BTC price

Bitcoin sentiment falls into ‘fear’ as BTC price action hits $42.9K breakdown target

Bitcoin (BTC) kept disappointing hodlers on April 7 as the Bitcoin 2022 conference got underway to a limp BTC price performance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Fed prepares $95 billion monthly balance sheet shrink Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it dropped below multiple support levels to reach its lowest since March 23. Reversing at $42,741 on Bitstamp on April 7, the largest cryptocurrency was decidedly less bullish than the week prior, with analysts quick to point out contributing factors. Central bank monetary tightening, namely from the U.S. Federal Reserve, remained the favorite, this having a potential long-lasting impact across risk assets going forward. “The biggest headwind to Bitcoin and macroeconomi...

Bitcoin bulls may have to wait until 2024 for next BTC price ‘rocket stage’

Bitcoin (BTC) may track sideways for another two years before reigniting its bull run, new data argues. In a tweet on April 6, veteran trader Peter Brandt highlighted historical patterns suggesting that hodlers will have to wait until 2024 for their next moonshot. 8 months down, 25 to go? Bitcoin has surprised analysts with its performance over the past year, as the highly anticipated “blow-off” top in Q4 2021 was much lower than expected. After BTC/USD lost over 50% of those modest new all-time highs, the debate around the relationship of price to Bitcoin’s four-year halving cycles changed. The market, as Cointelegraph reported, was used to a macro price top coming once per four-year cycle, specifically the year after each of Bitcoin’s block subsidy halving events....

Bitcoin dices with $46K as Elon Musk Twitter buy sends Dogecoin near 2-month highs

Bitcoin (BTC) traded in an uncertain territory on April 4 as the Wall Street open failed to unleash bullish continuation. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader gives $43,000 BTC near-term dip target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping above and below the $46,000 mark on April 4, continuing a low-volatility few days. The pair had managed to seal a second week near the 2022 yearly open, with analysts already hoping for a breakout to $50,000 or even beyond. At the time of writing, however, there was still no sign of such an outcome, while Bitcoin stuck to an increasingly narrow low-timeframe trading range. “Bitcoin is not really clear to me; it could be because of a very slow weekend, which is disturbing a bit, [in...

