Bitcoin

Acorns brings Bitcoin exposure to its savings and investment app

Acorns users can now allocate up to a maximum of 5% of their portfolio the ProShares Bitcoin Strategy (BITO) ETF The personal finance app has plans to create room for other cryptocurrencies in the future Backed by Galaxy Digital, savings and investment firm Acorns has announced the introduction of Bitcoin exposure to its portfolio, targeting long-term investments among its users. Through a Twitter post, Acorns said that it is glad to add “Bits of Bitcoin” to diversify its portfolio. With an increased rate of exposure to crypto among fintech firms, Acorns explained that it had to offer its investors the opportunity to diversify their holdings. The company cited the ‘low correlation’ between crypto and stocks as the rationale for the decision. In contrast, though, at ...

Bitcoin is ‘not regulated’ — Honduras’ central bank pushes back against legal tender rumors

The Central Bank of Honduras, or BCH, addressed rumors regarding the country potentially adopting Bitcoin as legal tender like its neighbor El Salvador — and the answer seems to be negative. In a Wednesday statement, Honduras’ central bank said “for the time being” Bitcoin (BTC) was not regulated in the country and not recognized as legal tender in many others. The BCH reiterated its authority under Honduras’ constitution that it was the only authorized “issuer of banknotes and coins” considered to be legal tender in the country. “BCH does not supervise or guarantee operations carried out with cryptocurrencies as means of payment,” said the central bank, according to a translated statement. “Any transaction carried out with these types of virtual assets is the responsibility an...

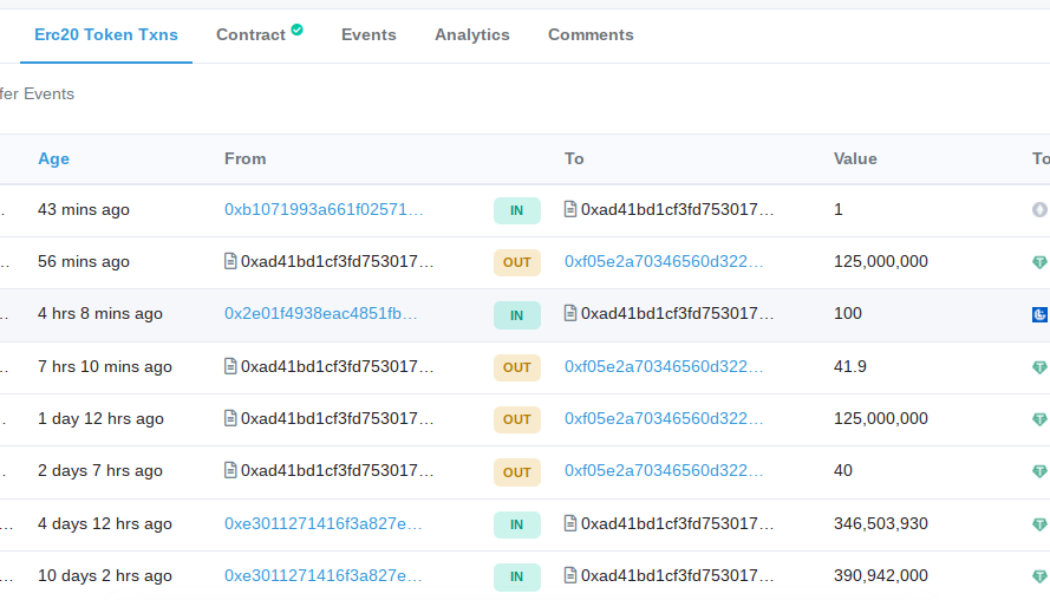

Terra may be about to repeat $125M BTC buy that sparked Bitcoin’s run to $43.3K

Bitcoin (BTC) could be set for a repeat of this week’s run to weekly highs after Blockchain protocol Terra appeared set to buy another $125 million of BTC. A wallet thought to belong to Terra but not officially confirmed to be under its control sent another 125 million Tether (USDT) to Binance on March 23. Rinse and repeat for 5.6% BTC price gains? The Bitcoin price narrative gained a new player this week after Terra co-founder Do Kwon let slip about a plan to back a new U.S. dollar stablecoin, TerraUSD (UST) with both BTC and Terra’s LUNA token. The buy-in required to do so amounts to $3 billion, he told commentator Udi Wertheimer last week, adding that the bulk of purchasing had yet to occur at the time. Analysis of the presumed wallet supports that thesis, with the first 125...

