United States

Regulations set the table for more talent, capital and building in crypto industry

The feeling in the crypto and decentralized finance space has been shifting and evolving. The industry is also becoming more scrutinized and, inevitably, more organized. Some weeks ago, United States President Joe Biden signed an Executive Order to expedite and focus regulatory oversight of the $3-trillion industry. The order will spur the government to examine the risks and benefits of cryptocurrencies, with a particular focus on consumer protection, financial stability, illicit activity, U.S. competitiveness, financial inclusion and responsible innovation. While the results of this order have yet to unfold, this moment helps to set the table for more clarity, predictability, security and stability for decentralized finance (DeFi). Like with any industry, clarity on how DeFi and cry...

Top universities have added crypto to the curriculum

The world of digital assets saw a significant rise last year. The total cryptocurrency market cap reached $3 trillion, making more people, governments and universities take a closer look at the asset class. The presence of crypto in the world’s major economies has created a big opportunity for diverse startups in the industry, leading to a massive demand for digital assets. This newly born market has helped develop more working and educational opportunities, among other things. Furthermore, some of the world’s top universities and educational institutions including MIT, the University of Oxford and Harvard University, have added pieces of the burgeoning technology to their curriculums. Here are some of the top universities that have added blockchain-related subjects to their syllabus...

President Biden announces former Ripple adviser as pick for Fed vice chair for supervision

Following the withdrawal of former Federal Reserve Board governor Sarah Bloom Raskin, United States President Joe Biden has announced his intention to nominate former Obama administration official and law professor Michael Barr as the central bank’s vice chair for supervision. In a Friday announcement, the White House said Barr was Biden’s pick to supervise the Federal Reserve and set the regulatory agenda for its leadership. Barr was on the advisory board of Ripple Labs from 2015 to 2017, served as the Treasury Department’s assistant secretary for financial institutions under former President Barack Obama, and taught courses on financial regulation at the University of Michigan. According to the White House, he was “a key architect” of the Dodd-Frank Act — legislation that continues to in...

Texas regulators order virtual casino to stop selling NFTs

A virtual, Cyprus-registered casino Sand Vegas Casino Club faced an emergency cease and desist order from Texas and Alabama state securities regulators. The company is ordered to “stop a fraudulent investment scheme tied to metaverses”. On April 13, the Texas State Securities Board reported issuing the order, accusing Sand Vegas Casino Club, Martin Schwarzberger and Finn Ruben Warnke of illegally offering nonfungible tokens (NFTs) to fund the development of virtual casinos in metaverses. Allegedly, Sand Vegas offered 11,111 NFTs to raise funds for its metaverse casinos. The firm offered those who purchased Gambler NFTs and Golden Gambler NFTs a share of the future casino’s profits. By Sand Vegas’ projections, owners of Gambler NFTs could expect profits between $1,224 and $24,48...

