CoinShares

CoinShares’ Butterfill suggests ‘continued hesitancy’ among investors

Minor inflows for digital asset investment products over the last few weeks suggest a “continued hesitancy” towards crypto amongst institutional investors amid a slowdown of the U.S. economy. In the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Coinshares head of research James Butterfill highlighted stand-offish institutional sentiment towards crypto investment products, which saw “minor inflows” for the third week in a row. “The flows remain low implying continued hesitancy amongst investors, this is highlighted in investment product trading volumes which were US$886m for the week, the lowest since October 2020.” Between Sept. 26 and Sept. 30, investment products offering exposure to Bitcoin (BTC) saw the most inflows at just $7.7 million, with...

Merge ‘jitters’ sees outflow from Ether-based investment products

Institutional investors may be wavering ahead of the Ethereum Merge, with Ether-based digital asset investment products seeing an outflow of $61.6 million, signaling concerns about the success of the upgrade. In its digital asset fund flows weekly report, fund manager CoinShares reported that Ether-based investment products made up for the majority of total outflows over the Sept. 5-11 week — leading to the market’s fifth consecutive week of outflows. Report author James Butterfill said the outflows have come “despite the improved certainty of the Merge,” which could highlight a concern amongst investors that the “event might not go as planned,” referring to the upcoming Ethereum Merge set for Sept. 15. This is despite the likelihood of a successful Merge improving over the last week...

Summer doldrums? Crypto volumes are down 55%, according to CoinShares

Crypto investment products registered minor weekly outflows last week as volumes plunged to their second-lowest levels of the year, signaling weak demand among institutional investors during the tail end of summer. Outflows from digital asset investment products totaled $8.7 million in the week ending Sunday, CoinShares reported Monday. Bitcoin (BTC) investment products saw a third consecutive week of outflows totaling $15.3 million. Funds with direct exposure to Solana (SOL) also registered minor outflows totaling $1.4 million. Meanwhile, Ether (ETH) and multi-asset investment products registered small weekly inflows of $2.9 million and $2.7 million, respectively. Overall, crypto investment products registered $1 billion in weekly volumes, which is 55% below the yearly average. CoinShares...

CoinShares reports $21.7M loss tied to Terra implosion

On Tuesday, European cryptocurrency investment firm CoinShares posted its interim Q2 2022 results. Compared to the prior year’s quarter, the firm’s revenue declined from 19.6 million pounds ($23.89 million) to 14.2 million pounds ($17.31 million). At the same time, its net income fell from 26.6 million pounds ($32.42 million) in Q1 2021 to 0.1 million pounds ($0.12 million). CoinShares explained that the losses were largely tied to its exposure to the Terra (LUNA) — now called Terra Classic (LUNC) — ecosystem, which collapsed in May of this year: “While our Asset Management business continued to generate solid profit, the Capital Markets business experienced a one-off loss of £17.7 million following the de-pegging of Terra Luna. The financial impact of this epi...

CoinShares launches staked Algorand ETP on Deutsche Boerse Xetra

Major European cryptocurrency investment firm CoinShares is expanding its exchange-traded products (ETP) with a new physically-backed ETP based on Algorand (ALGO). CoinShares on Thursday announced the listing of its physically-backed staked Algorand ETP on Xetra, the electronic trading platform run by Germany’s exchange operator Deutsche Boerse. Named the CoinShares Physical Staked Algorand, the new crypto investment product will be trading on Xetra under the ticker RAND. The ETP is enabled through CoinShares’ proprietary technology platform Galata, allowing investors to benefit from the 2% staking rewards associated with participating in Algorand’s blockchain security. The new Algorand ETP joins a family of CoinShares’s staked ETP offerings featuring blockchain networks and cryptocu...

Institutional investor sentiment about ETH improves as Merge approaches

Ethereum prices may have dipped again today, but there are signs that professional investors are warming to the asset as the highly anticipated Merge draws closer. In its digital asset fund flows weekly report, fund manager CoinShares reported that Ethereum-based products saw inflows for the third consecutive week. There was an inflow of $7.6 million for institutional Ethereum funds, whereas those for Bitcoin continued to outflow with a loss of $1.7 million. Referring to the Ethereum funds CoinShares stated: “The inflows suggest a modest turnaround in sentiment, having endured 11 consecutive weeks of outflows that brought 2022 outflows to a peak of US$460M.” It added that the change in sentiment may be due to the increasing probability of the Merge happening later this year. The Merge is a...

