Taxes

Italy approves 26% capital gains tax on cryptocurrencies

On Dec. 29, 2022, days before the year’s end, Italy’s Senate approved its budget for 2023, which included an increase in taxation for crypto investors — a 26% tax on capital gains on crypto-asset trading over 2,000 euros (approximately $2,13 at time of publication). The approved legislation defines crypto assets as “a digital representation of value or rights that can be transferred and stored electronically, using distributed ledger technology or similar technology.” Previously, crypto assets were treated as foreign currencies in the country, with lower taxes. As reported by Cointelegraph, the bill also establishes that taxpayers will have the option to declare the value of their digital-asset holdings as of Jan. 1 and pay a 14% tax, incentives that are intended to encourage Italians...

The outcome of SBF’s prosecution could determine how the IRS treats your FTX losses

FTX founder Sam Bankman-Fried has received official criminal charges after the collapse of his cryptocurrency exchange, which is more than just a moral victory for the exchange’s roughly 1 million individual investors. While not locked in yet, things appear to be on track for these investors to take a more favorable tax position as SBF’s fate continues to unravel. What kinds of losses can FTX investors claim on their taxes? Earlier this fall, it appeared that assets lost in the FTX collapse would be considered a capital loss under the United States tax code for the tax year 2022. This capital loss can be used to offset capital gains. But in a year in which the crypto market took a beating as a whole, most investors will not have capital gains to offset in 2022. A capital loss can also be u...

How can UK-based businesses accept Bitcoin?

Accepting Bitcoin payments is advantageous due to lower fees than credit and debit cards, expansion of customer base and real-time bank balances. However, risks like volatility and cybercrime may undermine these benefits. Cryptocurrency payments help save excessive credit and debit card processing fees as they are decentralized and do not need intermediaries to verify the transaction. Moreover, merchants do not incur overseas currency exchange changes if payments are made in BTC or other cryptocurrencies. High transaction speed is another benefit of accepting Bitcoin payments, allowing businesses to receive payments in real-time. Moreover, with the increasing customer demand to pay in crypto, offering Bitcoin as a payment method will help acquire more shoppers. However, accepting cryptocur...

European Parliament members vote in favor of crypto and blockchain tax policies

Members of the Parliament of the European Union voted in favor of a non-binding resolution aimed at using blockchain to fight tax evasion and coordinate tax policy on cryptocurrencies. In an Oct. 4 notice, the European Parliament said 566 out of 705 members voted in favor of the resolution originally drafted by member Lídia Pereira. According to the legislative body, the resolution recommended authorities in its 27 member states consider a “simplified tax treatment” for crypto users involved in occasional or small transactions and have national tax administrations use blockchain technology “to facilitate efficient tax collection.” For cryptocurrencies, the resolution called on the European Commission to assess whether converting crypto to fiat would constitute a taxable event, depending on...

