Binance Coin

Price analysis 8/26: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

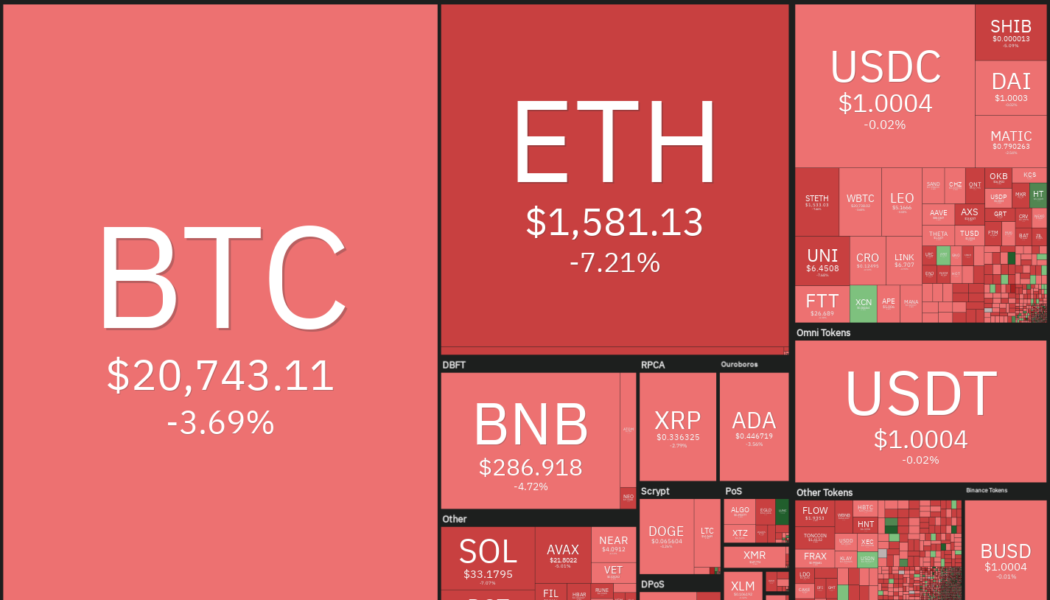

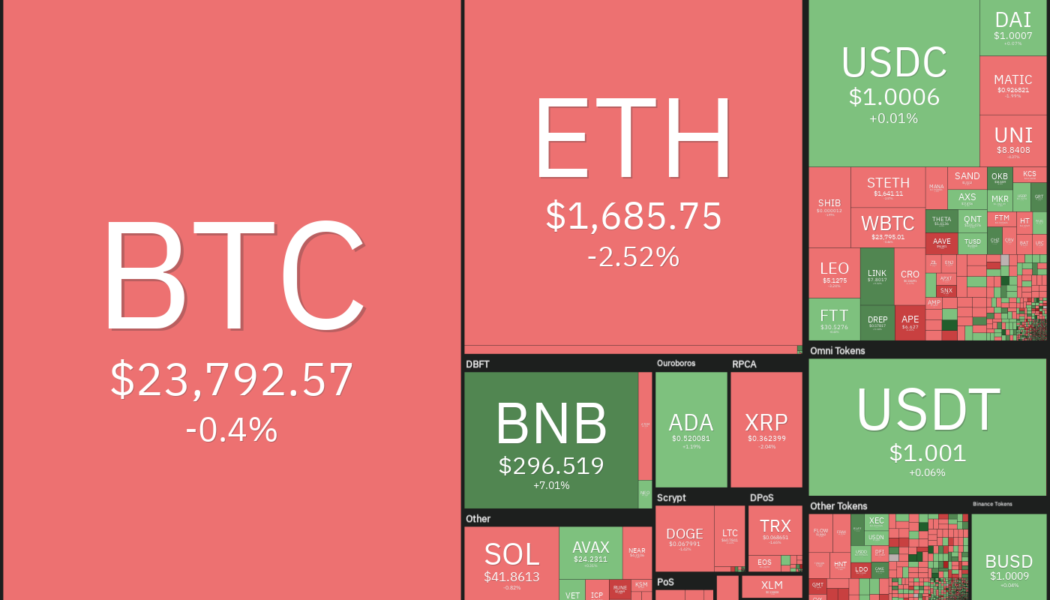

Federal Reserve Chairman Jerome Powell warned that the central bank will continue to use the “tools forcefully” to bring down inflation, which is close to its highest level in 40 years. He cautioned that the restrictive policy may remain for some time and warned that it could “bring some pain to households and businesses.” The United States equities markets reacted negatively to Powell’s comments with the Dow Jones Industrial Average dropping more than 600 points. The cryptocurrency markets also witnessed sharp selling with Bitcoin (BTC) and most altcoins threatening to break below their immediate support levels. Daily cryptocurrency market performance. Source: Coin360 Along with a not-so-supportive macro environment, Bitcoin’s historical data for September also presents a negative picture...