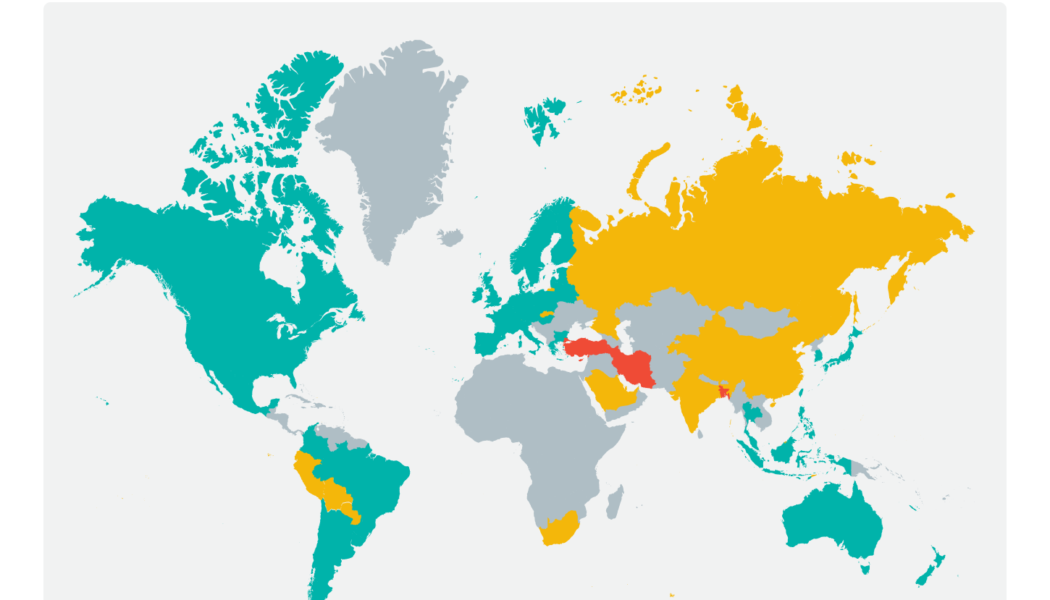

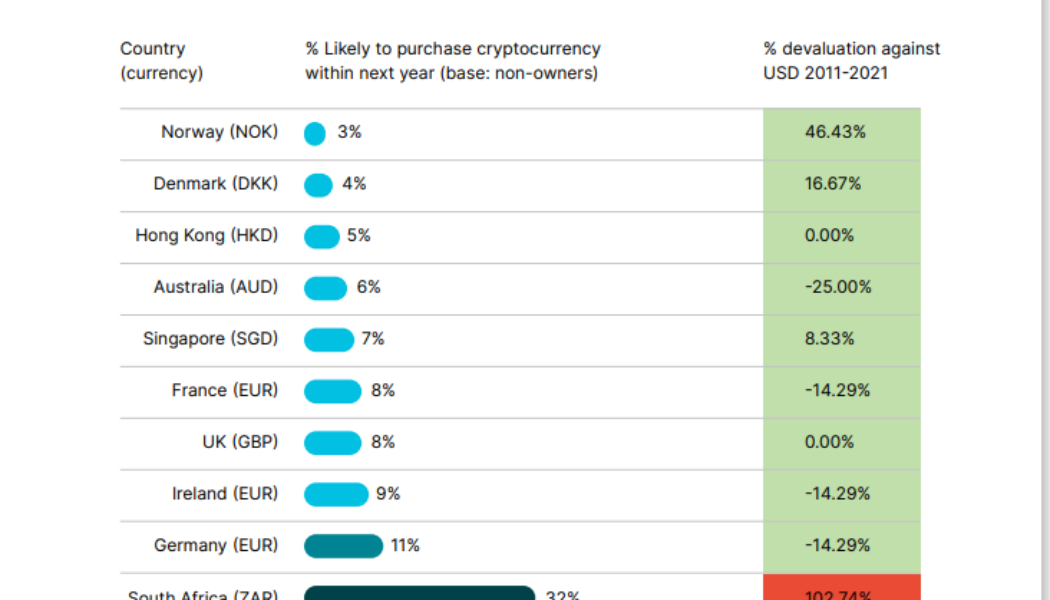

Crypto seen as the ‘future of money’ in inflation-mired countries

Last year, cryptocurrencies reached a “tipping point,” according to Gemini’s 2022 Global State of Crypto report, “evolving from what many considered a niche investment into an established asset class.” According to the report, 41% of crypto owners surveyed globally purchased crypto for the first time in 2021, including more than half of crypto owners in Brazil at 51%, Hong Kong at 51% and India at 54%. The study, based on a survey of 30,000 adults in 20 countries over six continents, also made a strong case that inflation and currency devaluation are powerful drivers of crypto adoption, especially in emerging market (EM) countries: “Respondents in countries that have experienced 50% or more devaluation of their currency against the USD over the last 10 years were more than 5 times as...

Former US Senator and House member joins Crypto Council for Innovation

Cory Gardner, who served as a United States senator for Colorado from 2015 to 2021, has joined the Crypto Council for Innovation, a crypto advocacy group aimed at establishing dialogues with governments and regulatory agencies on the benefits of digital assets. In a Thursday announcement, the Crypto Council for Innovation, or CCI, said Gardner was one of three new members to join the group’s leadership team. Under CEO Sheila Warren, the former senator will work alongside Amanda Russo, a communicators adviser for the World Economic Forum, and Annie Dizon, a former executive with social impact nonprofit TechSoup. In addition, Katherine Wu, a venture partner at Archetype, will become CCI’s first research fellow, while former Algorand Foundation CEO Sean Lee joined the group to help buil...