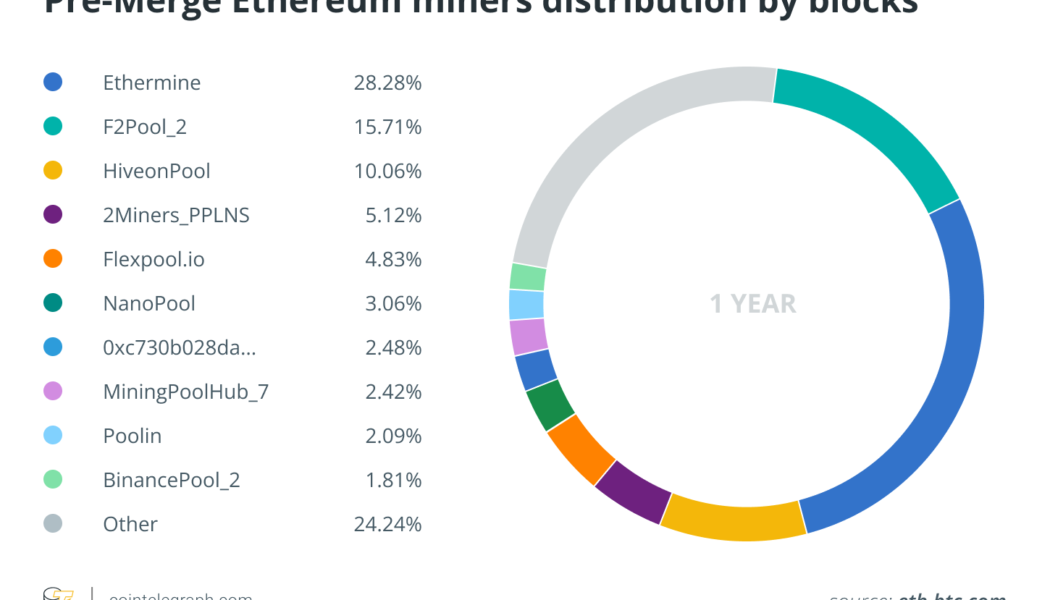

Tax on income you never earned? It’s possible after Ethereum’s Merge

After much buildup and preparation, the Ethereum Merge went smoothly this month. The next test will come during tax season. Cryptocurrency forks, such as Bitcoin Cash, have created headaches for investors and accountants alike in the past. While there has been progress, the United States Internal Revenue Service rules still weren’t ready for something like the Ethereum network upgrade. Nonetheless, there seems to be an interpretation of IRS rules that tax professionals and taxpayers can adopt to achieve simplicity and avoid unexpected tax bills. How Bitcoin Cash broke 2017 tax returns Because of a disagreement over block size, Bitcoin forked in 2017. Everyone who held Bitcoin received an equal amount of the new forked currency, Bitcoin Cash (BCH). But when they received it caused some issu...

LUNC investors react to CZ’s 1.2% trading tax recommendation on Binance

The infamous collapse of the Terra ecosystem, which erased market prices of TerraUSD (UST) and LUNA tokens, continues to trouble anxious investors as co-founder Do Kwon, crypto exchanges and the community together tries to identify the best route for a sustainable price recovery. Most recently, Changpeng ‘CZ’ Zhao, the CEO of crypto exchange Binance, recommended a flat 1.2% trading tax on LUNC trades that could be burned to reduce the token’s total supply and improve its price performance. Addressing the community, CZ stated: “We will implement an opt-in button (on the Binance exchange), for people to opt-in to pay a 1.2% tax for their LUNC trading.” However, the exchange would begin the taxation for opt-in traders following the consensus of 25% of the LUNC investors, making sure that earl...

