Sam Bankman-Fried

Alameda Research had a $65B secret line of credit with FTX: Report

Former FTX CEO Sam Bankman-Fried (SBF) reportedly ordered Gary Wang, co-founder of the crypto exchange, to open a $65 billion “secret backdoor line of credit” for Alameda Research, according to FTX attorney Andrew Dietderich. The attorney disclosed the information during a Delaware bankruptcy court hearing on Jan. 11, the New York Post reported. The alleged line of credit was financed with FTX customers’ funds. As per Dietderich testimony, the “backdoor was a secret way for Alameda to borrow from customers on the exchange without permission.” “Mr. Wang created this backdoor by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,” Dietderich told the court, adding...

Alameda Research had a $65B secret line of credit with FTX: Report

Former FTX CEO Sam Bankman-Fried (SBF) reportedly ordered Gary Wang, co-founder of the crypto exchange, to open a $65 billion “secret backdoor line of credit” for Alameda Research, according to FTX attorney Andrew Dietderich. The attorney disclosed the information during a Delaware bankruptcy court hearing on Jan. 11, the New York Post reported. The alleged line of credit was financed with FTX customers’ funds. As per Dietderich testimony, the “backdoor was a secret way for Alameda to borrow from customers on the exchange without permission.” “Mr. Wang created this backdoor by inserting a single number into millions of lines of code for the exchange, creating a line of credit from FTX to Alameda, to which customers did not consent,” Dietderich told the court, adding...

Skybridge eyes stake buyback from FTX, as Galaxy CEO says he would like to ‘punch’ SBF

SkyBridge Capital CEO Anthony Scaramucci said that his firm can buy back the stake of the company it sold to FTX back in September last year. While Galaxy Digital CEO Mike Novogratz has indicated that he would be tempted to “punch” SBF right in the jaw. SkyBridge and FTX FTX Ventures acquired a 30% stake in the alternative asset manager SkyBridge for an undisclosed fee on Sept. 9, just a couple of months before FTX filed for bankruptcy in November. Speaking to CNBC on Jan. 13, Scaramuci noted that in light of FTX’s troubles, SkyBridge is making progress in buying back that stake, but suggested the move wouldn’t be able to get sorted “until probably the end of the first half of this year.” “We’re waiting for the clearance from the bankruptcy people, the lawyers and the investment bankers to...

Here’s how to quickly spot a deepfake crypto scam — cybersecurity execs

Crypto investors have been urged to keep their eyes peeled for “deepfake” crypto scams to come, with the digital-doppelganger technology continuing to advance, making it harder for viewers to separate fact from fiction. David Schwed, the COO of blockchain security firm Halborn told Cointelegraph that the crypto industry is more “susceptible” to deepfakes than ever because “time is of the essence in making decisions” which results in less time to verify the veracity of a video. Cast your vote now! Deepfakes use deep learning artificial intelligence (AI) to create highly realistic digital content by manipulating and altering original media, such as swapping faces in videos, photos, and audio, according to technical writer at OpenZeppelin Vlad Estoup. Estoup noted that crypt...

Congress may be ‘ungovernable,’ but US could see crypto legislation in 2023

The United States House of Representatives finally elected a speaker last week, concluding a four-day, 15-ballot ordeal that left many wondering if political gridlock was now the new normal in the U.S., and if so, what the consequences would be. For example, were the concessions made by Republican Kevin McCarthy to secure his election as speaker ultimately going to make it difficult to achieve any sort of legislative consensus, making it impossible for the U.S. to raise its debt ceiling and fund the government later this year? Not all were optimistic. The House of Representatives will be largely “ungovernable” in 2023, Representative Ritchie Torres, a Democrat from New York, told Cointelegraph on Jan. 6, shortly before joining colleagues for that day’s series of ballots — which final...

