Mining

Bitcoin ready to attack key trendline, says data as BTC price holds $20K

Bitcoin (BTC) consolidated higher on July 16 after the Wall Street trading week finished with modest gains for United States equities. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Can Bitcoin bulls reclaim the 200-week moving average? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD ranging between $20,500 and $21,000 into the weekend. The pair thus preserved the majority of its comeback from the week’s lows, these following shock U.S. inflation data and sparking weakness across risk assets. Now, out-of-hours trading meant that the classic scenario of breakouts and fakeouts on thin liquidity could accompany Bitcoin into the weekly close. Eyeing order book data from Binance, the largest global exchange by volume, showed key resistance clustered ar...

Bitcoin miner prices will continue to fall, F2Pool exec predicts

The price of cryptocurrency mining hardware is likely to continue falling in the near future amid the ongoing crypto winter, according to an executive at major Bitcoin (BTC) mining pool F2Pool. Supporting 14.3% of the BTC network, F2Pool is one of the world’s biggest Bitcoin mining pools. On Tuesday, F2Pool released its latest mining industry update. Focusing on June 2022 BTC mining results, F2Pool’s report noted that the majority of Bitcoin mining companies like Core Scientific have opted to sell their self-mined Bitcoin recently. Bitfarms, a major Canadian BTC mining firm, sold 3,000 Bitcoin, or almost 50% of its entire BTC stake for $62 million ito reduce its credit facility in June. “I have studied almost 10 publicly traded industrial miners and found that they are...

Global GPU price drops to compensate for falling Bitcoin mining revenue

As a direct result of falling Bitcoin (BTC) prices, total revenue earned by miners in transaction fees and mining rewards dropped to its one-year lows at nearly $15 million on July 4. However, a concurrent fall in graphic cards or GPU prices is set to help miners offset their operational costs amid an ongoing bear market. Bitcoin mining revenue fell 79.6% over a period of 9 months, ever since reaching an all-time high of $74.4 million on Oct. 25, 2021. In addition, a global chip shortage and the coronavirus pandemic shot up prices of the most important part of a mining rig — the graphics processing unit (GPU) — further impacting the miners’ bottom line. Bitcoin mining revenue over the past year. Source: Blockchain.com With card manufacturers resuming operations across the world, GPU prices...

Global GPU price drops to compensate for falling Bitcoin mining revenue

As a direct result of falling Bitcoin (BTC) prices, total revenue earned by miners in transaction fees and mining rewards dropped to its one-year lows at nearly $15 million on July 4. However, a concurrent fall in graphic cards or GPU prices is set to help miners offset their operational costs amid an ongoing bear market. Bitcoin mining revenue fell 79.6% over a period of 9 months, ever since reaching an all-time high of $74.4 million on Oct. 25, 2021. In addition, a global chip shortage and the coronavirus pandemic shot up prices of the most important part of a mining rig — the graphics processing unit (GPU) — further impacting the miners’ bottom line. Bitcoin mining revenue over the past year. Source: Blockchain.com With card manufacturers resuming operations across the world, GPU prices...

