Bitcoin (BTC) could be set for a repeat of this week’s run to weekly highs after Blockchain protocol Terra appeared set to buy another $125 million of BTC.

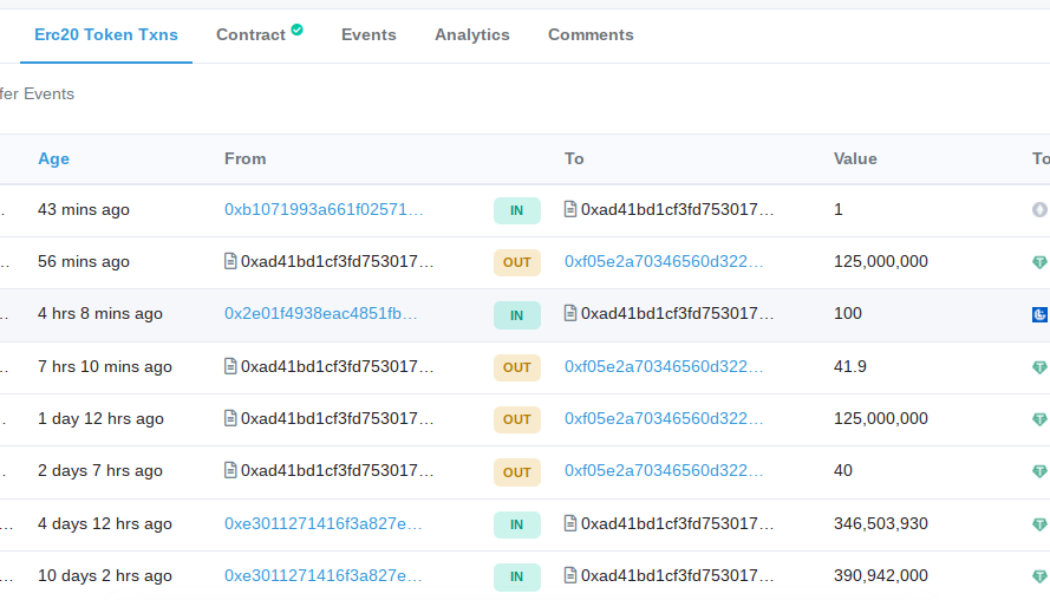

A wallet thought to belong to Terra but not officially confirmed to be under its control sent another 125 million Tether (USDT) to Binance on March 23.

Rinse and repeat for 5.6% BTC price gains?

The Bitcoin price narrative gained a new player this week after Terra co-founder Do Kwon let slip about a plan to back a new U.S. dollar stablecoin, TerraUSD (UST) with both BTC and Terra’s LUNA token.

The buy-in required to do so amounts to $3 billion, he told commentator Udi Wertheimer last week, adding that the bulk of purchasing had yet to occur at the time.

Analysis of the presumed wallet supports that thesis, with the first 125 million USDT transaction heading to Binance overnight on March 21. In the hours that followed, BTC/USD gained around 5.5%.

Now, an identical transaction has been made, fuelling fresh speculation that Bitcoin could soon see another $125 million worth of buyer demand executed in minutes.

For popular trader, analyst and commentator Cantering Clark, the move, in itself, was enough to enter the market.

“Terra foundation just sent another 125mil to Binance. Last time they did this was right before they aped into BTC. I plan on following. Will cut and re-evaluate if we lose these lows,” he told Twitter followers.

Kwon, himself, had not confirmed any of the activity at the time of writing, having already claimed that he had said too much during the interview with Wertheimer.

Trader demands $45,500 retest to pay attention

At March 23’s Wall Street open, however, there was not yet any sign of a fresh bullish impulse move on BTC/USD markets.

Related: Bitcoin dips 3.6% from weekly highs — What are the key BTC price levels to watch?

The pair traded at around $42,000, having come down over $1,300 versus the highs a day previously, data from Cointelegraph Markets Pro and TradingView showed.

“Gotta get above $45,500,” trader, analyst and podcast host Scott Melker added in his latest YouTube update on the day, ongoing at the time of writing.

“Anything else is just a tease.”

On the daily chart, he nonetheless noted that narrowing Bollinger Bands were hinting at incoming volatility, with BTC/USD tapping the top band this week.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, BTC price, crypto blog, Crypto news