The global concert industry has historically been a very healthy business. Prior to the onset of the COVID-19 pandemic in March 2020, every major indicator showed that touring was on pace to set a record in terms of economic activity.

For instance, a 2019 report titled The Global Entertainment & Media Outlook 2019–2023—commissioned by PricewaterhouseCoopers (PwC)—noted that live music ticket sales would increase at a compound annual growth rate of 3.33% from 2018 to 2023, from $21.256 billion in 2018 to $25.036 billion in 2023. These estimated figures became even more realistic after the 2019 touring year closed out with historic ticket movement and gross earnings across a variety of arena tours.

According to Billboard’s 2019 Boxscore charts, the best performing tour of 2019 was Ed Sheeran’s ÷ Tour, which grossed a staggering $223.7 million and sold 2,587,445 tickets. Coming closely behind Sheeran’s tour was P!nk’s acclaimed Beautiful Trauma World Tour, which moved a little over 2 million tickets to tune of grossing $216.9 million. Overall, the touring industry between 2018 and 2019 saw some of its highest grossing tours ever, including Sheeran’s, which became the highest grossing tour of all-time. The venture beat out massive tours from U2, Guns N’ Roses, the Rolling Stones, Coldplay, Roger Waters, AC/DC, Madonna and P!nk, according to data collected from Pollstar.

Complimenting the booming touring business in 2019 was the health of the US economy. Despite some underlying signals that pointed to a recession in the near term, indicators showed that the economy was continuing in a positive upward trajectory. Data from the US labor department noted that the unemployment rate remained at a 50-year historical low of 3.5% with highs in US labor participation during 2019.

Moreover, consumer spending—which generally accounts for about 70% of US GDP—remained strong month over month across 2019 and into early 2020. These factors were certainly beneficial to the touring industry to help set it up for a massive run in 2020, where consumers had the disposable income to spend record-setting amounts on live entertainment.

Millions of Dollars Lost, Forcing Consolidation and a New Venue Landscape

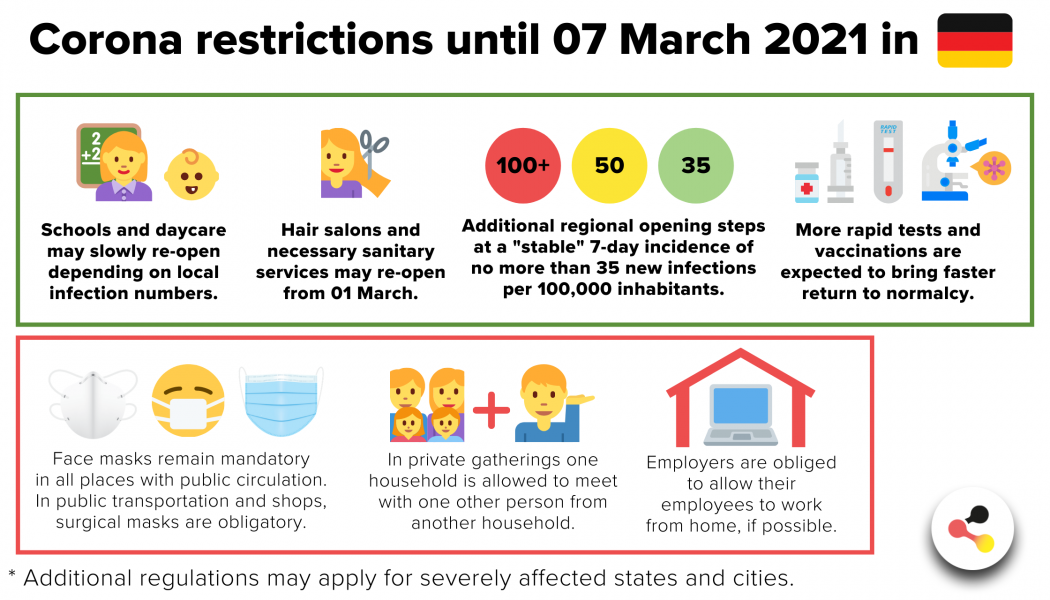

Then, as we all know, COVID-19 arrived and stomped on the sandcastles of the industry. Within two weeks, the concert industry began shutting down across the board. In early March, SXSW was canceled, which, according to some estimates, resulted in a $27 million loss for the event’s producers. It also negatively impacted the Austin, TX economy, losing nearly $350 million for small businesses. Following in SXSW’s footsteps were the postponement and eventual cancellations of Coachella Valley Music and Arts Festival and Stagecoach, two of the biggest and most well-known music festivals in North America.