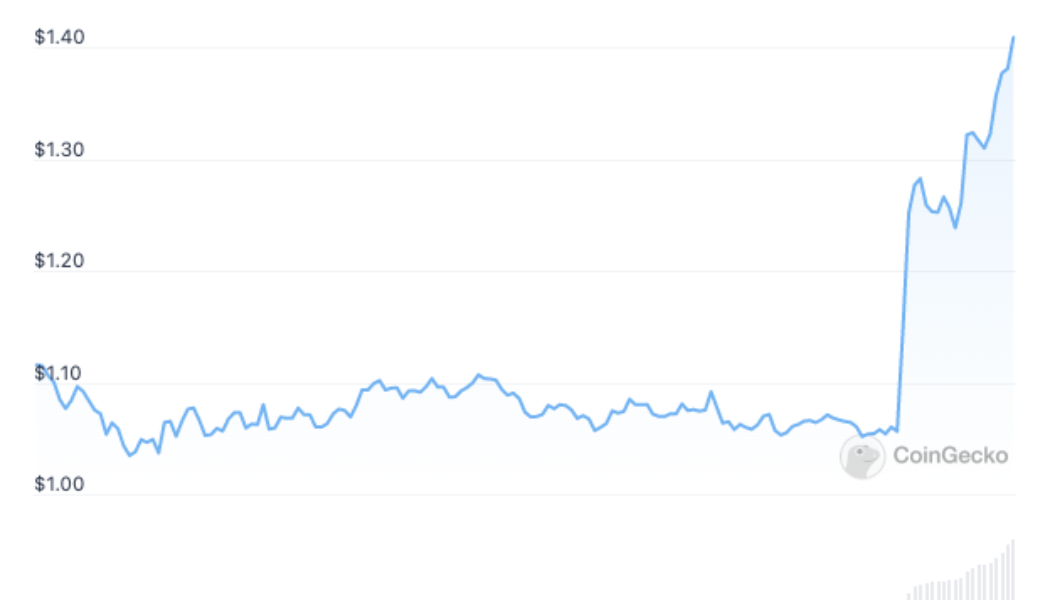

‘Unique phenomenon’: All 5B toncoins mined on PoS TON blockchain

The TON Foundation, an organization developing the Telegram-initiated blockchain project, the TON blockchain, on Tuesday officially announced that TON miners have mined the final toncoin. “Tens of thousands of miners have mined the entire issuance of toncoins, which was about 5 billion tokens,” TON Foundation founding member and core developer Anatoly Makosov said in a statement to Cointelegraph. The last toncoin was mined on June 28, he noted. The end of toncoin mining marks a major milestone in TON’s distribution, starting its new era as an entirely PoS blockchain. From now on, new toncoins will only enter circulation via PoS validation, the TON Foundation said. That will result in a cut in the total influx of new toncoins into the network by around 75% to the existing l...

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

Uzbekistan warms up to Bitcoin mining, but there’s a catch

The National Agency of Prospective Projects (NAPP) in Uzbekistan announced its demands toward crypto mining operators. It would only allow the companies that use solar energy to mine Bitcoin (BTC) or other cryptocurrencies. The normative act on the government page, dated June 24, describes the confirmation of “Guidelines on the registration of the crypto assets mining,” and sets the finalization date on July 9. The second article of the document offers an uncompromising wording: “Mining is being carried out only by the legal entity with the use of electric energy, provided by a solar photovoltaic power plant.” As a further complication, the miners should own the solar photovoltaic power plant that they will use for energy. The executive order also obliges any mining operator to obtai...

