United States

Former acting comptroller of the currency joins Voyager Digital’s board

Crypto trading platform Voyager Digital announced Bitfury CEO and former Acting Comptroller of the Currency Brian Brooks has joined the firm’s board of directors. In a Monday announcement, Voyager chair Philip Eytan said Brooks had joined the board as an “independent, non-executive director,” citing the former comptroller’s experience at crypto companies and his leadership behind regulatory initiatives in the United States during his time at the OCC. Brooks served as acting Comptroller of the Currency until January, was Coinbase’s chief legal officer from 2018 to 2020 and held the position of CEO at Binance.US for less than four months this year. Welcome Brian Brooks as the newest member of our Board of Directors Brooks, the Former Acting Comptroller of the U.S. Currency, is a globally rec...

Former acting comptroller of the currency joins Voyager Digital’s board

Crypto trading platform Voyager Digital announced Bitfury CEO and former Acting Comptroller of the Currency Brian Brooks has joined the firm’s board of directors. In a Monday announcement, Voyager chair Philip Eytan said Brooks had joined the board as an “independent, non-executive director,” citing the former comptroller’s experience at crypto companies and his leadership behind regulatory initiatives in the United States during his time at the OCC. Brooks served as acting Comptroller of the Currency until January, was Coinbase’s chief legal officer from 2018 to 2020 and held the position of CEO at Binance.US for less than four months this year. Welcome Brian Brooks as the newest member of our Board of Directors Brooks, the Former Acting Comptroller of the U.S. Currency, is a globally rec...

SEC commissioner Elad Roisman will leave by end of January

Elad Roisman, one of five members of the Securities and Exchange Commission’s board, has announced his intention to resign from the government agency. In a Monday announcement, Roisman said he had sent a letter to President Joe Biden informing him of his decision to leave the SEC by the end of January 2022. The SEC commissioner said he would continue working with his colleagues “to further our mission of protecting investors, maintaining fair, orderly and efficient markets, and facilitating capital formation” until his departure. Roisman was sworn into office in September 2018 under the previous administration and served as acting SEC chair from December 2020 to January 2021, when he was replaced by commissioner Allison Herren Lee. His term was originally set to expire in 2023. Gary Gensle...

SEC commissioner Elad Roisman will leave by end of January

Elad Roisman, one of five members of the Securities and Exchange Commission’s board, has announced his intention to resign from the government agency. In a Monday announcement, Roisman said he had sent a letter to President Joe Biden informing him of his decision to leave the SEC by the end of January 2022. The SEC commissioner said he would continue working with his colleagues “to further our mission of protecting investors, maintaining fair, orderly and efficient markets, and facilitating capital formation” until his departure. Roisman was sworn into office in September 2018 under the previous administration and served as acting SEC chair from December 2020 to January 2021, when he was replaced by commissioner Allison Herren Lee. His term was originally set to expire in 2023. Gary Gensle...

Law Decoded: Making sense of mixed signals, Dec. 13–20

The crypto regulation regime in any jurisdiction is an equilibrium among multiple institutional, group and personal interests of actors who have a sway over financial and monetary policies. These interests never perfectly align, frequently resulting in contradictory signals coming out of various power centers. Speaking about systemic risks facing the world’s largest economy last week, the United States Federal Reserve chair said digital assets were not a financial stability concern. Two days later, the U.S. Financial Stability Oversight Council issued a report that concluded that stablecoins and decentralized finance could pose sizeable financial stability risks. The source of this discrepancy could lie in the fact that the Fed’s mandate is to maintain a robust economy, while the FSOC, whi...

Law Decoded: Making sense of mixed signals, Dec. 13–20

The crypto regulation regime in any jurisdiction is an equilibrium among multiple institutional, group and personal interests of actors who have a sway over financial and monetary policies. These interests never perfectly align, frequently resulting in contradictory signals coming out of various power centers. Speaking about systemic risks facing the world’s largest economy last week, the United States Federal Reserve chair said digital assets were not a financial stability concern. Two days later, the U.S. Financial Stability Oversight Council issued a report that concluded that stablecoins and decentralized finance could pose sizeable financial stability risks. The source of this discrepancy could lie in the fact that the Fed’s mandate is to maintain a robust economy, while the FSOC, whi...

Celebrities that rode the crypto wave in 2021

Overshadowing its glory in previous years, the crypto ecosystem managed to maintain a year-long spotlight throughout 2021. Key catalysts include mainstream adoption of Bitcoin (BTC), a meme coin frenzy driven by Shiba Inu (SHIB) and Dogecoin (DOGE), and proactive participation from popular celebrities and authority figures. The year 2021 witnessed a greater inflow of influencers and celebrities to the space than ever before. All the way from mainstream tech entrepreneurs and presidents to rappers and reality TV stars, celebrities have gotten involved in crypto in their own unique ways. While some chose to create their own versions of crypto ecosystems and tokens, others helped spread awareness of various projects. As a tribute to all those who showed involvement in our world of crypt...

Bitcoin book for American policymakers gets 5x funding on Kickstarter

A group of eight Bitcoin (BTC) enthusiasts launched a Kickstarter campaign to publish an educational book for America’s federal policymakers, to reduce their reliance on the traditional media narrative on cryptocurrencies. The campaign managed to attract $23,151 in funding, nearly five times the goal of $5,000. The book was conceptualized soon after the United States House of Representatives passed the $1.2 trillion bipartisan infrastructure bill, which mandates stringent reporting requirements for the crypto community. According to the authors: “We set out to write a book to help policymakers understand where Bitcoin users are from and what they care about. We want to dispel the notion that it’s a nerd money and show how it’s impacting so many people in America.” Possibl...

