Bitcoin

Bitcoin Network Transaction Volume Surpasses American Express: Research

New research has found that the annual transaction volume on the Bitcoin network surpassed that of some well-known card networks, such as American Express (AmEx) and Discover, during 2021. The NYDIG Research Weekly’s Jan. 29 report stated that Bitcoin processed $3 trillion worth of payments during 2021, placing it above popular credit card networks American Express ($1.3 trillion) and Discover ($0.5 trillion). The report authors, NYDIG Global Head of Research Greg Cipolaro and Research Analyst Ethan Kochav, also found that the Bitcoin network had settled more transaction volume in Q1 2021 than “all credit card networks combined for the entire year.” “This is astonishing growth, in our opinion, for a payment network that just had its 13th birthday,” they wrote. American Express issued its f...

‘No signs Bitcoin has bottomed’ as data warns BTC price downtrend continuing

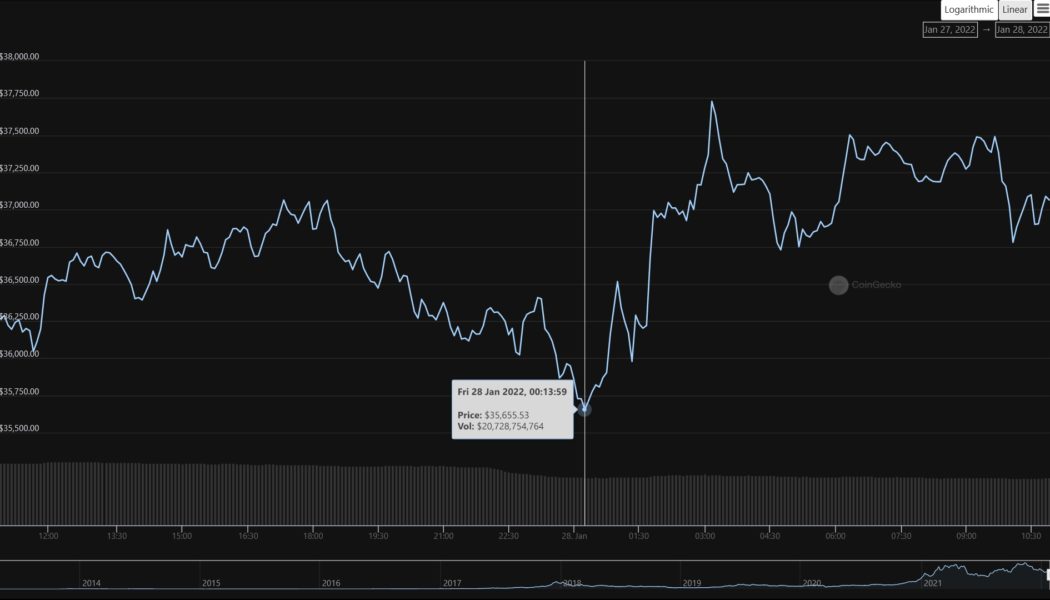

Bitcoin (BTC) received a welcome boost at the Wall Street open on Jan. 31 as fresh research painted a gloomy picture for near-term price action. BTC/USD 1-month candle chart (Bitstamp). Source: TradingView Trader “not interested” in longs below $38,500 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing toward $38,000 on Monday, reversing a correction which set in immediately after Sunday’s weekly close. With stocks giving some relief to bulls, many analysts remained hands-off on Bitcoin while higher levels nearer $40,000 remained unchallenged. “Bitcoin chopping around and fighting resistance, while the volume remains low overall,” Cointelegraph contributor Michaël van de Poppe summarized after his latest YouTube update. “As ...

New week kicks off with marginal dips in the crypto markets

Top crypto assets are down by between 2% and 5% over the last 24 hours. At the time of press, Bitcoin is holding $37,076, and Ethereum $2,544. Terra continues to lose significantly, declining 25% over the last week. The volatility that has plagued crypto markets in January continued into the last week of the month. Market swings sent the prices rocking with major crypto-asset tokens in the red into the start of the new week. Now having a market cap of $705.98 billion according to CoinMarketCap, Bitcoin has plunged 2.6% in the last 24 hours and is currently trading at $36,975. Though the world’s market-commanding digital asset resided north of $38k in bits over the weekend, it has remained inconsistent, and so has Ethereum’s native coin ETH. ETH is currently down 1.85% on the day, but ...

