Stablecoin

Ethereum price enters ‘oversold’ zone for the first time since November 2018

Ethereum’s native token Ether (ETH) entered its “oversold” territory this June 12, for the first time since November 2018, according to its weekly relative strength index (RSI). This is the last time $ETH went oversold on the weekly (hasn’t confirmed here yet). I had no followers, but macro bottom ticked it. Note, you can push way lower on weekly rsi, not trying to catch a bottom. https://t.co/kLCynTKTcS — The Wolf Of All Streets (@scottmelker) June 12, 2022 ETH eyes oversold bounce Traditional analysts consider an asset to be excessively sold after its RSI reading fall below 30. Furthermore, they also see the drop as an opportunity to “buy the dip,” believing an oversold signal would lead to a trend reversal. Ether’s previous oversold reading appeared i...

Crypto Biz: Stablecoins are paving the way for mass adoption of crypto, June 2–8

Stablecoins are a controversial subject in crypto. Questioning the legitimacy and backing of Tether (USDT) is a right of passage for many entering the crypto market for the first time. The meltdown of the Terra (LUNC; or the old LUNA) ecosystem left little doubt that algorithmic stablecoins don’t have a future beyond Do Kwon’s fantasies. Pesky regulators are constantly poking and prodding at dollar-pegged assets to carve out firmer rules on their usage. But, if you look beyond all the fear, uncertainty and doubt, stablecoins are providing liquidity to millions of people who don’t have access to dollars because of capital controls or sanctions, or because hyperinflation is destroying their local currency. This week’s Crypto Biz newsletter looks at the role of stablecoins in fueling e-...

Tether is ‘instrument of freedom’ and ‘Bitcoin onramp,’ says Bitfinex CTO

On a sun-splashed day in the Swiss Alps, the chief technology officer of Bitfinex and Tether, Paolo Ardoino, shed light on the Plan B Lugano strategy, Tether as an onramp into Bitcoin (BTC) and —crucially — his favorite pizza toppings. Fresh off the plane from Norway, where Ardoino attended an increasingly Bitcoiner-friendly event, the Oslo Freedom Forum, the Italian explained that, in contrast to the WEF,there was no “shilling” in Norway. Tether was invited to speak at the Oslo Freedom Forum as the stablecoin is increasingly considered an “instrument of freedom.” Tether has been adopted by the Myanmar government while the Ukrainian government has accepted crypto donations, including Tether, since the onset of the Russia-Ukraine war. “Tether is one of the tools to be used by di...

New York state releases guidance for issuing dollar-backed stablecoins

The New York State Department of Financial Services (DFS) on Wednesday released regulatory guidance for U.S. dollar-backed stablecoins issued by DFS-regulated entities. According to a DFS statement, it is the first regulator in the United States to impose such expectations on a stablecoin issuer. The requirements in the guidance concern redeemability, reserves and attestation. They state that a stablecoin must be fully backed by reserves as of the end of every business day and the issuer must have a redemption policy approved in advance in writing by the DFS that gives the holder the right to redeem the stablecoin for U.S. dollars. Furthermore, the issuer’s reserves must be segregated from its proprietary assets and consist of U.S. Treasury instruments or deposits at state or federall...

Reserve Rights (RSR) builds momentum ahead of its long-awaited mainnet launch

Bitcoin was created to give the average person a peer-to-peer economic system and a store of wealth asset that could provide financial autonomy and access to banking, especially for people living in places where financial services are sparse or non-existent. In the last five years, there have been a number of blockchain projects that aim to mirror Bitcoin’s original mission and the growing popularity of stablecoins further highlights the need for alternative financial models. One project that is beginning to see a bit of momentum is Reserve Rights (RSR), a dual-token stablecoin platform comprised of the asset-backed Reserve Stablecoin (RSV) and the RSR token which helps to keep the price of RSV stable through a system of arbitrage opportunities. Data from Cointelegraph Markets Pro an...

Weekly Report: New York passes bill limiting Bitcoin mining, El Salvador delays Bitcoin bonds again, Japan limits stablecoin issuance, and more

Here are this week’s most intriguing stories in the cryptocurrency sector: Not yet Bitcoin bonds, El Salvador’s Finance minister says When El Salvador adopted Bitcoin for use as an official tender in September last year, it also set out on several Bitcoin ambitions. Among them; are building a Bitcoin city and establishing Bitcoin bonds worth $1 billion. The bonds, having been postponed earlier in the year, seem set for another delay as Finance Minister Alejandro Zelaya confirmed that the nation would not venture into offering them in the current bear market. Speaking during a recent interview with a local news outlet, the finance minister was queried on the state of the $1 billion bonds that were not issued in mid-March as initially planned. No official date when the ...

