Regulation

SEC pushes decisions on WisdomTree’s and One River’s applications for spot Bitcoin ETFs

The United States Securities and Exchange Commission has extended its window to approve or disapprove spot Bitcoin (BTC) exchange-traded fund (ETF) applications from asset managers WisdomTree and One River. According to separate Friday filings, the SEC will push the deadline for approving or disapproving a rule change allowing shares of the WisdomTree Bitcoin Trust and One River Carbon Neutral Bitcoin Trust to be listed on the Cboe BZX Exchange and New York Stock Exchange Arca, respectively. The regulator said it would extend its window for the decision on WisdomTree’s Bitcoin investment vehicle to May 15 and One River’s to June 2. The spot BTC ETF application from WisdomTree followed the SEC rejecting a similar offering from the asset manager in December 2021 after several delay...

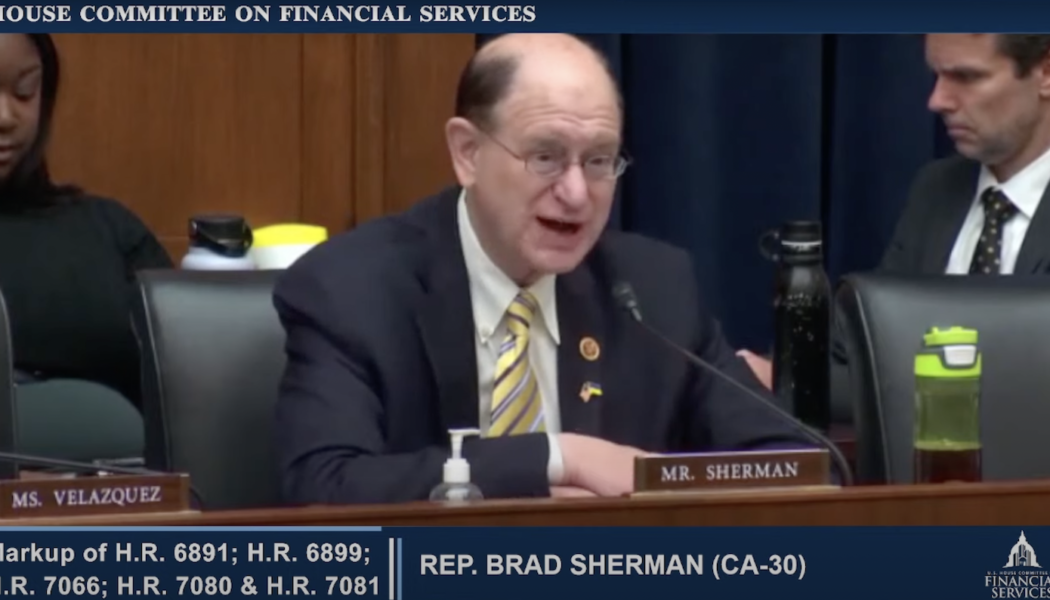

US lawmakers introduce bills that could force crypto exchanges to cut ties with Russian wallets

Representative Brad Sherman will be introducing a bill in the House aimed at cracking down on U.S. businesses handling crypto transactions for Russian banks and individuals. Speaking at a hybrid markup meeting with the House Financial Services Committee on Thursday, Sherman said he will be introducing a companion bill to Senator Elizabeth Warren’s legislation that would give the Biden administration “explicit authority to require that crypto exchanges that are subject to U.S. law stop facilitating transactions with Russian-based crypto wallets.” Warren first announced the legislation on March 8, later saying during a Senate Banking Committee hearing she will be introducing the bill on Thursday. Neither bill’s text is available through congressional records at the time of publication....

Ukraine’s president signs law establishing regulatory framework for crypto

Volodymyr Zelenskyy, the president of Ukraine currently based in Kyiv, has signed a law establishing a legal framework for the country to operate a regulated crypto market. In a Wednesday announcement, Ukraine’s Ministry of Digital Transformation said Zelenskyy signed a bill named “On Virtual Assets,” first adopted by the country’s legislature, the Verkhovna Rada, in February. Crypto exchanges and firms handling digital assets will be required to register with the government to operate legally in Ukraine, and banks will be allowed to open accounts for crypto firms. The law endows Ukraine’s National Securities and Stock Market Commission with the power to determine the country’s policies on digital assets, issue licenses to businesses dealing with crypto and act as a financial watchdo...

Biden’s pick for Fed vice chair for supervision withdraws amid Republican objections

Former Federal Reserve Board governor Sarah Bloom Raskin has withdrawn her name for consideration as the central bank’s vice chair for supervision in an attempt to allow other nominations to move forward. According to a Tuesday tweet from Washington Post journalist Seung Min Kim, Raskin sent a letter to U.S. President Joe Biden withdrawing as his nominee for the next vice chair for supervision of the Federal Reserve, citing “relentless attacks by special interests.” The letter referred to Republican lawmakers who, she said, have “held hostage” her nomination since February. “Their point of contention was my frank public discussion of climate change and the economic costs associated with it,” said Raskin. “It was — and is — my considered view that the perils of climate change must be added ...