Price analysis 8/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, MATIC

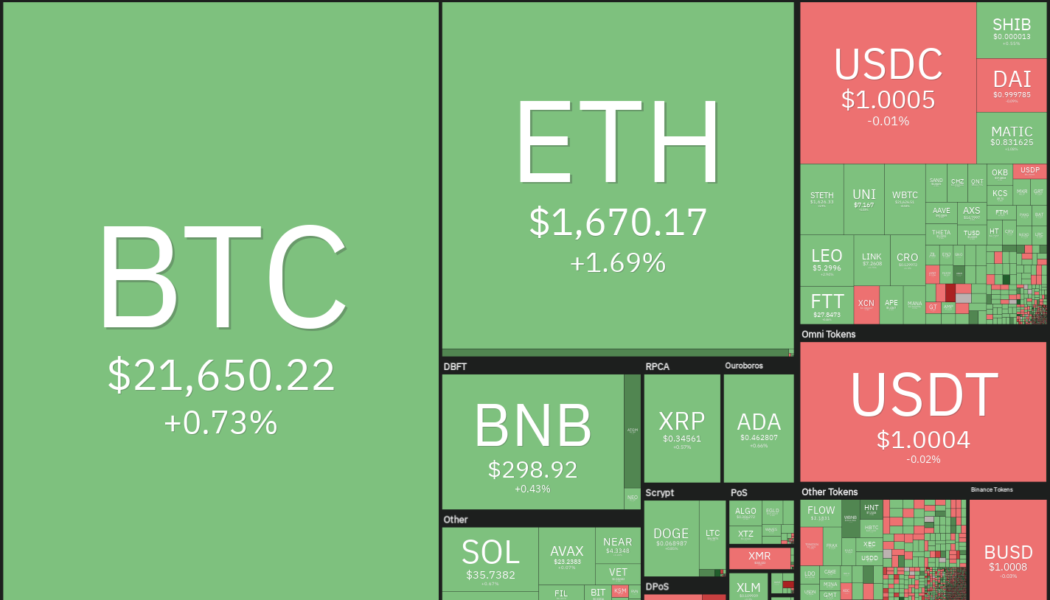

Bitcoin (BTC) and several major cryptocurrencies have been trading sideways as traders avoid taking large bets before the United States Federal Reserve’s Jackson Hole Economic Symposium, which begins on Aug. 25. The volatility is likely to soar as investors get some clarity on the Fed’s stance in the next few days. On Aug. 23, a team led by Goldman Sachs chief economist Jan Hatzius said that Fed chair Jerome Powell could sound dovish when he speaks on Aug. 26, reiterating that the central bank may move at a slower pace in future meetings. The analysts expect the Fed to raise rates by 50 basis points in the September meeting, which would be less than the 75 bps hike done in June and July. Daily cryptocurrency market performance. Source: Coin360 Although the short-term price...

Here’s 5 cryptocurrencies with bullish setups that are on the verge of a breakout

