Bitcoin

Bitcoin institutional buying ‘could be big narrative again’ as 30K BTC leaves Coinbase

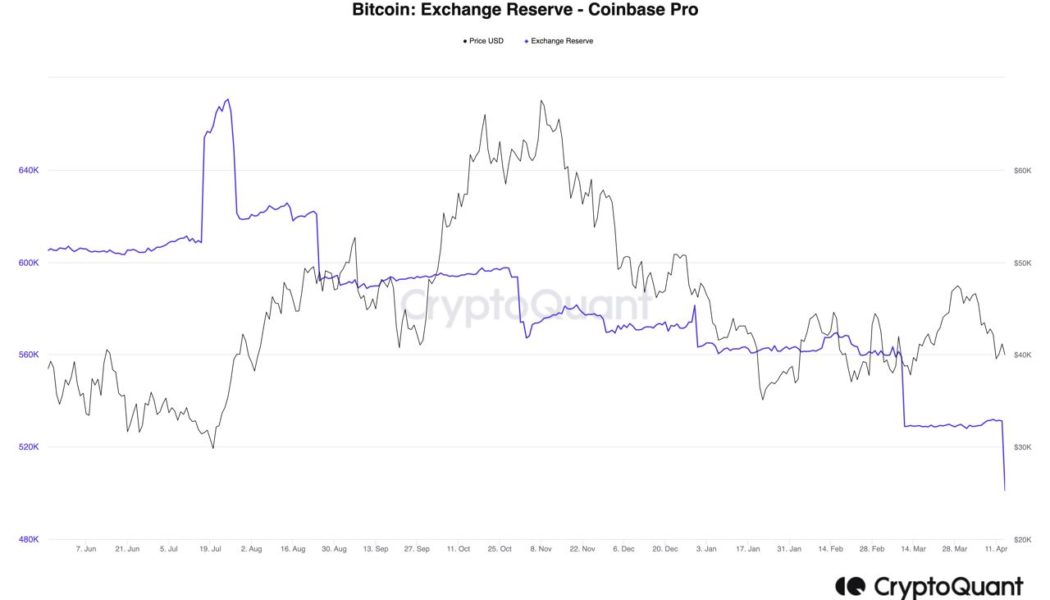

Bitcoin (BTC) may be heading under $40,000 but fresh data shows that demand from major investors is anything but decreasing. For Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, institutional BTC buying “could be the big narrative” in the crypto space once more. Coinbase Pro shifts serious amounts of BTC Ki highlighted figures from Coinbase Pro, the professional trading offshoot of United States exchange Coinbase, which confirm that large tranches of BTC continue to leave its books. Those tranches totalled 30,000 BTC in a single day this week, and the event is not an isolated one, with March seeing similar behavior. Coinbase Pro BTC reserves vs. BTC/USD chart. Source: CryptoQuant “30k BTC flowed out from Coinbase today,” he noted, “Institutional buys might be the bi...

Wikimedia community supports proposal to stop foundation from accepting crypto donations

Requests for comments on a proposal urging the Wikimedia Foundation to stop accepting donations in cryptocurrency have closed, with the majority of users voting in favor. According to a Tuesday update on the proposal, roughly 71%, or 232 out of 326, Wikimedia contributors who responded requested that the Wikimedia Foundation — the nonprofit that hosts Wikipedia — stop accepting cryptocurrency donations. The arguments in favor of the proposition included environmental concerns surrounding Bitcoin (BTC) transactions and “the risk to the movement’s reputation for accepting cryptocurrencies.” The community first opened the proposal to comment on Jan. 10, expanding the discussion to include topics like El Salvador adopting BTC as legal tender, crypto as a tool for illicit financial activities, ...

Luno Secures 10-Million Customers in over 40 Countries

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept All”, you consent to the use of ALL the cookies. However, you may visit “Cookie Settings” to provide a controlled consent.

Glassnode observes profits among BTC holders despite the recent market slump

Glassnode says three-quarters of Bitcoin addresses are in profit even though the markets are struggling Short-term holders are seeing reduced loss realisation, with a current figure of 8.3k BTC per day This week’s edition of the Week On-Chain newsletter by Glassnode has evaluated the development and ‘health’ of Bitcoin’s user base as indicated by on-chain activity and profitability of the network. The report, published on Monday, found that despite the recent bearish condition, the current market is performing better than the previous bear markets. Comparisons show less severity given that just between 25% to 30% of the market sits at an unrealised loss; however, warning that should sell-side pressure increase, the situation could change for the worse. “The current bear market is not as se...

