proof-of-stake

Ethereum futures backwardation hints at 30% ‘airdrop rally’ ahead of the Merge

Ether (ETH) bulls like a positive spread between its spot and ETH futures prices because the so-called contango reflects optimism about a higher rate in the future. But as of Aug. 1, the Ethereum futures curve slid in the opposite direction. Ethereum quarterly futures in backwardation On the daily chart, Ethereum futures quarterly contracts, scheduled to expire in December 2022, have slipped into backwardation, a condition opposite to contango, wherein the futures price becomes lower than the spot price. The spread between Ethereum’s spot and futures price grew to -$8 on Aug. 1. ETH230-ETHUSD daily price chart. Source: TradingView One one hand, the current ETH spot price being higher than its year-end outlook appears like a bearish sign. However, the conditions surrou...

Ethereum will outpace Visa with zkEVM Rollups, says Polygon co-founder

zkEVM Rollups, a new scaling solution for Ethereum, will allow the smart contract protocol to outpace Visa in terms of transaction throughput, said Polygon co-founder Mihailo Bjelic in a recent interview with Cointelegraph. Polygon recently claimed to be the first to implement a zkEVM scaling solution, which aims at reducing Ethereum’s transaction costs and improving its throughput. This layer-2 protocol can bundle together several transactions and then relay them to the Ethereum network as a single transaction. The solution, according to Bjelic, represents the Holy Grail of Web3 as it offers security, scalability and full compatibility with Ethereum, which means developers won’t have to learn a new programing language to work with it. “When you launch a scaling solution,...

Ethereum Merge: How will the PoS transition impact the ETH ecosystem?

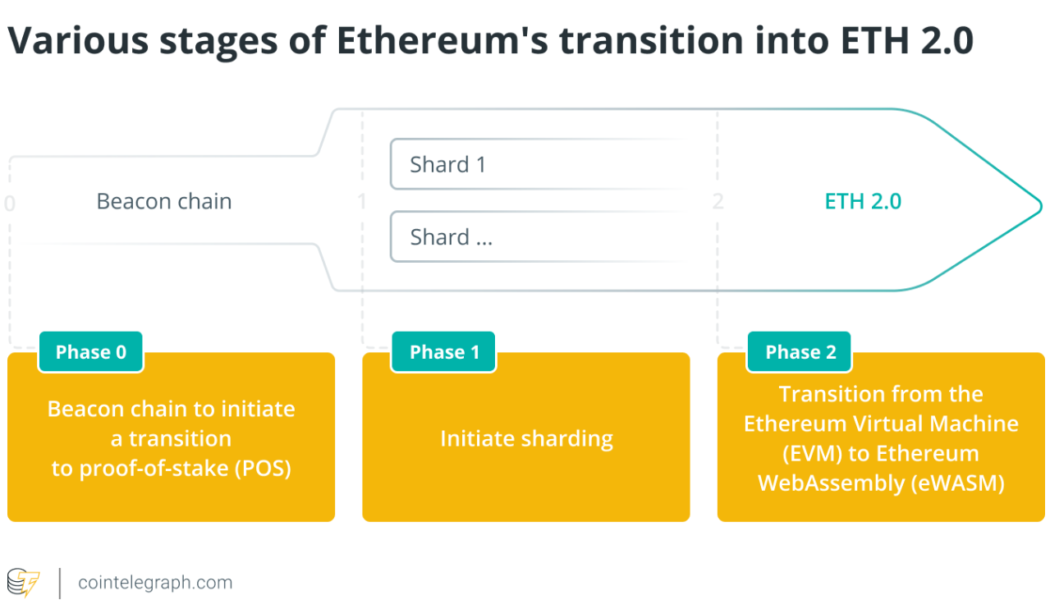

The Ethereum blockchain is on the verge of one of the most crucial technical updates since its inception, moving from proof-of-work (PoW) to proof-of-stake (PoS), also called Ethereum 2.0, or Eth2. Ethereum devs gave Sept. 19 as the perpetual date for the merger of the current PoW chain to the PoS chain. The Merge is expected to be deployed on the Goerli testnet in the second week of August. After the successful integration of the Goerli testnet, the blockchain will initiate the Bellatrix update in early August and roll out the Merge two weeks later. The discussion around the transition began with a focus on scalability, so Ethereum developers proposed a three-phase transformation process. The transition itself is nearly two years in the making, starting on December 1, 2020, with the...