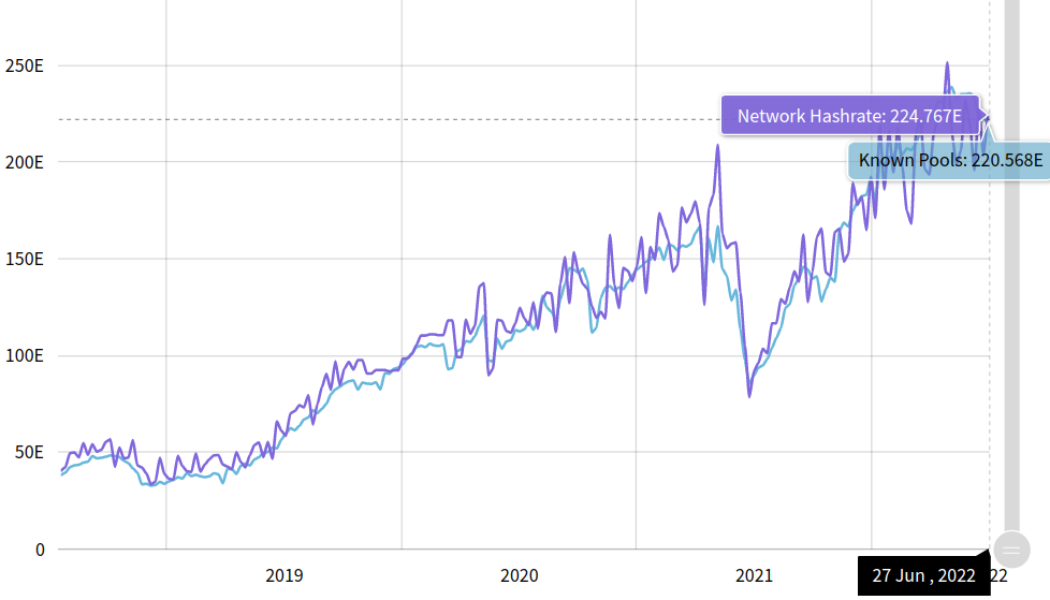

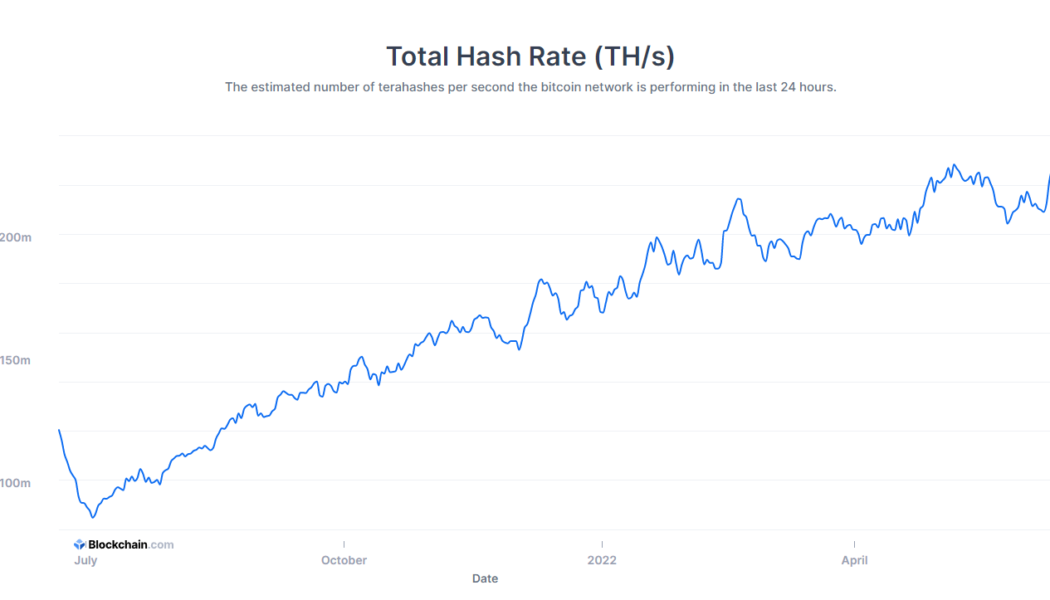

3 charts showing this Bitcoin price drop is unlike summer 2021

Bitcoin (BTC) bear markets come in many shapes and sizes, but this one has given many reason to panic. BTC has been described as facing “a bear of historic proportions” in 2022, but just one year ago, a similar feeling of doom swept crypto markets as Bitcoin saw a 50% drawdown in weeks. Beyond price, however, 2022 on-chain data looks wildly different. Cointelegraph takes a look at three key metrics demonstrating how this Bitcoin bear market is not like the last. Hash rate Everyone remembers the Bitcoin miner exodus from China, which effectively banned the practice in one of its most prolific areas. While the extent of the ban has since come under suspicion, the move at the time saw huge numbers of network participants relocate — mostly to the United States — in a matter of week...

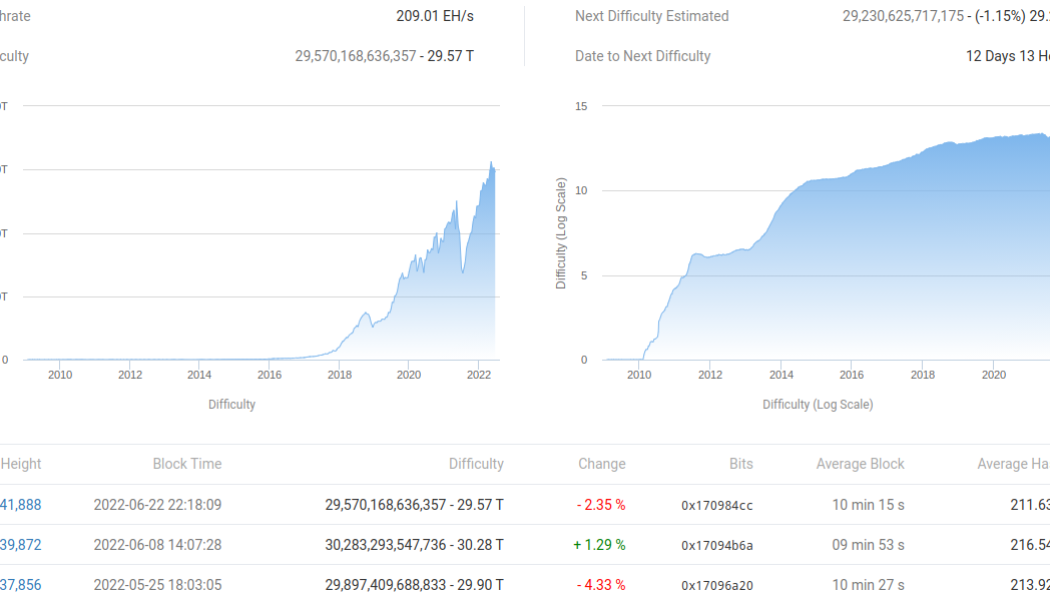

Bitcoin miner ‘capitulation event’ may have already happened — Research

Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded. In an update on June 24, Julio Moreno, senior analyst at on-chain data firm CryptoQuant, hinted that the BTC price bottom could now be due. BTC price bottom “typically” follows miner capitulation Miners have seen a dramatic change in circumstances since March 2020, going from unprecedented profitability to seeing their margins squeezed. The dip to $17,600 — 70% below November’s all-time highs for BTC/USD — has hit some players hard, data now shows, with miner wallets sending large amounts of coins to exchanges. This, CryptoQuant suggests, precedes the final stages of the Bitcoin sell-off more broadly in line with historical precedent. “Our data demonstrate a miner capitulation event that has...

