technology

Banks still show interest in digital assets and DeFi amid market chaos

The cryptocurrency sector is the Wild Wild West in comparison to traditional finance, yet a number of banks are showing interest in digital assets and decentralized finance (DeFi). This year in particular has been notable for banks exploring digital assets. Most recently, JPMorgan demonstrated how DeFi can be used to improve cross-border transactions. This came shortly after BNY Mellon — America’s oldest bank — announced the launch of its Digital Asset Custody Platform, which allows select institutional clients to hold and transfer Bitcoin (BTC) and Ether (ETH). The Clearing House, a United States banking association and payments company, stated on Nov. 3 that banks “should be no less able to engage in digital-asset-related activities than nonbanks.” Banks aware of potential While ba...

Assess Exposure to Multiple Vulnerabilities in Cisco Products to find Solutions, NCC-CSIRT Advises Users

Tweet Tweet Share Whatsapp reddit The Nigerian Communications Commission’s Computer Security Incident Response Team (NCC-CSIRT) has issued an advisory for users to frequently review alerts for Cisco products to assess their exposure and find a comprehensive update solution.The advisory, which also recommended using the appropriate software updates that are accessible from the vendor website, followed the identification of multiple vulnerabilities in Cisco Products, especially the Cisco AnyConnect Secure Mobility Client for Windows, which enables employees to access company servers from anywhere without compromising security.The two vulnerabilities made it possible for a remote attacker exploit to trigger remote code execution and data manipulation on the targeted system.According to ...

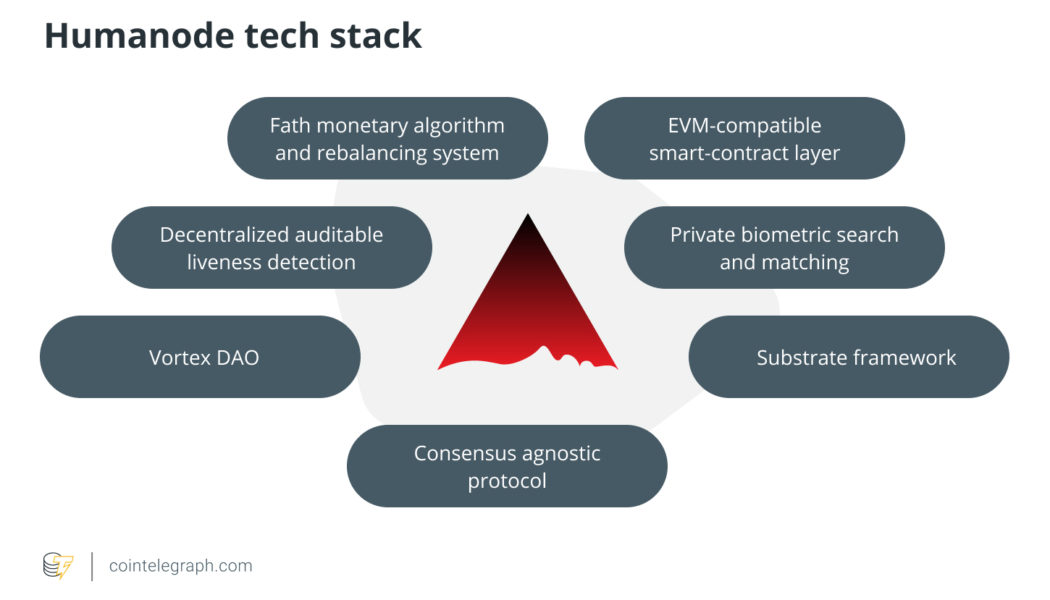

What is Humanode human-powered blockchain?

Humanode is a project that gracefully combines different technological stacks including blockchain and biometrics. Humanode tech encompasses a bunch of layers such as a blockchain layer represented by a Substrate module: a biometric authorization module based on cryptographically secure neural networks for the private classification of three-dimensional (3D) templates of users’ faces, a private liveness detection mechanism for identifying real human beings, a Vortex decentralized autonomous organization (DAO) and a monetary algorithm named Fath, where monetary supply reacts to real value growth and emission is proportional. Let’s look at them in more detail. Substrate framework Humanode is a layer-1 blockchain whose architecture lies on the Substrate open-sour...

