Stablecoin

Tether reduces commercial paper exposure to zero, replaces investments with T-Bills

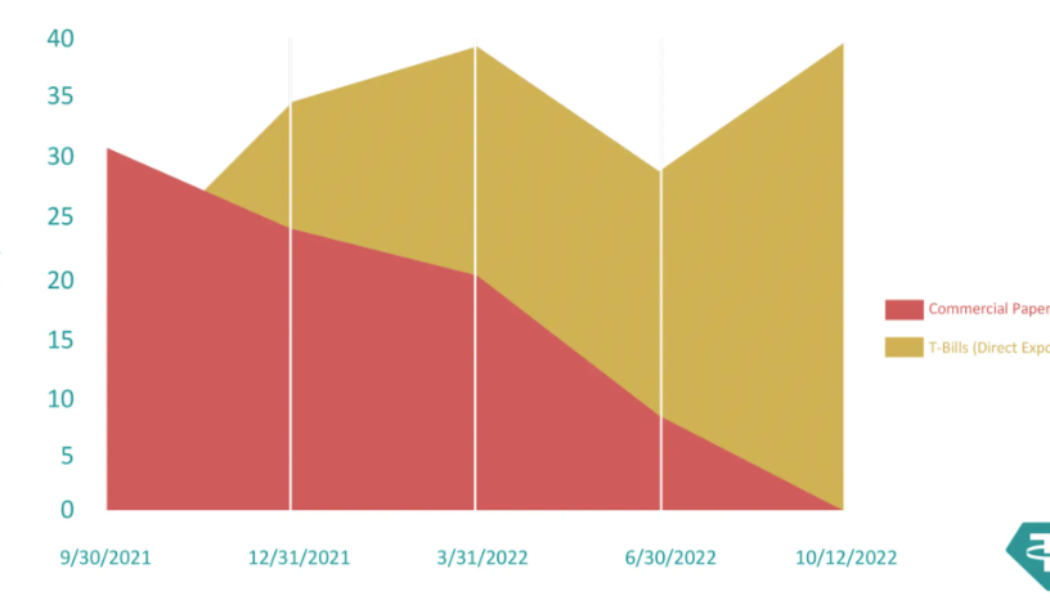

Stablecoin issuer Tether Holdings Limited has unwound its exposure to commercial paper, addressing a long-standing item of contention among detractors who’ve criticized the quality of its reserves. In addition to removing commercial paper from its reserves, Tether announced on Oct. 13 that it had replaced those investments with United States Treasury Bills. “Reducing commercial papers to zero demonstrates Tether’s commitment to backing its tokens with the most secure reserves in the market,” the company said. From roughly $30 billion down to zero, Tether has replaced its commercial paper holdings with more secure U.S. T-Bills. Source: Tether. While Tether has long been subjected to public scrutiny about its reserves detractors have focused on the composition of its assets for t...

What is the economic impact of cryptocurrencies?

Although the cryptocurrency market appears to grow in a positive feedback loop, that does not mean that (un)expected events may not impact the trajectory of the ecosystem as a whole. Although blockchain and cryptocurrencies are fundamentally meant as ‘trustless’ technologies, trust remains key there where humans interact with one another. The cryptocurrency market is not only impacted by the broader economy, but it may also generate profound effects by itself. Indeed, the Terra case shows that any entity — were it a single company, a venture capital firm or a project issuing an algorithmic stablecoin — can potentially set into motion or contribute to a “boom” or “bust” of the cryptocurrency ma...

US lawmaker hints at calling for Republican votes in 2022 midterms over crypto policies

North Carolina Representative Patrick McHenry may have used his virtual appearance at a cryptocurrency conference as a soapbox to call for votes in the 2022 United States midterm elections. In a prerecorded message for the attendees of the Converge22 conference in San Francisco on Sept. 29, McHenry suggested that the goal of a “clear regulatory framework” for digital assets could drive U.S. lawmakers to develop legislation. The Republican lawmaker used terms including “bipartisan consensus” and support from both major political parties over certain regulatory frameworks related to digital assets and stablecoins before seemingly encouraging crypto users to vote red in the next election. “To ensure that these technologies flourish here in the United States, we need to provide regulatory clar...

