Remittances

Central African Republic eyes legal framework for crypto adoption

A 15-member committee is tasked with working on a legal framework that will allow cryptocurrencies to operate in Central African Republic and expedite the development of the national economy. News Own this piece of history Collect this article as an NFT Central African Republic (CAR), a developing country in Central Africa, set up a 15-member committee responsible for drafting a bill on the use of cryptocurrencies and tokenization in the region. According to Faustin-Archange Touadéra, the president of CAR, cryptocurrencies can potentially help eradicate the country’s financial barriers. He believed in creating a business-friendly environment supported by a legal framework for cryptocurrency usage. A rough translation of the official press release reads: “With access to cryptocurrencies, th...

Western Union may be planning to expand its digital offerings far beyond remittances

Western Union may be preparing to offer crypto-related services, judging from trademark applications filed by the company last week. This is the latest of several attempts the company has made to enter the cryptoverse. So far, it has had limited success. Western Union filed for three trademarks on Oct. 18. According to trademark attorney Mike Kondoudis, activities covered by the applications include managing wallets; exchanging digital assets and commodities derivatives; issuing tokens of value and brokerage and insurance services. Western Union is a major provider of cross-border remittance services, and it showed its interest and uncertainty in cryptocurrency early. It partnered with Ripple to settle payments of remittances in 2015, but that partnership remained in the test phase three y...

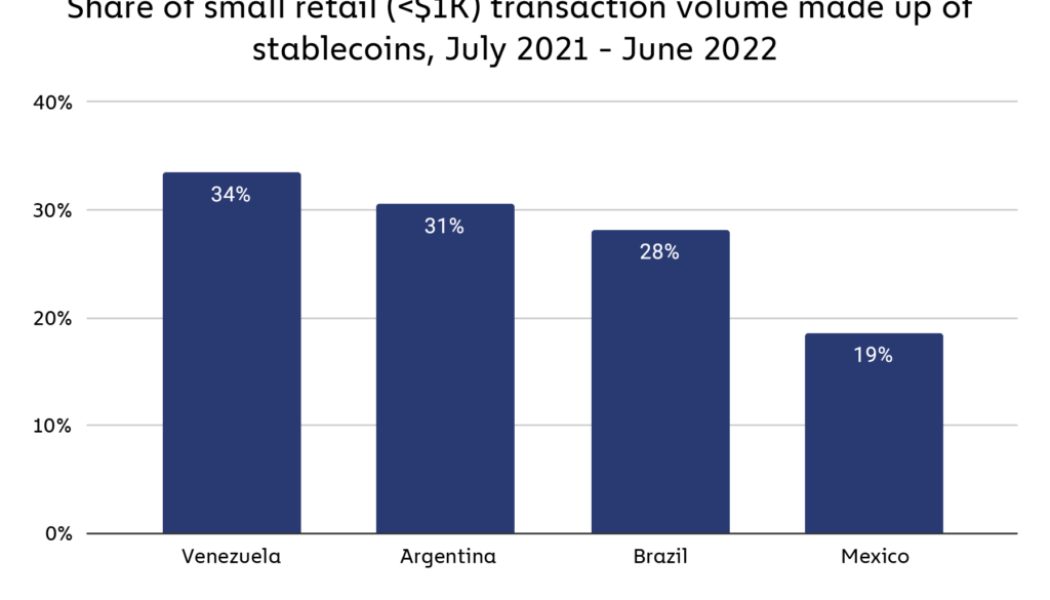

Remittances drive ‘uneven, but swift’ crypto adoption in Latin America

Remittance payments, fiat fears, and profit-chasing have been the three most significant drivers of crypto adoption in Latin America, according to a new report. The seventh-largest crypto market in the world saw the value of cryptocurrencies received by individuals rocket 40% between July 2021 to June 2022, reaching $562 billion, according to an Oct. 20 report from Chainalysis. Part of the surge was attributed to remittances, with the region’s overall remittance market estimated to have reached $150 billion in 2022. Chainalysis noted that crypto-based service adoption was “uneven, but swift.” The firm pointed to one Mexican exchange operating in the “world’s largest crypto remittance corridor” which processed over $1 billion in remittances between Mexico and the Unite...

Why crypto remittance companies are flocking to Mexico

Mexico is the second-largest recipient of remittances in the world, according to 2021 World Bank statistics. Remittances to the nation jumped to a record $5.3 billion in July, which is a 16.5% increase year-over-year compared to the same period last year. The steady growth presents myriad opportunities for fintech companies. Not surprisingly, droves of crypto companies are setting up shop in Mexico to claim a share of the burgeoning remittance market. Over the past year alone, about half a dozen crypto giants, including Coinbase, have set up operations in the country. In February, Coinbase unveiled a crypto transfer service tailored to United States-based clients looking to send crypto remittances to Mexico. The product enabled recipients in Mexico to withdraw their money in pesos. Other c...