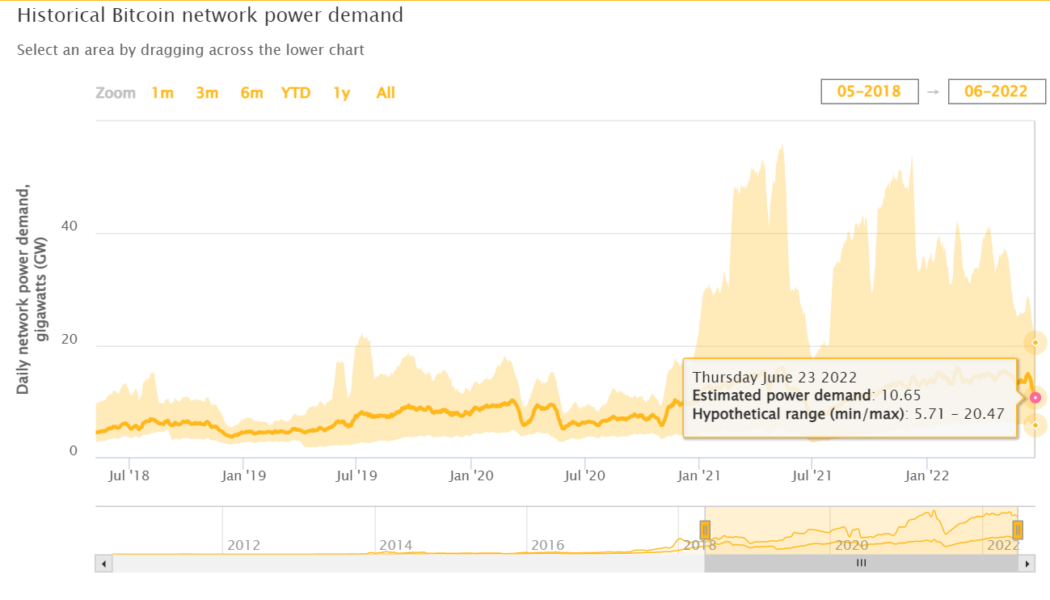

Bitcoin network power demand falls to 10.65GW as hash rate sees 14% drop

The overall power consumption of the Bitcoin (BTC) network recorded a drastic drop after mimicking the two-week-long fall in the mining hash rate, which reduced the commuting power for mining BTC blocks to 199.225 exahash per second (EH/s). According to the data shared by the Cambridge Centre for Alternative Finance, the Bitcoin network recorded the year 2022’s lowest power demand of 10.65 gigawatts (GW). At its peak, the BTC network demanded 16.09 GW of power. Bitcoin network power demand from 2018-2022. Source: ccaf.io On June 16, a Cointelegraph report highlighted how the banking sector utilizes 56 times more energy than the Bitcoin ecosystem. Publisher Michel Khazzaka, an IT engineer, cryptographer and consultant said in an exclusive interview: “Bitcoin Lightning, and Bitcoin, in...

Uganda’s gold discovery: What it could mean for crypto

These are fraught times for the cryptocurrency and blockchain sector, so it isn’t surprising that industry proponents might seize upon any promising news to help charge flagging markets. A Reuters report out of Uganda last week about a massive gold ore discovery supplied just this kind of fuel. What does the state of gold mining in Africa have to do with the price of global Bitcoin (BTC)? Quite a bit, potentially. Bitcoin has periodically laid claim to being digital gold largely on the strength of its strict 21 million supply limit, which makes it non-inflationary and a good store of value — in theory. Gold, of course, is the store of value par excellence, with a limited supply and a solid track record that goes back millennia. But, if Uganda is sitting on 31 million metric tons of gold or...

Marathon Digital keeps on mining despite BTC price slump

Despite data showing that the Bitcoin (BTC) price may have fallen to the point of being unprofitable for the average miner, Marathon Digital Holdings says it will continue working to accumulate the leading crypto asset. Charlie Schumacher, vice president of corporate communications at Marathon Digital, told Cointelegraph on Wednesday that while the company “isn’t immune to the macro environment,” it is “fairly well insulated and well-positioned” to weather the current downturn, due to the low cost of operations and fixed pricing for power “For reference, in Q1 2022, our cost to produce a Bitcoin was approximately $6,200. We also have fixed pricing for power, so we are not subject to changes in the energy markets.” Schumacher added that the company has been more focused on its Bitcoin...