XRP

XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

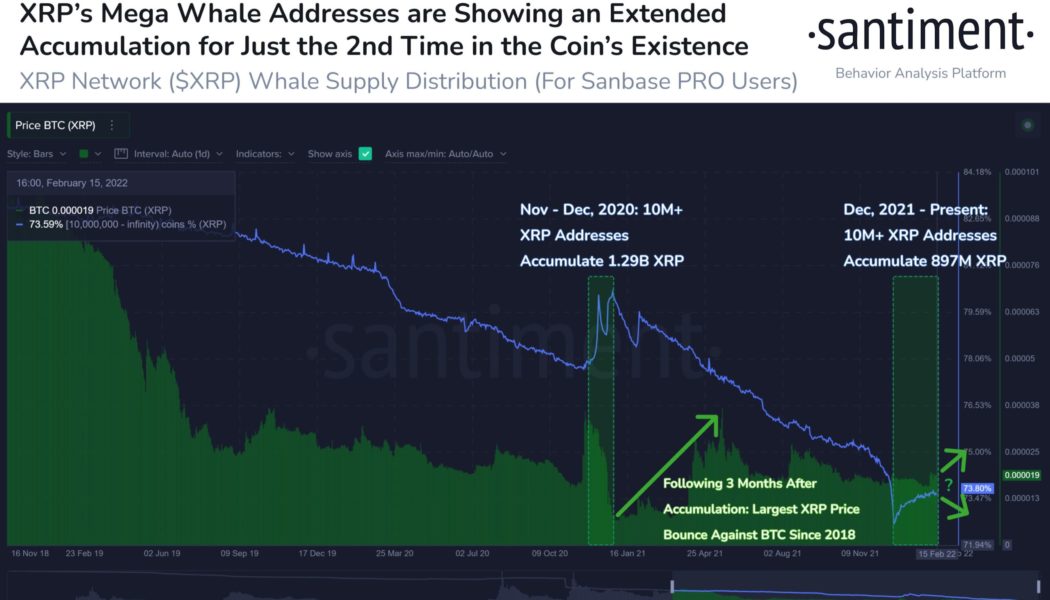

XRP addresses that hold at least 10 million native units have returned to accumulating more in the past three months, a similar scenario that preceded a big rally for the XRP/USD and XRP/BTC pairs in late 2020. The return of XRP ‘mega whales’ A 76% spike in XRP “mega whale” addresses since December 2021 has been noted by analytics firm Santiment showing that they added a total of 897 million tokens, worth over $712 million today, to their reserves. The platform further highlighted that the XRP accumulation witnessed in the last three months was the second-largest in the coin’s existence. The first massive accumulation took place in November-December 2020 that saw whales depositing a total of 1.29 billion XRP to their addresses. XRP supply into ...

Crypto analyst predicts gains for XRP, SHIB and BTC – Here’s his argument

Crypto analyst and Coin Bureau host is seeing a bull flag that could inspire a Bitcoin rally to $46k He also expects XRP to grow further with the news of Ripple joining the Digital Euro Association Metaverse news should eventually awaken SHIB to pump by up to 50% soon Pseudonymous Coin Bureau host, Guy, has observed that Bitcoin, XRP and Shiba Inu could be ready for a pump in the coming days. During a Monday YouTube session, Guy stated that the three had mounted a solid case to show that they are ripe for an uptrend. Bitcoin price can touch $56k soon The popular crypto markets analyst told his following that he is seeing the formation of a small bull flag for the world’s king of digital assets, which may or may not materialise. As the bull flag indicates an expectation for the upward...

Can XRP price reach $1 after 25% gains in one week? Watch this key support level

XRP price has continued to bounce back after falling by more than 70% in a correction between April 2021 and January 2022. Why the XRP/USD 50-week EMA is key On Feb. 13, XRP/USD reached as high as $0.916, above its 50-week exponential moving average (50-week EMA; the red wave) around $0.833. The upside move, albeit not decisive, opened possibilities for further bullish momentum, mainly owing to a historical buying sentiment around the said wave. XRP/USD weekly price chart featuring 50-week EMA. Source: TradingView For instance, traders had successfully reclaimed the 50-week EMA as support in the week ending July 27, 2020, more than a year after flipping the wave as resistance. Later, XRP’s price rallied by more than 820% to $1.98 in April 2021, its best level in more than three years...

