Premium

Bitcoin traders say $34K was the bottom, but data says it’s too early to tell

Bitcoin (BTC) price traded down 23% in the eight days following its failure to break the $45,000 resistance on Feb. 16. The $34,300 bottom on Feb. 24 happened right after the Russian-Ukraine conflict escalated, triggering a sharp sell-off in risk assets. While Bitcoin reached its lowest level in 30 days, Asian stocks were also adjusting to the worsening conditions, a fact evidenced by Hong Kong’s Hang Seng index dropping 3.5% and the Nikkei also reached a 15-month low. Bitcoin/USD at FTX. Source: TradingView The first question one needs to answer is whether cryptocurrencies are overreacting compared to other risk assets. Sure enough, Bitcoin’s volatility is much higher than traditional markets, running at 62% per year. As a comparison, the United States small and mid-cap stock ...

Ethereum futures premium hits a 7-month low as ETH tests the $2,400 support

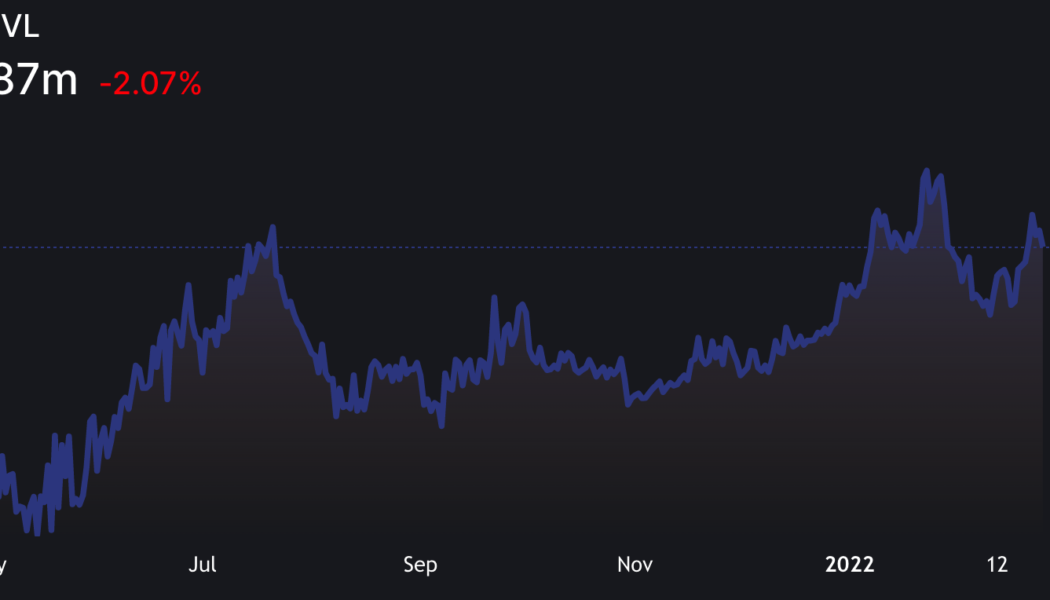

Ether (ETH) reached a $3,280 local high on Feb. 10, marking a 51.5% recovery from the $2,160 cycle low on Jan. 24. That price was the lowest in six months, and it partially explains why derivatives traders’ main sentiment gauge plummeted to bearish levels. Ether’s futures contract annualized premium, or basis, reached 2.5% on Feb. 25, reflecting bearishness despite the 11% rally to $2,700. The worsening conditions depict investors’ doubts regarding the Ethereum network’s shift to a proof-of-stake (PoS) mechanism. As reported by Cointelegraph, the much-anticipated sharding upgrade that will significantly boost processing capacity should come into effect in late 2022 or early 2023. Analyzing Ether’s performance from a longer-term perspective provides a more appealing sentiment, as the crypto...

Ethereum price holds above $3K but network data suggests bulls may get trapped

When analyzing Ether’s (ETH) price chart, one could conclude that the 3-month long bearish trend has been broken for a few reasons. The current $3,100 price range represents a 43% recovery in 15 days and, more importantly, the descending channel resistance was ruptured on Feb. 7. Should Ether bulls start celebrating and calling for $4,000 and higher? That largely depends on how retail traders are positioned, along with the Ethereum network’s on-chain metrics. For instance, is the $30-plus transaction fee impacting the use of decentralized applications (dApps), or are there any other factors that will prohibit Ether’s price growth? Ether (ETH) price at FTX, in USD. Source: TradingView Since the 55.6% correction from the $4,870 all-time high to the cycle bottom at $2,...

