Stablecoin

MiCA and ToFR: The EU moves to regulate the crypto-asset market

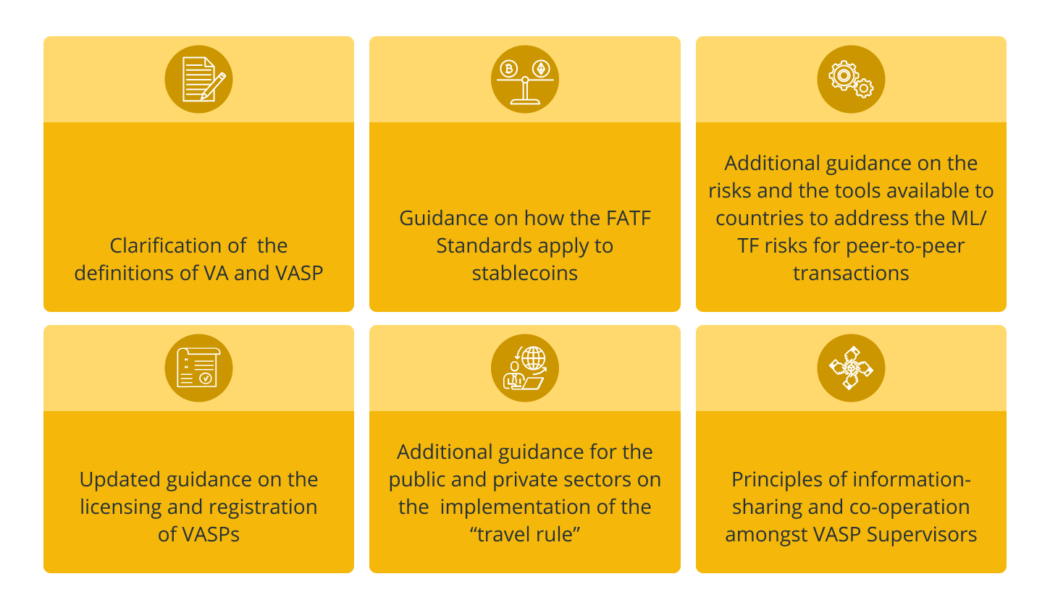

On the last day of June, the European Union reached an agreement on how to regulate the crypto-asset industry, giving the green light to Markets in Crypto-Assets (MiCA), the EU’s main legislative proposal to oversee the industry in its 27 member countries. A day earlier, on June 29, lawmakers in the member states of the European Parliament had already passed the Transfer of Funds Regulation (ToFR), which imposes compliance standards on crypto assets to crack down on money laundering risks in the sector. Given this scenario, today we will further explore these two legislations that, due to their broad scope, can serve as a parameter for the other Financial Action Task Force (FATF) members outside of the 27 countries of the EU. As it’s always good to understand not only the resul...

DeFi token AAVE faces major correction after soaring 100% in a month

The price of Aave (AAVE) has more than doubled in a month, but its bullish momentum could be reaching a point of exhaustion. AAVE price tests key inflection level Notably, AAVE has surged by over 103% after bottoming out locally at $45.60 on June 18, hitting almost $95.50 this July 15. Nevertheless, the token’s sharp upside retracement move has brought its price closer to the level that triggered equally sharp pullbacks since early June. In other words, AAVE has been testing an ascending trendline resistance that constitutes a “bear flag,” a bearish continuation pattern. For example, the trendline’s previous test on July 9 ended up in a 20% downside move. Similarly, a similar attempt on June 24 pushed AAVE price lower by nearly 30%. AAVE/USD daily price chart. ...

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

Tether fortifies its reserves: Will it silence critics, mollify investors?

There is an old Arabic proverb: “The dogs bark, but the caravan moves on.” It could summarize the journey to date of Tether (USDT), the world’s largest stablecoin. Tether has been embroiled in legal and financial wrangling through much of its short history. There have been lawsuits over alleged market manipulation, charges by the New York State attorney general that Tether lied about its reserves — costing the firm $18.5 million in fines in 2021 — and this year, questions voiced by United States Treasury Secretary Janet Yellen as to whether USDT could maintain its peg to the U.S. dollar. More recently, investment short sellers “have been ramping up their bets against Tether,” the Wall Street Journal reported on June 27. But, Tether has weathered all those storms and seems to keep mov...