Shiba Inu leading Dogecoin in gains, SHIB up over 23% on the day

The crypto market is once again showing signs of a fresh run on Monday morning Almost all coins are trading in the green with decent gains in the past 24 hours Bitcoin and Ethereum trading on solid grounds Bitcoin is currently swinging at around $42,700 and based on market sentiment; it could make an attempt at $43,000 early this week. Ether cleared resistance at $3,000 at the start of the weekend on the back of an end-week rally. The native token on Ethereum is currently trading at $3,076.05, having gained 2.45% in the last 24 hours. Shiba Inu leads the meme-coin chart with over 23% gains Notably, Shiba Inu has posted the biggest swell among the top 20 crypto assets by market capital. SHIB has gained a whopping 23% in the last 24 hours and is trading at $0.00002792. The meme coin tanked t...

Santiment analysis indicates XRP and Uniswap are entering an opportunity zone

On-chain data shows several altcoins could be set for an upturn as they approach historical opportunity zones Uniswap has recently hit an all-time negative low in MVRV, and XRP is on an eight-month low in this metric Blockchain analytics firm Santiment today reviewed the top altcoins that investors should look to after the sour January they have experienced with the markets. Over the course of the month, the markets have neither spared short-term nor mid-term investors, with the majority seeing trading losses at differing degrees. Advising traders to jump on the opportunity to buy low while others sulk, Santiment reviewed MVRVs of crypto assets and came up with a list of 150 assets that are prime for investment. The analytics firm justified the selection, noting that the tokens show “...

Here’s why Solana has lost more than other top ten crypto coins over the same period

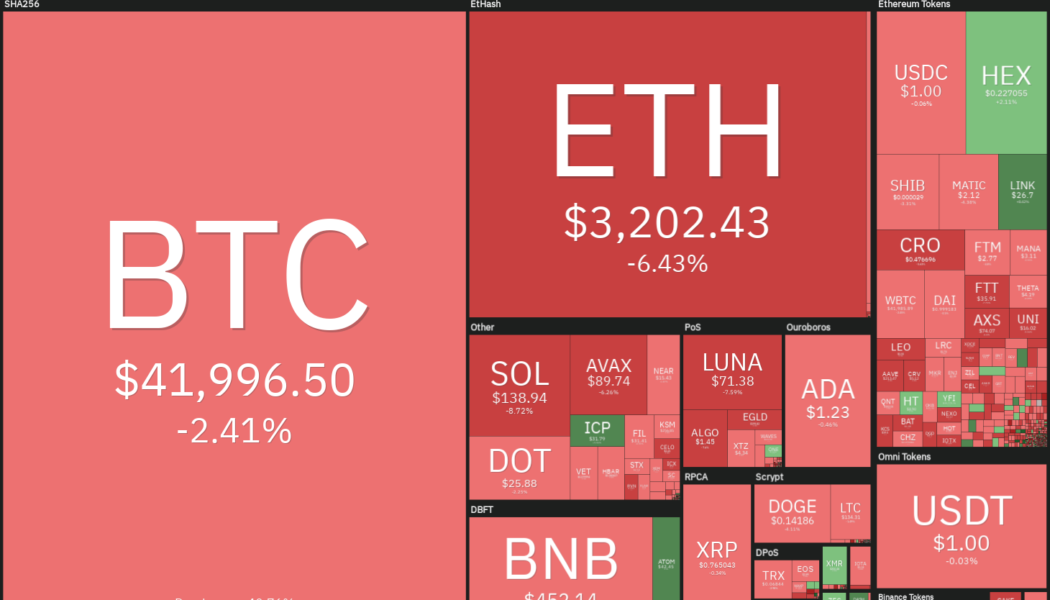

Solana has fallen to eighth place in market circulating value after being dethroned by Ripple’s XRP The cryptocurrency market is reeling from the extended decline that started at the end of last week. The majority of crypto tokens and coins have taken a huge beating, shedding as much as 40% of their value since Friday. The king cryptocurrency has almost 3% over the past 24 hours and is labouring to stay above $34,000. Ether (ETH) and Cardano (ADA) have all posted bigger losses – both down over 6.50% on the day. Solana price has seen the biggest slump, and this is why The altcoin market has similarly recorded huge losses following the latest selling wave. Notably, Solana has one of the biggest red candles in daily and weekly time frames – down 11.08% in the last 24 hours and almost 40...