A key Ethereum price metric hits a 6 month low as ETH falls below $3K

Ether (ETH) price lost the $3,600 support on Jan. 5 as minutes from the Federal Reserve’s December FOMC meeting showed that the regulator was committed to decreasing its balance sheet and increasing interest rates in 2022. Even with that looming overhead, Ether has problems of its own, more specifically, the ongoing $40 and higher average transaction fees. On Jan. 3 Vitalik Buterin said that Ethereum needs to be more lightweight in terms of blockchain data so that more people can manage and use it. The concerning part of Vitalik’s interview was the status of the Ethereum 2.0 upgrade, which is merely halfway implemented after six years. The subsequent roadmap phases include the “merge” and “surge” phases, followed by “full sharding implementation.&#...

Bitcoin price can’t find its footing, but BTC fundamentals inspire confidence in traders

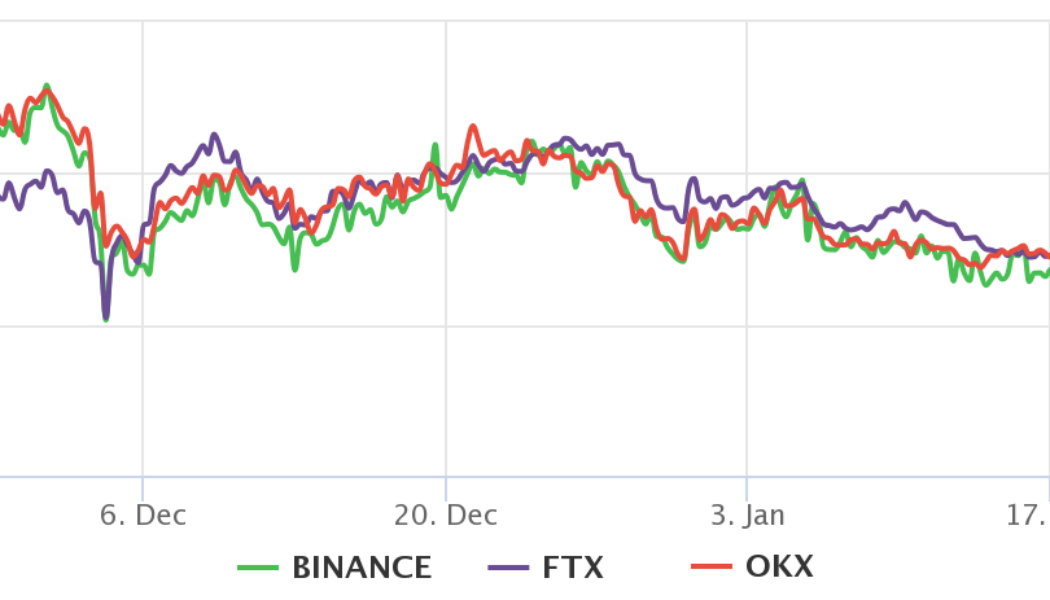

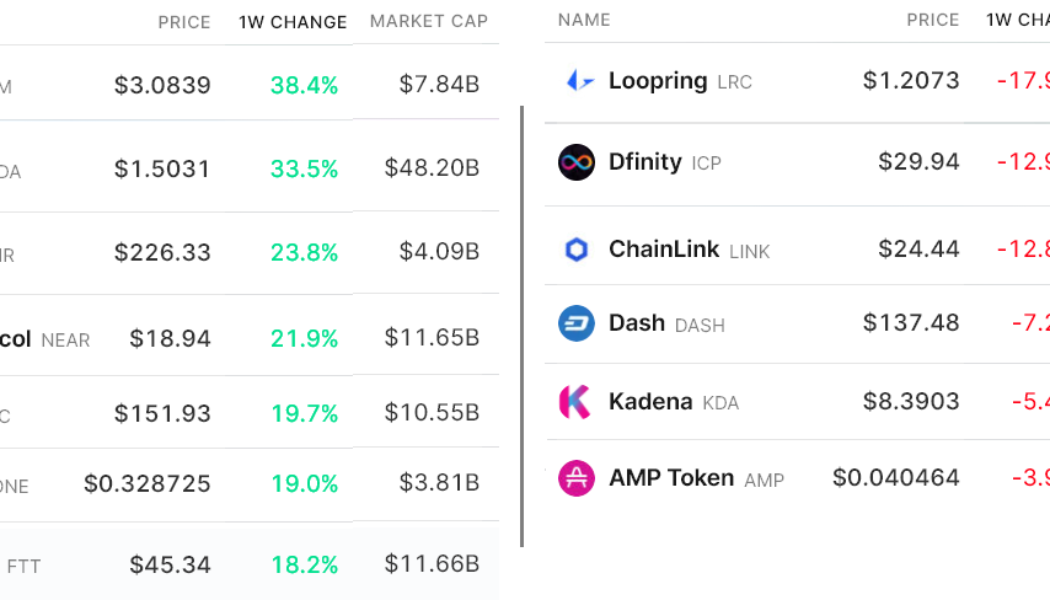

Bitcoin’s (BTC) sudden crash on Jan. 10 caused the price to trade below $40,000 for the first time in 110 days and this was a wake-up call to leveraged traders. $1.9 billion worth of long (buy) futures contracts were liquidated that week, causing the morale among traders to plunge. The crypto “Fear & Greed” index, which ranges from 0 “extreme fear” to 100 “greed” reached 10 on Jan. 10, the lowest level it has been since the Mar. 2020 crash. The indicator measures traders’ sentiment using historical volatility, market momentum, volume, Bitcoin dominance and social media. As usual, the panic turned out to be a buying opportunity because the total crypto market capitalization rose by 13.5%, going from a $1.85 trillion bottom to $2.1 trillion in le...

Ether drops below $3,800, but traders are unwilling to short at current levels