Ethereum price ‘bullish triangle’ puts 4-year highs vs. Bitcoin within reach

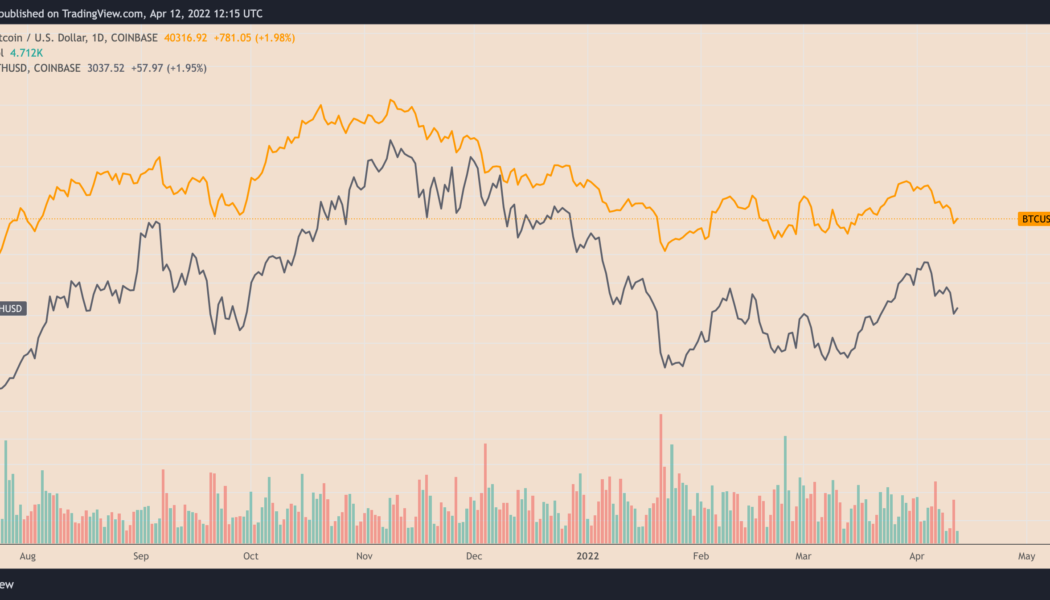

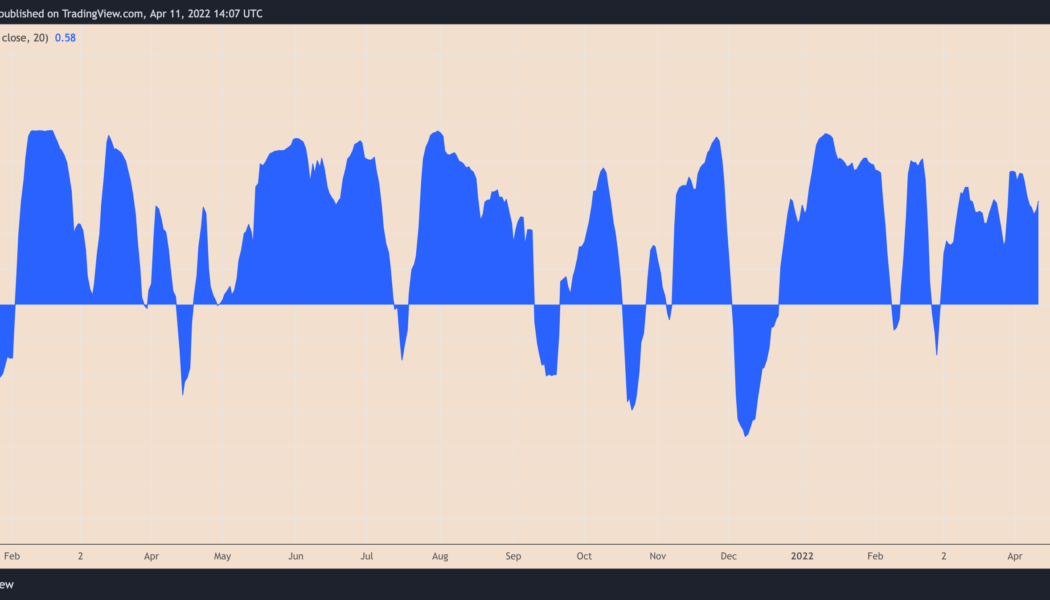

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period. The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month. The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981. BTC/USD vs. ETH/USD daily price chart. Source: TradingView ETH/BTC triangle breakout Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still l...

Tables turn as shorts suffer in the wake of Bitcoin reclaiming $40k

Monday’s slump saw over $470 million in long bets wiped away from the market In the last four hours, the majority of the liquidations have been from traders betting on prices declining Bitcoin price fell below $40k early on Tuesday for the first time since March 16 as the market underwent further correction. Altcoins felt the pinch as well, with their prices sliding even further than they did on Monday. The premier alt, Ether, fell to a multi-week low of $2,958, CoinMarketCap data shows. Two contrasting strokes The crypto market has since slightly loosened, with Bitcoin climbing back to $40,210 where it was last spotted hovering. Ethereum’s native token has moved up to $3,020. This minor recovery has meant losses for traders betting on a continued downtrend. Data from Coinglass shows that ...