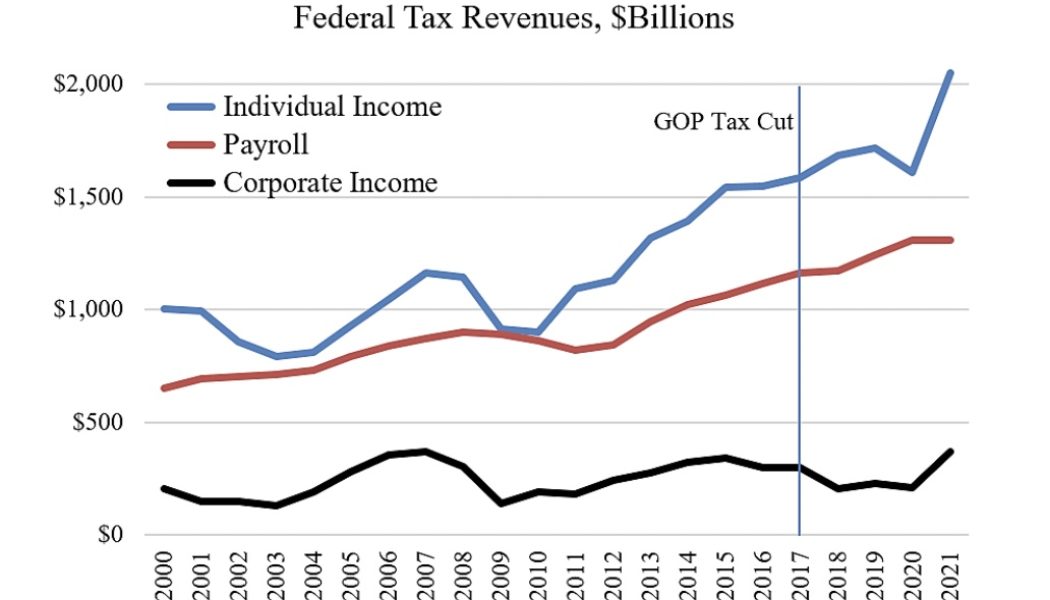

Get ready for even more incompetence at the IRS in 2023

The Internal Revenue Service is hiring 87,000 new agents, but taxpayers will not feel the pain for another two to three years. That’s how long it will take the agency to hire and train agents. Few have discussed the extent of this pain. Still, it’s something to think about when you consider the majority of coming audits will be conducted by new agents, many of whom will have been hastily hired and operating with minimal supervision. Playing the audit lottery will not be smart in future tax years. Taxpayers should protect themselves now, especially when profiting from statutory gray areas — such as cryptocurrency staking, investing through decentralized autonomous organizations (DAOs) and other decentralized finance (DeFi) products. When I started my career in the mid-2000s, business audits...

Can the government track Bitcoin?

Apart from data analysis done alone or in cooperation with private companies, authorities may request information from centralized exchanges. Due to regulation, centralized exchanges may also be obligated to share such information. However, not all cryptocurrency exchanges collaborate with authorities. A centralized exchange is a cryptocurrency exchange that is run by a single entity, such as Coinbase. To become a licensed operator in a certain country or territory, centralized exchanges need to comply with regulations. For instance, to decrease cryptocurrency anonymity and the illicit use of cryptocurrencies, most centralized exchanges have incorporated Know Your Customer (KYC) checks. KYC is meant to verify customers’ identities alongside helping authorities to analyze activity...

Biden is hiring 87,000 new IRS agents — and they’re coming for you

The Inflation Reduction Act, signed into law this month by President Joe Biden, empowers the IRS with nearly $80 billion in new funds. The world’s most powerful tax collection agency is using the money to go on a hiring spree to fuel much tougher enforcement efforts. It is widely assumed that the audits will be brutal and widespread. Taxes start with tax returns, which must be signed under penalties of perjury. The Biden administration has said that the audits on steroids are for fat cats who have escaped having to pay their fair share for too long. The administration has suggested the IRS would perform no new audits on anyone making less than $400,000 annually. Republicans tried to include that in the law, but every Senate Democrat voted against the amendment, as well as IRS audit protect...

IRS takes out John Doe summons on crypto prime dealer SFOX to find tax cheat customers

The Central District of California federal court entered an order Monday to authorize the United States Internal Revenue Service (IRS) to serve a John Doe summons on SFOX, a Los Angeles-based cryptocurrency prime dealer. The IRS filed suit to receive the order, which directs SFOX to reveal the identities of customers who are U.S. taxpayers and documents relating to their cryptocurrency transactions equivalent to at least $20,000 carried out between 2016 and 2021. The IRS filed suit in the Southern District of New York to receive a John Doe summons on SFOX as well. SFOX’s partner bank, M.Y. Safra, is headquartered in New York. The bank provides Federal Deposit Insurance Corporation (FDIC) insured accounts for SFOX institutional traders. Related: Crypto dealer SFOX gets trust charter a...

Crypto firms failed to deliver ‘promised benefits’ from lawmaker-backed incentives, says nonprofit

The Tech Transparency Project, or TTP, a research initiative of the United States-based nonprofit watchdog group Campaign for Accountability, has released a report claiming crypto firms “provided little in return” for state governments offering financial incentives. In a report released Thursday, the TTP said that many crypto firms based in certain U.S. states have “reaped special benefits” for setting up operations while not always delivering jobs, economic growth or tax benefits for residents. According to the group, crypto lobbyists worked on behalf of firms to gain tax breaks and discounted energy prices while state governments have “faced budget shortfalls, surging energy consumption and serious environmental damage.” A new TTP report outlines favorable laws and tax breaks given...

India needs global collaboration to decide on crypto’s future, says finance minister

Indian finance minister Nirmala Sitharaman has called for global collaboration on cryptocurrencies, assessing their pros and cons to form a common standard and taxonomy. Addressing a question on cryptocurrency in the Lok Sabha, the lower house of the Indian parliament, Sitharaman said that the Indian central bank had advised the government to prohibit the use of cryptocurrencies as it poses a risk to financial stability. However, the government is looking for a global approach. She said: “Any legislation for regulation or banning can be effective only after significant international collaboration on evaluation of the risks and benefits and evolution of common taxonomy and standards.” She also reiterated the Indian central bank’s stance on crypto’s value is based on speculation....