Mining

Bitcoin daily mining revenue slumped in May to eleven-month low

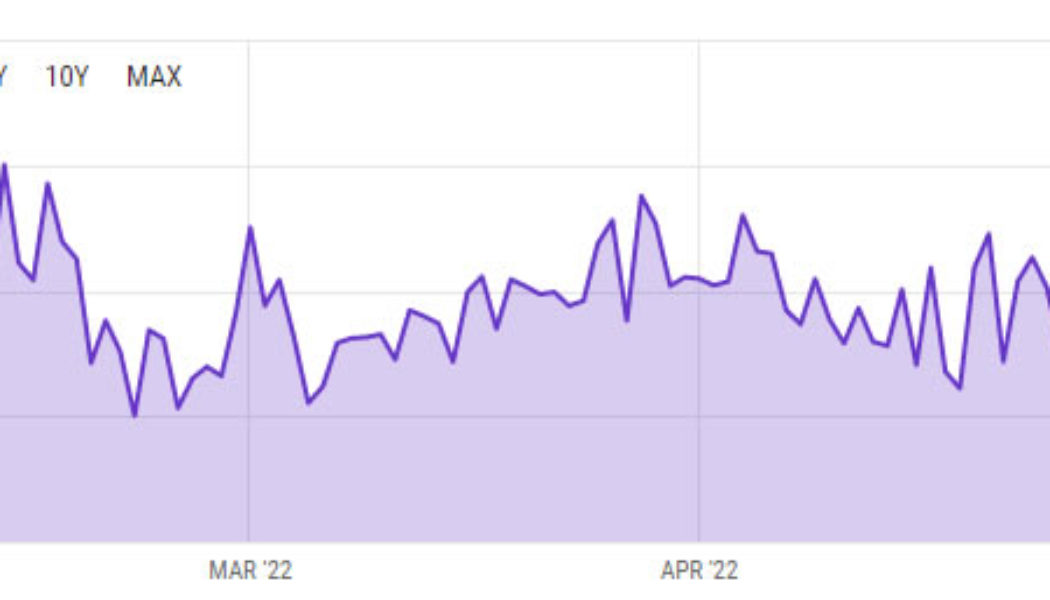

Bitcoin (BTC) mining revenue and profitability have continued to slide along with the asset’s price this year as the crypto winter deepens. May has been one of the worst months for Bitcoin miners in the past year as revenue and profitability continue to tank. Bitcoin daily mining revenue tanked as much as 27% in May, according to data from Ycharts sourcing data from Blockchain.com. On May 1, the analytics provider reported daily revenue of $40.57 million for BTC miners, but by the end of the month, it had fallen to $29.37 million. Daily mining revenue hit an eleven-month low of $22.43 million on May 24. BTC daily mining revenue YTD – ycharts.com Daily mining revenue spiked to a peak of around $80 million in April 2021 but has since fallen 62% to current levels. May ended the...

Here’s how much Kazakh gov’t made off crypto mining in Q1 2022

The government of Kazakhstan, one of the world’s largest countries by the Bitcoin (BTC) mining hash rate distribution, has reported budget earnings derived from cryptocurrency mining. On May 30, Kazakhstan’s state revenue committee of the Ministry of Finance released a report on the amount of total energy fees paid by local crypto miners in the first quarter of 2022. According to the report, Kazakhstan’s budget added 652 million Kazakhstani tenge ($1.5 million) in energy fees from crypto mining in Q1 2022 after the government introduced a digital mining fee on Jan. 1, 2022. The committee stressed that a significant amount of the expected sum of fees has not been received by the budget as the government has shut down a wide number of crypto mining firms in order to “ensure energy security.”...

3 metrics contrarian crypto investors use to know when to buy Bitcoin

Buying low and selling high is easier said than done, especially when emotion and volatile markets are thrown into the mix. Historically speaking, the best deals are to be found when there is “blood on the streets,” but the danger of catching a falling knife usually keeps most investors planted on the sidelines. The month of May has been especially challenging for crypto holders because Bitcoin (BTC) dropped to a low of $26,782, and some analysts are now predicting a sub-$20,000 BTC price in the near future. It’s times like these when fear is running rampant that the contrarian investor looks to establish positions in promising assets before the broader market comes to its senses. Here’s a look at several indicators that contrarian-minded investors can use to spot opportune moments for ope...

GPU prices are still on a decline: Is Bitcoin’s sorrow gamers’ joy?

The prices of graphics processing units (GPUs), also known as graphics cards, are undoubtedly still a far cry from the manufacturer’s suggested retail price (MSRP). However, they aren’t what they used to be either, especially considering what GPU prices looked like just a year ago. For instance, the price of a GPU from Nvidia GeForce RTX 30-series is 14% over its MSRP, according to reports from 3D Center. Whereas AMD’s Radeon RX 6000 is up 7% from its MSRP from April 17 and May 8. On the other hand, it is the first time since January that AMD’s Radeon RX 6000 dropped below 10% over MSRP. Meanwhile, just a month ago, these same prices were 19% and 12% above their MSRPs, respectively. The Nvidia RTX 3080 currently goes for a price range between $1,000 to $1,300. Despite being at such a long ...

