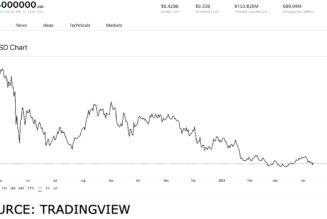

Bitcoin (BTC) starts the second week of April with a whimper as bulls struggle to retain support above $40,000.

After a refreshingly low-volatility weekend, the latest weekly close saw market nerves return, and in classic style, BTC/USD fell in the final hours of April 10.

There is a feeling of being caught between two stools for the average hodler currently — macro forces promise major trend shifts but are being slow to play out. At the same time, “serious” buyer demand is also absent from crypto assets more broadly.

However, those on the inside show no hint of doubt about the future, as evidenced by all-time high Bitcoin network fundamentals and more.

The combination of these opposing factors is price action that simply does not seem to know where to go next. Can something change in the coming week?

Cointelegraph takes a look at five potential Bitcoin price cues as a retest of $40,000 looms closer.

No “massive drawdown” for BTC?

April 11 is starting out with a reclaim of $42,000 for BTC/USD, which the pair briefly lost overnight as it dipped into the weekly close.

Hitting $41,771 on Bitstamp in the process, Bitcoin thus saw its lowest levels in weeks, matching those from March 23.

In doing so, the largest cryptocurrency, likewise, gave up all of its gains from the intervening period to fall back to the top of its trading range from last month. However, this could end up being a retest of previous resistance as support. Instead of fearing the worst, many traders are hopeful that a reversal would soon kick in.

“Bullish retest of flipped weekly level, finex whale filling bids, I’m buying the dip. If you want to wait for confirmation you can wait for a monthly close to confirm,” popular Twitter user Credible Crypto wrote as part of comments overnight.

Credible Crypto was commenting on both Bitfinex whale buying and fresh chart data, showing that Bitcoin’s Aroon indicator has flipped bullish in recent days.

Designed to identify uptrends or downtrends in an asset, Aroon has only delivered such bearish-to-bullish “crosses” six times since 2017 — the time of Bitcoin’s previous blow-off top.

Pretty good odds of you ask me. Aroon is designed to act like both a smooth indicator and exponential one due to its behavior toward time instead of price.

I’m not expecting a massive drawdown.

— Otsu (@OtsukimiCrypto) April 11, 2022

As Cointelegraph recently reported, trader and analyst Rekt Capital also had plenty of reasons to adopt a bullish thesis for Bitcoin. But, at around $42,150, the weekly close ultimately disappointed compared to his required $43,100.

“A BTC Weekly Candle Close like this and the retest of ~$43.100 as new support would be successful,” he explained alongside a chart on April 10.

“Therefore, BTC would be positioned for a move higher inside the ~$43100-$52000 range, as per the previous blue circle.”

Cointelegraph contributor Michaël van de Poppe, meanwhile, also noted that the late dip on April 10 had closed the potential for a CME Group futures gap to provide a short-term price target at the start of trading on April 11.

Stocks pressured across the board

It’s a gloomy day for stocks so far, as Asia leads with widespread losses, thanks in no small part to China’s latest COVID-19 lockdowns.

Both the Shanghai Composite Index and Hong Kong’s Hang Seng fell over 2% in morning trading.

In Europe, markets were yet to open at the time of writing, but the ongoing geopolitical tensions focused on Russia showed no signs of change.

A glimmer of hope for the euro came in the form of a potential lead for incumbent French President Emmanuel Macron against rival Marine Le Pen in polls.

Beyond the short term, however, analysts are eyeing concerning trends: rapidly increasing inflation, bond market losses and a seeming inability for central banks to respond so far.

The European Central Bank (ECB) is due to meet this week with a key focus on inflation control — ending asset purchases and raising interest rates.