Even though Ether (ETH) reached a $4,870 all-time high on Nov. 10, bulls have little reason to celebrate. The 290% gains year-to-date have been overshadowed by Dec.’s 18% price drop. Still, Ethereum’s network value locked in smart contracts (TVL) increased nine-fold to $155 billion. Looking at the past couple of months’ price performance chart doesn’t really tell the whole story, and Ether’s current $450 billion market capitalization makes it one of the world’s top 20 tradable assets, right behind the two-century-old Johnson & Johnson conglomerate. Ether/USD price at FTX. Source: TradingView 2021 should be remembered by the decentralized exchanges’ sheer growth, whose daily volume reached $3 billion, a 340% growth versus the last quarter of 202...

Crypto regulation is coming, but Bitcoin traders are still buying the dip

Looking at the Bitcoin chart from a weekly or daily perspective presents a bearish outlook and it’s clear that (BTC) price has been consistently making lower lows since hitting an all-time high at $69,000. Bitcoin/USD on FTX. Source: TradingView Curiously, the Nov. 10 price peak happened right as the United States announced that inflation has hit a 30-year high, but, the mood quickly reversed after fears related to China-based real estate developer Evergrande defaulting on its loans. This appears to have impacted the broader market structure. Traders are still afraid of stablecoin regulation This initial corrective phase was quickly followed by relentless pressure from regulators and policy makers on stablecoin issuers. First came VanEck’s spot Bitcoin ETF rejection by the U.S....

YouTube to bring picture-in-picture to iPhones and iPads

The YouTube app on iOS will be getting picture-in-picture support, allowing all users to watch videos while doing other things on their iPhones and iPads. A YouTube spokesperson told the media that the feature is currently rolling out to Premium subscribers, and that a launch for all iOS users (including the free ones) in the US is in the works. Apple added support for picture-in-picture video for iPads with iOS 13, and brought it to iPhones with iOS 14. Since then, YouTube’s support for the feature on iPhones and iPads has been spotty — it works for iPad if you’re using Safari (though some have reported it doesn’t work for non-Premium subscribers); iPhone users have only been able to access the feature periodically. That complication seems to be going away, at least for those in the US: i...