Weak stocks and declining DeFi use continue to weigh on Ethereum price

Ether’s (ETH) 12-hour closing price has been respecting a tight $1,910 to $2,150 range for twelve days, but oddly enough, these 13% oscillations have been enough to liquidate an aggregate of $495 million in futures contracts since May 13, according to data from Coinglass. Ether/USD 12-hour price at Kraken. Source: TradingView The worsening market conditions were also reflected in digital asset investment products. According to the latest edition of CoinShare’s weekly Digital Asset Fund Flows report, crypto funds and investment products saw a $141 million outflow during the week ending on May 20. In this instance, Bitcoin (BTC) was the investors’ focus after experiencing a $154 weekly net redemption. Russian regulation and crumbling U.S. tech stocks escalate the situation Regula...

Contrarian Bitcoin investors identify buy zones even as extreme fear grips the market

Bitcoin (BTC) support at the $30,000 level has proven to be quite resilient amidst the turmoil of the past two weeks with many tokens in the top 100 now showing signs of consolidation after prices bounced off their recent lows. Fear & Greed Index. Source: Alternative.me During high volatility and sell-offs, it’s difficult to take a contrarian view and traders might consider putting some distance from all the noise and negative news-flow to focus on their core convictions and reason for originally investing in Bitcoin. Several data points suggest that Bitcoin could be approaching a bottom which is expected to be followed by a lengthy period of consolidation. Let’s take a look at what experts are saying. BTC may have already reached “max pain” The spike in realize...

China returns as 2nd top Bitcoin mining hub despite the crypto ban

The Chinese government has not managed to take down cryptocurrency operations as part of its crypto ban last year as China has re-emerged as one of the world’s largest Bitcoin (BTC) mining hubs, according to a new report. China became the second-largest Bitcoin hash rate provider as of January 2022, months after the local government banned all crypto operations in the country, according to the latest update from the Cambridge Bitcoin Electricity Consumption Index (CBECI) shared with Cointelegraph on May 17. Bitcoin miners in China accounted for 21.1% of the total global BTC mining hash rate distribution as of early 2022, following only the United States, which produced 37.8% of the total hash rate as of January, according to the data. China was once the world’s largest Bitcoin m...

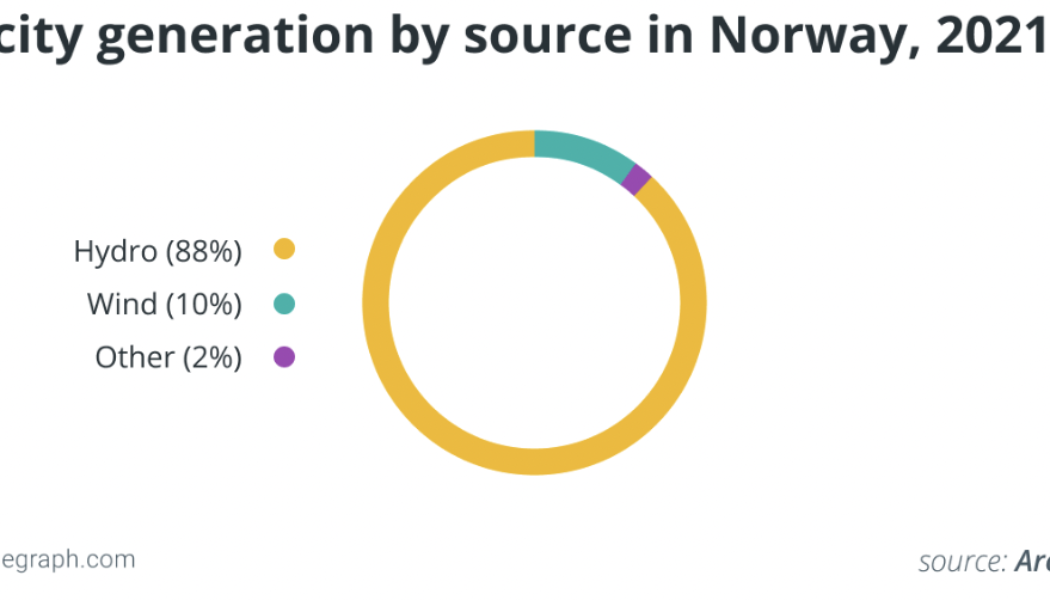

Bitcoin mining in Norway gets the green light as the proposed ban rejected

There’s Nor-way they can ban Bitcoin (BTC) mining in Norway now. That’s according to a majority vote passed by the Norwegian parliament on May 10. The proposal to ban Bitcoin mining in Norway was first suggested in March this year by the Red Party (Norway’s communist party.) In this week’s vote, the proposal was overturned as only Norway’s left-leaning parties, including the Socialist Left Party, the Red Party and the Green Party would support a ban on cryptocurrency mining. Jaran Mellerud, an Analyst at Arcane Research and a Cointelegraph confidant shed light on the developments: “The vote these parties lost was against banning large-scale Bitcoin mining overall.” “Having lost this vote, these political parties will likely make one more attempt at increasing the power tax specifical...