Treasury Secretary hints at regulatory framework to address potential risks in digital asset markets

United States Treasury Secretary Janet Yellen listed stablecoins as one of the major policy concerns in the digital asset space for regulators, currently subject to “inconsistent and fragmented oversight.” Speaking to attendees at American University in Washington, D.C. on Thursday, Yellen said the Treasury Department was working with Congress to advance legislation to help ensure that “stablecoins are resilient to risks” for consumers and the U.S. financial system. According to the Treasury Secretary, while stablecoins raised “policy concerns” and issues around the coins’ reserve assets, many parts of the digital asset space present potential risks that could exacerbate inequality. “Our regulatory frameworks should be designed to support responsible innovation while managing risks and esp...

Toomey drafts bill to exempt stablecoins from securities regulations

Republican Senator Pat Toomey, the ranking member for the Senate Banking Committee, has drafted a bill proposing a regulatory framework for stablecoins in the United States. According to a draft released Wednesday, the Stablecoin Transparency of Reserves and Uniform Safe Transactions Act, abbreviated as the Stablecoin TRUST Act, proposed that the digital assets be identified as “payment stablecoins” — a convertible virtual currency used as a medium of exchange that can be redeemed for fiat by the issuer. Critically, the bill proposed that such offerings should be exempt from securities regulations by amending existing laws to ensure the definition of “security” does not include a payment stablecoin. The legislation also proposed that stablecoin issuers — which would include national t...

ProShares files with SEC for Short Bitcoin Strategy ETF

Exchange-traded funds (ETFs) issuer ProShares has filed a registration statement with the United States Securities and Exchange Commission to list shares of a Short Bitcoin Strategy ETF. In a Tuesday filing, ProShares applied with the SEC for an investment vehicle that would allow users to bet against Bitcoin (BTC) futures using an exchange-traded fund. According to the registration statement, the Short Bitcoin Strategy ETF will be based on daily investment results corresponding to the inverse of the return of the Chicago Mercantile Exchange Bitcoin Futures Contracts Index for a day. ProShares just filed for a Short Bitcoin Futures ETF. Even tho SEC rejected similar filing last year, this has shot IMO given ProShares’ perfect read on SEC w/ $BITO and the lack of issues w/ futures ETF...

US sanctions Russia’s largest darknet market and crypto exchange Garantex

The United States Department of the Treasury’s Office of Foreign Assets Control has announced it will impose sanctions on darknet market Hydra and virtual currency exchange Garantex. In a Tuesday announcement, the Treasury Department said it had worked with the Department of Justice, the Federal Bureau of Investigations, the Drug Enforcement Administration, the Internal Revenue Service Criminal Investigation and Homeland Security Investigations to sanction the Russia-based darknet marketplace as well as Garantex. The move from the U.S. government agencies came the same day the German Federal Criminal Police announced it had shut down Hydra’s servers in Germany and seized more than $25 million worth of Bitcoin (BTC) connected to the marketplace. Illegaler #Darknet-Marktplatz „Hydra Market“ ...

In the US, public-private state associations form networks of support for crypto businesses

When you think of a crypto-friendly U.S. state, Washington is hardly the first to come to mind. Yet, a lot has been happening on the ground in the Pacific Northwest lately. Washington Governor Jay Inslee signed a bill, SB5544, into law on March 30. The new legislation creates a working group of seven state officials and eight trade association leaders to examine “various potential applications of and policies for blockchain technology” and report to the governor in December 2023. Republican state Senator Sharon Brown, one of the sponsors of the legislation, said, “By creating the Washington Blockchain Work Group, we are sending a clear message that Washington is ready to start working with the private sector to advance this technology for the benefit of all Washington residents, empl...

SEC chair: retail crypto investors should be protected

Gary Gensler, chair of the United States Securities and Exchange Commission, said the agency’s protections that apply to investors of traditional assets should extend to those in the crypto market. In prepared remarks released Monday for the Penn Law Capital Markets Association Annual Conference, Gensler said he had requested SEC staff to explore getting crypto platforms registered, having them subject to the same regulatory framework as exchanges. In addition, the SEC chair said the agency’s staff could be working towards addressing regulatory clarity in the crypto space by considering how to register platforms “where the trading of securities and non-securities is intertwined” and whether retail crypto investors should be afforded the same protections as those in traditional markets. “Cr...