Singapore

ADDX bags $58M to reduce min. private investment by 10x via smart contracts

ADDX, a blockchain and smart contract-based digital securities platform from Singapore raised $58 million from mainstream financial institutions to fund its goal of reducing minimum private investment sizes via tokenization and fractionalization. The Monetary Authority of Singapore regulates ADDX as a digital securities exchange that aims to democratize private markets. The Pre-Series B funding round saw participation from the Stock Exchange of Thailand (SET), UOB, Nasdaq-listed Hamilton Lane and Thailand’s Krungsri Bank, which has brought total funds raised by ADDX to around $120 million. As explained in the announcement, ADDX uses blockchain technology and smart contracts to tokenize and fractionalize private markets, including pre-IPO equity, private equity, and hedge funds and bonds. A...

Eileen Chan, DJ and Singapore Nightlife Pioneer, Found Dead at 32

Eileen Chan, a champion of Singapore’s underground club scene, has reportedly passed away in Berlin at the age of 32. Chan was a power player in the Singaporean nightlife sector. A founder of the music promotional company The Council and co-owner of the music venues Headquarters and Tuff Club respectively, Chan wore many hats. For that reason, the impact of the businesswoman and DJ’s career is difficult to quantify into words, but her legacy certainly lives on in the vibrant scene she helped foster. Chan’s commitment to the underground was unwavering. “The idea of Headquarters was simple, we wanted a no-frills kind of place where people could come enjoy themselves and have a good night out, a place where people don’t feel like they need to dress up o...