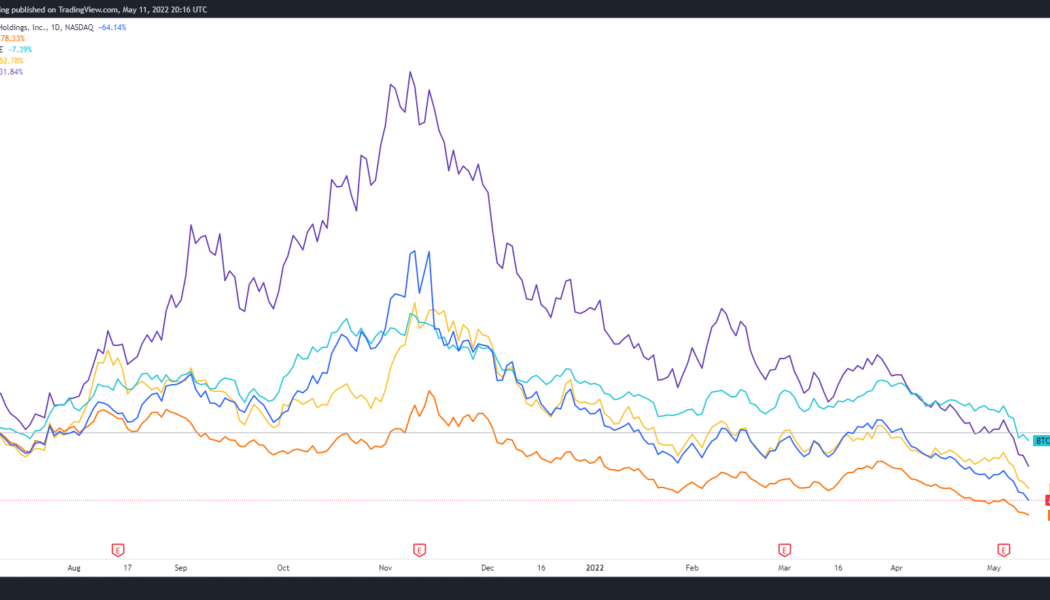

Crypto-associated stocks hammered as COIN and HOOD drop to record lows

Bad news continues to dominate crypto media headlines and May 12’s juiciest tidbit was the unexpected collapse of the Terra ecosystem. In addition to the weakness seen in equities, listed companies with exposure to blockchain startups and cryptocurrency mining have also declined sharply. Bitcoin mining stocks continue bleeding… Mining investors probably wish they had simply bought bitcoin instead at the beginning of 2022, as most bitcoin mining stocks have underperformed bitcoin by a wide margin. pic.twitter.com/anSoUEoUJ1 — Jaran Mellerud (@JMellerud) May 11, 2022 While it may be easy to blame the current pullback solely on Terra’s implosion, the truth is that the price of Bitcoin mining stocks has largely mirrored the performance of BTC since reaching a peak in November...

Crypto mining stocks crash as the market continues bleeding heavily

Bitcoin is down 13% in the last 24 hours, extending a bearish run that has wiped almost 30% of its value over the last seven days The massive-sell off has been felt by Bitcoin mining companies whose stock has registered declines Terra’s collapsing ecosystem has been the biggest headline in the crypto sector, but it isn’t the only crypto entity that has been affected by the market downturn. Its native token LUNA crumbled after continued losses totalling 98% in the last 24 hours. Its related stable coin, TerraUSD, has suffered a similar fate – down to $0.4711 against the dollar. Bitcoin is faring badly itself but is much better than Ethereum and many other altcoins. The flagship asset today fell below $28,000 – a low it hasn’t visited since December 2020. Notably, the latest b...

Environmental groups urge US government to take action on crypto miners

A group of eight organizations focused on the environment have called on different government agencies under the Biden administration to implement new approaches in response to Proof-of-Work and other crypto mining operations. In a letter to the United States Office of Science and Technology Policy on Monday, the Environmental Working Group, Earthjustice, Greenpeace, the League of Conservation Voters, the Sierra Club, Friends of the Earth, the Seneca Lake Guardian, and the Milwaukee Riverkeeper urged the White House to enact policies aimed at curbing “the electricity use and climate pollution associated with digital currencies that rely on [PoW].” Specifically, the organizations alleged crypto mining in the United States harmed communities by creating increasing demand for electricity sour...