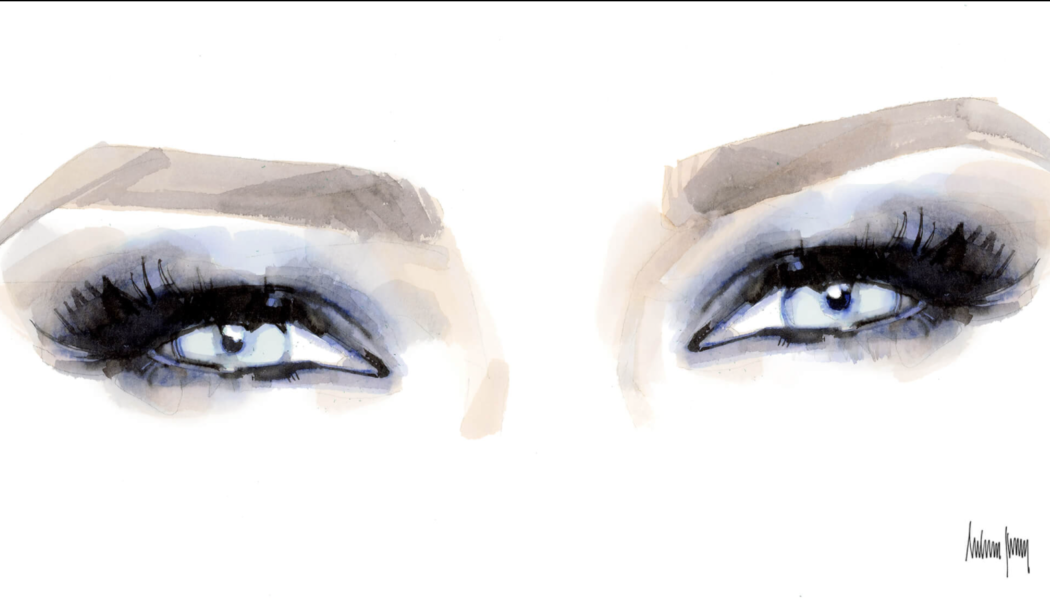

Nifty News: Melania Trump drops NFT, Arabian Camels produces NFT film and Whitney Houston keeps selling hits

Catch up on nonfungible token (NFT)-related news this week from restaurants to movies and music. Below is a roundup of stories you don’t want to miss. Melania Trump’s eyes become an NFT Former first lady Melania Trump launched her own NFT platform and dropped her first digital collectible titled “Melania’s Vision,” which will be on sale through the rest of the month. “Melania’s Vision” is a watercolor art piece by artist Marc-Antoine Coulon. The limited-edition digital artwork will be available for 1 SOL ($150) and includes an audio recording from Mrs. Trump. The Melania Trump NFT platform utilizes the Solana blockchain protocol and is powered by Parler, an alternative social media network. “Melania’s Vision” NFT...

Six senators urge Treasury Secretary to clarify definition of broker in infrastructure law before 2022

A bipartisan group of U.S. senators have called on Treasury Secretary Janet Yellen to clarify the language in the infrastructure bill signed into law by President Joe Biden around the tax reporting requirements on crypto. In a Tuesday letter, Senators Rob Portman, Mike Crapo, Pat Toomey, Mark Warner, Kyrsten Sinema, and Cynthia Lummis urged Yellen to “provide information or informal guidance” on the definition of “broker” in the recently passed infrastructure law, HR 3684. Under the current wording, people in the crypto space including miners, software developers, transaction validators and node operators are required to report most digital asset transactions worth more than $10,000 to the Internal Revenue Service, or IRS. However, according to the U.S. lawmakers, the law contains an ...

Witnesses offer differing opinions on approach to stablecoins at congressional hearing

The Senate Committee on Banking, Housing and Urban Affairs heard from several expert witnesses with knowledge of stablecoins who urged lawmakers to establish a clear regulatory framework but could not seem to agree on where lines would be drawn. In a Tuesday hearing on “Stablecoins: How do They Work, How Are They Used, and What Are Their Risks?” Hilary Allen, a professor at the American University Washington College of Law, Alexis Goldstein, director of financial policy at Open Markets, Jai Massari, partner at Davis Polk & Wardwell, and Dante Disparte, chief strategy officer and head of global policy at Circle, addressed U.S. senators regarding some of the risks stablecoins may pose to the U.S. financial system and how lawmakers could handle regulating the space. Goldstein’s written te...

‘DeFi is the most dangerous part of the crypto world,’ says Senator Elizabeth Warren

Massachusetts Senator Elizabeth Warren did not hold back in her criticism of decentralized finance (DeFi), expressing concern about how a run on stablecoins would affect the average investor. In a Tuesday hearing with the Senate Banking Committee discussing stablecoins, Warren questioned Hilary Allen, a professor at the American University Washington College of Law, as to whether a run on stablecoins could potentially endanger the United States financial system. Though Allen said an “en masse” redemption of stablecoins from people who had lost faith in the tokens would be unlikely to have “systemic consequences” for traditional markets at present, the DeFi system would be more likely to feel the effects. Warren countered that because stablecoins provided “the lifeblood of the DeFi eco...