Retail

Hyper personalisation and enhanced CX will be key to online retailers’ Black Friday campaigns

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Fidelity offers retail investors commission-free BTC and ETH trading

Fidelity Investments is expanding retail access to commission-free cryptocurrency trading services — a move designed to recognize growing mainstream interest in digital assets. According to CNBC, Fidelity’s new crypto offering will be powered by its subsidiary, Fidelity Digital Assets. Dubbed Fidelity Crypto, the new service will give retail investors the ability to buy and sell Bitcoin (BTC) and Ether (ETH) with minimal fees. Instead of a commission, Fidelity Crypto will incorporate a 1% spread into every trade. In financial markets, a spread represents the difference between the buy and sell prices quoted for an asset. Although Fidelity didn’t specify a launch date for the new offering, it has opened up an early-access waitlist to users. The brokerage said it is targeting retail in...

Singapore’s MAS says no urgent case for retail CBDC, but launches 4 fast trials of it

The Monetary Authority of Singapore (MAS) has wrapped up the first stage of its Project Orchid examination of a retail central bank digital currency (CBDC). According to the white paper released on Oct. 31, there is no “urgent case” for a retail CBDC in Singapore, but the study envisioned the infrastructure required in case a need arose. It also conceptualized a new model for digital currency — purpose-bound money — and pulled large Singaporean banks and government agencies into the research with a series of trials. Singaporean consumers do not need a retail digital dollar at present because of the high quality of services already available, the authors wrote. They indicated, however, that the most foreseeable use case may be for the benefit of the MAS rather than users: “Electro...

Taylor Swift Is Selling Over 20 Versions of ‘Midnights’ in Different Styles and Formats

For over a decade, Taylor Swift has been offering fans a multitude of options when it comes to purchasing her albums across physical formats with exclusive editions available through a longstanding partnership with Target. But with her new album, Midnights, out Friday (Oct. 20), she’s truly outdone herself. There are over 20 different versions of the album available on CD, LP and cassette in various colors, with different cover artwork, censored and uncensored, with and without autographs. That plethora of options is great for fans who may want a different version than their friends, or who — as many seem to — feel driven to collect them all. It’s also great for Swift, who’s earning more money from increased sales that will impact her performance on the Billboard charts and likely add up t...

The CD Turns 40: How the ‘Shiny, Tiny’ Discs Took Over

On Oct. 1, 1982, in Japan, when Billy Joel‘s 52nd Street became the first-ever CD to go on sale, two electronics giants had been pushing for years to switch from the beloved vinyl LP to the shiny new digital-optical disc. Sony in Japan and Philips in Eindhoven, Netherlands, had invented the compact-disc hardware, and they were aggressively lobbying the world’s biggest labels to provide the software – music – to go with it. Up to that point, the labels wouldn’t cooperate – not even CBS Records, Sony’s longtime partner for years before the electronics company bought it outright in 1987. “If there would have been rotten eggs available, they would have thrown them at me,” recalls Jan Timmer, then head of Philips Worldwide, of an Athens, Greece, music-industry conference where he attempted to i...

Hong Kong Monetary Authority provides update on retail CBDC that may become DeFi onramp

The Hong Kong Monetary Authority (HKMA) published a paper outlining the state of research on its proposed retail central bank digital currency (rCBDC) and plans for its further development. This is the third paper the HKMA has published on the e-HKD, as the proposed CBDC is called. The proposed rCBDC would have a two-tier structure consisting of a wholesale interbank system and the retail user wallet system. No wholesale Hong Kong CBDC has been introduced yet, but research on it began in 2017, four years before rCBDC planning started. The rCBDC would be disintermediated. The paper notes: “While it appears that e-HKD might not have an imminent role to play in the current retail payment market, we believe prospective use cases for e-HKD can emerge quickly out of the rapid evolution, or...

Online Shopping Surges in SA, but Not All Shoppers are Equal

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

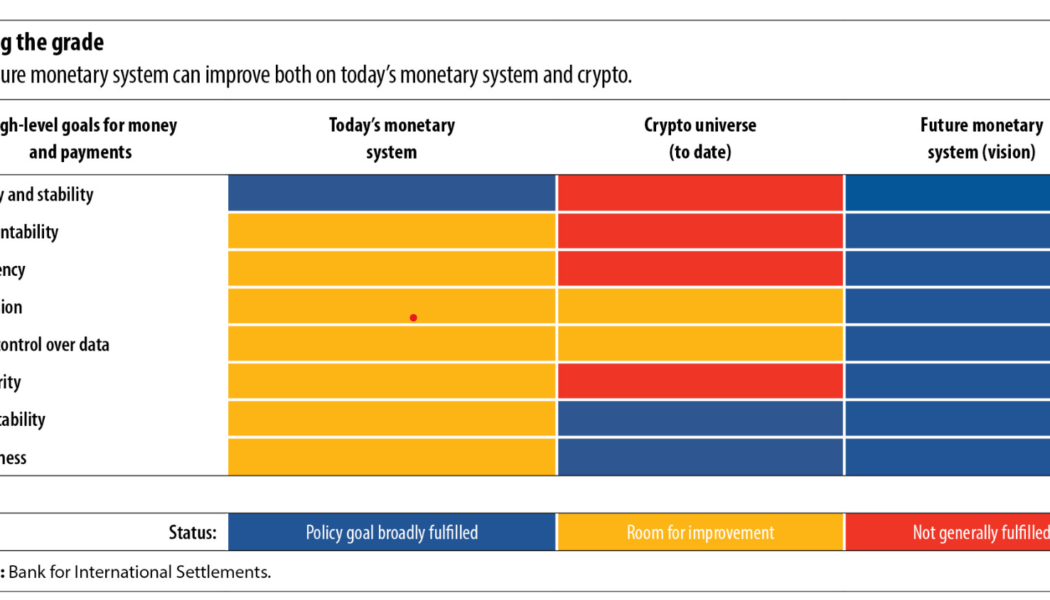

Crypto’s adaptability, openness key to ideal monetary system, say BIS execs

Governments across the globe see central bank digital currencies (CBDC) as a means to improve the existing fiat ecosystem. Cryptocurrency’s technical prowess supported by the central bank’s underlying trust is key to enabling a rich monetary ecosystem, suggests an International Monetary Fund (IMF) publication. “Digital technologies promise a bright future for the monetary system,” reads the publication attributed to IMF deputy managing director Agustín Carstens and BIS executives Jon Frost and Hyun Song Shin. A BIS study from June revealed that cryptocurrencies outdo fiat ecosystems when it comes to achieving the high-level goals of a future monetary system. Some of the most significant flaws preventing present-day cryptocurrencies from mainstream adoption, pointed out by the BIS exe...