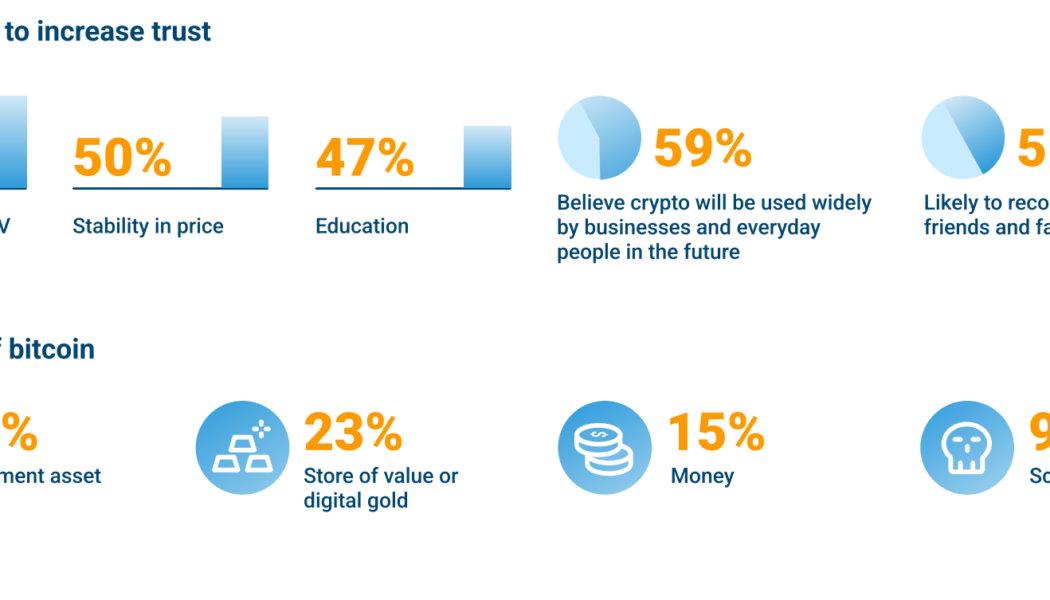

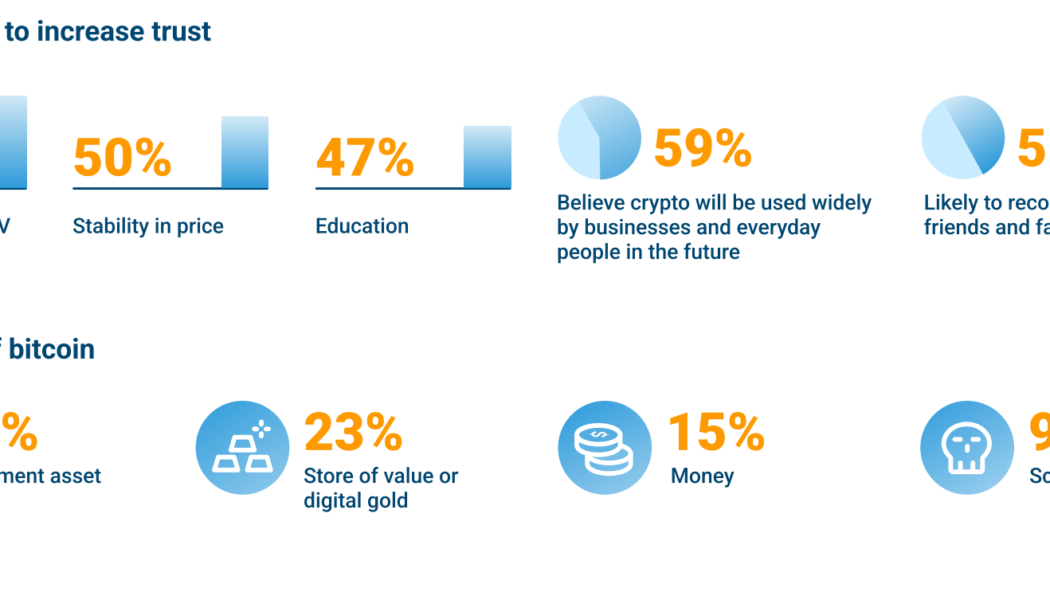

Singaporean investors’ appetite for crypto is key to mainstream adoption — Survey

As Singapore continues to play an active role in boosting crypto adoption across the Asia-Pacific region, the country’s first licensed crypto exchange Independent Reserve conducted a retail-focused survey to better understand the underlying potential of the regulated market. Independent Reserve’s survey — conducted across all age groups and genders of the Singapore population — revealed a strong affinity for various financial opportunities brought forward by decentralized finance (DeFi) and other investment opportunities. As explained by Raks Sondhi, managing director of Independent Reserve Singapore, the country’s rapid crypto adoption is driven by high level of trust and confidence in the future of crypto: “58% [Singaporeans surveyed] perceive Bitcoin as an investment asset or a sto...

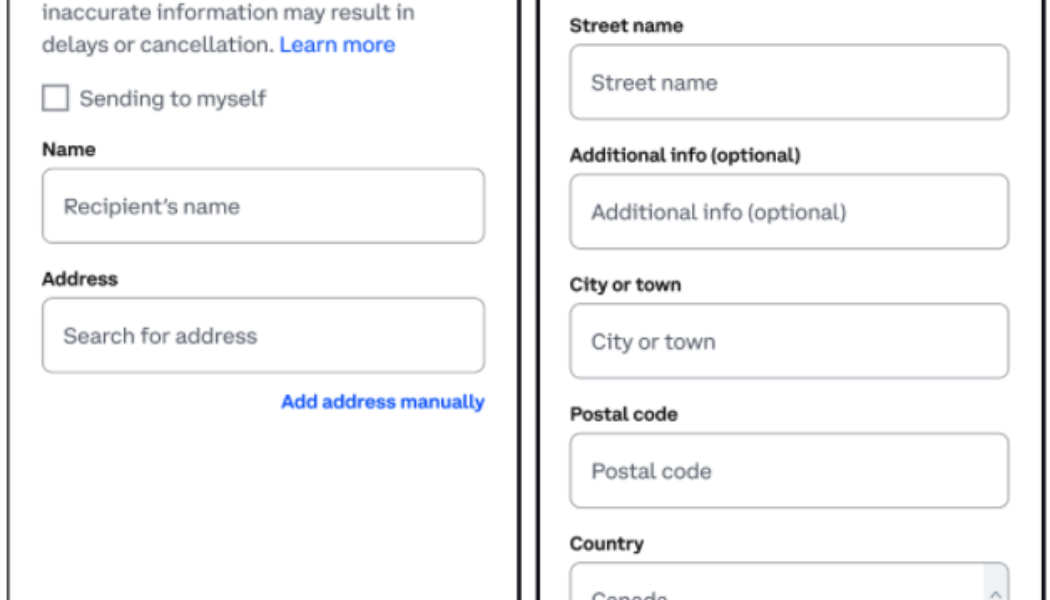

Coinbase to track off-platform crypto transfers in Canada, Singapore, Japan

Citing compliance with local jurisdictions, crypto exchange Coinbase announced to soon collect additional information from users based in Canada, Singapore and Japan. Effective from April 1, Coinbase users from Canada, Singapore and Japan will be required to provide additional information while sending cryptocurrencies to a different (non-Coinbase) platform. However, while Singaporean and Japanese investors will be required to share additional information about the recipient for every single off-platform transaction, Canadians sending less than $801 (1,000 CAD) will be exempted from this requirement. Screenshot of Coinbase requesting recipient information from Canadian users. Source: Coinbase As shown in the above screenshot, Canadian users will need to share the full name and ...

Sony Music Opens Singapore Office, Shifting Asia Hub From Hong Kong

Sony Music Group is moving its Southeast Asia headquarters to Singapore, joining a host of other music and tech companies that have shifted regional business hubs away from Hong Kong amid street protests and crackdowns by the Chinese government. The new Singapore office will house SMG companies Sony Music Entertainment, Sony Music Publishing and artists and label services company The Orchard, the company said in a press release Tuesday (March 22). It will also serve as the new base for Sony Interactive Entertainment, creators of PlayStation. A host of pan-regional specialists focused on Singapore and the wider region will work out of the new headquarters, including in marketing, data analytics, human resources, finance, digital innovation, business development, A&R, and publicity. Esta...

