technology

Web3 solutions aim to make America’s real estate market more accessible

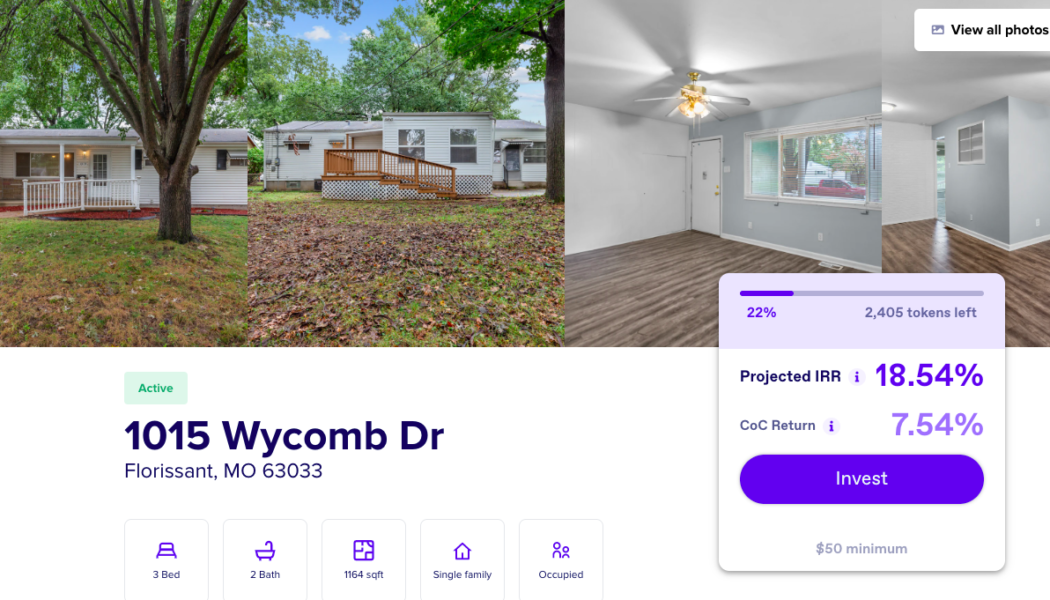

America’s housing market may soon be facing its next bubble as home prices across the country continue to be fueled by demand, speculation and lavish spending that could result in a collapse. Moreover, many homeowners are opting to stay put due to climbing mortgage rates, creating a housing shortage. Data from the Federal National Mortgage Association, commonly known as Fannie Mae, found that 92% of homeowners think their current home is affordable. Yet, findings further show that 69% of the general population, consisting of both homeowners and renters, believe it’s becoming too difficult to find affordable housing. Web3 and the real-estate market While the fate of the United States housing market remains unclear, the rise of Web3 business models based around nonfungible tokens (NFTs...

TRON DAO is launching Decentralised USD (USDD) this May

Justin Sun says USDD would be backed by a $10 billion crypto reserve Proper algorithms would be used to retain the USDD tie with the dollar at 1:1 despite volatility 31-year-old crypto figure Justin Sun has revealed plans to launch the first token of the Stablecoin 3.0 era – Decentralised USD (USDD). According to an open letter sent out last week, Sun explained that TRON DAO had initiated efforts with top figures in the blockchain space to launch USDD as the most decentralised stablecoin. The stablecoin will boast a $10 billion backing in a crypto reserve, a figure that Sun said will be raised by the newly-established TRON DAO Reserve over the next six months to one year. The reserve will be made of highly liquid assets and derived from leading entities in the blockchain scene. USDD w...

A Step-by-Step Guide on How to Create Useful Data-Driven Content

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Decentralized credit scores: How can blockchain tech change ratings

The concept of lending and borrowing is as old as time itself. Regarding finances, while some individuals have more than enough for themselves, others barely have enough to get by. As long as there is this imbalance in finance distribution, there will always be a need to borrow and a desire to lend. Lending involves giving out a resource on credit with the condition of it being returned upon an agreed period of time. In this case, such resources would be money or any financial asset. The lender could be an individual, a financial institution, a firm or even a country. Whichever the case may be, the lender, oftentimes, needs a sort of assurance that their resources would be returned to them upon the agreed time. Certain criteria qualify a borrower to take a loan. Among these are the borrowe...