contactless payments

How COVID-19 Has Driven a Cashless World Through Contactless Payments

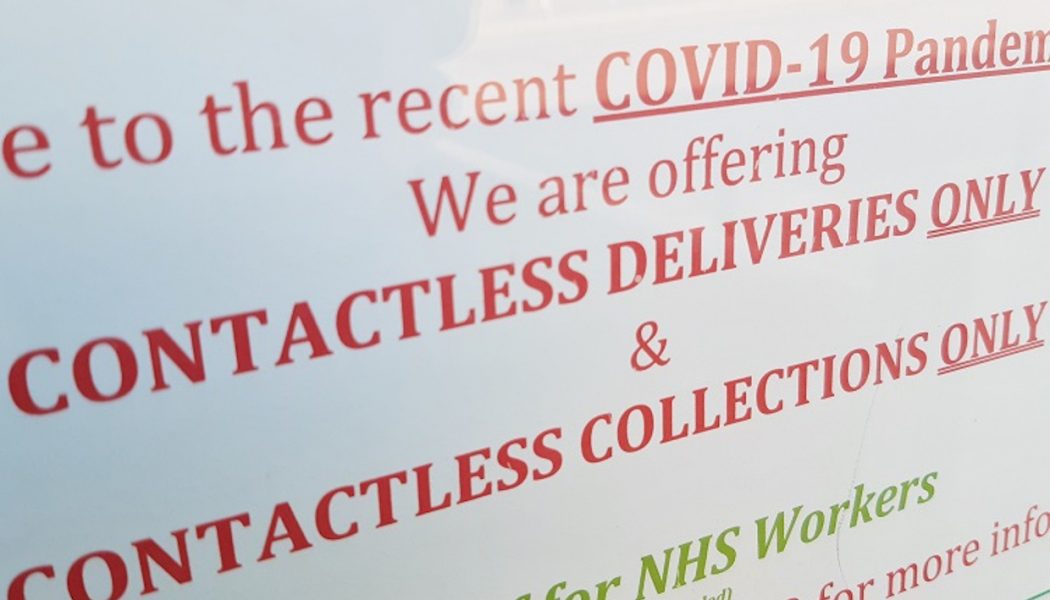

Image sourced from PYMNTS. /* custom css */ .tdi_4_560.td-a-rec-img{ text-align: left; }.tdi_4_560.td-a-rec-img img{ margin: 0 auto 0 0; } Driven by the COVID-19 pandemic, contactless payments have become the world’s preferred payment method. In addition to being safer from a viral transmission perspective, contactless payments are also faster, and integrating multiple contactless payment methods assists small businesses to better maintain financial liquidity. While choice in payment methods boosts Customer Experience (CX), we still have a way to go before South Africa fully embraces cashless payments. This will necessitate educating the population on card security and business owners on the benefits of contactless payments and the reduction of cash on hand. Formal vs Informal Trading /* c...

Firm restates commitment to enhance financial inclusion

Nigeria-based fintech solution, NowNow, has said that it will continue to upgrade its services to attune to current realities, such that will drive economic and social growth. Founder of NowNow, Sahir Berry, while speaking on how COVID-19 pandemic has disrupted the financial space recently, mentioned that Nigeria needs to strengthen its fintech space more than before. Berry stated that it was important for Nigeria to tap into the trends and prospects of fintech given the country’s large unbanked or underbanked. He added the company recognised this gap in Nigeria, which informed its investment in the space. “In 2017 we identified that one of the two big problems in Nigeria was lack of youth empowerment and financial inclusion. With a population of almost 100 million youths, we found that ac...

Cashless and Contactless Payments Beyond COVID-19

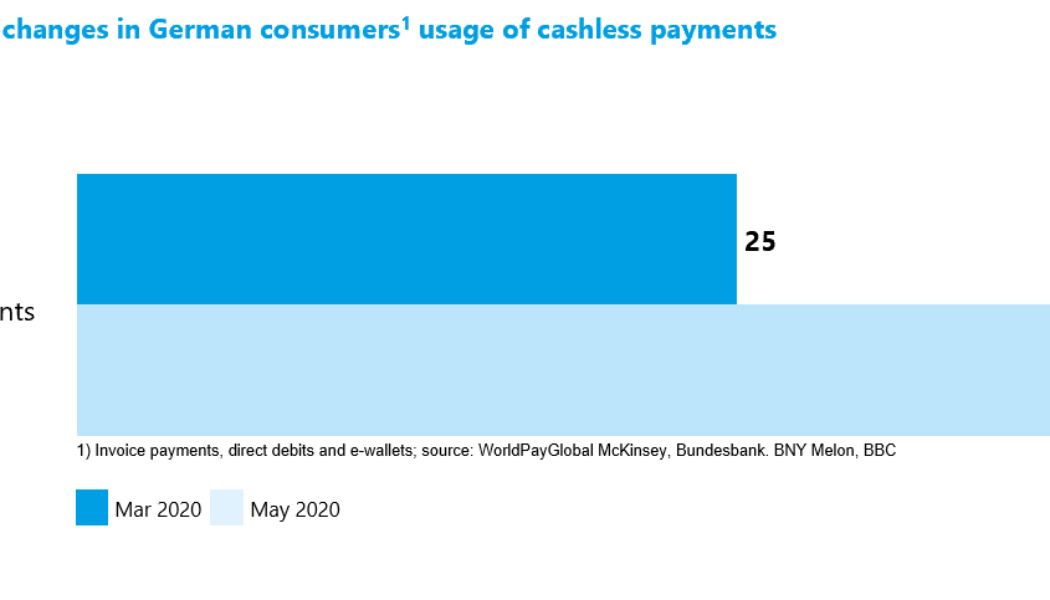

The emergence of COVID-19 has made the need for digitising payments more critical than ever before and for this to be a success, electronic payments need to offer similar benefits to those afforded by cash. Globally, economies are in various stages of development having either started developing, replaced or are busy replacing daily batch payment systems with real-time systems that execute payments in seconds with the flexibility to meet the needs of the future digital economy. The drive towards digital payments and lowering the reliance on cash is not new to South Africa’s payments market. There are several mechanisms already in place to enable this and banks, card companies, fintechs and retailers are all involved in rolling out digital, non-touch payment mechanisms. Contactless cards us...