CBDC payments infrastructure project involving four central banks concludes

The project has created prototypes to model international transactions settlement via multiple CBDCs There remain concerns over who should transact on the platform, how to create a trusted payment system across governments, and how to deploy the platform despite varying regulations Last September, the Bank of International Settlements’ (BIS) Innovation Hub led the Monetary Authority of Singapore, the South African Reserve Bank, the Reserve Bank of Australia, and Bank Negara Malaysia in an initiative to prototype-test the use of CBDCs in settling cross-border transactions. The aim was to establish whether these government-controlled tokens can be vehicles enabling inexpensive transactions across the said countries. Today, the four central banks have confirmed in a released report that...

Ukraine to make the planned NFT collection a museum of war, Deputy Minister says

Ukraine’s forthcoming NFT collection will depict the Russian Invasion in NFT format. The NFTs would feature stories from reliable sources on the ongoing war Elsewhere, Singapore plans to tax NFT traders, with a ‘specified’ criterion The Ukrainian government has divulged further information on its planned release of an NFT series to support its military as the country copes with the ongoing invasion by Russia. According to the Deputy Minister of Digital Information, Alex Bornyakov, Ukraine expects that the NFT series will be a museum of this war. Bornyakov told The Guardian that by wrapping the information in NFTs, Ukraine wants to “tell the world in NFT format” what is happening in their country. With an intention to be “cool, good-looking,” U...

Crypto bank Sygnum expands its scope of regulated ventures in Singapore

Swiss crypto bank Sygnum has gotten a nod to expand digital asset activities in Singapore The approval is a boost in the company’s efforts to offer tokenisation of assets Swiss crypto bank Sygnum today announced that its Sygnum Singapore subsidiary has received approval to venture further into offering regulated products in the country. Sygnum Singapore now holds in-principle approval from the Monetary Authority of Singapore (MAS) to provide additional services under the capital markets services (CMS) licence it gained in 2019. The three new regulated activities include providing custodial services, corporate advisory on finance, and access to tokenised products, including digital assets. Sygnum is a first of its kind – digital asset bank – and provides banking services around digita...

Swiss crypto bank Sygnum secures in-principal approval in Singapore

Sygnum Singapore, a subsidiary of Switzerland-based cryptocurrency bank Sygnum, is expanding services after securing new regulatory approval from local authorities. The company announced Tuesday that Sygnum Singapore received in-principle approval from the Monetary Authority of Singapore (MAS) to offer three additional regulated activities under capital markets services (CMS) license. The CMS license was initially granted in 2019, allowing Sygnum Singapore to conduct asset management activities. The latest in-principle regulatory approval upgrades Sygnum Singapore to enable new tools like providing corporate finance advisory services, dealing with tokenized capital market products and digital assets, as well as offering custodial services for asset and security tokens. With the additional ...

Singapore’s DBS Bank set to offer crypto services to retail customers

Singapore’s megabank DBS plans to expand crypto trading to the retail crowd CEO Piyush Gupta has highlighted that the plan is to expand into online trading and a 24/7 operational model DBS Bank was the first financial body to receive MAS approval last year Singapore’s largest lender DBS Bank has highlighted plans to expand the offering to retail investors by the end of the year. The bank is notable for being among the first financial institutions to host a crypto trading desk for institutional investors. The Bank CEO and Director of the DBS Group, Piyush Gupta, revealed during an earnings call for 2021 Q4 on Monday that it had already kickstarted the process of expanding territory. While he did not directly provide any details, he suggested that the bank had set in motion the p...

Singaporean megabank DBS works on expanding Bitcoin trading to retail

DBS Bank, Singapore’s largest bank, is working on expanding its cryptocurrency exchange beyond its current investor base of institutional clients, according to the CEO. DBS Bank CEO Piyush Gupta spoke of the bank’s cryptocurrency business during the Q4 2021 earnings call on Monday, stating that the company will focus on measures to further scale its crypto exchange operations in 2022. During the call, Gupta was asked whether DBS Bank has a roadmap for rolling out digital asset trading to retail investors. While the CEO did not provide a straightforward answer, he still said that DBS Bank did initiate some work in order to expand its current investor base, stating: “We’ve started doing the work on seeing how we get in a sensible way, take it out and expand it beyond the current investo...

Bitcoin dated futures with physical settlement go live on Eqonex

The Nasdaq-listed digital assets financial services company Eqonex has launched a new type of Bitcoin (BTC) investment product, a BTC dated futures contract with a physical settlement. Announcing the news on Wednesday, Eqonex explained that its BTC dated futures are denominated in the USD Coin (USDC) stablecoin and increase in parallel with the BTC price increase against USDC. In contrast to perpetual futures, which have no maturity limit, dated futures expire at a pre-set date and time frame like each month or each quarter, Eqonex noted. “Any position in a perpetual future stays open until the trader decides to close the trade by executing an offsetting trade, or until the trade gets liquidated by Eqonex,” the firm added. According to the announcement, the Eqonex BTC dated futures contrac...