technology

Nvidia says there’s a fix for Discord slowing down your GPU

/ Users reported that having the popular chat app open would limit their video memory clock speeds.

Electrify America is increasing prices at its DC fast charging stations

/ Electrify America users were paying standard rates of 43 cents per kilowatt hour. Now, it’s going up to 48 cents starting March 6th.

Amazon reportedly facing FTC antitrust investigation

/ It apparently hasn’t decided whether to file a complaint.

Vivo’s X90 Pro and its massive 1-inch camera sensor get an international launch

/ The X90 Pro is being released alongside the standard X90, with Vivo emphasizing the camera smarts of both handsets. a:hover]:text-gray-63 [&>a:hover]:shadow-underline-black dark:[&>a:hover]:text-gray-bd dark:[&>a:hover]:shadow-underline-gray [&>a]:shadow-underline-gray-63 dark:[&>a]:text-gray-bd dark:[&>a]:shadow-underline-gray”>Image: Vivo Vivo’s X90 Pro, announced for the Chinese market last November, is getting an international release. The X90 Pro is notable for being the latest to use Sony’s 1-inch-type 50-megapixel IMX989 camera sensor, and Vivo is keen to emphasize the low-light photography capabilities such a large (for a smartphone) sensor allows for. It’s joined by the non-Pro X90, which is getting a more limited release outside China. Vivo is bein...

YouTube’s livestream co-hosting feature is rolling out on iOS and Android

/ Go Live Together is now available on the YouTube mobile app and enables two creators to co-host a live broadcast. a:hover]:text-gray-63 [&>a:hover]:shadow-underline-black dark:[&>a:hover]:text-gray-bd dark:[&>a:hover]:shadow-underline-gray [&>a]:shadow-underline-gray-63 dark:[&>a]:text-gray-bd dark:[&>a]:shadow-underline-gray”>Illustration by Alex Castro / The Verge YouTube is rolling out a collaboration feature that allows two users to livestream together. “Go Live Together” was first introduced in November last year, but as per a recent tweet from YouTube (and our own tests), seems to now be available more broadly across iOS and Android mobile devices. The feature enables creators with 50 or more subscribers to invite a guest to livestream with them....

It sounds like Google’s getting ready to compete with ChatGPT

/ Sundar Pichai is promising that you’ll be able to ‘interact directly’ with the company’s language models.

Why hundreds of thousands of Texans lost power in another cold snap

/ This isn’t a repeat of 2021, but the grid still needs work. a:hover]:text-gray-63 [&>a:hover]:shadow-underline-black dark:[&>a:hover]:text-gray-bd dark:[&>a:hover]:shadow-underline-gray [&>a]:shadow-underline-gray-63 dark:[&>a]:text-gray-bd dark:[&>a]:shadow-underline-gray”>Photo by Brandon Bell / Getty Images Power outages hit hundreds of thousands of Texans during a winter storm this week, bringing to mind deadly blackouts the state suffered in a 2021 cold spell. More than 400,000 customers had no electricity today as the icy storm that started Monday entered its final stretch. This week’s blackouts, however, played out much differently than the 2021 disaster. And fortunately, the ice storm is forecast to finally ease up today. But it was another reminder ...

SimpliSafe’s new camera lets agents talk to intruders inside your home

/ The home security company is testing a camera with an optional live guard feature: if the alarm goes off, monitoring agents can view the camera stream and tell intruders to scram. a:hover]:text-gray-63 [&>a:hover]:shadow-underline-black dark:[&>a:hover]:text-gray-bd dark:[&>a:hover]:shadow-underline-gray [&>a]:shadow-underline-gray-63 dark:[&>a]:text-gray-bd dark:[&>a]:shadow-underline-gray”>Image: SimpliSafe DIY home security company SimpliSafe is beta testing a new service that lets its agents both see inside your home and talk with potential intruders during an alarm event. SimpliSafe’s live guard protection service relies on a new AI-powered security camera. If the camera detects human motion while the system is armed, it can trigger the alarm and open a...