BTC starts 2022 all over again — 5 things to know in Bitcoin this week

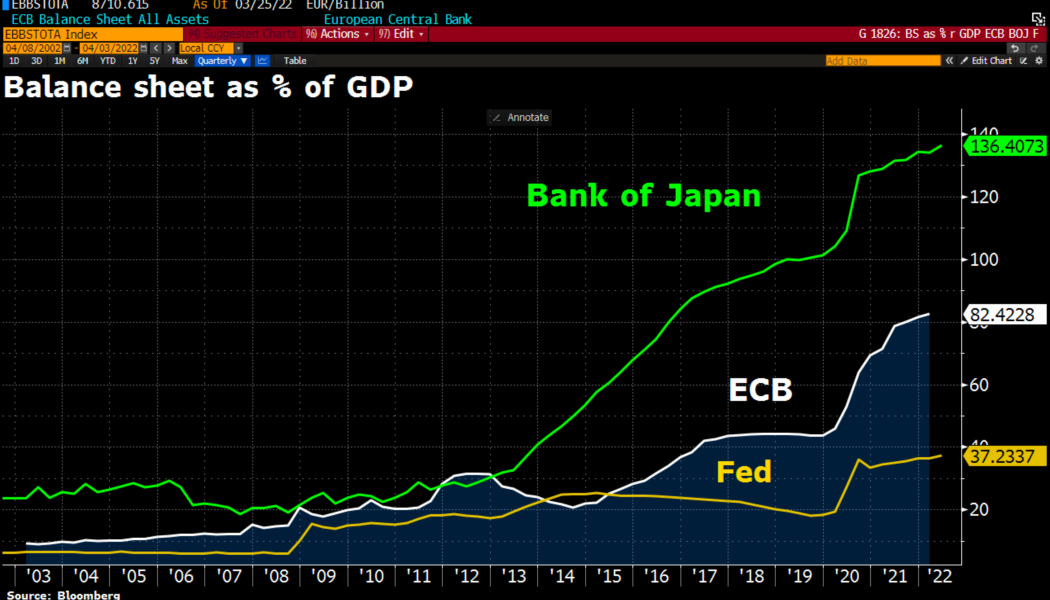

Bitcoin (BTC) starts a new week and a new quarter as if it were starting the new year — at just over $46,000. In what will seem like some serious deja-vu for hodlers, BTC/USD is at practically the same level it was on Jan. 1, 2022. Price action has been quiet — too quiet, perhaps — in recent days, but behind the declining volatility, there are signs that the market is busy deciding future direction. From macro to on-chain, there are in fact plenty of cues to keep an eye on in April, amid a backdrop of Bitcoin — at least so far — retaining its yearly open price as support. Cointelegraph takes a look at five of these factors as they pertain to BTC price performance over the coming week. Inflation meets fresh money printing There has been much talk of the end of the post-COVID “easy money” pe...

Can Bitcoin seal its best weekly close of 2022? BTC price sits at $46.5K

Bitcoin (BTC) bulls had everything to play for on April 3 as the first weekly close of the month looked set to be above the all-important $46,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Anything could happen in final hours of Sunday Data from Cointelegraph Markets Pro and TradingView painted an interesting picture Sunday, as commentators waited for some classic end-of-week volatility. BTC/USD had delivered few surprises over the weekend, with an overnight dip to near $45,500 the worst that hodlers had to confront. Now, the odds were on for a potential second weekly close above the 2022 yearly open of $46,200. Will #Bitcoin close its second consecutive weekly candle above $46,000? Find out soon! pic.twitter.com/0zIAMtOGzS — Matthew Hyland (@MatthewHyland_) Ap...

Bitcoin regains yearly open as trader says $50K next week ‘might be likely’

Bitcoin (BTC) consolidated above the 2022 yearly open on April 2 after a return to form briefly saw bulls reclaim $47,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC price holds “crucial” long-term support Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $46,600 Saturday on the back of a clear bounce at long-term support. The pair had dipped to lows of around $44,300 Friday, these nonetheless shortlived as positive sentiment took control into the Wall Street open. For Cointelegraph contributor Michaël van de Poppe, with intent to retain newly flipped support confirmed, the odds were on for an attack on $50,000. “Crucial area held up for Bitcoin, in which continuation upwards seems likely,” he summarized to Twitter...

Bitcoin suddenly dives to $46K as attention focuses on large CME futures gaps

Bitcoin (BTC) began to show fresh signs of an impending correction on March 31 as BTC price action began to eat into last weekend’s CME futures gap. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Up or down, CME futures gaps provide targets Data from Cointelegraph Markets Pro and TradingView showed BTC/USD abruptly spiking down by $1,000 in minutes on Bitstamp after March 31’s Wall Street open. The pair had ranged after failing to cement $48,000 as support earlier in the week, amid calls for a retest of lower levels as a necessary step after considerable gains. At the time of writing, Bitcoin circled $46,700, having hit its lowest levels since the night of March 27. A look at the CME futures chart showed that short-term price performance could have a dow...

Bitcoin sentiment hits ‘greed’ in 2022 first amid calls for $45K BTC price pullback

Bitcoin (BTC) sentiment is seeing its first significant test of the rally to year-to-date highs as bullish gains dry up. The start of Wall Street trading on March 30 failed to induce a fresh advance on BTC/USD, which threatened to lose support at $47,000. From “extreme fear” to “greed” in one week After gaining nearly 30% since March 14, Bitcoin has managed to cling to its yearly opening price as support, this previously marking the resistance ceiling of its trading range for throughout 2022. Now, however, hopes of a retracement appear to be coming true, as momentum shows signs of — at least temporary — fatigue. Data from Cointelegraph Markets Pro and TradingView captured the turnaround overnight on March 30, with $48,000 currently the level proving stubborn fo...

Bitcoin hits 3-day low as Terra BTC buy-ins dry up below $48K

Bitcoin (BTC) hinted at a welcome retracement overnight into March 30 after relentless upside failed to flip $48,000 to support. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: BTC still on target to crack $50,000 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $46,572 on Bitstamp as Wednesday began — its lowest since March 27. A susbequent rebound alleviated some of the losses, and at the time of writing, the pair traded at around $47,400. The change of tack followed a cooling of the narratives which had surrounded Bitcoin’s initial push beyond its yearly open price of $46,200 — a significant achievement which ended the cryptocurrency’s multi-month trading range. Blockchain protocol Terra, on its way to amassing an inital ...