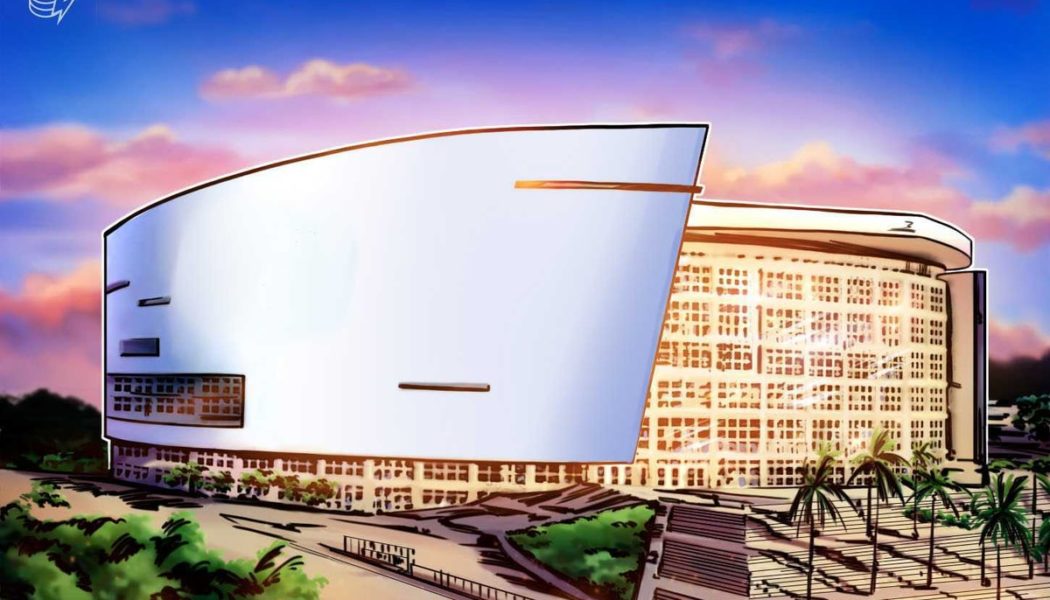

Miami-Dade gains right to remove FTX name from Heat arena

Miami-Dade County will soon start to remove FTX’s advertising brand from the NBA’s Miami Heat arena, after granting the right from a United States bankruptcy judge in Delaware on Jan. 11, the Associated Press reports. County officials negotiated in 2021 a $135 million deal with the crypto exchange for renaming rights to the Miami Heat’s arena as FTX Arena until 2040. A number of entrances, the roof of the arena, the basketball court, the security polo shirts, as well as many of the cards employees use to access the facility are branded with FTX logos. Following FTX’s bankruptcy filing, officials in Miami-Dade filed on Nov. 22 a motion to terminate the naming rights agreement. As part of that deal, the Heat were to receive $2 million annually beginning in June 2021. ...

