Yuga Labs

WSJ says ‘the NFT market is collapsing’ but the data says otherwise

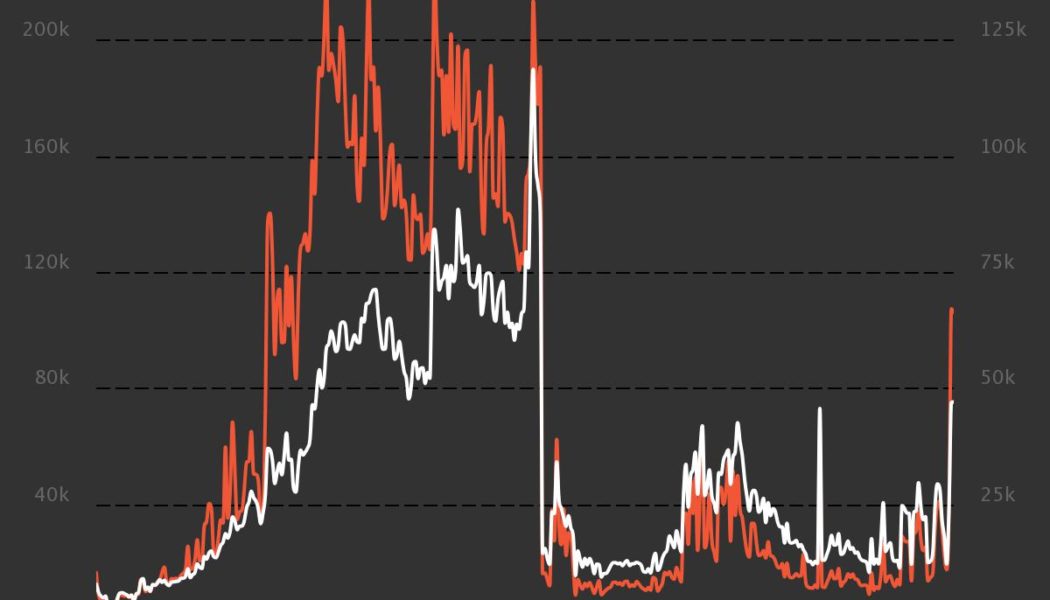

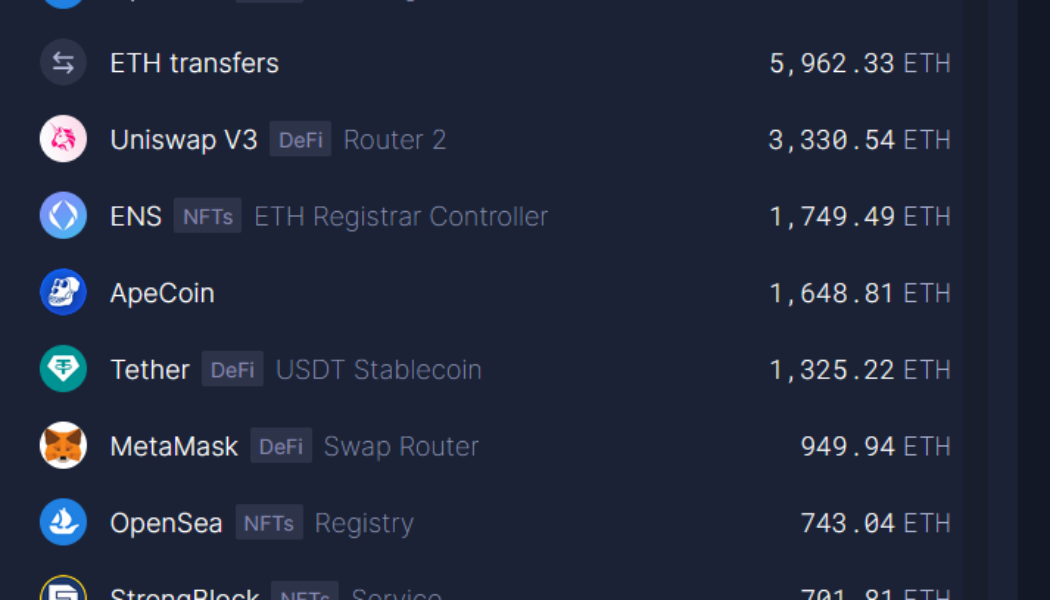

An article in the Wall Street Journal has claimed sales of non-fungible tokens (NFTs) are “flatlining” — in the same week that the top five collections alone accounted for more than $1 billion in primary and secondary sales. The article cited data from NFT market analysis platform Nonfungible suggesting the number of NFT sales has fallen by 92% since an all-time high in September 2021. Wallets active in the Ethereum (ETH) NFT market were also said to have declined by 88% since a high in November 2021. “The NFT market is collapsing,” the article concluded. Red line shows number of sales with volume on left y-axis, white shows active market wallets, volume on right y-axis. Source: Nonfungible However, onchain data from Dune Analytics’ dashboard suggest that the NFT market is still robust, wi...

Reports Bored Ape creator in talks with A16z: Potential valuation $5B

Silicon Valley tech VC Andreessen Horowitz (A16z) is reportedly eying an investment in Bored Ape Yacht Club creator Yuga Labs, with a reported valuation as high as $5 billion. Sources for the Financial Times revealed that Yuga Labs is seeking funding for a multi-million dollar piece of the company. If a deal is secured, it would mark the first institutional investment Yuga Labs has accepted as its popular nonfungible token (NFT) collection has become one of the biggest in the industry. The terms of the deal have not yet been set and negotiations may be canceled outright. Neither A16z nor Yuga Labs have confirmed the talks p Bored Ape Yacht Club (BAYC) is currently the second-most traded collection on the largest NFT marketplace OpenSea, with 380,821 ETH ($1 billion) in total traded volume....

- 1

- 2