Bitcoin on track to see its highest weekly close of 2022

Bitcoin (BTC) saw a fresh spike to near $45,000 overnight into March 27 as the weekend looked set to deliver a decisively bullish close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Weekly close of key importance Data from Cointelegraph Markets Pro and TradingView showed BTC/USD grinding back to higher levels seen days previously after a rejection at just above the $45,000 mark. While still within its extended trading range with $46,000 as its ceiling, the pair was still firmly on the radar of long-term traders as the weekly close drew near, this being apt to be Bitcoin’s highest of the year so far. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView Popular trader and analyst Rekt Capital added that Bitcoin’s 21-week exponential moving average...

Bitcoin sellers keep BTC price action in check amid $45K ‘fakeout’ warning

Bitcoin (BTC) took a breather from its latest upside on March 26 after predicted resistance kicked in just under the yearly open. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin fakeouts: Third time’s the charm? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD lingering around $44,500 Saturday, preserving the lion’s share of the week’s progress. Traders had sounded the alarm on a possible retracement after a large sell wall appeared on major exchange Bitfinex. In the event, sell-side pressure prevailed, halting bulls’ advance at just above $45,000. “Still waiting to see how price trades around yearly open. The prev times I targeted it we came up short but got very close although this time looks better for BTC. Almost ...

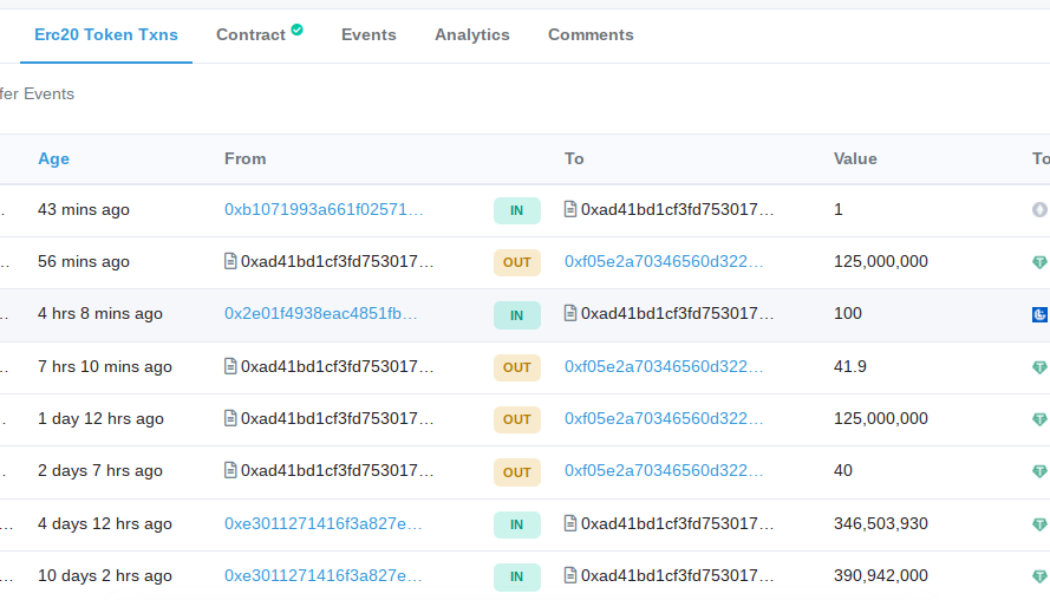

Terra may be about to repeat $125M BTC buy that sparked Bitcoin’s run to $43.3K

Bitcoin (BTC) could be set for a repeat of this week’s run to weekly highs after Blockchain protocol Terra appeared set to buy another $125 million of BTC. A wallet thought to belong to Terra but not officially confirmed to be under its control sent another 125 million Tether (USDT) to Binance on March 23. Rinse and repeat for 5.6% BTC price gains? The Bitcoin price narrative gained a new player this week after Terra co-founder Do Kwon let slip about a plan to back a new U.S. dollar stablecoin, TerraUSD (UST) with both BTC and Terra’s LUNA token. The buy-in required to do so amounts to $3 billion, he told commentator Udi Wertheimer last week, adding that the bulk of purchasing had yet to occur at the time. Analysis of the presumed wallet supports that thesis, with the first 125...