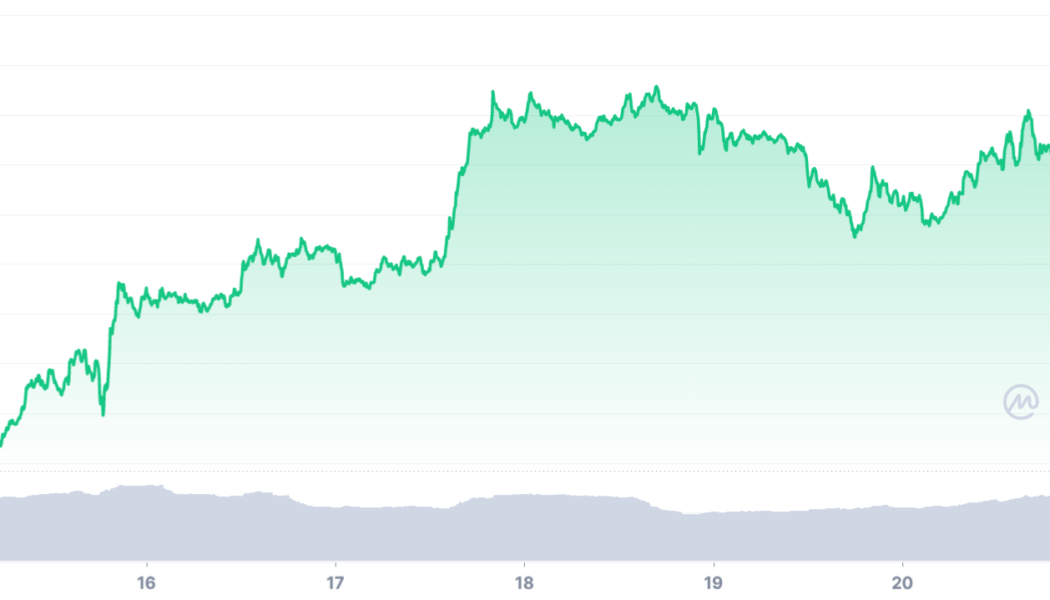

On-chain: Ethereum surges, outperforms Bitcoin and stocks

The never-ending battle of Ethereum against the psychologically-important $3K barrier continues. The DeFi king broke through the resistance earlier, meaning it is now up 16% on the week. Ethereum 7-day returns, data via CoinMarketCap Order Volume The $3K area has been a tug-of-war over the last while, and today reads no different. Data below via IntoTheBlock shows the boisterous volume on both sides of $3K, as order-books burst with bids and asks. It’s difficult to ascertain where ETH will go from here; like most financial assets, it may depend on external geopolitical developments, which have been plentiful in recent times. Order volume around the $3K barrier, data via IntoTheBlock Volume Volume provides no clue in either direction, with withdrawals from exchanges continuing to fol...

Bitcoin hovers at $43K on Wall Street open amid growing fever over Terra’s $3B BTC buy-in

Bitcoin (BTC) showed signs of wanting higher levels still on March 22 as Wall Street trading saw a return above $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra co-founder: ‘Most of’ $3 billion still unpurchased Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it continued its newly confident stride to three-week highs. The pair had already gained thanks to encouraging macro signs from China, but it was news from within that really set the pace on the day. In a Twitter Spaces conversation with infamous Bitcoin pundit Udi Wertheimer, Do Kwon, co-founder of Blockchain protocol Terra, revealed that he planned to back his new TerraUSD (UST) stablecoin with BTC in addition to Terra’s LUNA token. “Haven’t been fo...

Bitcoin hits 3-week high as fresh impulse move sends BTC price to $43.3K

Bitcoin (BTC) saw a fresh impulse move overnight into March 22 as bulls briefly reclaimed $43,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView RSI hints at underlying strength Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $43,337 on Bitstamp Tuesday, the pair’s highest since March 3. The action contrasted with the lack of volatility since the weekend, and neatly fitted with the more bullish predictions surrounding near-term trajectory. For popular trader Crypto Ed, who had previously given $43,000 as a low-timeframe target, all was going to plan. #BTC Been showing red box at $43k for a couple of days now…. Imagine not watching my YT videos….. No need at all to listen to dudes, who like to hear talking themselves for >2...

SEC pushes decisions on WisdomTree’s and One River’s applications for spot Bitcoin ETFs

The United States Securities and Exchange Commission has extended its window to approve or disapprove spot Bitcoin (BTC) exchange-traded fund (ETF) applications from asset managers WisdomTree and One River. According to separate Friday filings, the SEC will push the deadline for approving or disapproving a rule change allowing shares of the WisdomTree Bitcoin Trust and One River Carbon Neutral Bitcoin Trust to be listed on the Cboe BZX Exchange and New York Stock Exchange Arca, respectively. The regulator said it would extend its window for the decision on WisdomTree’s Bitcoin investment vehicle to May 15 and One River’s to June 2. The spot BTC ETF application from WisdomTree followed the SEC rejecting a similar offering from the asset manager in December 2021 after several delay...