Polygon Studios’ Ryan Watt talks Web3’s core principles and fairer internet

The year 2022 in crypto was eventful in many ways. However, the negative impacts of a bear market dampened the excitement around the blockchain upgrades that significantly brought crypto ecosystems closer to the future of finance. For Bitcoin, it was the Taproot soft fork upgrade, which was aimed at improving the scripting capabilities and privacy of the Bitcoin network. Ethereum underwent the Merge upgrade to transition from a proof-of-work to a proof-of-stake (PoS) consensus mechanism. Leading decentralized Ethereum scaling platform Polygon kicked off the year with mainnet upgrades based on Ethereum Improvement Proposal (EIP)-1559, otherwise known as the London hard fork. The upgrade was accompanied by Polygon (MATIC) token burning and better fee visibility. On Jan. 25, Ryan Wyatt joined...

Digital asset platform Bakkt set to acquire Apex Crypto for $200M

Digital asset platform Bakkt has entered into an agreement to acquire Apex Crypto, LLC from Apex Fintech Solutions, Inc. According to the agreement, Bakkt is expected to acquire Apex Crypto for the price tag of $200 million, making its first payment of $55 million at the closing of the deal. The transaction will likely be completed by the first half of 2023 and is subject to regulatory approvals. Launched in 2019, Apex Crypto is a “turnkey platform” dedicated to integrated crypto trading, built with the intention of meeting the increasing demands of more than 30 fintech firms and their growing customers. Apex Crypto was essentially built “to allow investors to transition between trading equities and cryptocurrency by offering efficient account opening and funding solut...

Crypto adoption via regulation: Setting rules for centralized exchanges

Centralized cryptocurrency exchanges have become the backbone of the nascent crypto ecosystem, making way for retail and institutional traders to trade cryptocurrencies despite a constant fear of government crackdowns and lack of support from policymakers. These crypto exchanges over the years have managed to put self-regulatory checks and implemented policies in line with the local financial regulations to grow despite the looming uncertainty. Cryptocurrency regulation continues to occupy mainstream debates and experts’ opinions, but despite public demand and requests from stakeholders of the nascent ecosystem, policymakers continue to overlook the rapidly growing sector that reached a market capitalization of $3 trillion at the peak of the bull run in 2021. Over the past five years...

Can internet outages really disrupt crypto networks?

In the wee hours of Oct. 18, several parts of Europe, America and Asia were left without any internet due to several undersea internet cables being “cut,” causing a chain reaction of connectivity problems across the globe. France, Italy and Spain, in particular, were faced with significant outages, with many experts claiming that vandals were to be blamed for the same. According to Jay Chaudhary, CEO of Zscaler — an American cloud security company — there is no doubt that nefarious third-party agents were to be blamed for the cut cables that resulted in packet data losses as well as latency for various websites and applications, adding that despite their best efforts authorities have been unable to pin down the individuals responsible for the attacks. Furthermore, it bears mentioning that ...

14 years since the Bitcoin white paper: Why it matters

Happy white paper day, Bitcoin. It’s been 14 years since Satoshi Nakamoto first sent an email to the Cypherpunk mailing list with the subject line, “Bitcoin P2P e-cash Paper.” The email included a link to the white paper, an outline of what would soon become a one trillion-dollar market. The first sentence of the email has become iconic among the Bitcoin community: “I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” Over the past 14 years, Bitcoin (BTC) has morphed from a hobbyist pastime into a globally recognized brand. Bitcoin has been adopted as legal tender in regions of the global south such as El Salvador and the Central African Republic. It is used by freedom fighters and campaigners while being a tool for financial eman...

What directional liquidity pooling brings to DeFi

Modern decentralized exchanges (DEXs) mainly rely on liquidity providers (LP) to provide the tokens that are being traded. These liquidity providers are rewarded by receiving a portion of the trading fees generated on the DEX. Unfortunately, while liquidity providers earn an income via fees, they’re exposed to impermanent loss if the price of their deposited assets changes. Directional liquidity pooling is a new method that is different from the traditional system used by DEXs and aims to reduce the risk of impermanent loss for liquidity providers. What is directional liquidity pooling? Directional liquidity pooling is a system developed by Maverick automated market maker (AMM). The system lets liquidity providers control how their capital is used based on predicted price changes. In the t...