Internet Computer plans to roll out BTC and ETH integrations by year-end

The Internet Computer has released a roadmap for 2022 and beyond, indicating plans to roll out integrations with Bitcoin and Ethereum by the end of the year. The Internet Computer is a public blockchain and protocol that allows developers to install smart contracts and decentralized applications (DApps) directly on the blockchain. It was incubated and launched in May 2021 after years of development by Dfinity — a nonprofit based in Zurich. The #ICP #BTC integration will prompt a new wave of DeFi applications built to leverage the world’s largest cryptocurrency. Full story:https://t.co/kexreQTw20 pic.twitter.com/bQkKdel7r5 — DFINITY Foundation (@dfinity) January 27, 2022 The direct Bitcoin integration will be launched as part of Dfinity’s “Chromium Satoshi Release,” which is planned for Q1 ...

US crypto executive order looms — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week with a bang — but not in the right direction for bulls. A promising weekend nonetheless saw BTC/USD attract warnings over spurious “out of hours” price moves, and these ultimately proved timely as the weekly close sent the pair down over $1,000. At $37,900, even that close was not enough to satisfy analysts’ demands, and the all-too-familiar rangebound behavior Bitcoin has exhibited throughout January thus continues. The question for many, then, is what will change the status quo. Amid a lack of any genuine spot market recovery despite solid on-chain data, it may be an external trigger that ends up responsible for a shake-up. The United States’ executive order on cryptocurrency regulation is due at some point in February, for ex...

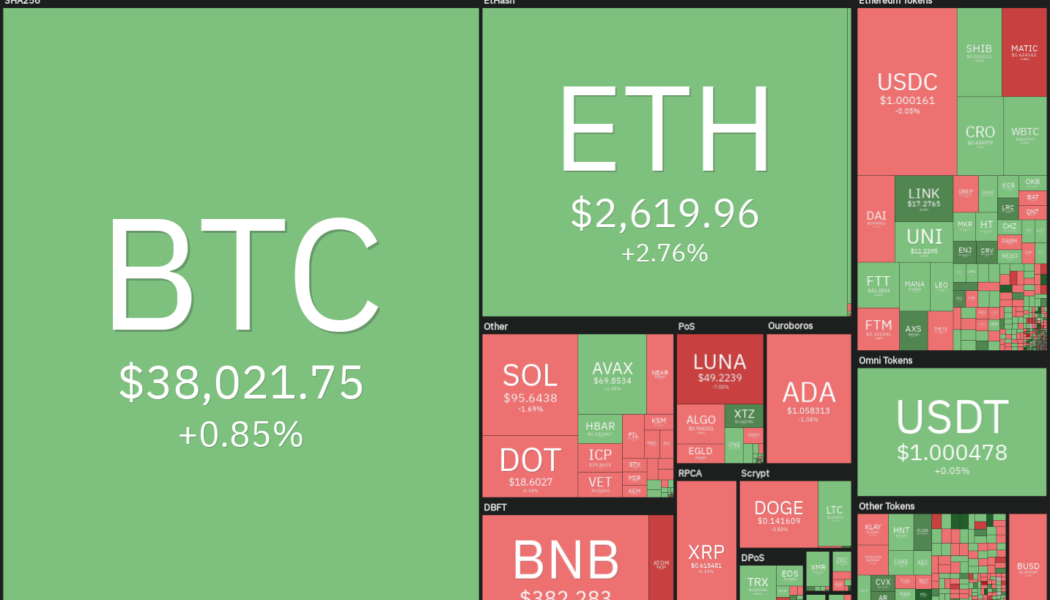

Top 5 cryptocurrencies to watch this week: BTC, LINK, HNT, FLOW, ONE

Bitcoin’s (BTC) relief rally rose above $38,500 on Jan. 29, but the bulls are struggling to sustain the higher levels. For the past few days, Bitcoin’s sentiment has closely followed the U.S. equity markets. Hence, analysts warned traders to be careful and not to read much into any possible weekend rallies when traditional markets are closed because it could be a trap. However, analysts at trading suite Decentrader said in a recent report that a “near-term relief bounce” is possible. The report also highlighted that “meaningful buyers” were stepping in and that could result in “a potential change in the higher time frame trend from bearish to bullish.” Crypto market data daily view. Source: Coin360 The recent downturn in Bitcoin seems to have turned the JPMorgan analysts bearish as they be...