Bitcoin claws back $40K as 24-hour crypto liquidations near $500M

Bitcoin (BTC) attempted to reclaim $40,000 as support on April 12 after a troubling start to the week saw BTC/USD hit three-week lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Extraordinarily elevated” CPI data due Data from Cointelegraph Markets Pro and TradingView showed the largest cryptocurrency bouncing to $40,200 on Bitstamp Tuesday after falling to just $39,300. Spurred on by a bleed-out in tech stocks in particular, Bitcoin looked decidedly unappetizing on short timeframes, and those previously betting on bullish continuation were left empty-handed. According to on-chain monitoring resource Coinglass, the past 24 hours cost crypto traders a total of $428 million in liquidated long positions — the most in a day since Jan. 22. Crypto liquidations ...

Terra price key support level breaks after 30% weekly drop — more pain for LUNA ahead?

Terra (LUNA) price slid on April 11 as a broader correction across crypto assets added to the uncertainties concerning its token burning mechanism. Bitcoin (BTC) and Ether (ETH) led to a decline in the rest of the cryptocurrency market, with LUNA’s price dropping by over 8% to nearly $91.50, and about 30% from its record high of $120, set on April 6. The overall drop tailed similar moves in the U.S. stock market last week after the Federal Reserve signaled its intentions to raise interest rates and shrink balance sheets sharply to curb rising inflation. Arthur Hayes, the co-founder of BitMEX exchange, said Monday that Bitcoin’s correlation with tech stocks could have it run for $30,000 next. In other words, LUNA’s high correlation with BTC so far this year puts it at risk...

Bitcoin loses support above $42,000 as crypto markets turn red

Bitcoin is trading below $42k for the first time in almost three weeks Altcoins led by Ether have shed some of the gains from the rally at the end of March A sharp fall in the prices of the majority of the top cryptocurrencies on Monday has pushed the total crypto market capital below $2 trillion. The dip, which started late yesterday, continued overnight and has been the theme throughout the day. Red is the order of the day The market leader, Bitcoin, glided under $42,0oo earlier today and was last observed trading at $41,030. These figures reflect a downward movement of 3.7% on the day and 10.85% over the week. Market data shows BTC/USD hasn’t retouched the current level since March 22. Ether price has moved down 6.25% in the last 24 hours and the token appears likely to fall below $3,00...

BTC stocks correlation ‘not what we want’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts the second week of April with a whimper as bulls struggle to retain support above $40,000. After a refreshingly low-volatility weekend, the latest weekly close saw market nerves return, and in classic style, BTC/USD fell in the final hours of April 10. There is a feeling of being caught between two stools for the average hodler currently — macro forces promise major trend shifts but are being slow to play out. At the same time, “serious” buyer demand is also absent from crypto assets more broadly. However, those on the inside show no hint of doubt about the future, as evidenced by all-time high Bitcoin network fundamentals and more. The combination of these opposing factors is price action that simply does not seem to know where to go next. Can something change in the ...

Bitcoin battles for weekly close above $42K as LFG buys 4,130 more BTC

Bitcoin (BTC) prepared for its lowest weekly close of the month so far on April 10 after a week of disappointing losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: BTC “giving people a second chance” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $42,700 Sunday with a matter of hours to go until the conclusion of the weekly candle. The pair had fallen into the end of Wall Street trading Friday, while the weekend provided some nervous calm as $42,000 support remained intact. For popular trader and analyst Rekt Capital, there was still cause for optimism despite the past seven days seeing losses of nearly 10%. This #BTC pullback is a second chance for a lot of people If you promised yourself that you’ll buy $BT...

Top 5 cryptocurrencies to watch this week: BTC, NEAR, FTT, ETC, XMR

Bitcoin (BTC) dropped from a high of $47,200 on April 5 to a low of $42,107 on April 8, indicating possible selling by short-term traders who may have preferred to lock in their profits. However, the price action is still stuck in a tight range during the weekend, indicating that supply and demand are in balance. Although the Crypto Fear & Greed Index is in the fear zone, Bitcoin whales on crypto exchange Bitfinex remained unfazed and continued to purchase BTC. Interestingly, one large investor continued to buy $1 million of Bitcoin every day, without attempting to time the market, using the strategy of dollar-cost averaging. Crypto market data daily view. Source: Coin360 Another whale that utilized the dip to add more Bitcoin to its existing stockpile was Terra. This week, the wallet ...