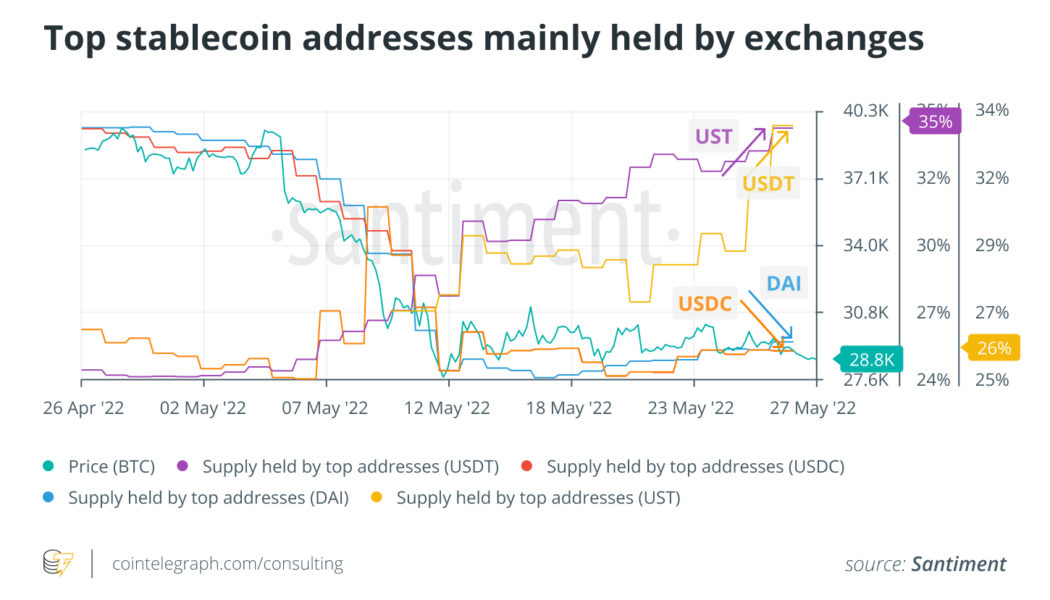

The crypto market dropped in May, but June has a silver lining

May 2022 was not for the faint-hearted. Even the most embattled and experienced crypto traders were tested in the first two weeks of the month on a brutal drop following the United States Federal Reserve’s announcement that interest rates would be rising by 0.5%. Crypto used to exhibit a lower correlation with real-world events and was generally unaffected by capitalistic successes and failures. However, a very steady approximate peg between Bitcoin (BTC) and the S&P 500 index was seen throughout the first five months of 2022. Inflation and war fears have not been kind to both markets either. Crypto mimicking the equity market could be due to the massive market capitalization growth in 2020 and 2021. At unprecedented rates, retail investors from equities have flocked to cryptocurrencie...

Is education the key to curbing the rise of scammy, high APY projects?

Most people who have dealt with cryptocurrencies in any capacity over the last couple of years are well aware that there are many projects out there offering eye-popping annual percentage yields (APY) these days. In fact, many decentralized finance (DeFi) protocols that have been built using the proof-of-stake (PoS) consensus protocol offer ridiculous returns to their investors in return for them staking their native tokens. However, like most deals that sound too good to be true, many of these offerings are out-and-out cash grab schemes — at least that’s what the vast majority of experts claim. For example, YieldZard, a project positioning itself as a DeFi innovation-focused company with an auto-staking protocol, claims to offer a fixed APY of 918,757% to its clients. In simple term...

Terra’s collapse prompts UK regulation of stablecoins

The collapse of UST and LUNC has made it a matter of urgency for the United Kingdom as well as other jurisdictions to have proper regulatory frameworks for digital assets The, the UK hope will ensure economic and financial stability as well as safeguard investors from losing out on their investments by oversighting stablecoin issuers. The United Kingdom has become the latest country to express concern on the stability of stablecoins and call for their regulation. This echoes the sentiments of the European Union as well as the United States Consumer Financial Protection Bureau – both having raised questions on the long-term stability of these digital assets. The authorities, in the consultation paper they released, hope that proper regulation will create a conducive environment for investor...

These are the least ‘stable’ stablecoins not named TerraUSD

The recent collapse of the once third-largest stablecoin, TerraUSD (UST), has raised questions about other fiat-pegged tokens and their ability to maintain their pegs. Stablecoins’ stability in question Stablecoin firms claim that each of their issued tokens is backed by real-world and/or crypto assets, so they behave as a vital component in the crypto market, providing traders with an alternative in which to park their cash between placing bets on volatile coins. They include stablecoins that are supposedly 100% backed by cash or cash equivalents (bank deposits, Treasury bills, commercial paper, etc.), such as Tether (USDT) and Circle USD (USDC). At the other end of the spectrum are algorithmic stablecoins. They are not necessarily backed by real assets but depend on financial engin...

Binance’s CZ says he is ‘skeptical’ about the Terra relaunch

Binance CEO Changpeng Zhao, also known as CZ, expressed skepticism around the revival plan for the Terra ecosystem and the launch of the new LUNA token. “I try not to predict what the community will do. […] Many are skeptical. I’m one of those guys,” said CZ in an exclusive interview with Cointelegraph. Following the collapse of TerraUSD (USD), the Terra ecosystem’s stablecoin, CZ criticized its team for not handling the crisis properly and pointed at the project’s flaws that led to the crash. Still, Binance is now actively participating in Terra’s revival plan by hosting the airdrop of its new LUNA token. As CZ pointed out, despite the widespread skepticism around the Terra relaunch, Binance has a responsibility to help users affected by the crash of LUNA. “We still need to ensure c...

Tether’s reported bank partner Capital Union shares its crypto strategy

Capital Union, a Bahamas-based bank that reportedly holds a portion of reserves by the Tether (USDT) stablecoin issuer, has been itself actively involved in the cryptocurrency industry. The banking institution has rolled out crypto trading and custody services to its professional clients as part of the bank’s trading desk, a spokesperson for Capital Union told Cointelegraph on May 31. “We work with a few selected trading venues and liquidity providers and a handful of custodians and technology providers, which allows us to support a large variety of digital assets as part of our trading and custody services,” the firm’s representative said. Capital Union’s crypto-related services still represent a “fairly small portion” of its business, which is mainly focused on providing...