Regulation

Tennessee lawmaker introduces bill which would allow state to invest in crypto

Jason Powell, a member of the Tennessee House of Representatives, has introduced a bill proposing counties, municipalities, and the state to invest in cryptocurrencies and nonfungible tokens, or NFTs. According to Tennessee House Bill 2644 introduced on Feb. 2, Powell proposed amending the current state code to add crypto, blockchain, and NFTs to the list of authorized investments for the counties, state, and municipalities to make with idle funds. Lawmakers assigned the bill to the House Finance, Ways, and Means Subcommittee on Feb. 8 for further consideration. The legislation was the second related to crypto and blockchain introduced by Powell. The same day, he asked Tennessee lawmakers to consider forming a study committee aimed at making the state “the most forward thinking and p...

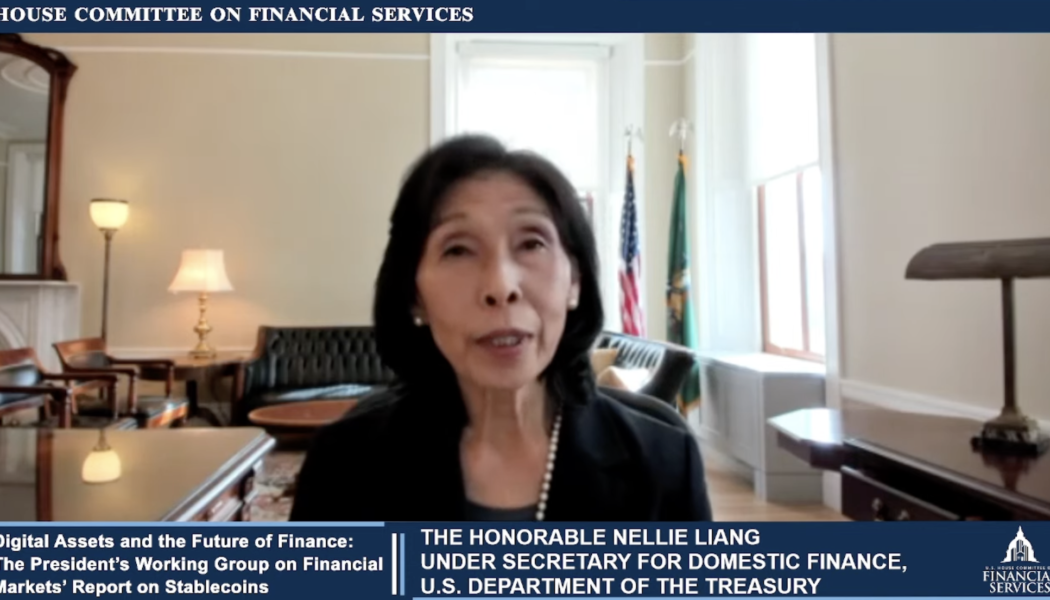

US lawmaker pushes for state-level regulations on stablecoins at hearing on digital assets

Whether regulations on stablecoins and digital assets should be addressed at the state or federal level was the topic of discussion among at least two U.S. lawmakers in a hearing for the House Committee on Financial Services. Speaking virtually at a Tuesday hearing titled “Digital Assets and the Future of Finance: The President’s Working Group on Financial Markets’ Report on Stablecoins,” North Carolina Representative and ranking committee member Patrick McHenry asked the committee to consider state-level regulatory frameworks in lieu of a comprehensive federal law on stablecoins. In response to McHenry, Jean Nellie Liang, the Under Secretary for Domestic Finance at the U.S. Treasury Department, said there was no explicit law governing stablecoins and digital assets at the federal level bu...

Major crypto firms and groups form coalition aimed at promoting ‘market integrity’

Several cryptocurrency exchanges and advocacy groups across different countries have banded together to form a coalition intended to fight market manipulation. In a Monday announcement, market surveillance firm Solidus Labs and exchanges including Bitstamp, Coinbase, BitMEX, and CrossTower said they would be launching the Crypto Market Integrity Coalition, or CMIC, asking all other companies involved in the crypto space to follow their example. According to the CMIC, members must pledge to encourage “a fair digital asset marketplace to combat market abuse and manipulation and promote public and regulatory confidence” in crypto. The group’s 17 founding members includes U.S.-based crypto advocacy group Chamber of Digital Commerce, United Kingdom-based self-regulatory trade association Crypto...

