United States

Fed’s Lael Brainard hints at US playing a lead role in development of CBDCs

Lael Brainard, a member of the Federal Reserve’s Board of Governors, encouraged the United States to be a leader in research and policy regarding central bank digital currencies, or CBDCs, due to potential international developments. In remarks prepared for the U.S Monetary Policy Forum in New York on Friday, Brainard said the People’s Bank of China’s pilot program for its digital yuan could have implications on the dollar’s dominance in cross-border payments and payment systems. However, a digital dollar could allow people around the world to continue to rely on its fiat counterpart. “It is prudent to consider how the potential absence or issuance of a U.S. CBDC could affect the use of the dollar in payments globally in future states where one or more major foreign currencies are is...

Biden expected to issue executive order on crypto and CBDCs next week: Report

The White House will reportedly be issuing an executive order as early as next week directing government agencies to study different aspects of the digital asset space with the goal of creating a comprehensive regulatory framework. In a Thursday report from Yahoo! Finance, Jennifer Schonberger said an official familiar with the matter within the Biden administration revealed the executive order could arrive as soon as next week. The directive from President Biden would reportedly order the Office of the Attorney General, the State Department, and the Treasury Department to study the potential rollout of a U.S.-issued central bank digital currency. In addition, the Director of the Office of Science and Technology Policy — the newly appointed Alondra Nelson — would provide an evaluation on t...

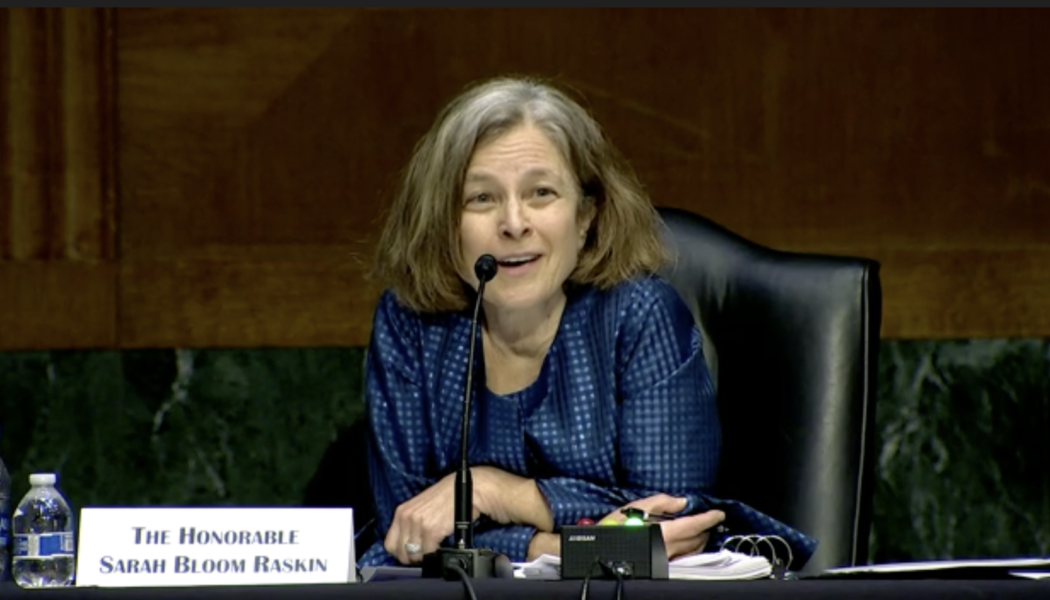

Concerns over Fed nominee may stop Senate from confirming Biden’s picks: Report

Members of the U.S. Senate Banking committee have reportedly divided along party lines regarding President Joe Biden’s pick of Sarah Bloom Raskin as vice chair for supervision for the Board of Governors at the Federal Reserve. According to a Tuesday report from Reuters, Senator Pat Toomey, the ranking member on the Senate Banking Committee, said he had asked the 12 Republican senators on the committee to not attend a meeting in which members were expected to vote on President Biden’s nominees for the Fed. Toomey reportedly said that Democratic leadership can proceed with “five of the six nominees” put forth by the President and expect Republican support — with the exception of Raskin. Republicans’ boycott is reportedly due to concerns over allegations that the prospective Fed vice chair fo...

Super Bowl 2022: Here’s the scoreboard of crypto ads

Super Bowl commercials have always been an intrinsic part of the annual National Football League (NFL) championship, and for businesses, it’s a fair sign of making it in the real world. This year, however, marked a new milestone for the crypto community as FTX, eToro, Crypto.com and Coinbase debuted crypto ads during Super Bowl 2022. With rising demand in crypto — recently fueled by nonfungible tokens, meme tokens and the metaverse — Super Bowl crypto ads stole the limelight from traditional businesses on social media platforms such as Twitter. Let’s gauge the advertisements and echo the feelings expressed by the community. Coinbase Super Bowl 2022 commercial Coinbase is one of the most popular crypto exchanges in the United States, often taking the No. 1 spot for being the most downloaded...