Ethereum’s bearish U-turn? ETH price momentum fades after $1.6K rejection

Ethereum’s native token Ether (ETH) tumbled on July 26, reducing hopes of an extended price recovery. The ETH/USD pair dropped by roughly 5%, followed by a modest rebound to over $1,550. Ethereum gets rejected at $1,650 These overnight moves liquidated over $80 million worth of Ether positions in the last 24 hours, data from CoinGlass reveals. ETH/USD hourly price chart. Source: TradingView The seesaw action also revealed an underlying bias conflict among traders who have been stuck between two extremely opposite market fundamentals. The first is the euphoria surrounding Ethereum’s potential transition to proof-of-stake in September, which has helped Ether’s price to recover 45% month-to-date. However, this bullish hype is at odds with macroeconomic headwinds, namel...

Ethereum Classic soars 100% in nine days outperforming ETH as ‘the Merge’ approaches

Ethereum Classic (ETC) has been outperforming its arch-rival Ethereum’s native token Ether (ETH) during the current crypto market rebound with the ETC/ETH pairs at 10-month highs. Why is ETC beating ETH? ETC’s price has risen to $27 on July 22, amounting to a 100% gain in nine days after bottoming out at $13.35. Comparatively, ETH’s price has seen a 64% rally in U.S. dollar terms. ETC/USD versus ETH/USD daily price chart. Source: TradingView Ethereum’s rebound has been among the sharpest among the top cryptocurrencies, primarily due to the euphoria surrounding its potential network upgrade in September. Dubbed “the Merge,” the long-awaited technical update will switch Ethereum from proof-of-work (PoW) to proof-of-stake (PoS). Anyone who believes the #Eth...

Ethereum price ‘cup and handle’ pattern hints at potential breakout versus Bitcoin

Ethereum’s native token Ether (ETH) has rebounded 40% against Bitcoin (BTC) after bottoming out locally at 0.049 on June 13. Now, the ETH/BTC pair is at two-month highs and can extend its rally in the coming weeks, according to a classic technical pattern. ETH paints cup and handle pattern Specifically, ETH/BTC has been forming a “cup and handle” on its lower-timeframe charts since July 18. A cup and handle setup typically appears when the price falls and then rebounds in what appears to be a U-shaped recovery, which looks like a “cup.” Meanwhile, the recovery leads to a pullback move, wherein the price trends lower inside a descending channel called the “handle.” The pattern resolves after the price rallies to an approximately equal size to ...

Inflation got you down? 5 ways to accumulate crypto with little to no cost

Experienced crypto traders know that bull markets are for selling and bear markets are for accumulation, but the latter can be difficult amid a backdrop of surging inflation that saps the purchasing power of fiat currencies. As the crypto market heads deeper into crypto winter, with prices in the gutter and developers focused on creating the next popular protocol or breakout token, some crypto fans have begun to explore new ways of increasing their stack in preparation for the next bull market. Here’s a look at the top five ways hodlers can increase the size of their crypto portfolio without breaking the bank so that the money they earn can go toward combating the rising cost of living. Staking Staking is perhaps the most tested and proven way to increase the number of tokens held, a...

All ‘Ethereum killers’ will fail: Blockdaemon’s Freddy Zwanzger

Blockdaemon’s ETH ecosystem lead Freddy Zwanzger believes Ethereum will retain its leadership position in the crypto ecosystem over the coming years due to its utility as a smart contract platform and upgrades to the network following the Merge. Speaking to Cointelegraph during the Ethereum Community Conference (EthCC) this week, Zwanzger said: “It’ll continue to be a leader. I mean, obviously, the first and most important smart contract platform, and that’s not going to change.” Blockdaemon is an institutional-grade blockchain infrastructure platform that offers node operations and infrastructure tooling for blockchain projects. The Blockdaemon employee also took aim at so-called “Ethereum killers” — competing Layer 1 blockchains — which have tried to topple Ethereum fro...

Will Ethereum Merge hopium continue, or is it a bull trap?

Ethereum is outperforming the broader cryptocurrency market as the highly anticipated Merge approaches, but the bigger picture is still largely bearish. Ethereum (ETH) has gained a whopping 48% over the past seven days, outperforming its big brother Bitcoin, which has only managed to achieve 19% in the same period. It’s also up 66% from its market cycle bottom of $918 on June 19, reaching its current price of $1549. However, the current Ethereum rally could be a bull trap with the macroeconomic clouds darkening. A bull trap is a signal indicating that a declining trend in a crypto asset has reversed and is heading upwards when it will actually continue downwards. The primary driver of recent momentum for the asset has been linked to announcements regarding its final switch to pr...