Price analysis 1/7: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and the U.S. equity markets fell sharply on Jan. 5, reacting negatively to the minutes from the Federal Reserve’s December FOMC meeting, which showed that the members expect the balance sheet reduction to start after the Fed begins hiking interest rates in early 2022. Adding to the negative sentiment was the shutdown of the world’s second-biggest Bitcoin mining hub in Kazakhstan, where the internet has been shut down following massive protests by citizens. This caused a dip of about 13.4% in the Bitcoin network’s overall hash rate from 205,000 petahash per second (PH/s) to 177,330 PH/s. Daily cryptocurrency market performance. Source: Coin360 According to Galaxy Digital Holdings CEO Mike Novogratz, the current decline was with low volumes and he believes that the market...

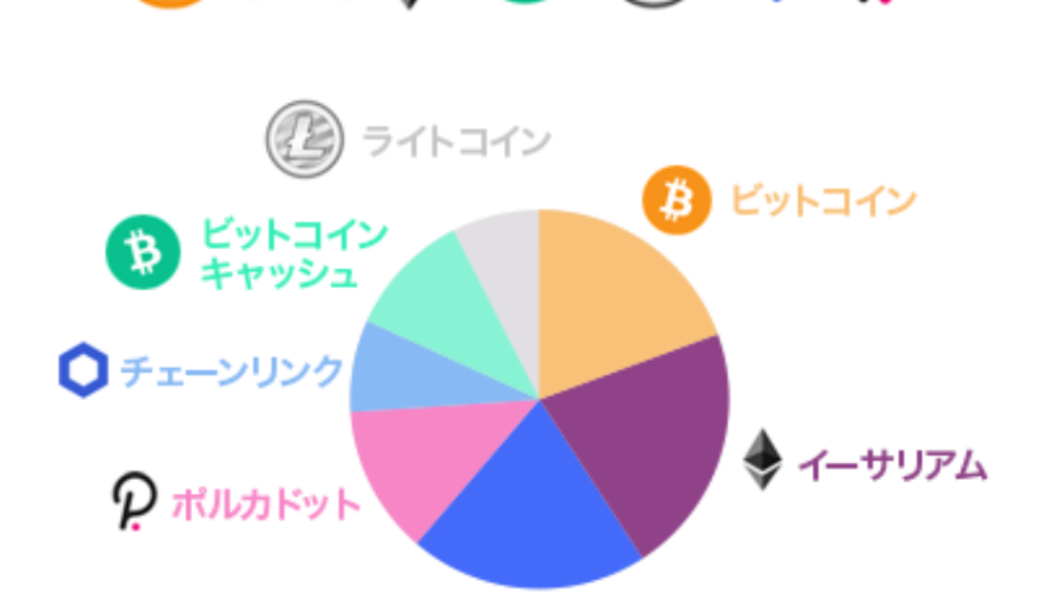

SBI Group launches crypto-asset fund for Japanese investors

Tokyo’s biggest finserv firm, SBI Group, will now allow general Japanese investors to purchase cryptocurrencies via its newly launched ‘crypto asset fund’. The fund is composed of seven cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), XRP, Bitcoin Cash (BCH), Chainlink (LINK) and Polkadot (DOT). The crypto-asset fund, to be traded and operated by the SBI Alternative Fund, was established on Dec. 02 with a dedicated capital of 5 million yen, worth approximately $45,000 at the time of writing. However, the company may choose to release the capital in smaller break-ups of 1 million yen each. Source: SBI According to the official statement, investors will be required to go through an application process that includes an anonymous partnership agreement with SBI Al...