Bitcoin stays near $38K as RSI breakout challenges ‘boring’ weekend

Bitcoin (BTC) circled the $38,000 mark into Jan. 30 as a “trappy” weekend still offered the chance of a solid weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Choppy waters” for Bitcoin Data from Cointelegraph Markets Pro and TradingView showed BTC/USD regaining the $38,000 mark after seeing local highs of $38,740 on Bitstamp the previous day. Despite its strong “out of hours” performance, few analysts believed in BTC as a firm bullish play without traditional market guidance. “Still choppy waters for Bitcoin,” Cointelegraph contributor Michaël van de Poppe summarized in his latest Twitter update. “Looking at $37K to see whether that sustains. If not -> I’m assuming we’ll test lows for daily...

Why is my Bitcoin transaction unconfirmed?

Transaction costs are calculated based on the transaction’s data volume and network congestion. As a block can only hold 4 MB of data, the number of transactions that can be executed in one block is limited. Therefore, more block data is required for a larger transaction. As a result, more significant transactions are usually charged on a per-byte basis. When you use a BTC wallet to send a transaction, the wallet will typically provide you with the option to choose your Bitcoin fee rate. This charge will be determined in satoshis per unit of data (there are 100,000,000 satoshis in one Bitcoin) consumed on the blockchain by your transaction, abbreviated as sats/vByte. This rate will then be multiplied by the size of your transaction to get the total fee you’ll pay. If you want y...

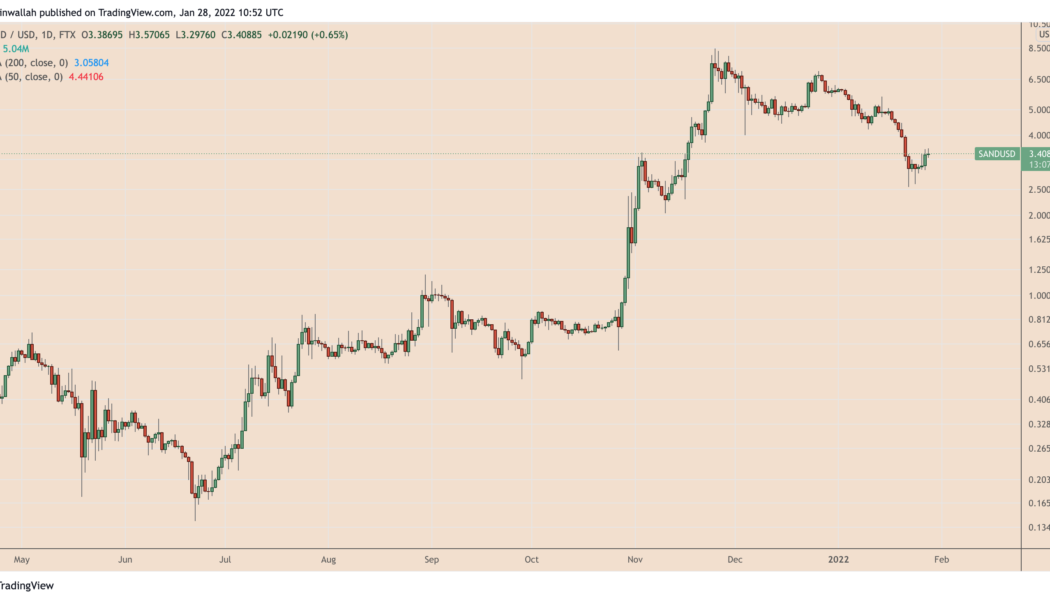

Terra (LUNA) at risk of 50% drop if bearish head-and-shoulders pattern plays out

Terra (LUNA) may fall to nearly $25 per token in the coming weeks as a head-and-shoulders (H&S) setup develops, indicating a 50% price drop, according to technical analysis shared by CRYPTOPIKK. H&S patterns appear when the price forms three peaks in a row, with the middle peak (called the “head”) higher than the other two (left and right shoulders). All three peaks come to a top at a common price floor called the “neckline.” Traders typically look to open a short position when the price breaks below the H&S neckline. However, some employ a “two-day” rule where they wait for the second breakout confirmation when the price retests the neckline from the downside as resistance, before entering a short position. Meanwhile, the ideal short ta...