Terra’s LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The price of Terra (LUNA2) has recovered sharply nine days after falling to its historic lows of $1.62. On June 27, LUNA2’s rate reached $2.77 per token, thus chalking up a 70% recovery when measured from the said low. Still, the token traded 77.35% lower than its record high of $12.24, set on May 30. LUNA2’s recovery mirrored similar retracement moves elsewhere in the crypto industry with top crypto assets Bitcoin (BTC) and Ether (ETH) rising by approximately 25% and 45% in the same period. LUNA2/USD four-hour price chart versus BTC/USD. Source: TradingView LUNA2 price rally could trap bulls The recent bout of buying in the LUNA2 market could trap bulls, given it has come as a part of a broader correction trend. In detail, LUNA2 appears to be forming a “bear flag&#...

Swiss National Bank exec: Regulators may favor centralized stablecoins after Terra crisis

Swiss National Bank (SNB) deputy head Thomas Muser talked to Cointelegraph editor Aaron Wood and discussed the ongoing trends in central bank digital currencies (CBDCs), stablecoins, and regulations, during the recently concluded European Blockchain Convention (EBC) 2022. Talking about the innovation and adoption of private stablecoins and plans of central banks regarding the CBDC launch, Moser said both could co-exist. He said that CBDC’s function would be very basic and private stablecoin issuers can add services on top of them to meet retail customers’ needs. When asked about the recent collapse of the Terra’s UST and its subsequent impact on regulations, Moser said that the recent spiral crash of the Terra and its decentralized algorithmic stablecoin UST could have a lastin...

CBDC may threaten stablecoins, not Bitcoin: ARK36 exec

Central bank digital currencies (CBDCs) do not pose any direct threat to cryptocurrencies like Bitcoin (BTC) but are still associated with risks in relation to stablecoins, one industry executive believes. According to Mikkel Morch, executive director at the digital asset hedge fund ARK36, a state-backed digital currency like the U.S. dollar doesn’t necessarily have to be a competitor to a private or a decentralized cryptocurrency. That’s because the use cases and value proposition of the decentralized digital assets “often go beyond the realm of simple transactions,” Morch said in a statement to Cointelegraph on Thursday. The exec referred to Federal Reserve Chair Jerome Powell who earlier this year hinted that the United States government would not stop a “well regulated, privately issue...