Russia unlikely to choose Bitcoin for cross-border crypto payments: Analysis

Despite Russia pushing the idea of using cryptocurrencies for cross-border payments, the specific digital asset the government plans to adopt for such transactions still remains unclear. Russian authorities are quite unlikely to approve the use of cryptocurrencies like Bitcoin (BTC) for cross-border transactions, according to local lawyers and fintech executives. Bank of Russia needs to control cross-border transactions That Russia would allow Bitcoin or any other similar cryptocurrency to be usefor cross-border payments is “highly questionable” because such assets are “hard to control,” according to Elena Klyuchareva, the senior associate at the local law firm KKMP. Klyuchareva emphasized that the draft amendments to the legislation on cross-border crypto payments are not...

WSJ: Terraform Labs claims case against Do Kwon is ‘highly politicized’

Terraform Labs, the company behind the development of the Terra (LUNA) blockchain said South Korea’s case against its co-founder Do Kwon has become political, alleging prosecutors expanded the definition of a security in response to public pressure. “We believe that this case has become highly politicized, and that the actions of the Korean prosecutors demonstrate unfairness and a failure to uphold basic rights guaranteed under Korean law,” a Terraform Labs spokesman said to The Wall Street Journal on Sept. 28. South Korean prosecutors issued an arrest warrant for Kwon on Sept. 14 for violations of the countries capital markets laws, but Terraform Labs laid out a defense arguing Terra (now known as Terra Luna Classic (LUNC)) isn’t legally a security, meaning it isn’t covered by capital mar...

JPMorgan’s CEO feels threatened by disruption in payment systems: Kevin O’Leary

JPMorgan Chase’s CEO Jamie Dimon feels threatened by how the crypto space is disrupting the payment systems, stated the Shark Tank host and multi-millionaire venture capitalist Kevin O’Leary speaking at a Converge22 panel on Sept 28. O’Leary made his remarks after Dimon declared himself as a “major skeptic” on “crypto tokens, which you call currency, like Bitcoin,” referring to them as “decentralized Ponzi schemes” in his testimony to the United States Congress last week. Still on the panel, O’Leary explained that friction is one of the major problems in the traditional financial system and, plus, it’s how banks profit on transaction fees, adding that stablecoins could lead to a reduction in fees throughout the world. He stated: “...

UFC fighter El Ninja to become first argentinian athlete paid in crypto

Guido Cannetti, an Argentinian Ultimate Fighting Championship (UFC) fighter, is now the first martial arts athlete in the country to receive 100% of his salary in stablecoins, amid rising inflation and Argentina’s economic deteriorating, announced the crypto payroll company Bitwage on Monday. Dubbed El Ninja, he returns to the Octagon on October 1st in the United States to face the local fighter Randy Costa. According to Bitwage, Guido will receive his payment in USDC stablecoin via the Stellar Network on Vibrant, a wallet application developed by the Stellar team specifically for Argentines experiencing inflation. As per official government figures’, inflation in the 12 months through August was 78.5% in the country, whereas prices in the first eight months of the year were up...