On top of the struggles of major festivals, companies like Live Nation saw a dramatic drop in their revenues and underwent unprecedented layoffs. Since March, SEC filings from Live Nation saw revenue earnings drop 95% from those in Q3 of 2020, seeing only $180 million in revenue compared to the $3.77 billion the company saw the year prior. Live Nation’s liquidity issues even forced CEO Michael Rapino to cut costs by $800 million and raise over $1.2 billion via a secured note sale. This was even after Saudi Arabia’s sovereign wealth fund bought a 5.7% stake in the organization, injecting another $518 million.

The liquidity issues didn’t just impact the top companies. There was a long-range, protracted ripple effect that put massive financial pressure on independent venues. The pressure was so strong that a survey conducted by the 2,000-plus members of the National Independent Venue Association (NIVA) found that 90% of independent venue owners, promoters, and bookers would go out of business by the end of the year without some sort of infusion of targeted government funding.

Although a few government officials have proposed a new Save Our Stages Act, which would create a $10 billion grant program to provide at least six months of financial support to keep venues afloat, the help doesn’t seem to be coming fast enough. Unlike Live Nation or its private company competitor AEG, who can leverage their size to offset cash flow issues with raising capital from investors, independent venues do not have that option. There have been 97 venue closures to date, according to Billboard’s Venue Closure list.

It is no wonder that with no financial leverage, investors have predicted a massive consolidation of independent venues to be absorbed by companies like Live Nation or even mid-size venue companies like Bowery Presents. There has even been heavy action in the venture capital scene to acquire venues, most notably by former William Morris Endeavor executive Marc Geiger, whose new company SaveLive has raised over $75 million to invest in struggling venues. Detailed by Geiger as a safety net opportunity, the investment would give SaveLive 51% ownership of the venue.

Although many of these independent venues will have a $15 billion venue relief fund to tap into due to the execution of the Save Our Stages act, it is quite possible that if the economic shutdowns continue, venture capital money or acquisitions may be many of these venues’ last hopes, dramatically shifting the very landscape of the concert industry via massive consolidation and ending the independent venue as we know it.

A Vaccine Gives Hope, But the US Economy Must Make a Large-Scale Rebound for Concerts to Make a Comeback

There is no doubt that the US economy suffered immeasurable damage due to the impact of COVID-19. It has forced businesses to layoff over 20.6 million people and furlough an estimated 35 million Americans, resulting in a peak unemployment rate of 14.7%—a gauge not seen since the Great Depression in the 1930s. Even though unemployment has leveled out to 6.7% according to December’s jobs report, it is clear that there has been menial job gain month over month since July, a notion that points to a slow economic recovery.

It should come as no surprise why a September Pew Research study noted that overall, one-in-four adults have had trouble paying their bills since the onset of the pandemic, a third have dipped into savings or retirement accounts to make ends meet, and about one-in-six have borrowed money from friends or family or received food from a food bank. If disposable income remains tight due to a slow economic recovery and stagnant job market, it will be hard for the concert business to close the gap of what the industry lost and rebound revenues to anywhere near where they were during fiscal year 2018-2019.

The good news is that two viable vaccines from both Moderna and Pfizer/BioNTech may finally illuminate a light at the end of the tunnel. Both vaccines—which showed a 90% prevention rate—pushed entertainment stocks up across the board, including Live Nation’s, whose shares jumped 22% on the back of the news. The issue, however, is no longer around when the vaccine will be developed, but how long will it take to mass-produce it at scale across the US. Although no one has an exact answer to that question, Deloitte economist Daniel Bachman noted in a recent op-ed that “widespread distribution of these vaccines is unlikely until (at the earliest) summer or fall 2021.”