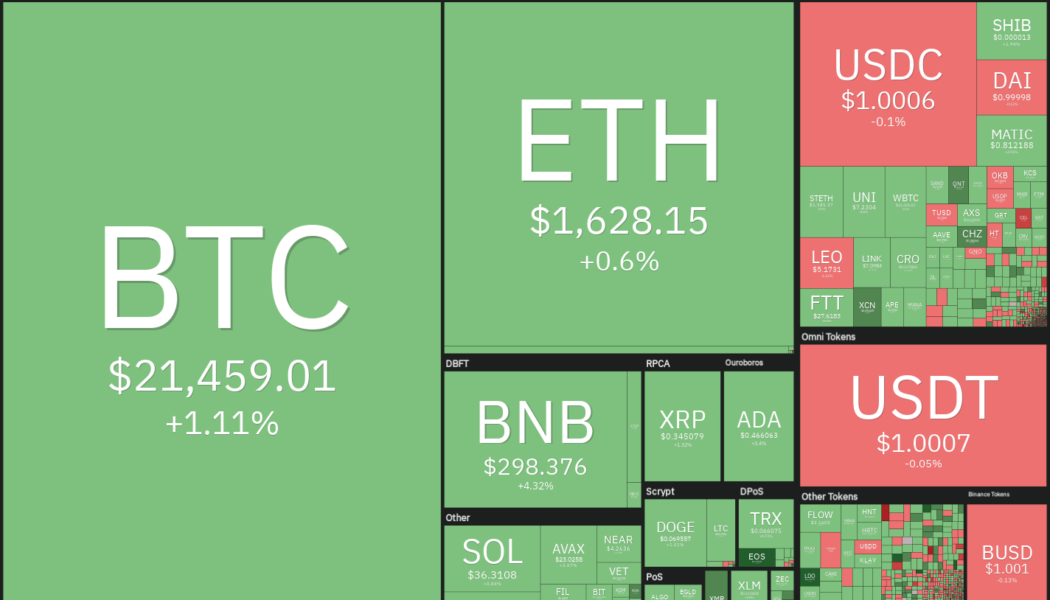

The S&P 500 ended its four-week-long recovery last week after minutes from the Federal Reserve’s July meeting hinted that the central bank’s rate hikes will continue until inflation is under control. Members of the Fed said there was no evidence that inflation pressures appear be easing. Another dampener was the statement by St. Louis Fed president James Bullard who said that he would support a 75 basis point rate hike in September’s Fed policy meeting. This reduced hopes that the era of aggressive rate hikes may be over. Crypto market data daily view. Source: Coin360 Weakening sentiment pulled the S&P 500 lower by 1.29% for the week. Continuing its close correlation with the S&P 500, Bitcoin (BTC) also witnessed a sharp decline on Aug. 19 and is likely to end the week with ste...

Price analysis 8/19: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) and most major altcoins witnessed a sharp sell-off on Aug. 19, but there does not seem to be a specific trigger for the sudden drop. The sharp fall resulted in liquidations of more than $551 million in the past 24 hours, according to data from Coinglass. Barring a V-shaped bottom, other formations generally take time to complete as buyers and sellers try to gain the upper hand. This tends to cause several random volatile moves that may be an opportunity for short-term traders, but long-term investors should avoid getting sucked into the noise. Daily cryptocurrency market performance. Source: Coin360 Glassnode data shows that investors who purchased Bitcoin in 2017 or earlier are just doing that by holding their positions. The percentage of Bitcoin supply dormant for at least ...

Price analysis 8/15: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) has been witnessing a tough battle between the bulls and the bears near the $25,000 level. A clear winner may not emerge in the short term due to a lack of a catalyst and because there is no major macroeconomic data scheduled for this week in the United States. Data points from Asia or Europe may increase volatility, but they are unlikely to start a new directional move. Anthony Scaramucci, founder and managing partner of Skybridge Capital, in an interview with CNBC, advised investors to ride out the current uncertainty in cryptocurrencies and “stay patient and stay long term.” He expects Bitcoin to reward investors immensely with a sharp uptrend over the next six years. Daily cryptocurrency market performance. Source: Coin360 Along with the focus on Bitcoin, investors are al...

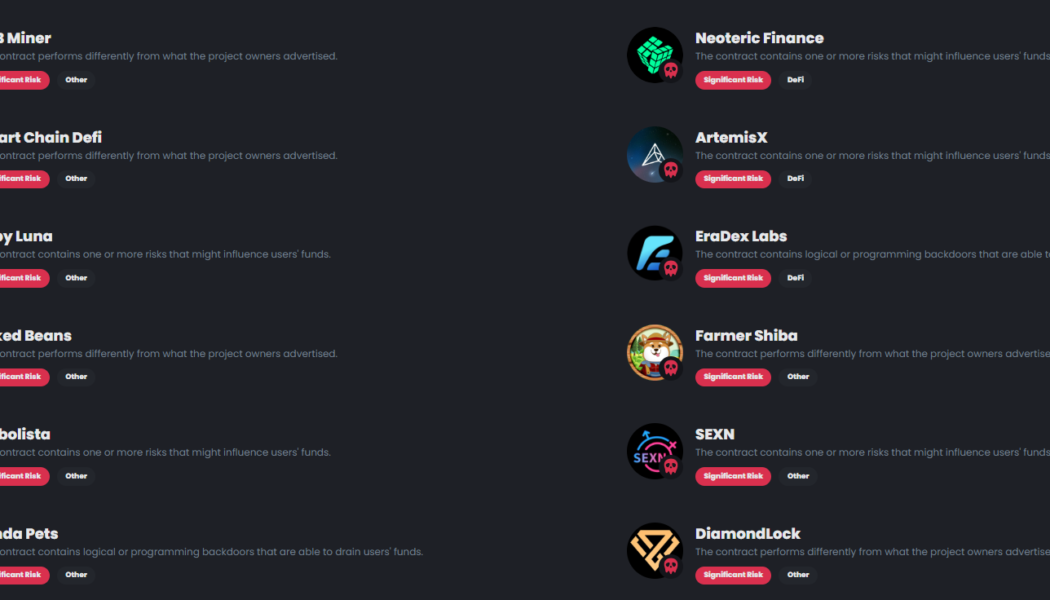

Pandas, cyborgs, dogs, koalas dominate BNB Chain Red Alarm flag list

BNB Chain, a blockchain network created by crypto exchange Binance, identified over 50 on-chain projects that pose a significant risk to the users. A mix of crypto spin-offs resembling Dogecoin (DOGE) and Binance and others dedicated to pandas, cyborgs and koalas made the list as untrustworthy and high-risk projects. BNB Chain’s Red Alarm feature, which was implemented to protect investors from potential rug pulls and scams, flagged projects based on two main criteria — if the contract performs differently from what the project owners advertised or if the contract shows risks that might influence users’ funds. Speaking to Cointelegraph, Gwendolyn Regina, Investment Director at BNB Chain, said that the Red Alarm system analyzed 3,300 contracts just in July, adding that the company con...