2018 Ethereum price fractal suggests a $400 bottom, but analysts say the merge is a ‘wildcard’

There’s no rest for the weary during a bear market, and the Crypto Fear and Greed index shows that investor sentiment has been stuck in a state of “extreme fear” for a record 70 consecutive days. As the market looks for a catalyst to reverse the trend, there is little on the horizon besides the Ethereum (ETH) Merge that seems capable of sparking a rally. If that is indeed the case, the market could continue to trend down or sideways until the tentative Merge date of September 19. Data from Cointelegraph Markets Pro and TradingView shows that Ether price remains sandwiched in the trading zone it has been trading in since June 13 and it is currently running into the upper resistance near $1,240. ETH/USDT 1-day chart. Source: TradingView With the Merge still a couple of months awa...

Lido DAO most ‘overbought’ since April as LDO price rallies 150% in two weeks — what’s next?

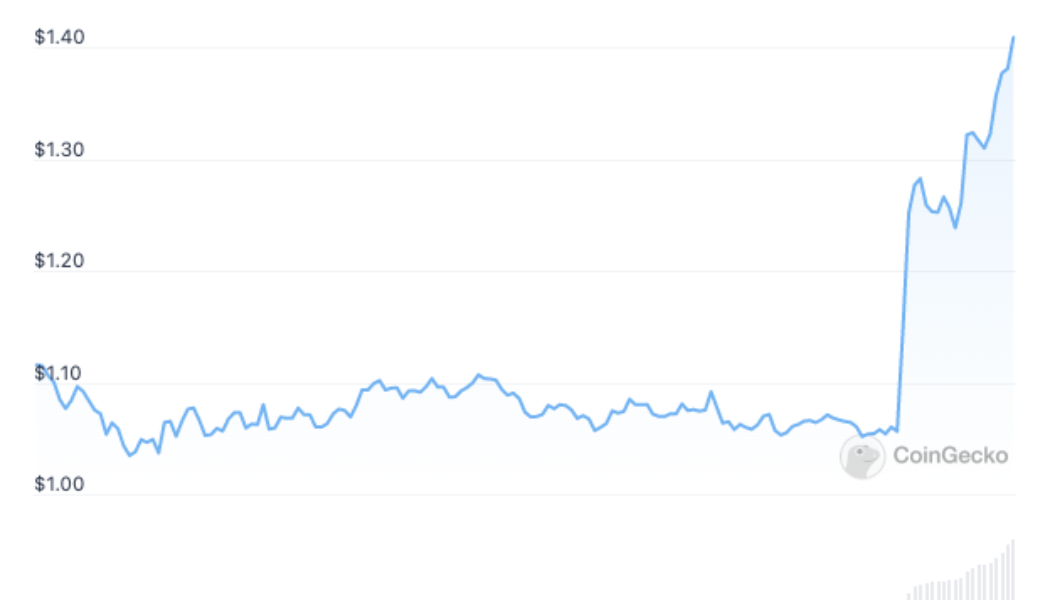

The price of Lido DAO (LDO) dropped heavily a day after its key momentum oscillator crossed into “overbought” territory. LDO undergoes overbought correction LDO’s price plunged to as low as $1.04 on July 16 from $1.32 on July 15, amounting to a 20%-plus decline. The token’s sharp downside move took its cues from multiple bearish technical indicators, including its daily relative strength index (RSI) and its 100-day exponential moving average (EMA). LDO’s latest plunge came after it rallied over 150% in just two weeks, a move that simultaneously pushed its daily RSI above 70 on July 15, thus turning it overbought. An overbought RSI signals that the rally may be nearing an end while readying for a short-term pullback. Meanwhile, more downside cues for the ...

‘Unique phenomenon’: All 5B toncoins mined on PoS TON blockchain

The TON Foundation, an organization developing the Telegram-initiated blockchain project, the TON blockchain, on Tuesday officially announced that TON miners have mined the final toncoin. “Tens of thousands of miners have mined the entire issuance of toncoins, which was about 5 billion tokens,” TON Foundation founding member and core developer Anatoly Makosov said in a statement to Cointelegraph. The last toncoin was mined on June 28, he noted. The end of toncoin mining marks a major milestone in TON’s distribution, starting its new era as an entirely PoS blockchain. From now on, new toncoins will only enter circulation via PoS validation, the TON Foundation said. That will result in a cut in the total influx of new toncoins into the network by around 75% to the existing l...