During that time, the economy will continue to experience major barriers to grow jobs, thus making it more difficult for consumers to justify spending money on entertainment. Even McKinsey’s “US Consumer Confidence” survey supported this claim, sharing data which noted that 40% of Americans believe their finances will not return to normal until the latter half of 2021 or early 2022, with over 50% of Americans decreasing their spending on discretionary categories (including live entertainment) into 2021. The key for the concert industry to see a sizeable financial rebound will rely heavily on the timeline of the economic rebound and for the general consumer to feel confident in their personal finances to justify spending on discretionary categories again.

Although there are various arguments to be made for what shape a recovery model may take, a survey conducted by the World Economic Forum, which asked over 600 of the world’s leading CEOs, found that nearly half are predicting a moderate to slow U-shaped recovery. However, the big question on many across the touring industry’s mind is, “When will the “U” begin to take shape?” Whenever that curve starts to trend upward will arguably be the most important catalyst for the concert business to begin its recovery. Simply put, without disposable income and confidence in the economy, spending on concerts will be few and far between and revenues will likely not be anything near the values seen pre-COVID-19.

Insurance, Insurance, Insurance: COVID-19 Liability for Concert Venues and Promoters Remains the Industry’s Biggest Risk

Although the economy’s short-term future is uncertain, from a macro perspective, it will bounce back longterm and consumers will once again spend in flurries. An estimate by Deloitte’s economic team predicts that this will happen by Q1 of 2022, where consumers are likely to start spending in record numbers on travel, food services, and entertainment.

Although longterm there is high confidence that the economy will bounce back, the stakes will be very high once mass gatherings commence again for the touring business. In particular, the biggest risk that the touring business will have to manage is the responsibility for patrons’ safety and who will be deemed liable for the spread of COVID-19 should concert-goers contract the virus. This is why companies like Ticketmaster, the largest ticket provider in the world owned by Live Nation, have been working on a framework for post-pandemic fan safety that uses smartphones to verify fans’ vaccination status or whether they’ve tested negative for the COVID-19 within a 24 to 72-hour window.

With all these risk factors taking center stage, there has been a huge uptick in the amount of insurance claims promoters, event producers, and live gathering spaces have looked to secure since April. The insurance market has been so active that estimates show there have been more than $1 billion worth in insurance claims from the concert industry to cover losses for contracts that held business interruption insurance against “acts of god” that interrupt business operations.

In addition to a high level of claims, there has been a recognition across the concert industry that every insurance-based contract needs riders to include coverage from infectious deceases and bacteria disruptions. The issue is that a majority of independent concert promoters and venues did not hold business interruption insurance in the first place and the companies that held it likely did not pay upfront for additional coverage to protect against viruses. The risk assessors—especially at big companies like Live Nation—will likely have to revisit all their insurance policies and pay up to get that line of coverage. This transition of increasing insurance to cover future liabilities, lawsuits, and losses is already happening at scale, as AMA Research & Media LLP noted in a recent study that more than $250 million have already been invested in upscaled insurance contracts to protect against virus and bacteria interruptions by entertainment, hospitality, and travel companies this year.

Innovation Out of Necessity: A Digital and Physical Hybrid Concert Model Pandemic Proofs the Future and Reinvents the Economics of Touring

The concert industry’s fight against COVID-19 isn’t all doom and gloom. There have certainly been some very positives areas of forced innovation that will become a bigger piece to how concerts are constructed, promoted, and monetized.

The biggest trend has been the growth of virtual and digital concerts. Since March, the level of viewership of livestreamed video has seen record-breaking engagement. For instance, Amazon-owned Twitch topped three billion hours watched over the first quarter of 2020 (January to March). Since March, Twitch has outperformed every estimate around its growth, growing its overall platform userbase to over 3.8 million unique broadcasters daily. This growth isn’t just unique to Twitch, but was seen across every major livestreaming platform from Instagram, Facebook, YouTube, and even Twitter.

Tapping into this new trend around quarantine culture, artists started building streaming experiences that could be viewed at home with scale. Since March, there are a few concerts and activations that really stood above the rest. First was Swizz Beatz and Timbaland’s Verzuz series on Instagram, which broke more livestreaming records on the platform than any other series this year. As an example, the battle, which featured Brandy and Monica, garnered over 4 million total viewers, 5 billion impressions, and 1,234,435 concurrent viewers.

