technology

Identity and the Metaverse: Decentralized control

“The Metaverse” and “Web3” are the buzzwords of the moment, with their concepts permeating across the worlds of fintech, blockchain, and now even mainstream media. With decentralization thought to be at the core of the Web3 Metaverse, the promise of a better user experience, security and control for consumers is what’s driving its growth. But with users’ identities at the heart of the Metaverse, coupled with unprecedented amounts of data online, there are concerns over data security, privacy and interoperability. This has the potential to hinder the development of the Metaverse, but both regulated and self-sovereign identities could play an important role in ensuring that we truly own our identity and data within this new space. Related: Digital sovereignty: Reclaiming your private data in...

NFT 2.0: The next generation of NFTs will be streamlined and trustworthy

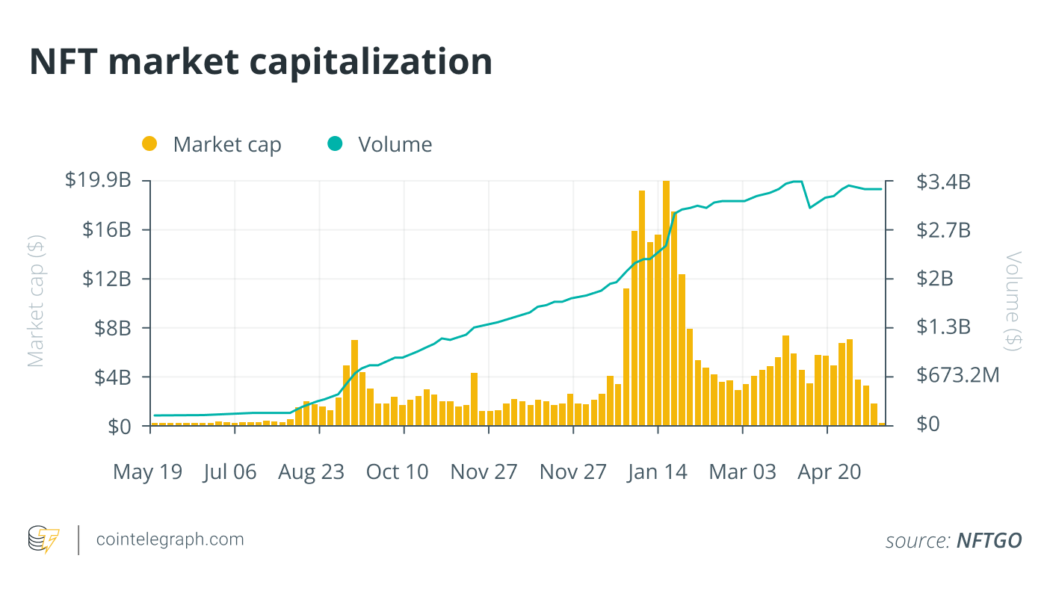

Nonfungible tokens (NFTs) have been in the headlines for the past few years. While swaths of the population have tried to get their head around why NFTs exist, demand has soared, institutions have been built, and the lingo has entered our collective consciousness. There is an elephant in the room, though: NFTs are difficult to use and a majority of them are digital snake oil. But these problems create the opportunity to provide answers. The accessibility and legitimacy of NFTs are both ripe for change. As funding pours into the space, the market is starting to mature, and that change is gaining momentum. We’re entering a new era of NFTs — NFT 2.0 — where the technology will be more easily accessible by the mainstream, and the underlying value proposition of the NFTs will be more transparen...

Why Data Compliance is Critical for Your Business

The regulatory environment is a complex one that impacts all facets of a business. And if dealing with the continually evolving South African compliance landscape is not challenging enough, companies must also keep in mind new EU regulations that can also affect them even if they do not have operations there. Much of this comes down to how data is managed, the expectations of regulators, and how customers are influenced by this both locally and abroad. Every company, regardless of industry, uses data to improve engagement, enhance business processes, drive product innovation, and differentiate itself in a competitive market. As such, data must be managed as the mission-critical asset it is. This extends to policies, stewardship (as it pertains to the management and oversight of data), and ...

China’s TECNO Ranks Amongst Top 6 Brands in Africa

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

How to Stop the Costliest Internet Scams

Image sourced from isnews.stir.ac.uk According to Steve Flynn, Sales and Marketing Director at ESET Southern Africa, it’s long past time organisations get a handle on business email compromise scams which generated more losses for victims in 2021 than any other type of cybercrime. While ransomware, hacking, API hacks, and all the other cybersecurity threats make headlines, it’s worth remembering that the costliest internet scam is still business email compromises, according to the latest FBI Internet Crime Report. Among the complaints received by the FBI in 2021, ransomware, business e-mail compromise (BEC) schemes, and the criminal use of cryptocurrency are among the top incidents reported. Technology-based systems are under attack, and they cost organisations around the world billions in...