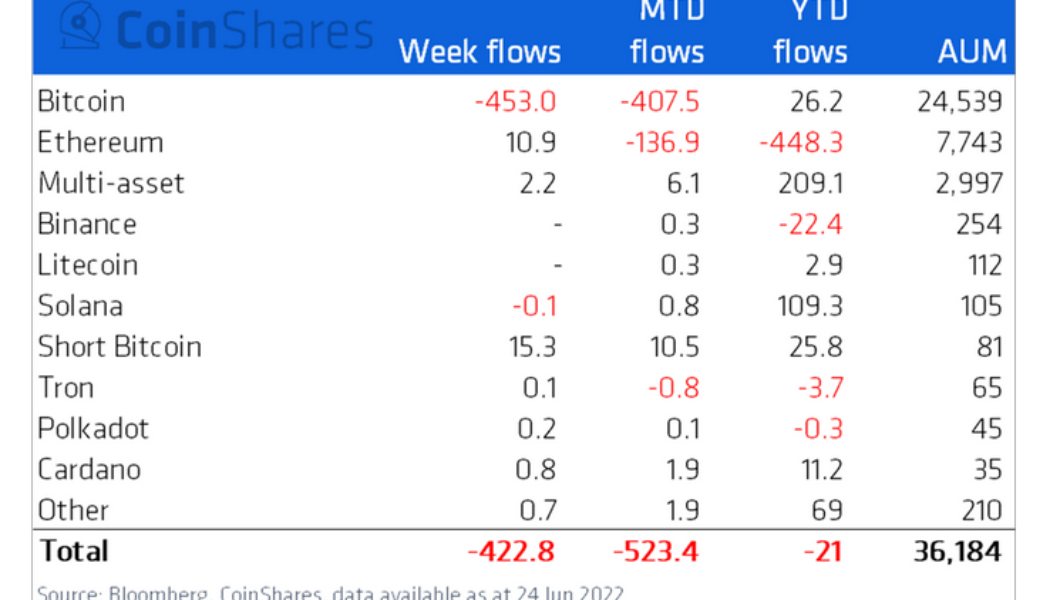

Institutional crypto asset products saw record weekly outflows of $423M

Digital asset investment products saw record outflows totaling $423 million last week, with institutional investors from Canada representing nearly all of the carnage. According to the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Canadian investors offloaded a whopping $487.5 worth of digital asset products between June 20 and June 24. The total outflows for the week were partially offset by $70 million worth of inflows from other countries, with U.S.-based investors accounting for more than half of the inflows with $41 million. Outside of the U.S., investors from Germany and Switzerland accounted for inflows totaling $11 million and $10.4 million apiece. In comparison, Brazilians and Australians also pitched in with minor inflows of $1.6 million and $1.4 million...

The crypto industry must do more to promote encryption, says Meltem Demirors

“I like to call myself a future, or aspiring, cult leader,” Meltem Demirors, chief strategy officer of CoinShares — a publicly listed investment firm managing around $5 billion in assets — told Cointelegraph. Demirors, who first entered the Bitcoin (BTC) space in late 2012, further mentioned that it has been “fun to see how big the crypto sector has become,” noting that people from all walks of life are now interested in the cryptocurrency space. As such, Demirors explained that “crypto cults” are bringing people together in a positive manner, especially since it gives people a sense of purpose and belonging. When it comes to regulations — one of the most important topics facing the crypto industry today — Demirors expressed skepticism. “Having been in this industry professiona...

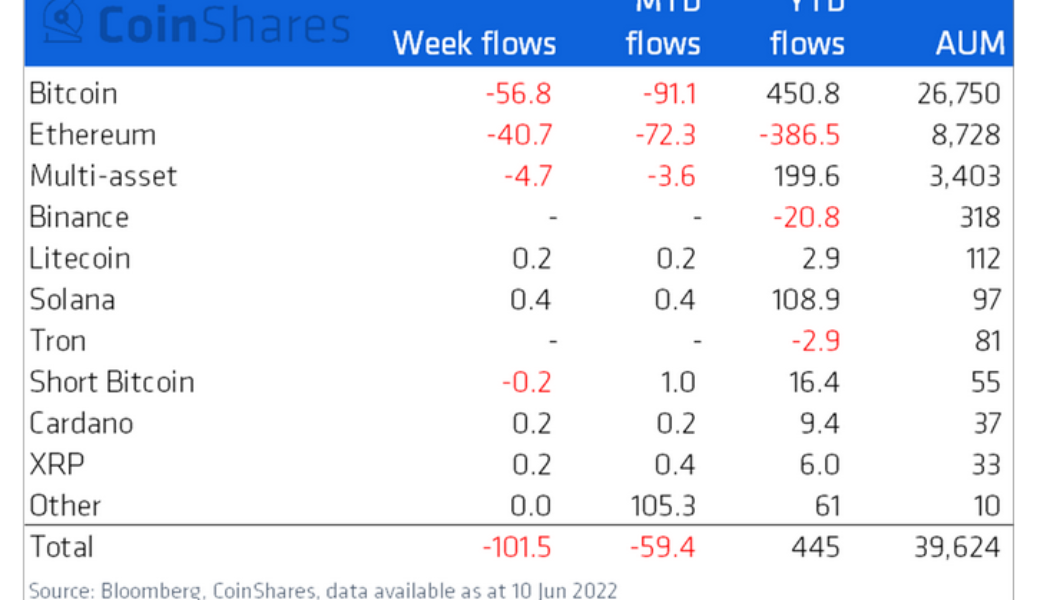

Almost $100M exits US crypto funds in anticipation of hawkish monetary policy

Institutional investors offloaded $101.5 million worth of digital asset products last week in ‘anticipation of hawkish monetary policy’ from the U.S. Federal Reserve according to CoinShares. U.S. inflation rates hit 8.6% year-on-year at the end of May, marking a return to levels not seen since 1981. As a result, the market is expecting the Fed to take considerable action to reel in inflation, with some traders pricing in three more 0.5% rate hikes by October. According to the latest edition of CoinShares’ weekly Digital Asset Fund Flows report, the outflows between June 6 and June 10 were primarily led by investors from the Americas at $98 million, while Europe accounted for just $2 million. Products offering exposure to crypto’s top two assets, Bitcoin (BTC) and Ethereum (ETH), accounted ...