Second was Travis Scott’s virtual concert in the gaming platform Fortnite, which further reinforced the importance and scale gaming has in the world of entertainment and broader culture at large. The concert drew in 12.3 million player participants and was viewed by over 27.7 million people, according to data released by Scott’s label, Epic Records.

Lastly, Dua Lipa’s Thanksgiving-weekend “Studio 2054” stream seemed to take lessons from all the incredible livestream concepts throughout quarantine and built an experience that could very well be a harbinger for what virtual concerts look and feel like in the future. The concert brought a star-studded guest list that included Kylie Minogue and Elton John, ultimately drawing in a whopping 5 million paid viewers.

So, what do these record-breaking numbers across various styles of livestreams mean for the live concert business? It’s clear that livestreaming is here to stay—even post COVID-19—and that the model of physical only concerts will likely be a thing of the past. The benefits to streaming are all too clear. For smaller cap venues, livestreaming can take a 500-cap room and allow it to touch every corner of the globe, increasing its earnings potential to unimaginable heights. For massive festivals and arena concerts, it means an additional revenue stream to monetize shows to reach consumers in secondary or third tier markets.

Outside the benefits financially, virtual touring also offers a way for artists to tour and build hard ticket values without the need to hit the road. This is an important development post-COVID-19, as many artists who go on the road for their first few tours tend to lose money. This model could be significant, especially for artists without labels, who can provide some level of financial assistance to support going on the road.

The Process for Normalizing Streaming Metadata Is the Key to Unlocking the Power of Livestream and Hybrid Concerts

Although the future for livestreamed concerts is bright, there is one major hurdle the industry must combat, which is the normalization of livestream metadata. Currently, the method for finding, discovering, and watching streams differs from platform to platform. This process is so fragmented that PwC’ 2020 report, A New Video World Order, noted that only 12% of streaming video viewers found it easy to discover the kind of content that interested them on streaming platforms since March 2020.

Why isn’t there normalization? Well, the way in which livestream metadata is coded from a platform like YouTube to Instagram Live is significantly different, which makes it difficult for search engines like Google or concert aggregators like Bandsintown to correctly source and scrape for all the information. Secondly, outside of the trouble it gives fans in terms of discovery, the convoluted nature of metadata is not allowing bigger and more lucrative monetization to happen within these streams, particularly as it pertains to advertising.

For context, video streaming services like Hulu saw massive ad spend growth throughout the height of the pandemic in 2020, so much so that spending between January 1st and June 30th exploded past $1 billion, up 205% from the same period in 2019. Yet, due to livestreaming’s metadata issues, concerts were not able to partake in that pie and earn a piece of the ad revenue even when many livestreaming shows, such as Verzuz or DJ D-Nice‘s viral “Club Quarantine,” were attracting millions of viewers across the US.

For livestreams to succeed at scale, there must be a level of normalization of metadata much like that which exists in music streaming or cable television and online video streaming services. Once the metadata standards can be normalized, ad revenue can certainly become a much bigger piece of the global concert business pie, especially when these online shows move from digital only to a more hybrid physical model in the near future.

The Demand for Concerts Is Still High, and Will Continue to Remain High Despite COVID-19 Risks

Although the concert business has seen a seismic shift in the way that concerts will operate, tours routed, and fans and concerts built for the future, there is no doubt that live shows will be back. People love music and attending live shows. That has always been true, especially now that the option to attend live concerts has been at best watching something on a small screen. Recent data from MRC even found that 59% of US concert-goers are willing to attend a live event again within two months after the pandemic ends or a vaccine or treatment becomes available. Wall Street seems to agree with this optimistic viewpoint, as December 17th marked the first time Live Nation’s stock share price surpassed its pre-pandemic levels, sitting at $73.93 a share. This is incredible, considering the free fall the global touring industry has had to deal with since early March.

Overall, 2020 will be a year to remember, when the global touring industry faced its toughest challenges but came out the other side with new innovative business models. Those models will tap into a digital ecosystem that will transform the concert business for the better. Touring, concerts and music is here to stay, and the industry’s reliance is a testament to the importance music holds within our greater society.