3 reasons why USDC stablecoin dropping below $50B market cap is Tether’s gain

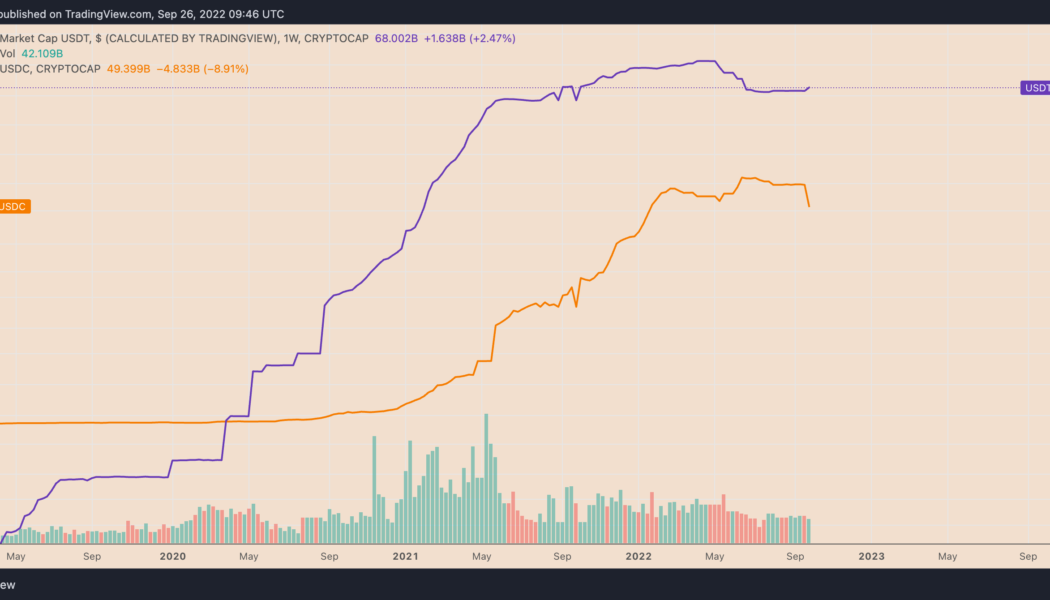

The market capitalization of USD Coin (USDC), a stablecoin issued by U.S.-based payment tech firm Circle, has dropped below $50 billion for the first time since January 2022. On the weekly chart, USDC’s market cap, which reflects the number of U.S. dollar-backed tokens in circulation, fell to $49.39 billion on Sep. 26, down almost 12% from its record high of $55.88 billion, established merely three months ago. USDC versus USDT weekly market cap chart. Source: TradingView In contrast, the market cap of Tether (USDT), which risked losing its top stablecoin position to USDC in May, crossed above $68 billion on Sep. 26, albeit still down 17.4% from its record high of $82.33 billion in May 2022. The divergence between USDT and USDC shows investors’ renewed preference...

Australian senator drafts bill aimed at stablecoin, digital yuan regulation

Australian Liberal Senator Andrew Bragg has released a new draft bill aimed at clamping down on digital asset exchanges, stablecoins, and China’s central bank digital currency, the e-Yuan. In a statement on Sept. 18, Senator Bragg stated that “Australia must keep pace with the global race for regulation on digital assets” as “it is essential that the parliament drives law reform” on the matter. The new draft bill, titled Digital Assets (Market Regulation) Bill 2022, calls for the introduction of licenses for digital asset exchanges, digital asset custody services, stablecoin issuers, as well as disclosure requirements for facilitators of the e-Yuan in Australia. Australia must keep pace in the digital assets race: a bill to protect consumers, promote investment & protect our inter...

Terra co-founder Do Kwon says he’s not ‘on the run’

Do Kwon, the co-founder of the Terra ecosystem, took to Twitter on Saturday asserting he’s “not ‘on the run’ or anything similar” after the Singapore Police Force (SPF) said Kwon wasn’t in the city-state. On Sept. 14, South Korean authorities issued an arrest warrant for Kwon and five other associates for alleged violations of the country’s capital markets laws. All were known to be in Singapore at the time, with prosecutors also attempting to revoke their passports a day later on Sept. 15. “For any government agency that has shown interest to communicate, we are in full cooperation and we don’t have anything to hide,” Kwon tweeted. I am not “on the run” or anything similar – for any government agency that has shown interest to communicate, we are in full cooperation and we don’t hav...

Global inflation mounts: How stablecoins are helping protect savings

Economies around the world are facing a motley of challenges caused by rising inflation. High inflation devalues national currencies, which, in turn, pushes up the cost of living, especially in scenarios where earnings remain unchanged. In the United States, the government has responded aggressivelyto inflation. The nation hit a 9.1% inflation rate in June, prompting the Federal Reserve to implement a series of fiscal countermeasures designed to prevent the economy from overheating. Hiking interest rates was one of them. Soaring Fed interest rates have consequently slowed down consumer spending and business growth in the country. The counter-inflation approach has also strengthened the value of the U.S. dollar against other currencies due to tight dollar liquidity checks. As 79.5% of all i...

Compound Treasury to let institutions use digital assets as collateral when borrowing USD or USDC

Compound Treasury, a cash management solution for institutions powered by the Compound Protocol, announced on Sept. 14 that accredited institutions can now borrow USD or USDC with fixed rates starting from 6% APR, using Bitcoin (BTC), Ether (ETH), and supported ERC-20 assets as collateral. Starting today, to meet the growing demand for liquidity, institutions can now borrow from Compound Treasury, using digital assets as collateral.https://t.co/xgDIep18Qa — Compound Labs (@compoundfinance) September 14, 2022 The DeFi-backed company whose notable clients include crypto companies, fintech institutions and banks, shared that the decision was made in response to recent market volatility, which has created a more robust demand for liquidity. Reid Cuming, vice president of Compound Treasur...