from New York to Alabama

Digihost, a United States-based cryptocurrency mining company, has announced plans to move part of its fleet from New York to Alabama in an effort to lower energy costs. In a Tuesday announcement, Digihost said its 55-megawatt (MW) facility in Alabama — which the company acquired in June — will host some of its crypto miners from New York, leading to lower operating costs. According to the mining firm, it aims to have a hashing capacity of 28 MW at the Alabama facility by the fourth quarter of 2022, and 55 MW by the second quarter of 2023. Like other crypto miners dealing with rising energy costs amid a bear market and record heat in parts of the United States, Digihost reported that it sold Bitcoin (BTC) produced in July. As of July 31, the company reported it held roughly 220 BTC and 1,0...

What happens when 21 million Bitcoin are fully mined? Expert answers

When the last Bitcoin (BTC) is finally mined, the livelihood of miners who rely on block rewards as a source of income will be affected. Despite this, the future of mining stays promising, according to an expert in space. In a Cointelegraph interview, Mohamed El Masri, the founder of mining solutions provider PermianChain, talked about new players jumping into mining, the future of mining and what happens to mine profitability after the 21 millionth BTC is minted. El Masri highlighted that efficiency is a very important focus that new players in the space must take into consideration. Because mining profit depends on how efficient a mining operation is, the executive noted that efficiency brings down the cost of energy to a minimum. [embedded content] When asked about the future of t...

Will the Fed prevent BTC price from reaching $28K? — 5 things to know in Bitcoin this week

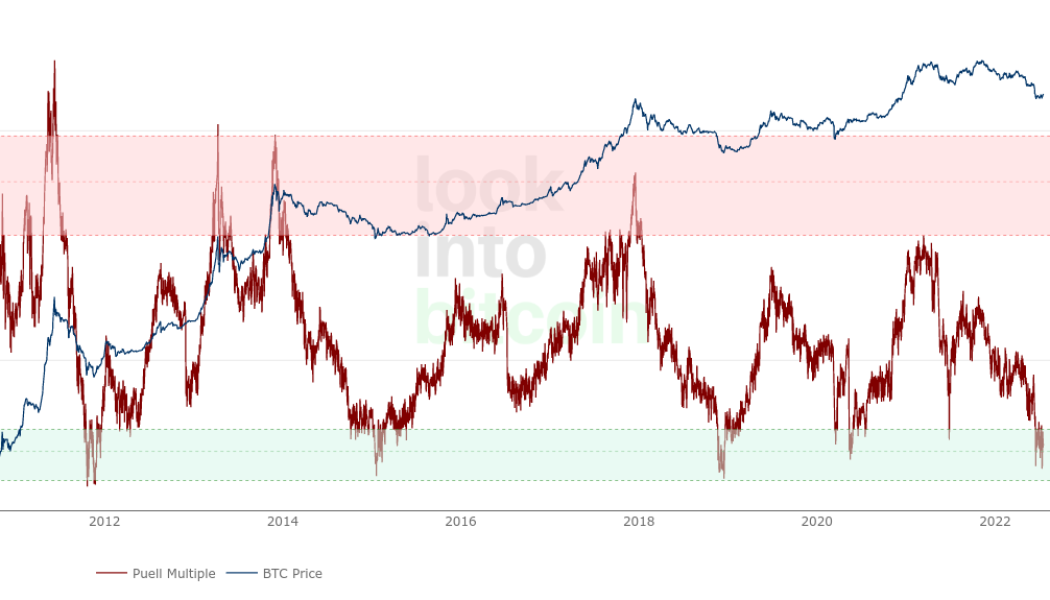

Bitcoin (BTC) enters a new week with a question mark over the fate of the market ahead of another key United States monetary policy decision. After sealing a successful weekly close — its highest since mid-June — BTC/USD is much more cautious as the Federal Reserve prepares to hike benchmark interest rates to fight inflation. While many hoped that the pair could exit its recent trading range and continue higher, the weight of the Fed is clearly visible as the week gets underway, adding pressure to an already fragile risk asset scene. That fragility is also showing in Bitcoin’s network fundamentals as miner strain becomes real and the true cost of mining through the bear market shows. At the same time, there are encouraging signs from some on-chain metrics, with long-term investors still re...