Technicals suggest Bitcoin is still far from ideal for daily payments

It is no secret that a vast majority of investors, both from the realm of traditional as well as crypto finance, view Bitcoin (BTC) as a long-term store of value akin to “digital gold.” And, while that may be the dominant narrative surrounding the asset, it is worth noting that in recent years the flagship crypto’s use as a medium of exchange has been on the rise. To this point, recently, the central bank of El Salvador revealed that its citizens living abroad have sent over $50 million in remittances to their friends and family. To elaborate, Douglas Rodríguez, president of El Salvador’s Central Reserve Bank, announced that $52 million worth of BTC remittances had been processed via the country’s national digital wallet service Chivo through the first five months of the year alone, markin...

The world doesn’t need banks, policymakers or NGOs — It needs DeFi

Where I grew up, on the southern border in Texas, a tremendous number of people have come to the United States to work and send money back home. They don’t make much money, but they pay considerable fees on their transfers. Their focus is not on getting rich, but on supporting those back home in their native country. They support their families as they do hard labor day in and day out. It costs them too much to do so. Truth be told, my father was a migrant worker. He picked fruit in the fields. We sent money back to our family in Mexico. But the remittance providers chipped away at what little money he was able to make so that they had no hope of achieving the American Dream and prospering. The world needs DeFi due to corruption. Big governments and international corporations are controlle...

World Bank: Nigeria responsible for over 40 percent diaspora remittances in Sub Saharan Africa

The World Bank says Nigeria is responsible for over 40 percent of diaspora remittances in Sub Saharan Africa (SSA). In a statement on Wednesday, the Washington-based financial institution said remittances to SSA declined by an estimated 12.5 percent in 2020 to $42 billion. The decline was almost entirely due to a 27.7 percent decline in remittance flows to Nigeria, “Remittances to Sub-Saharan Africa declined by an estimated 12.5 percent in 2020 to $42 billion,” the statement read. “The decline was almost entirely due to a 27.7 percent decline in remittance flows to Nigeria, which alone accounted for over 40 percent of remittance flows to the region. “Excluding Nigeria, remittance flows to Sub-Saharan African increased by 2.3 percent. “Remittance growth was reported in Zambia (37 percent), ...

NNPC assures will continue to meet financial obligations to FAAC

The Nigerian National Petroleum Corporation (NNPC) has clarified that the revenue projection contained in the letter to the Accountant General of the Federation being cited in the media pertains only to the Federation revenue stream being managed by the Corporation and not a reflection of the overall financial performance of the Corporation. A press release by the Corporation’s spokesman, Dr. Kennie Obateru, stated that the clarification became necessary in the light of media reports insinuating that the Corporation was in financial straits. NNPC maintains that it is conscious of its role and was doing everything possible to shore up revenues and support the Federation at all times. “The shortfall will be remedied by the Corporation as it relates only to the Federation revenue stream being...

CBN: Naira to fall further in January

Barely five days to the end of the year 2020, the Central Bank of Nigeria has disclosed that a survey carried out by its Statistics Department revealed that the naira is expected to depreciate further in January 2021. The report, titled, ‘December 2020 Business Expectations Survey Report’ added that there might also be a steady rise in interest rate from December till the next six months. The naira witnessed a sharp fall in recent weeks, reaching its lowest on November 30, 2020, when it exchanged for N500/$1. Since then, the dollar has been hovering between N460 and N470. As of Friday, however, one dollar exchanged for 465 in the parallel market. Also, the Nigerian economy had on November 21 slid into its second recession in five years when the economy shrank again in the third quarter. Th...

Naira weakens to lowest in three years

The Naira yesterday weakened to the lowest in over three years in the parallel market due to increased demand for dollars amid foreign-currency shortages. The local currency depreciated to N495 to a dollar yesterday, lowest since February 23, 2017, widening the gap with the official rate of N379.5 to over 30 per cent. The currency traded in the interbank market at 389.74 as of 4:54p.m. in Lagos. Agency reports quoted traders as alleging a groundswell of diversion of dollars, a development which heightened scarcity of the green back in the parallel market this week. There is a diversion of inflows away from official channels to the parallel market due to the gap in rates, Murega Mungai, trading desk manager for Aza Finance said in a note Thursday. The market spread has created arbitrage opp...