Price predictions

Bloomberg strategist Mike McGlone predicts a bullish run once the correction ends

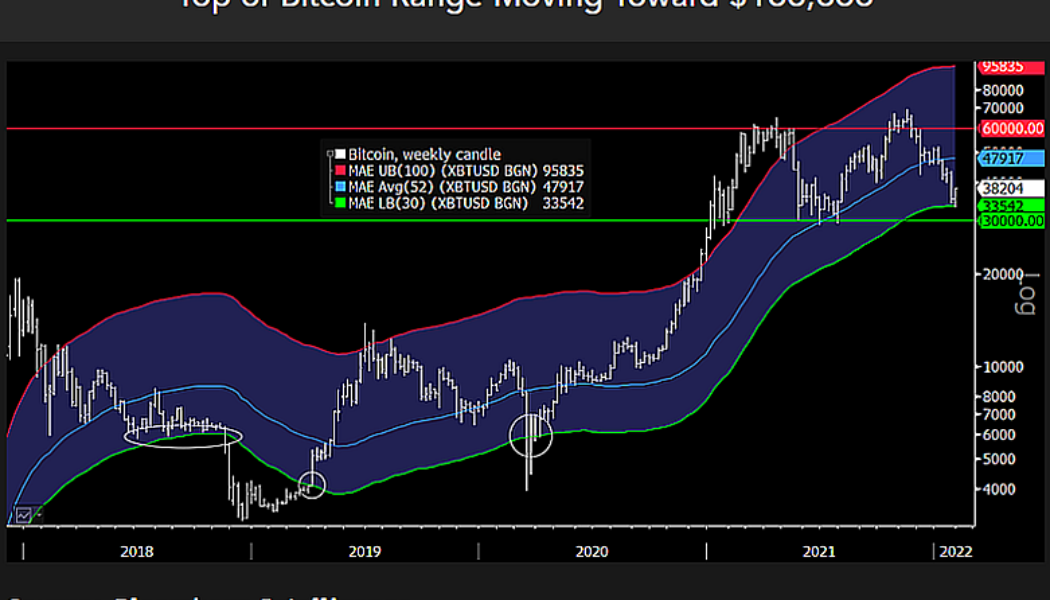

McGlone based his projection on the law of demand and supply He also posited that Bitcoin could be carving a bottom at $30k The two leading cryptocurrencies, Bitcoin and Ethereum, are poised to surge if they escape the persistent range-bound trading, according to Bloomberg’s Mike McGlone. McGlone argues that the former will get out of the current market slump on ‘bullish fundamentals.’ In a tweet shared today, he forecasted that the value of the two crypto assets will potentially rocket, citing the law of demand and supply. “What Ends #Bitcoin, #Ethereum Range Trade? Bullish Fundamentals – By the rules of economics, a market with rising demand and declining supply will go up over time, suggesting that Bitcoin may be forming a bottom again around $30,0...

Here is why ARK Invest believes Bitcoin will trade at $1 million by 2030

Cathie Wood’s investment management firm ARK Invest has laid bold predictions for Bitcoin and Ethereum in a recently published outlook report Disruptive innovation-oriented investment firm ARK Invest has predicted that Bitcoin’s market capital will reach $28.5 trillion by 2030. The firm’s analyst Yassine Elmandjra noted in its annual research report that the price of a bitcoin will surge to $1.36 million by then. He justified the prediction by pointing out that the crypto asset’s usage is only in its nascent stage. “Bitcoin’s market capitalisation still represents a fraction of global assets and is likely to scale as nation-states adopt as legal tender. According to our estimates, the price of one bitcoin could exceed $1 million by 2030,” Elmandjra...

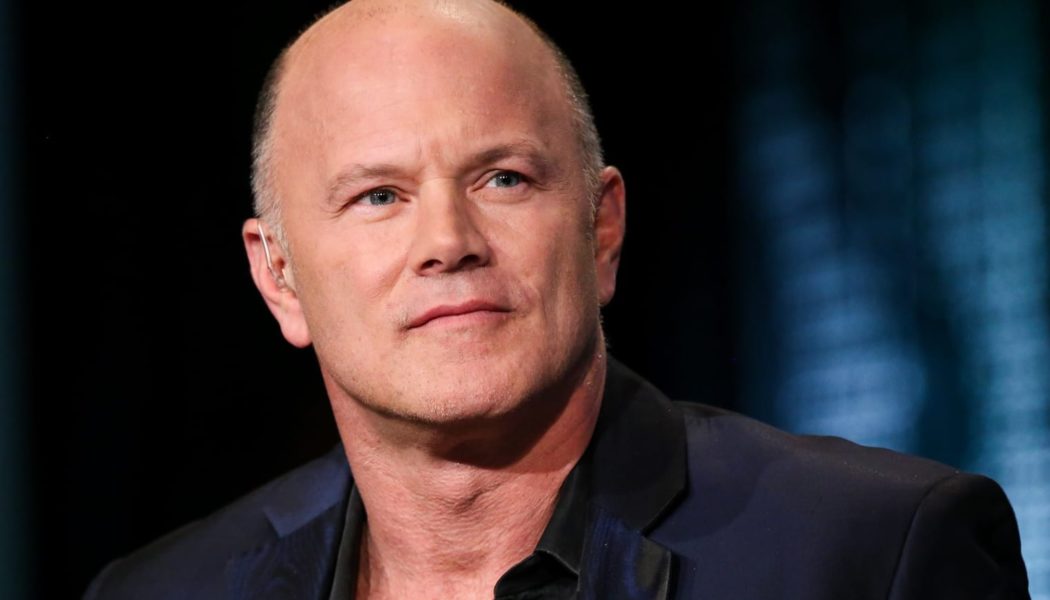

Bitcoin down 11% over the last 7-days: Here’s Galaxy Digital chief’s projected BTC price floor figure

The ex-hedge fund manager predicted last month that Bitcoin could hold at $42,000 Financier and crypto investor Mike Novogratz recently told CNBC that he expects to see Bitcoin fall even further to a price floor much around $40,000 or $38,000. Bloomberg reported the change of heart from the crypto bull who recently opined that Bitcoin could hold at $42,000. Delving into the projection, Novogratz stated that he would put a hold on buying crypto again. The Galaxy Investment chief added that there is a substantial amount of institutional money, ready to pounce on the opportunity to get into the space. “(There is a) tremendous amount of institutional demand on the sidelines,” he said. He insisted he is not tense about the medium-term performance of cryptocurrencies even though...

Nexo’s Antoni Trenchev predicts a $100k Bitcoin price point by mid this year

Anthony Trenchev sees Bitcoin as an inflation hedge equivalent to gold Antoni Trenchev, the co-founder of crypto lending platform Nexo, has given his predictions on the world’s most dominant digital asset. In an interview published yesterday, Trenchev told CNBC that he sees the world’s largest crypto coin doubling in value by the end of June this year. “I’m quite bullish on bitcoin. I think it’s going to reach $100K this year, probably by the middle of it,” he said. Institutional adoption and Macroeconomic realities are the key drivers The Bulgarian crypto businessman bases his prediction to two major reasons. First, he explained that many major businesses are shifting part of their portfolios into Bitcoin investment and that this would be the major reason that would bo...