United States

US Virginia Senate allows state banks to offer crypto custody services

The Senate of Virginia in the United States unanimously approved a bill amendment request that now allows traditional banks operating in the Commonwealth of Virginia to provide virtual currency custody services. Delegate Christopher T. Head introduced the bill (House Bill No. 263) back in January 2022, seeking an amendment to allow eligible banks to offer crypto custody services: “A bank may provide its customers with virtual currency custody services so long as the bank has 26 adequate protocols in place to effectively manage risks and comply with applicable laws.” The bill passed Senate with a sweeping 39-0 vote and is waiting to be signed into law by Governor of Virginia Glenn Youngkin. Banks that intend to offer this service to clients will need to adhere to three specific requir...

Crypto dealer SFOX gets trust charter approval from Wyoming regulators

The State of Wyoming has approved California-based crypto broker SFOX for a trust charter, allowing the firm to provide custodial and other crypto-related services to institutional clients. In a Tuesday announcement, SFOX said the Wyoming trust charter will allow the firm to operate in the state as the SAFE Trust Company, offering services to institutional clients, private clients, and advisers. According to the company, SAFE will “serve in a variety of fiduciary roles” including direct trustee, discretionary trustee, trust advisor, and protector. “The new charter will enable us to provide secure, reliable and efficient investment, trading, and custodian services for a wide range of digital assets, meeting the needs of investors, particularly small-to-mid-sized firms, which until now have ...

US Treasury Dept lists digital currencies as part of effort to sanction Russia’s government

The Treasury Department and reportedly the White House are warning U.S.-based companies and individuals not to facilitate crypto transactions sent to certain Russian nationals and banks. According to regulations from the Treasury Department’s Office of Foreign Assets Control scheduled to go into effect on March 1, U.S. residents may not use digital currencies to benefit Russia’s government — including the country’s central bank — as an attempt to circumvent U.S. sanctions in response to the invasion of Ukraine. The guidelines equated crypto transactions to “deceptive or structured transactions or dealings” in attempting to evade sanctions. Treasury Secretary Janet Yellen said the department’s actions were aimed at “significantly limit[ing] Russia’s ability to use assets to finance its dest...

Crypto firms may still face SEC penalties for self-reporting securities laws violations: Report

The U.S. Securities and Exchange Commission’s enforcement director has reportedly said cryptocurrency companies will not receive amnesty for reporting themselves for possible violations of securities laws. According to a Monday report from Reuters, the SEC director of the agency’s division of enforcement, Gurbir Grewal, said the agency may view crypto companies’ conduct “more favorably” if they reach out first for self-reporting securities law violations. However, he added that though firms may face smaller penalties, they will not be completely off the hook. “Our message to [crypto companies] is not, ‘Register your product and we’ll just ignore the billions you have under management in this crypto lending product and your violations of the securities laws,’” said G...

Are crypto and blockchain safe for kids, or should greater measures be put in place?

Crypto is going mainstream, and the world’s younger generation, in particular, is taking note. Cryptocurrency exchange Crypto.com recently predicted that crypto users worldwide could reach 1 billion by the end of 2022. Further findings show that Millennials — those between the ages of 26 and 41 — are turning to digital asset investment to build wealth. For example, a study conducted in 2021 by personal loan company Stilt found that, according to its user data, more than 94% of people who own crypto were between 18 and 40. Keeping children safe While the increased interest in cryptocurrency is notable, some are raising concerns regarding the ways those under the age of 18 are interacting with digital assets. These challenges were highlighted in UNICEF’s recent “Prospects for children in 202...