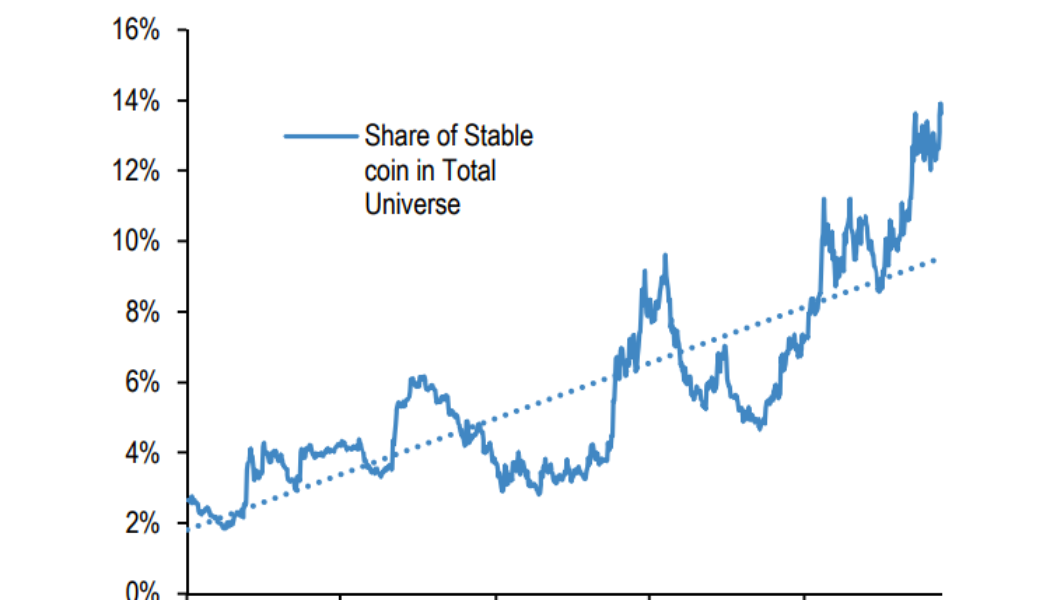

Record stablecoin market share points to crypto upside: JPMorgan

The rapid surge in share of stablecoins like Tether (USDT) in the cryptocurrency market may point to an upcoming crypto upside, according to analysts at the American investment bank JPMorgan Chase. The percentage of stablecoins in the total crypto market value has been on the rise, reaching new historical highs in mid-June, JPMorgan strategists believe. Led by JPMorgan crypto market analyst Nikolaos Panigirtzoglou, the analysts provided their industry insights in the bank’s new investor note shared with Cointelegraph. Released on June 15, the investor note reads that the share of all stablecoins rose to above 14%, or a “new historical high, which brings it to well above its trend since 2020.” “The share of stablecoins in total crypto market cap looks excessively high, pointing to ove...

Magic Internet Money token depegs as Terra (LUNA) domino effect persists

Magic Internet Money (MIM), a US dollar-pegged stablecoin of the Abracadabra ecosystem, joins the growing list of tokens losing their $1 value amid an untimely crypto winter. The sudden de-pegging of the MIM token commenced roughly on June 17, 7:40 pm ET, which saw the token’s price drop to $0.926 in just three hours. Terra’s LUNA and TerraUSD (UST) death spiral not only affected the investors but also had a negative impact on numerous crypto projects, including Abracadabra’s MIM token ecosystem — as alleged by Twitter handle @AutismCapital. Depegging of Magic Internet Money (MIM) token price chart. Source: CoinMarketCap Citing an insider scoop, AutismCapital claimed that Abracadabra accrued $12 million in bad debt as a direct result of Terra’s sudden downfall “because liquidations couldn&...

Coinbase is facing class action suits over unstable stablecoins GYEN, TerraUSD

A class-action suit was filed against Coinbase on Thursday claiming the trading platform was negligent in its listing of the TerraUSD stablecoin and alleging that it failed to disclose its financial relationship with Terraform Labs. This is the second class-action suit outstanding against Coinbase. A suit was filed last month in connection with the depegging of GYEN in November. Thursday’s suit alleges Coinbase was negligent for failing to conduct due diligence of Terraform Labs before it listed TerraUSD and misrepresenting TerraUSD’s risk as an algorithmic stablecoin. The suit compares the information on stablecoins provided by trading platforms Robinhood, Gemini and Kraken to that of Coinbase and concluded that “Rather than disclose the nature of TerraUSD as uncollateralized, contr...

Tether’s USDT market cap dips below $70B for an 8-month low

Tether (USDT), the biggest stablecoin and the third largest digital currency by market capitalization, continues losing its market value amid the current market downturn. On June 16, USDT’s market cap dropped below $70 billion for the first time since October 2021. The drop followed a cascade of repeated declines shortly after the USDT market value reached its all-time high above $80 billion in May. At the time of writing, Tether USDT’s market capitalization stands at $69.3 billion, up around $300 million from the multi-month low, according to data from CoinGecko. USDT 90-day market capitalization chart. Source: CoinGecko Tether’s biggest rival, USDC, is the second-largest U.S. dollar-pegged stablecoin backed by the peer-to-peer payments technology company Circle. The stablecoin reached $5...

Elusive Bitcoin ETF: Hester Perice criticizes lack of legal clarity for crypto

The crypto sector may be maturing, but regulatory clarity around the treatment of digital assets continues to remain cumbersome. This was recently highlighted by Commissioner Hester Peirce — also known as the United States Securities and Exchange Commission’s (SEC) “crypto mom” — in remarks she made at “The Regulatory Transparency Project Conference on Regulating the New Crypto Ecosystem: Necessary Regulation or Crippling Future Innovation?” Peirce began her speech by emphasizing the importance of “regulating the new crypto ecosystem.” While this may be, Peirce also noted that the crypto industry is still in search of an actual regulator. She said: “A bipartisan bill announced last week attempts to answer that question. Some people in the crypto industry are celebrating the all...