Laundering via digital pictures? A new twist in the regulatory discussion around NFTs

On Feb. 6, the United States Department of the Treasury released a report under the headline “Study of the facilitation of money laundering and terror finance through the trade in works of art.” In fact, only a tiny fraction of the 40-page document is dedicated to the “Emerging Digital Art Market,” by which the department understands the market for nonfungible tokens, or NFTs. Still, even a brief mention of the emerging NFT space in this context can have major implications for the tone of the nascent regulatory debate with regard to the asset class. What the report said The overall tone of the report is hardly alarming for the NFT space: The document casually mentions the growing interest in the digital art market both from private investors and legacy institutional players such as a...

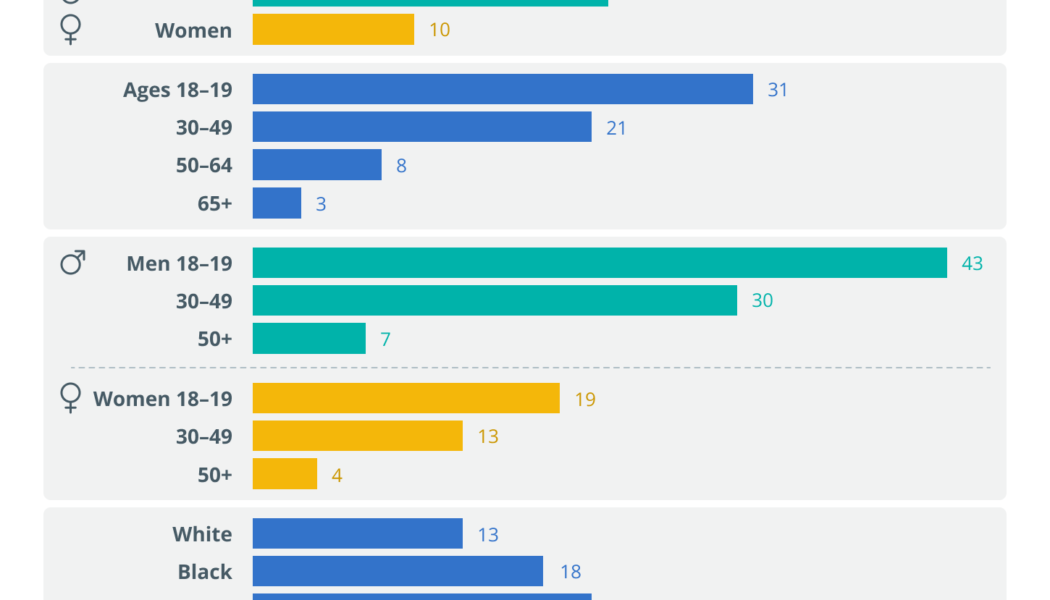

Love in the time of crypto: Does owning cryptocurrency make daters more desirable?

Cryptocurrency has become one of the most widely discussed topics of 2022. As such, it shouldn’t come as a surprise that mentioning “crypto” in an online dating profile may generate additional attention. A newstudy from brokerage firm eToro found that 33% of Americans who were surveyed would be more likely to go on a date with someone who mentioned crypto assets in their online dating profile. Out of the 2,000 adult residents in the United States between the ages of 18 and 99 surveyed, more than 40% of men and 25% of women indicated that their interest in a potential date is stronger when crypto is written on a dating profile. Crypto: What’s love got to do with it? Callie Cox, U.S. investment analyst at eToro, told Cointelegraph that the findings from eToro’s inaugural “Crypto & ...

Bitcoin’s last security challenge: Simplicity

It’s been just 13 years since Bitcoin’s (BTC) “Mayflower moment,” when a tiny handful of intrepid travelers chose to turn their back on the Fiat Empire and strike out to a new land of financial self-sovereignty. But, whereas it took 150 years for the American colonists to grow sufficient in number to throw off the yoke of unrepresentative government, the Republic of Bitcoin has gone from Pilgrims to Revolutionary Army in little over a decade. What sort of people are these new Bitcoiners? How do their character, demographics and technical knowledge differ from earlier adopters? Is “Generation Bitcoin” sufficiently prepared to protect their investment against current and future security threats? And, most importantly, what are the challenges that the rapidly growing community must urgently a...

New Hampshire Governor issues executive order establishing commission to study crypto

Chris Sununu, who has served as the governor of New Hampshire since 2017, has established a commission aimed at investigating the technology and laws around digital assets in addition to recommending new legislation. On Wednesday, the New Hampshire Governor’s office announced it would be issuing Executive Order 2022-1 to create the Governor’s Commission on Cryptocurrencies and Digital Assets. Governor Sununu cited the “rising use and acceptance” of crypto as well as the growth of distributed ledger and blockchain technologies in his decision to establish the commission. According to the executive order, the crypto commission will have 180 days — until Aug. 8 — to submit a report to officials within the New Hampshire state government consisting of a “review and investigation regarding...