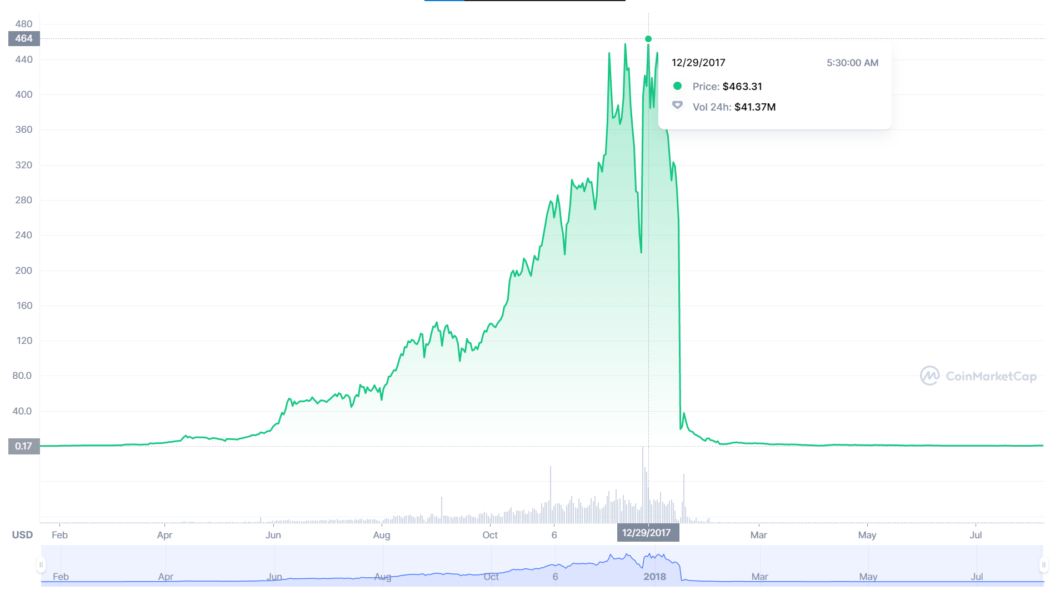

DOJ indicts BitConnect’s Indian founder for $2.4B crypto Ponzi scheme

The founder of the infamous crypto exchange BitConnect, Satish Kumbhani, has been charged for allegedly misleading investors globally and defrauding them of $2.4 billion in the process. According to the Department of Justice (DOJ), a San Diego-based federal grand jury specifically charged Kumbhani for orchestrating the alleged Ponzi scheme via BitConnect’s “Lending Program”: “BitConnect operated as a Ponzi scheme by paying earlier BitConnect investors with money from later investors. In total, Kumbhani and his co-conspirators obtained approximately $2.4 billion from investors.” BitConnect (BCC) price history. Source: CoinMarketCap Back in 2017 amid the hype, BitConnect (BCC) recorded an all-time high of $463.31 in trading price, which according to the DOJ reached a peak market capitalizati...

Crypto could bypass President Biden’s ‘devastating’ sanctions on Russian banks and elites: Report

The sanctions announced by United States President Joe Biden in response to Russia’s attack on Ukraine did not include cutting the country off from payments on the SWIFT system or cryptocurrency transfers. In a Thursday announcement from the White House, Biden said the U.S. and its allies and partners would be enforcing sanctions aimed at imposing “devastating costs” on Russia due to “Putin’s war of choice against Ukraine.” The U.S. president announced that the country would sever its financial system from Russia’s largest bank, Sberbank, as well as impose “full blocking sanctions” on VTB Bank, Bank Otkritie, Sovcombank OJSC, Novikombank, and their subsidiaries. Biden also named several elite nationals who have “enriched themselves at the expense of the Russian state” as part of the ...

Russia to seize retail deposits if sanctions go too far, official warns

In the event of harsh Western sanctions as Russian forces invade Ukraine, retail customers could risk losing their savings. Russians’ savings could be confiscated in response to sanctions against the country, according to Nikolai Arefiev, a member of the country’s Communist Party and vice-chairman of the Duma’s committee on economic policy. The Russian government can potentially seize about 60 trillion rubles ($750 billion) worth of people’s deposits should Western nations decide to block all of Russia’s foreign funds, Arefiev said in an interview with the local news agency News.ru on Monday. “If all the foreign funds are blocked, the government will have no other choice but to seize all the deposits of the population, or 60 trillion rubles in order to solve the situation,” the official st...

BNY Mellon partners with Chainalysis to track users’ crypto transactions

The Bank of New York (BNY) Mellon has announced a partnership with blockchain-data platform Chainalysis to help track and analyze cryptocurrency products. BNY Mellon is the world’s largest custodian bank, currently overseeing $46.7 trillion in assets. Chainalysis is a blockchain-data analysis platform that offers services to traditional financial institutions, allowing large firms to manage the legal risks that come with cryptocurrency more easily. As part of the partnership, BNY will utilize Chainalysis software to track, record and make use of the data surrounding crypto assets. The risk management software offered by Chainalysis includes KYT (Know Your Transaction), Reactor, and Kryptos, with the most important being the KYT flagging system — which automatically detects whether cryptocu...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

BTC helps our effort to unseat a 20+ year incumbent: Aarika Rhodes on Bitcoin Day

Aarika Rhodes, an elementary school teacher-turned congressional candidate, recently featured in the Bitcoin Day Sacramento 2022 event to discuss the impact of Bitcoin (BTC) in local politics. Speaking to Cointelegraph, Rhodes highlighted the difficulty for grassroots candidates like herself to compete against established members of the US Congress. Our campaign has officially adopted Lighting for campaign contributions.⚡️ This revolutionary technology creates accessibility and looks towards the future. I am excited to provide this option to our supporters across all 50 states. #Bitcoin — Aarika for CA-32 (@AarikaRhodes) November 30, 2021 “If it wasn’t for Bitcoin and the Lightning Network, a grassroots campaign like ours wouldn’t have made it this far with the amount o...

Georgia lawmakers consider giving crypto miners tax exemptions in new bill

Five members of the Georgia House of Representatives have introduced a bill that would exempt local crypto miners from paying sales and use tax. On Monday, Georgia Representatives Don Parsons, Todd Jones, Katie Dempsey, Heath Clark, and Kasey Carpenter introduced HB 1342, a bill which has yet to be titled. The legislation proposes to amend the state tax code “to exempt the sale or use of electricity used in the commercial mining of digital assets” and would likely only apply to commercial miners operating in a facility of at least 75,000 square feet — roughly 6,968 square meters. The proposed bill is the latest in the series of state-level measures aiming to encourage crypto miners to set up shop. In January, Illinois lawmakers introduced a bill which would extend tax incentives for data c...