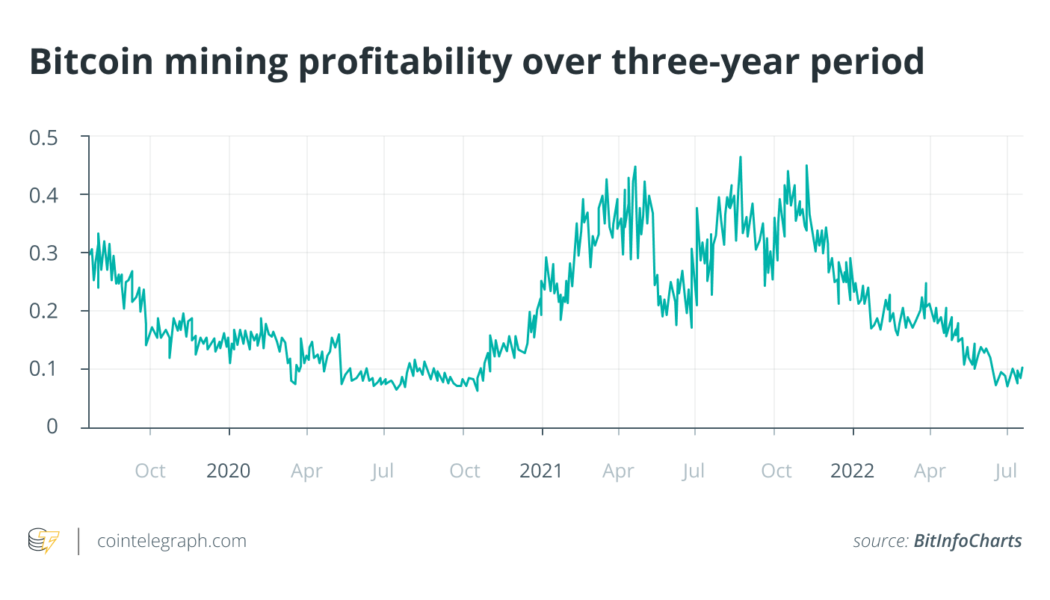

Not just Bitcoin price: Factors affecting BTC miner profitability

The ongoing cryptocurrency bear market has triggered a massive decline in Bitcoin (BTC) mining profitability as BTC mining expenses outpace the price of Bitcoin. Closely tied to the drop in the BTC price, Bitcoin mining profitability has been tanking since late 2021 and reached its lowest multi-month levels in early July 2022. According to data from crypto tracking website Bitinfocharts, BTC mining profitability tumbled to as low as $0.07 per day per 1 terahash per second (THash/s) on July 1, 2022, touching the lowest level since October 2020. The decline in BTC mining profitability has caused some big changes in the crypto mining industry. Lower Bitcoin prices fueled selling pressure as miners were pushed to sell their BTC to continue mining and pay for electricity. The majority of big cr...

Bitcoin network difficulty drops to 27.693T as hash rate eyes recovery

The difficulty in mining a block of Bitcoin (BTC) was reduced further by 5% to 27.693 trillion as network difficulty maintains its three-month-long downward streak ever since reaching an all-time high of 31.251 trillion back in May 2022. Network difficulty is a means devised by Bitcoin creator Satoshi Nakamoto to ensure the legitimacy of all transactions using raw computing power. The reduced difficulty allows Bitcoin miners to confirm transactions using lower resources, enabling smaller miners a fighting chance to earn the mining rewards. Despite the minor setback, zooming out on blockchain.com’s data reveals that Bitcoin continues to operate as the most resilient and immutable blockchain network. While the difficulty adjustment is directly proportional to the hashing power of miner...

100X Bitcoin energy use would mean ‘absurd’ $20M BTC price — developer

A new contributor to the Bitcoin (BTC) energy debate says that 1 BTC would have to cost $20 million to use 100 times its current energy demands. In a Twitter debate on July 18, Sjors Provoost, a Bitcoin developer and author of “Bitcoin: A Work in Progress,” cast doubt on the largest cryptocurrency’s future energy use. Bitcoin could survive on “waste energy breadcrumbs” How much energy Bitcoin uses to survive has become a topic of friction which has gone from within the industry to global government. Throughout the process, Bitcoin proponents have complained that a combination of bias and lack of understanding of network principles are leading those in power to make incorrect conclusions about how and why Bitcoin uses the energy it does. While critics argue that Bitcoin must red...

Could Bitcoin miners’ troubles trigger a ‘death spiral’ for BTC price?

A July 9 post by @PricedinBTC on the “cost to mine Bitcoin” in the United States gathered the crypto community’s attention, especially considering the recent headlines that BTC miners have made. The crypto bear market and growing energy costs have caused a perfect storm for the mining sector and this has led some companies to lay off employees and others to defer all capital expenditures. Some went as far as raising concerns of Bitcoin miners hitting a “death spiral.” In bear markets like this, inevitably a Bitcoin critic comes out and says that Bitcoin will soon collapse from a “miner death spiral”, meaning that miners will go offline because it is not profitable to run their operations, and then Bitcoin’s hash rate will fall, causing its… — Cory Klippsten (@coryklippste...