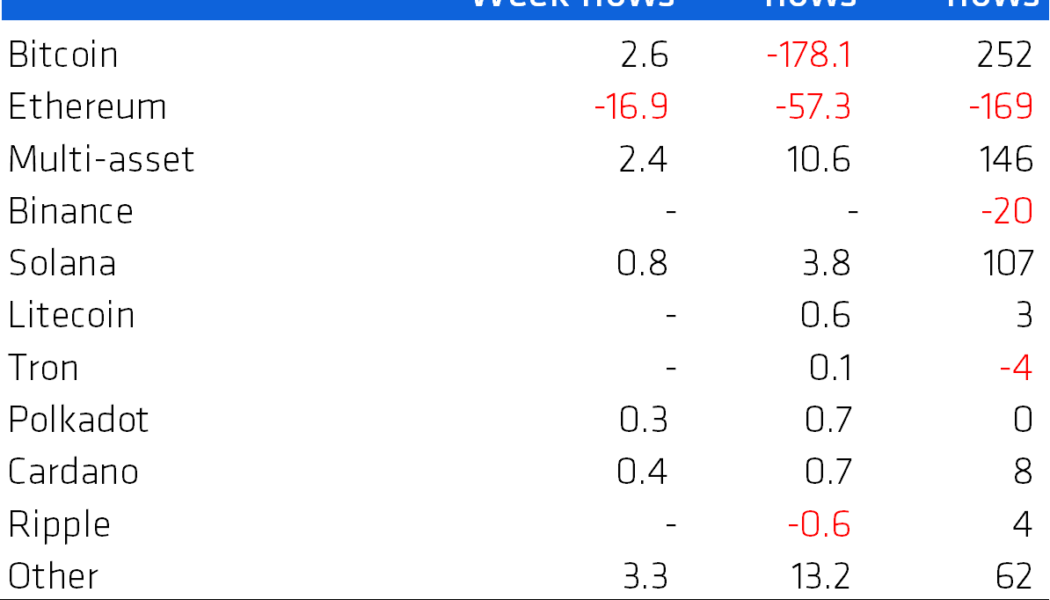

Institutional investment flows out of ETH and into competing L1 altcoins

Institutional investors have shifted their attention from Ethereum (ETH) to competing Layer 1 blockchains of late, with capital inflows for altcoin investment products increasing last week whilst Ether products posted outflows for the third week in a row. Data from CoinShares’ latest Digital Asset Fund Flows report shows that investors last week (ending April 22) loaded up on $3.5 million worth of Avalanche (AVAX), Solana (SOL), Terra (LUNA) and Algorand (ALGO) funds whilst capital outflows from Ether products totaled $16.9 million. It marks the third straight week that Ethereum products have seen outflows, bringing the total over that time to $59.3 million, equal to around 35% of the year-to-date outflows of $169 million from the second-largest blockchain. Notably, investors also favored ...

Crypto funds register largest weekly inflows since December

Inflows into cryptocurrency investment funds rose sharply last week, offering cautious optimism that investors are broadening their exposure to digital assets despite geopolitical uncertainty and monetary tightening from central banks. Digital asset investment products registered $127 million worth of cumulative inflows for the week ending March 6, according to CoinShares data. A CoinShares representative told Cointelegraph that this was the highest weekly inflows since Dec. 12, 2021. The increase was also significantly higher than the $36 million of inflows registered the previous week. Like in previous weeks, Bitcoin (BTC) products recorded the largest weekly inflows at $95 million. Bitcoin fund flows have increased for seven consecutive weeks. Ether (ETH) funds saw inflows totaling $25 ...

Green shoots? Institutional crypto funds see first inflows in 5 weeks

After five weeks of constant outflows, institutional investment is finally trickling back into crypto funds with BTC the asset of choice and ETH falling out of favor. In its weekly Digital Asset Fund Flows report published on Jan. 24, crypto investment firm CoinShares observed inflows for some institutional products. It is the first time in five weeks that there has been a net positive inflow as $14.4 million re-entered the space with investors buying the dip. The researchers reported that these inflows came during a period of significant price weakness, adding that this suggests investors “are seeing this as a buying opportunity” at current price levels. Capital continued to flow out from CoinShares own BTC fund, however, 21Shares and ProShares registered minor gains. Most of the inflows ...

- 1

- 2