The biggest bond bubble in 800yrs continues to deflate after the start of the Fed’s rate-hike cycle, ahead of next week’s #ECB meeting & as rising #inflation shakes up bond mkts. Value of global bonds has dropped by another $960bn this week, bringing total loss from ATH to $6tn. pic.twitter.com/g78Pu2dyLo

— Holger Zschaepitz (@Schuldensuehner) April 10, 2022

The situation underscores the difficulties stocks and risk assets face in the current climate. As commentators agree that the inflationary environment and associated central bank measures will reduce demand for Bitcoin and crypto, the true extent of the economic reality is already clear.

In a previous Twitter post last week, Holger Zschaepitz revealed that for all the gains in the S&P 500, for example, the Fed’s asset purchases mean that progress has, in fact, been flat since the global financial crisis.

“Just to put things into perspective: The S&P 500 may have hit a new ATH today, but if you put the index in relation to the Fed’s balance sheet, it is trading at the same level as in 2008, so equities have traded sideways since 2008, basically counteracting balance sheet expansion,” he wrote.

Down together?

For Arthur Hayes, ex-CEO of derivatives giant BitMEX, the bullish case for Bitcoin as a store of value in the face of failing fiat is still there.

The problem is that such a scenario is not reality — yet.

In his latest blog post released on April 11, Hayes repeated warnings that pain would precede gain for the average investor with significant risk asset exposure.

The future could well see a shift away from United States dollar hegemony toward different assets by nation-states and individuals alike, but in the meantime, macro forces will continue taking their toll on crypto.

If stocks are due to dive as central banks act, notionally to combat inflation, crypto’s increasing correlation to them means only one thing.

“The short-term (10-day) correlation is high, and the medium term (30-day and 90-day) correlations are moving up and to the right. This is not what we want,” Hayes argued about crypto correlations with the Nasdaq 100 (NDX).

“For me to hoist the flag in support of selling fiat and buying crypto in advance of an NDX meltdown (30% to 50% drawdown), correlations across all time frames need to trend demonstratively lower.”

Could equities really see half their value removed as a result of the Fed and its actions? It would be anyone’s guess, Hayes answered.

“Down 30%? […] Down 50%? […] your guess is as good as mine,” he added.

“But let’s be clear– the Fed isn’t planning to grow its balance sheet again any time soon, meaning equities ain’t going any higher.”

Sentiment diverges from traditional markets

With the macro gloom on the horizon, it is no surprise that market sentiment is taking a beating.

Having sensed “greed” across crypto at the end of March, the Crypto Fear & Greed Index is now firmly back in “fear” territory.

An analog of the traditional market Fear & Greed Index, the metric has shed half its normalized score in under two weeks as cold feet return to traders.

On April 11, Crypto Fear & Greed measured 32/100, while its traditional market counterpart was higher at 46/100, defined as “neutral.”

Deserved or not, Van de Poppe, meanwhile, reminded readers not to trade based on sentiment cues.

“Everyone was super bullish on the markets, but now the markets start to correct, and the fear takes over,” he summarized.

“The sentiment isn’t a great indicator of how you should trade usually.”

Fundamentals keep the faith

A glimmer of hope comes from a familiar source this week. For all the price drawdowns, Bitcoin’s network difficulty is only due to decrease by 0.4% in the next few days.

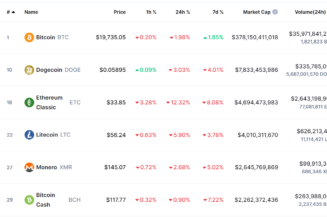

Related: Top 5 cryptocurrencies to watch this week: BTC, NEAR, FTT, ETC, XMR

Arguably the most important aspect of the Bitcoin network’s self-maintaining paradigm, the difficulty will adjust downward from all-time highs to reflect changes in mining composition.

The adjustment’s small size suggests that miners remain financially buoyant at current levels and are not struggling despite last week’s 10% BTC/USD dip.

Further data supports the argument, with hash rate estimates from monitoring resource MiningPoolStats likewise lingering at record highs.

As Cointelegraph recently reported, mining continues to attract major investment, including from Blockstream, which last week announced a solar-powered farm set to generate 30 petahashes per second in hash rate once operational.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, Bitcoin Mining, BTC price, crypto blog, Crypto news, Difficulty, Federal Reserve, macro, Markets, Stocks