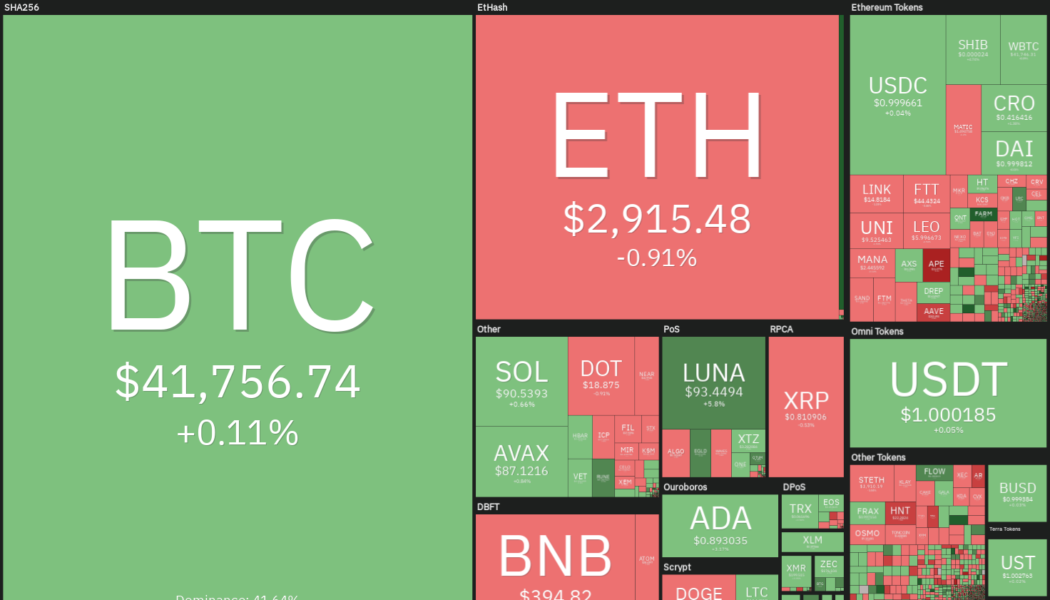

Price analysis 3/21: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

Bitcoin (BTC) and most major altcoins are attempting to start the new week on a positive note by bouncing off their respective support levels. Goldman Sachs became one of the first major banks in the United States to complete an over-the-counter “cash-settled cryptocurrency options trade” with the trading unit of Michael Novogratz’s Galaxy Digital. This could encourage other major banks to consider offering OTC transactions for cryptocurrencies. It is not only select nations that are showing growth in crypto adoption. A report by cryptocurrency exchange KuCoin shows that crypto transactions in Africa have soared by about 2,670% in 2022. Bitcoin Senegal founder Nourou believes that Africa could continue its thousand plus percent growth rates in the next few years. Daily cryptocurrency marke...

Deloitte 2021 Global Blockchain Survey: 76% of respondents believe digital assets are a strong alternative to, or outright replacement for, fiat currencies

Pre-COVID, cryptocurrency was still a relatively unknown commodity in mainstream circles and to average consumers. Two years into the pandemic (or post-pandemic, can we say???), that has changed entirely. Deloitte’s 2021 global blockchain survey highlights the extent of crypto’s emergence – and this survey was conducted only one year into the pandemic, in March/April 2021. Note: “FSI Pioneers” are respondents whose organisations have already deployed blockchain activities into production and/or integrated digital assets into their core business activities Remarkably, 76% of respondents believe that “digital assets will serve as a strong alternative to, or outright replacement for, fiat currencies in the next 5-10 years”. That’s quite a staggering number and one that really surprised u...

Turning losses to wins: How a Ponzi victim became a crypto evangelist

Losing money to a Ponzi scam is not the ideal introduction to the crypto ecosystem. Thankfully, Mark Dave Manansala gave crypto and blockchain a second chance and discovered a new passion. It all started when Manansala was invited by an acquaintance to join a very popular crypto project in 2017. The project’s team asked him to create a video of himself in exchange for free tokens. After this, he was advised to reinvest the gains. Baited by the high returns, Manansala ended up investing more money into the scheme only to discover that it was a scam. “After studying and putting my money in for about three months, it became clearer that it was a scam. I did what a can to recover and pull out what I could, and I was able to save some of the investments before their token totally crashed.” When...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, AVAX, ETC, EGLD

Bitcoin (BTC) rose above $42,000 on March 19 but the bulls continue to face a strong challenge from the bears at higher levels. Although Bitcoin’s price has recovered from $37,578 on March 13, Cointelegraph market analyst Marcel Pechman highlighted that the long-to-short net ratio of top traders across three major exchanges shows that professional traders have not been buying aggressively. But while Bitcoin struggles at higher levels, select altcoins are showing strength. Twitter account BTCFuel anticipates that altcoins could be entering “the final leg up of the hype phase” and may peak in the Summer. Crypto market data daily view. Source: Coin360 Glassnode data shows that investors have withdrawn roughly 550,000 Ether (ETH) from centralized exchanges year-to-date. Due to the outflo...

Bitcoin eyes highest weekly close since early February as BTC price hovers under $42K

Bitcoin (BTC) stayed the near top of its recent trading range on March 20 as the weekly close looked set to crack a multi-week high. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Weekly close could set 4-week high Data from Cointelegraph Markets Pro and TradingView showed BTC/USD maneuvering around the upper $41,000 zone Sunday. Friday’s late surge had broadly held, and Saturday saw a return of $42,400 on Bitstamp, matching the high from the start of March. Now, the weekly chart looked set to deliver Bitcoin’s best weekly close since early February. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView “This could change anytime, but frankly the Bitcoin price chart currently looks better than it has for quite a while now,” analyst Lyn Alden ...