Tennessee lawmaker introduces bill which would allow state to invest in crypto

Jason Powell, a member of the Tennessee House of Representatives, has introduced a bill proposing counties, municipalities, and the state to invest in cryptocurrencies and nonfungible tokens, or NFTs. According to Tennessee House Bill 2644 introduced on Feb. 2, Powell proposed amending the current state code to add crypto, blockchain, and NFTs to the list of authorized investments for the counties, state, and municipalities to make with idle funds. Lawmakers assigned the bill to the House Finance, Ways, and Means Subcommittee on Feb. 8 for further consideration. The legislation was the second related to crypto and blockchain introduced by Powell. The same day, he asked Tennessee lawmakers to consider forming a study committee aimed at making the state “the most forward thinking and p...

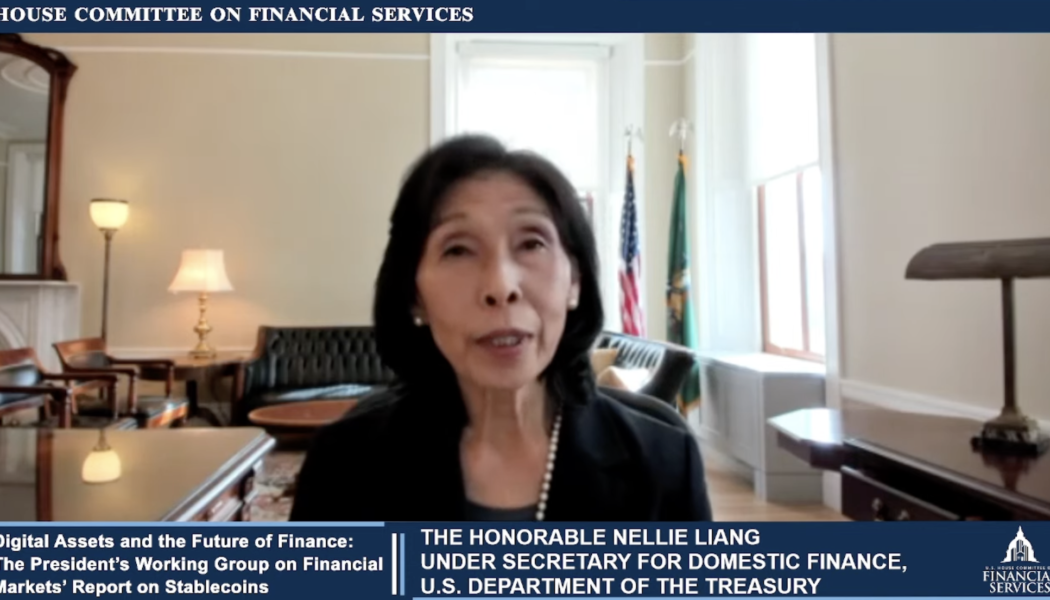

US lawmaker pushes for state-level regulations on stablecoins at hearing on digital assets

Whether regulations on stablecoins and digital assets should be addressed at the state or federal level was the topic of discussion among at least two U.S. lawmakers in a hearing for the House Committee on Financial Services. Speaking virtually at a Tuesday hearing titled “Digital Assets and the Future of Finance: The President’s Working Group on Financial Markets’ Report on Stablecoins,” North Carolina Representative and ranking committee member Patrick McHenry asked the committee to consider state-level regulatory frameworks in lieu of a comprehensive federal law on stablecoins. In response to McHenry, Jean Nellie Liang, the Under Secretary for Domestic Finance at the U.S. Treasury Department, said there was no explicit law governing stablecoins and digital assets at the federal level bu...

US Treasury targets NFTs for potential high-value art money laundering

The U.S. Department of the Treasury released a study on the high-value art market, highlighting the potential in the nonfungible tokens (NFT) space to conduct illicit money laundering or terror financing operations. The treasury’s “Study of the facilitation of money laundering and terror finance through the trade in works of art” suggested that the increasing use of art as an investment or financial asset could make the high-value art trades vulnerable to money laundering: “The emerging online art market may present new risks, depending on the structure and incentives of certain activity in this sector of the market (i.e., the purchase of NFTs, digital units on an underlying blockchain that can represent ownership of a digital work of art).” The study underlines the importance of NFTs in r...

Stealth rulemaking: Is proposed SEC rule with no mention of crypto a threat to DeFi?

On Jan. 26, the United States Securities and Exchange Commission proposed amendments to Rule 3b-16 under the Exchange Act that lacks any mention of digital assets or decentralized finance, which could adversely affect platforms that facilitate crypto transactions. Some cryptocurrency advocates — including SEC Commissioner Hester Peirce — believe that the commission’s extended definition of an exchange could thrust an entire class of crypto entities under the regulator’s jurisdiction, subjecting them to additional registration and reporting burdens. How real is the threat? The proposed change The amendments proposed by the regulator dramatically expand the definition of what an exchange is while eliminating the exemption for systems that merely bring together buyers and sellers of securitie...