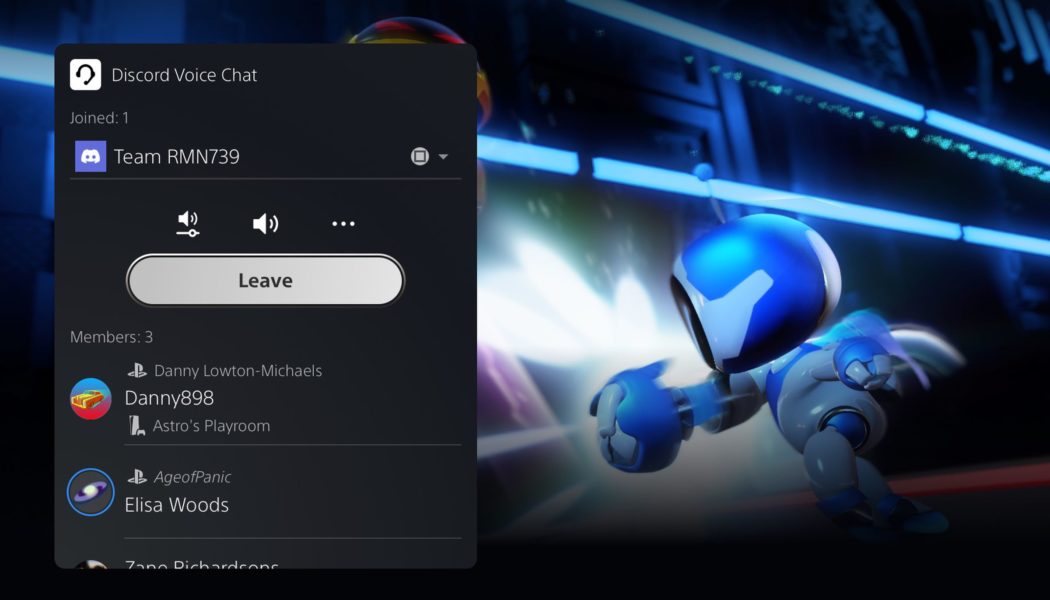

Discord arrives on PS5 for beta testers today

/ The PS5 also gets VRR support for 1440p and a host of dashboard improvements. a:hover]:text-gray-63 text-gray-63 dark:[&>a:hover]:text-gray-bd dark:text-gray-bd dark:[&>a]:text-gray-bd [&>a]:shadow-underline-gray-63 [&>a:hover]:shadow-underline-black dark:[&>a]:shadow-underline-gray dark:[&>a:hover]:shadow-underline-gray”>Image: Sony Beta testers will be able to join Discord voice calls on a PS5 console in the US, Canada, Japan, and UK starting today. The integration allows PS5 owners to join Discord calls by linking accounts and then using the Discord mobile app to transfer calls to the PS5. Sony is also adding Variable Refresh Rate support for 1440p, alongside various dashboard improvements. The Discord voice integration on PS5 appears seems similar to how...

Pinterest’s new round of layoffs comes weeks after its last cuts

/ These ‘organizational changes’ will reportedly affect around 150 people.

Samsung Galaxy Unpacked 2023: all the news and updates from the event

This year’s first Samsung Galaxy Unpacked event was presented in front of an audience in San Francisco’s Masonic Auditorium, marking the first in-person event for Samsung in three years. It started on Wednesday, February 1st, at 1PM ET / 10AM PT, with some exciting announcements. Samsung’s Galaxy S23 Ultra leads the updated lineup with a lightly-tweaked formfactor, 200-megapixel main camera sensor, and more bang for your buck, as its $1,199.99 is unchanged from last year but provides double the storage with 256MB onboard. Meanwhile, the standard Galaxy S23 and S23 Plus have similarly-updated specs, plus they now share the floating camera design of the Ultra, with MSRPs that also match last year’s phones. On the laptop side, Samsung’s new Galaxy Book3 Ultra leads the way with a 16-inch, 120...