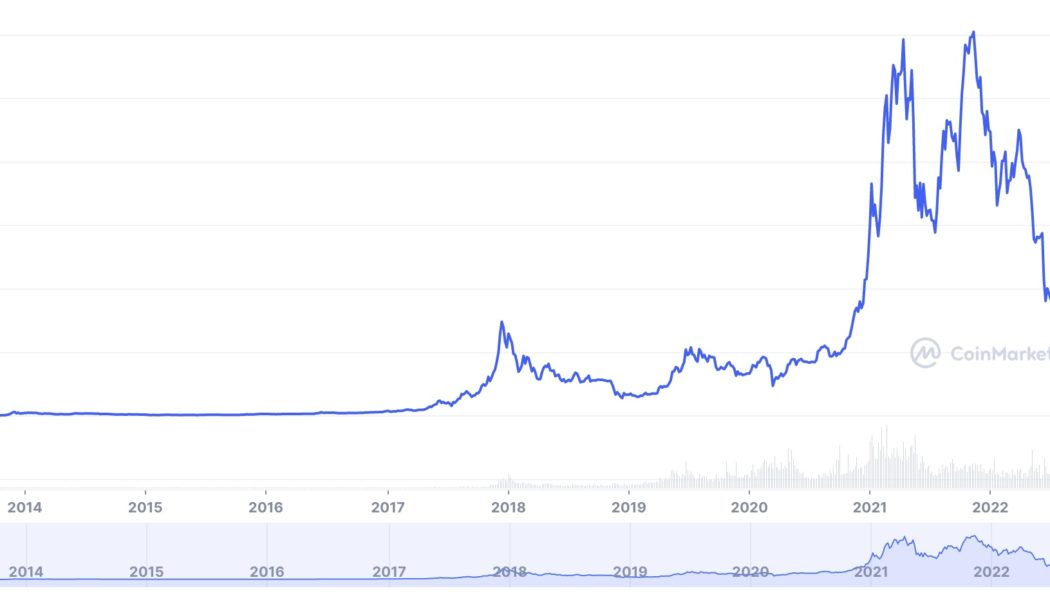

From Bernie Madoff to Bankman-Fried: Bitcoin maximalists have been validated

Long before Bitcoin (BTC), Bernie Madoff sat atop the longest-running, largest fraud in history. The rise and real-time fall of Sam “SBF” Bankman-Fried, former CEO of crypto exchange FTX, were expedited in comparison. While the similarities are profound, the storyline is not: Create organizations under false pretenses, develop relationships with people in authority positions, defraud clients, survive as long as possible, and try not to get caught. Madoff advisers experienced a “liquidity” problem in 2008, around late November into early December, where the fund was unable to meet client redemption requests. On its surface, the fourth-quarter timing of the Madoff collapse more than a decade ago appears eerily similar to FTX’s 2022 implosion. Bitcoiners who hold their keys will never experie...

FTX former lead engineer in talks with federal prosecutors in Bankman-Fried case

As the investigation into FTX continues, the crypto exchange’s former engineering chief, Nishad Singh, followed former FTX and Alameda Research executives Gary Wang and Caroline Ellison by reportedly meeting with federal prosecutors to cut a deal. Singh attended a proffer session during the week of Jan. 2 at the office of the United States Attorney for the Southern District of New York. Individuals may be granted limited immunity to share their knowledge with prosecutors at such meetings. Prosecutors likely sought to determine if Singh has valuable information to offer in the lawsuit against FTX founder Sam Bankman-Fried, according to a Jan. 10 Bloomberg report. Bankman-Fried also faces campaign finance violations and prosecutors are interested in Singh’s knowledge about FTX’s political do...

FTX asset sales challenged by U.S. Trustee: Report

Bankrupt crypto exchange FTX’s plans to sell its digital currency futures and clearinghouse LedgerX, among other businesses, were challenged by the U.S. Trustee on Jan. 7, according to Reuters. As per the filing, U.S. Trustee Andrew Vara called for an independent investigation before any sale, claiming that valuable information related to the exchange’s bankruptcy could be compromised. The document states: “The sale of potentially valuable causes of action against the Debtors’ directors, officers and employees, or any other person or entity, should not be permitted until there has been a full and independent investigation into all persons and entities that may have been involved in any malfeasance, negligence or other actionable conduct.” In an effort to recov...

Sam Bankman-Fried’s charitable donations sought by FTX: Report

FTX’s new management is seeking to recover millions of dollars in donations made by the crypto exchange and its former CEO Sam Bankman-Fried, reports the Wall Street Journal. At the end of September, FTX’s charity arm, Future Fund, had committed more than $160 million to over 110 nonprofit organizations, including biotech startups and university researchers developing Covid-19 vaccines and working on pandemic studies, as well as nonprofit organizations in India, China and Brazil. As per the report, Future Fund committed $3.6 million to AVECRIS, a company working on a genetic vaccine platform, and another $5 million were donated to Atlas Fellowship for scholarships and high-school summer programs in San Francisco. A spokesperson for Bankman-Fried said that charitable donat...

Sam Bankman-Fried’s legal team warns of ‘harassment and threats’ to parents in latest court filing

The legal team behind former FTX chief executive officer Sam Bankman-Fried has petitioned a court to redact certain information on individuals acting as sureties for his $250-million bond, citing threats made against his family. In a letter dated Jan. 3 filed to Judge Lewis Kaplan for the United States District Court in the Southern District of New York, Bankman-Fried’s legal team requested the court order “names and other identifying information” of two bail sureties not be disclosed to the public and redacted from bonds once they were signed on Jan. 5. Mark Cohen of the law firm Cohen & Gresser said that if the individuals’ personal information were to be available, they could be subject to similar harassment as the former FTX CEO’s parents, Barbara Fried and Joseph Bankman. “In...

Bahamas regulator denies asking crypto exchange FTX to mint new tokens

The Securities Commission of The Bahamas (SCB) has denied FTX debtors’ claims and expresses concern that the investigation has been ‘impeded.’ According to a statement released on Jan.3, The Securities Commission of The Bahamas (SCB) has had to correct material misstatements made by John J. Ray III, the representative of the United States-based FTX debtors, in press and court filings. The document stated that the Chapter 11 Debtors had “publicly challenged” the Commissions calculations of digital assets transferred to digital wallets under the Commission’s control in Nov. 2022. It argued that these statements were based on “incomplete” information and the debtors did not do due diligence by requesting information from the Joint Provisional Liquidators. The statement added that the FT...