Price analysis 8/12: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) could not overcome the barrier at $25,000 on Aug. 11 even though it had two catalysts in the form of a “favorable” Consumer Price Index print and news that BlackRock — the world’s largest asset manager, overseeing over $10 trillion in total assets — had launched a spot Bitcoin investment product. In comparison, Ether (ETH) has managed to hold on to its recent gains on news that the Goerli testnet had successfully activated proof-of-stake, clearing the path for Ethereum’s mainnet transition planned for Sept. 15 or 16. Data from Santiment shows that Ether whale transactions have increased along with possible whale accumulation. Daily cryptocurrency market performance. Source: Coin360 However, analysts remain divided about the prospects of the current rec...

Price analysis 8/5: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

The United States Labor market added 528,000 jobs in July, much better than the 258,000 estimate. Wages saw growth of 5.2% year-over-year and 0.5% over the month. This suggests that inflation remains high and the U.S. Federal Reserve may continue with its rate hikes in the near future. After staying in close correlation with the U.S. equities markets for the past several months, the crypto space could be ready to chalk out a new course. Bloomberg Intelligence senior commodity strategist Mike McGlone and senior market structure analyst Jamie Coutts said in a recent report that Bitcoin (BTC) has started base building similar to the one seen near $5,000 in 2018–2019. They expect the recovery to decouple from stocks and behave more like U.S. “Treasury bonds or gold.” Daily cryptocu...

Top 5 cryptocurrencies to watch this week: BTC, BNB, UNI, FIL, THETA

Bitcoin (BTC) has made a strong comeback in the month of July and is on track for its best monthly gains since October 2021. The sharp recovery in Bitcoin and several altcoins pushed the Crypto Fear and Greed Index to 42/100 on July 30, its highest level since April 6. Investors seem to be making the most of the depressed levels in Bitcoin. Data from on-chain analytics firm Glassnode shows that Bitcoin in exchange wallets has dropped to 2.4 million Bitcoin in July, down from the March 2020 levels of 3.15 million Bitcoin. This has sent the metric to its lowest level since July 2018. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence senior commodity strategist Mike McGlone highlighted that the United States Federal Reserve’s indication to consider rate hikes on a “meeting...

Price analysis 7/29: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) hit a six-week high above $24,000 on July 29, extending its rally that picked up momentum after the United States Federal Reserve hiked rates by 75 basis points on July 27. If the rally sustains for the next two days, Bitcoin could be on target to close the month of July with gains of more than 20%, according to data from Coinglass. It is not only the crypto markets that have seen a post-Federal Open Market Committee (FOMC) rally. The U.S. equities markets are on track for big monthly gains in July. The S&P 500 and the Nasdaq Composite are up about 8.8% and 12% in July, on track to their best monthly gains since November 2020. Daily cryptocurrency market performance. Source: Coin360 The crypto and equities markets have risen in the expectation that the pace of rate hikes ...

Price analysis 7/25: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

Bitcoin (BTC) and most major altcoins are witnessing profit-booking on July 25 as the bulls scale back their positions before the Federal Open Market Committee meeting on July 26 through July 27. This indicates that the sentiment remains fragile and that bulls are not confident about carrying long positions into the event. Several analysts have retained their bearish view after Bitcoin failed to sustain above the 200-week moving average at $22,780. CryptoQuant contributor Venturefounder expects the selling to resume and Bitcoin to fall as low as $14,000 before a macro bottom is confirmed. Daily cryptocurrency market performance. Source: Coin360 The institutional investors seem to be absent from the markets and the recovery is being driven by the retail investors. Data from on-chain analyti...

Price analysis 7/22: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

In a downtrend, when markets do not respond negatively to bearish news, it is a sign that the selling may have reached exhaustion. Reports of electric vehicle maker Tesla dumping 75% of its Bitcoin (BTC) holdings in the second quarter only caused a minor blip as lower levels attracted strong buying from the bulls. Tesla was not the only institution that sold its Bitcoin. Arcane Research analyst Vetle Lunde highlighted in a Twitter thread that large institutions have sold 236,237 BTC since May 10. It is encouraging to note that even after huge selling by institutions and the unfavorable macro environment, Bitcoin has held up quite well. Daily cryptocurrency market performance. Source: Coin360 The current bear market allows an opportunity for new traders to enter at lower levels. A repo...