Chainalysis findings show that there is currently more than $10 billion in illicit money (mostly stolen) held in crypto wallets

A new report from the blockchain data platform Chainalysis has revealed that crime involving cryptocurrencies last year hit an all-time high of $14 billion. This figure is almost twice the sum ($7.8 billion) recorded in 2020.

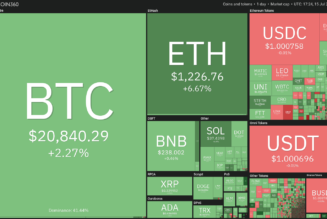

This upsurge in funds lost to fraudulent activity was, however, majorly attributed to the growth of the crypto markets. The markets saw transaction volumes rise by more than 550% to reach $15.8 trillion. The $14 billion sum lost represents just a mere figure of 0.15% of all the blockchain transactions seen in 2021.

“We had an explosion in the amount of on-chain activity (in 2021). It’s just that the amount of crime didn’t grow as fast as the amount of legitimate use cases,” Chainalysis head of research Kim Grauer said

DeFi targeted heavily

The report also found that the swollen figure related to the explosion seen in the decentralised finance niche last year. Grauer explained that DeFi was particularly targeted as most of its resources have been made available for open-source access. She also explained that being a burgeoning field, DeFi was widely exploited by cybercriminals as it qualified as a target for crime.

More specifically, the report detailed that by the close of the year, DeFi protocols were involved in about two-thirds, $2.2 billion of all the crypto lost to theft last year. This figure equates to a more than 500% increase from 2020.

“DeFi platform protocols are hacked very often because it’s a new industry and a lot of the code is open-source, so people can look at the code and see vulnerabilities,” Grauer stated.

Scams led the way, accounting for $7.8 billion worth of losses, and Chainalysis says that around $3 billion of this figure resulted from rug pulls. Rug pulls came about in a trend where developers create a seemingly (but not) legitimate crypto project, only to pull out and disappear with a load of cash, leaving the investors exposed.

The role of law enforcement

In the last year, law enforcement activity seen in handling crypto crime rose significantly. The IRS Criminal Investigation Unit is said to have seized $1 billion in crypto associated with the Silk Road darknet. Moreover, most of the Colonial Pipeline ransom was recovered.

However, Grauer elucidated that increased federal activity against crime does not mean crime figures more so in scamming will necessarily fall. Her reason is that several projects are coming up, and it’s impossible to vet the legitimacy of them all.

“People are treating (investing) like a roulette table, and so I think that means there will be a lot of opportunities for people to get scammed,” she noted.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: 2021, Chainalysis, Crime, crypto blog, Crypto news, DeFi