Top Stories

Cisco South Africa Appoints New General Manager

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Safaricom Builds Ethiopian Data Centre Worth $100M With 2 More on the Way

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

War in Ukraine: 3 Knock-On Effects Felt in the Tech Sector

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

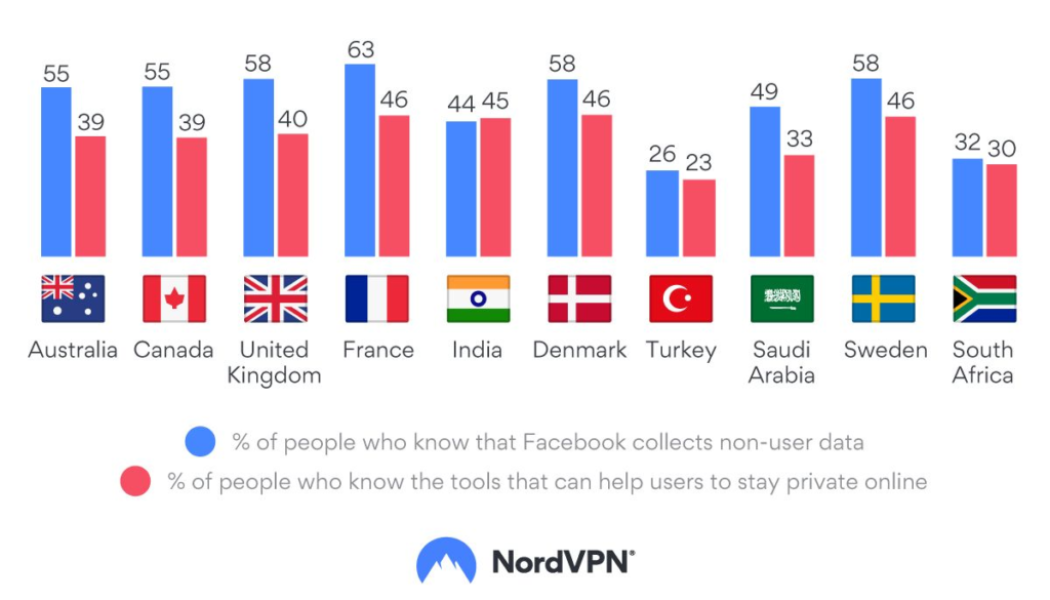

Do South Africans Know How Facebook Collects Their Data?

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Mobile Malware Attacks Across Africa are on the Decline – Why It Isn’t a Good Thing

Image sourced from Sectigo. While analysing the threat landscape of African countries, Kaspersky experts saw a steady decline in attacks on mobile devices in the region, as cybercriminals consolidated their efforts to focus on more complicated, dangerous and profitable threats instead. These and other findings are featured in Kaspersky’s Mobile Threats in 2021 report. Overall, in 2021, South African users faced 38% less mobile malware attacks than in 2020, while other countries in the region have seen even more dramatic changes of their mobile threat landscape: Mozambique saw a 48% decrease, followed by Botswana (58%), Nigeria (59%), Ethiopia (69%) and Ghana (76%). The only countries where the share of attacks increased was Angola, where mobile malware actually grew by 12%. “Indeed, there ...

Facebook Reels Has Finally Launched in These Sub-Saharan African Countries

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

SA Fintech Clickatell Wins $91-Million in its Latest Round of Funding

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Johannesburg Gears Up for the 5th IoT Forum Africa – IoTFA 2022

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Rwanda’s Largest Bank Takes a Major Step Towards Modern Digital Banking

The Bank of Kigali. Image sourced from Frontier Africa Reports. Temenos, the Swiss banking software company, today announces that Bank of Kigali Plc, Rwanda’s largest bank by assets and market share, has gone live on the Temenos platform effectively taking a major step towards modern digital banking practices. According to the software firm, replacing its core banking system with Temenos open platform for composable banking allows Bank of Kigali to break free from legacy constraints and accelerate its digital transformation. Bank of Kigali can now quickly expand its digital channels and engagement to deliver faster, smarter customer experiences, according to Temenos. Renewed through Temenos’ platform, Bank of Kigali aims to double its retail and SME customer base to over one million in the...

7 Things You Need to Know About DStv’s New Streaming Rules

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Why There Won’t Be a Call of Duty Game Coming Out Next Year

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Salesforce Makes a Big Push for South Africa, Appoints Local Execs

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.