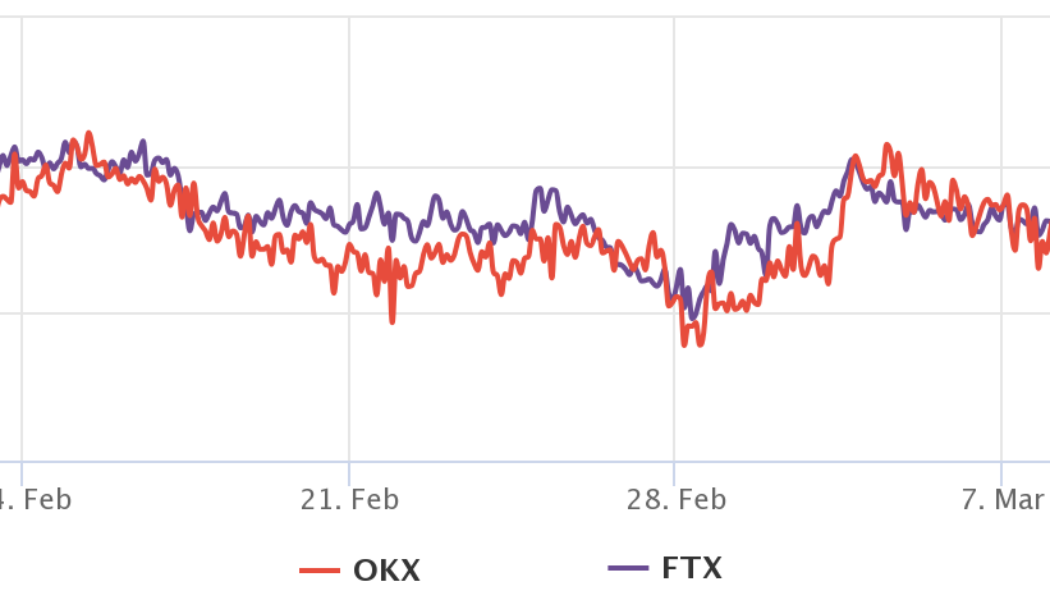

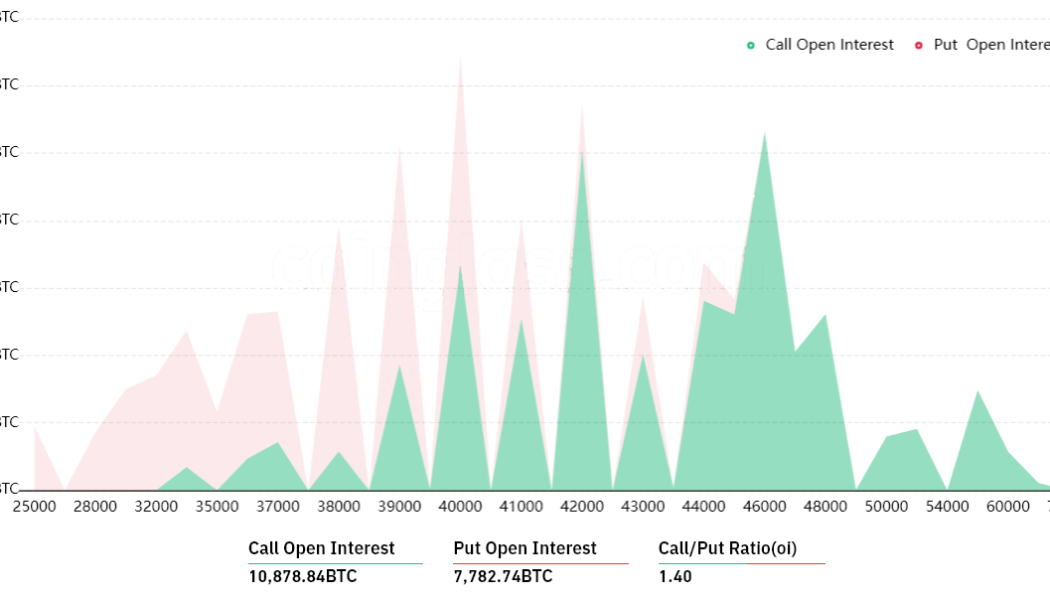

Bitcoin derivatives metrics reflect traders’ neutral sentiment, but anything can happen

Bitcoin’s (BTC) last daily close above $45,000 was 66 days ago, but more importantly, the current $39,300 level was first seen on Jan. 7, 2021. The 13 months of boom and bust cycles culminated with BTC price hitting $69,000 on Nov. 10, 2021. It all started with the VanEck spot Bitcoin exchange-traded fund being rejected by the United States Securities and Exchange Commission (SEC) on Nov. 12, 2020. Even though the decision was largely expected, the regulator was harsh and direct on the rationale backing the denial. Curiously, nearly one year later, on Nov. 10, 2021, cryptocurrency markets rallied to an all-time high market capitalization at $3.11 trillion right as U.S. inflation as measured by the CPI index hit 6.2%, a 30-year high. Inflation also had negative consequences on risk ma...