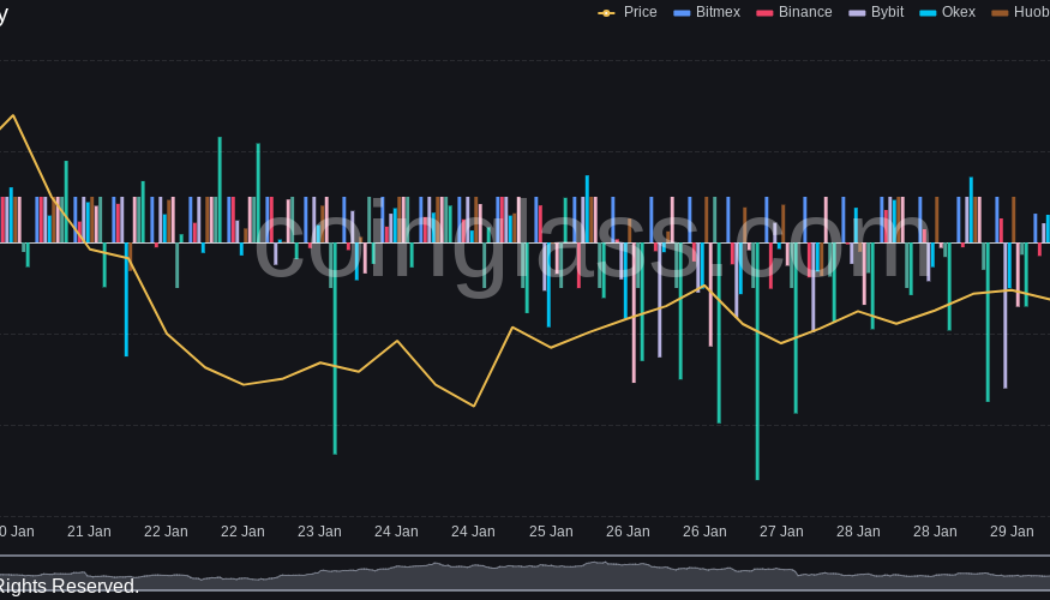

Bitcoin dodges ‘sub-$30K liquidity grab’ — Levels to watch now

Bitcoin (BTC) could still crash to $29,000 and lower, but price action is “healthier” than a week ago, the latest research concludes. In a fresh market update on Friday, analysts at trading suite Decentrader said that BTC price action is finally showing “green shoots of optimism.” Eyes on “near-term relief bounce” for BTC After a difficult week in which BTC/USD dipped to just under $33,000, market analysis is now focusing on the likely outcomes of the rangebound behavior seen over the past few days. For Decentrader, there is reason to be cautiously optimistic now where there was none a week ago. “We believe that the current derivatives landscape shift and this extremely negative sentiment backdrop does increase the potential for at least a near-term relief bounce,” analysts summarized. The...

Macro trends expert Lyn Alden doesn’t see Bitcoin sinking below $20k

Alden is optimistic the flagship will stay above $20,000 even if the slump intensifies Bitcoin is trading on the green today and has cleared $37,000 Macroeconomics strategist Lyn Alden has shared her view on Bitcoin which, like other crypto assets, has suffered considerable losses in the recent market slump. In a mid-week interview with Kitco News’ David Lin, Alden noted that it is unlikely for the price of the leading cryptocurrency to sink below $20,000. Alden, who manages an eponymous equity research and investment research firm, backed his forecast, noting that the market is maturing and, as such, Bitcoin won’t see massive price fluctuations. “I’d be somewhat surprised to see a sub 20,000 print. I don’t rule it out as an option though […] Bitcoin ha...