Myanmar’s military government considers launching digital currency: Report

The armed forces of Myanmar, which have been in control of the government since forcibly detaining many elected leaders in 2021, is reportedly planning to release a digital currency to help the local economy. According to a Thursday report from Bloomberg, Major General Zaw Min Tun said rolling out a digital currency would “help improve financial activities in Myanmar,” but military officials were undecided on whether to work with local companies or release the token on their own. Tun, the chief of the military government’s “True News Information Team,” acts as a spokesperson for the Myanmar army. The digital currency is aimed at supporting payments within Myanmar as well as improving the economy. According to a Jan. 25 report, the World Bank estimated that the country’s economy...

America COMPETES Act passes House without ‘disastrous’ provision on crypto

A piece of legislation aimed at addressing supply chain issues to keep the U.S. economy and businesses competitive has passed the House of Representatives — without a provision many in the crypto space had criticized for giving the Treasury Secretary authority to shut down exchanges. In a 222-210 vote on Friday, the House of Representatives passed the America COMPETES Act mostly along party lines. The provision originally proposed by Connecticut Representative Jim Himes would seemingly have allowed the Treasury Secretary to have fewer limits on surveilling financial institutions with suspected transactions connected to money laundering and not open the matter to include public feedback. However, lawmakers modified the wording earlier this week to safeguard restrictions currently under by t...

US lawmakers reintroduce bill to stop IRS from taxing crypto transactions under $200

A bill previously introduced by Washington Representative Suzan DelBene aims to exempt crypto users from paying taxes on transactions under $200. According to a Tuesday draft of the Virtual Currency Tax Fairness Act of 2022, Washington Representative Suzan DelBene is seeking to amend the Internal Revenue Code of 1986 to exclude gains from certain personal transactions of virtual currency. If signed into law, the bill could stop the Internal Revenue Service, or IRS, from requiring U.S. filers to pay taxes on capital gains from crypto transactions of $200 or more. “Antiquated regulations around virtual currency do not take into account its potential for use in our daily lives, instead treating it more like a stock or ETF,” said DelBene. “Virtual currency has evolved rapidly in the past few y...

Bitcoin, Ether and NFTs will ‘never become legal tender’ in India, says Finance Secretary

T.V. Somanathan, the finance secretary for the Indian government, is reportedly pushing back against the narrative that cryptocurrencies will be widely accepted in the country — by dismissing the possibility of using them as legal tender. According to a Wednesday tweet from Asian News International, Somanathan said that a digital rupee backed by the Reserve Bank of India, or RBI, will be accepted as legal tender, but major cryptocurrencies have no chance of doing so. The finance secretary added that because digital assets including Bitcoin (BTC) and Ether (ETH) do not have authorization from the government, they will likely remain “assets whose value will be determined between two people.” “Digital rupee issued by RBI will be a legal tender,” said Somanathan. “Rest all aren’t legal t...

SEC’s proposed rule on exchanges could threaten DeFi, says Crypto Mom

Hester Peirce, a commissioner for the U.S. Securities and Exchange Commission known by many in the space as Crypto Mom, is warning that a proposed rule from the agency could potentially affect the regulation of firms involved with decentralized finance. According to a Tuesday Bloomberg report, Peirce said that the 654-page proposal recently released by the SEC to amend the definition of “exchange” as defined by the Securities Exchange Act of 1934 could impact the digital asset space. The SEC commissioner reportedly opposed opening the proposal to public comment and said the text could impose additional regulations on decentralized finance, or DeFi, firms. “The proposal includes very expansive language, which, together with the chair’s apparent interest in regulating all things crypto, sugg...

House members urge US Treasury Secretary to clarify definition of broker in infrastructure law

A bipartisan group of members from the U.S. House of Representatives called on Treasury Secretary Janet Yellen to clarify the language in the infrastructure bill signed into law in November around the definition of “broker.” In a Wednesday letter, House Financial Services Committee ranking member Patrick McHenry and ten other representatives urged Yellen to reference the Keep Innovation in America Act to “ensure that any future guidance” in the November infrastructure bill would provide “the necessary clarity to the digital asset ecosystem.” In addition to the reporting requirements, the lawmakers said that the Treasury Department should narrow the scope of the information a broker can capture, as it would risk “the creation of an unlevel playing fie...