US and EU double down on measures against Russia potentially using crypto to evade sanctions

The United States and the European Union have announced new actions targeting Russia’s economy and wealthy individuals as a report suggests Vladimir Putin’s allies have attempted to circumvent sanctions using cryptocurrency in foreign countries. In a Friday announcement, the White House said leadership from the United States, Canada, France, Germany, Italy, Japan, the United Kingdom and the European Union will take additional actions aimed at economically isolating Russia in response to President Vladimir Putin’s military invasion of Ukraine. The announcement includes banning imports of many Russian goods, banning the export of luxury goods to Russia and guidance for the U.S. Treasury Department to monitor the country’s attempts to evade existing sanctions. “Treasury’s expansive actions ag...

FBI director: Russia overestimates its ability to bypass US sanctions using crypto

Christopher Wray, the director of the Federal Bureau of Investigation, said that fiat was a more likely avenue for Russia to explore in circumventing sanctions, given the United States’ ability to block efforts using crypto. In a Thursday hearing of the Senate Select Committee on Intelligence, New Mexico Senator Martin Heinrich asked the FBI director if Russia might respond to the economic impact of the United States banning imports of the country’s oil and gas by using reserves of gold, China’s currency or cryptocurrency. Director Wray said the FBI and its partners had “built up significant expertise” on digital assets, citing the department’s recent work in seizing large amounts of tokens as evidence there were vulnerabilities in using crypto to get around sanctions. “The Rus...

Regulators and industry leaders react to Biden‘s executive order on crypto

Joe Biden has signed his 82nd executive order since being sworn into office in January 2021, directly addressing a regulatory framework for digital assets in a rare moment for the U.S. president. In a Wednesday announcement, the White House said President Biden’s executive order required government agencies to explore the potential rollout of a United States central bank digital currency as well as coordinate and consolidate policy on a national framework for crypto. Many media outlets previously reported the U.S. president had initially planned to sign the executive order in February, an event that was likely postponed following Russia’s military actions in Ukraine. The reaction from many industry leaders compared the executive order to a regulatory opportunity — Biden had rarely sp...

Dubai establishes virtual asset regulator and announces new crypto law

Sheikh Mohammed bin Rashid Al Maktoum, the ruler of Dubai in the United Arab Emirates who holds several positions including prime minister, has announced a new law on virtual assets as well as the establishment of a crypto regulator. In a Wednesday announcement, Sheikh Al Maktoum said he had issued a law creating a legal framework for crypto in the Emirate of Dubai aimed at protecting investors and “designing much-warranted international standards” for industry governance. In addition, the ruler said a newly formed Dubai Virtual Asset Regulatory Authority, or VARA, would have enforcement powers in the Emirate’s special development zones and free zones with the exception of the Dubai International Financial Centre. “Approving the virtual asset law and establishing the Dubai Virtual As...

Treasury to launch financial education initiative around crypto investments

The United States Treasury Department is launching a new initiative to raise awareness of the risks involved in investing in digital assets. The move comes as the asset class transitions from a niche market into mainstream investment, according to a top Treasury official, potentially drawing in less sophisticated investors. The Department’s Financial Literacy Education Commission is developing educational materials designed to inform the public how crypto assets operate and differ from traditional assets. Treasury undersecretary for domestic finance, Nellie Liang, told Reuters that the target demographic is people that have limited access to mainstream financial services. She stated: “We’re hearing more and more about investors and households who are purchasing crypto assets, and we recogn...

FinCEN includes crypto in alert on Russia potentially evading sanctions

The United States Financial Crimes Enforcement Network, or FinCEN, a bureau of the Treasury Department, has warned financial institutions to consider crypto as a possible means Russia may attempt to use to evade sanctions related to the country’s military action in Ukraine. In a Monday alert, FinCEN reminded U.S.-based financial institutions “with visibility into cryptocurrency” and convertible virtual currency, or CVC, to report any activity that could be considered a potential way for Russia to evade sanctions imposed by the U.S. and its allies. While the U.S. watchdog said that the Russian government using CVCs to evade large scale sanctions was “not necessarily practicable,” financial institutions were obligated to report such activities from Russian and Belarusian individuals named in...