crypto blog

Bitcoin profitability for long-term holders decline to 4-year low: Data

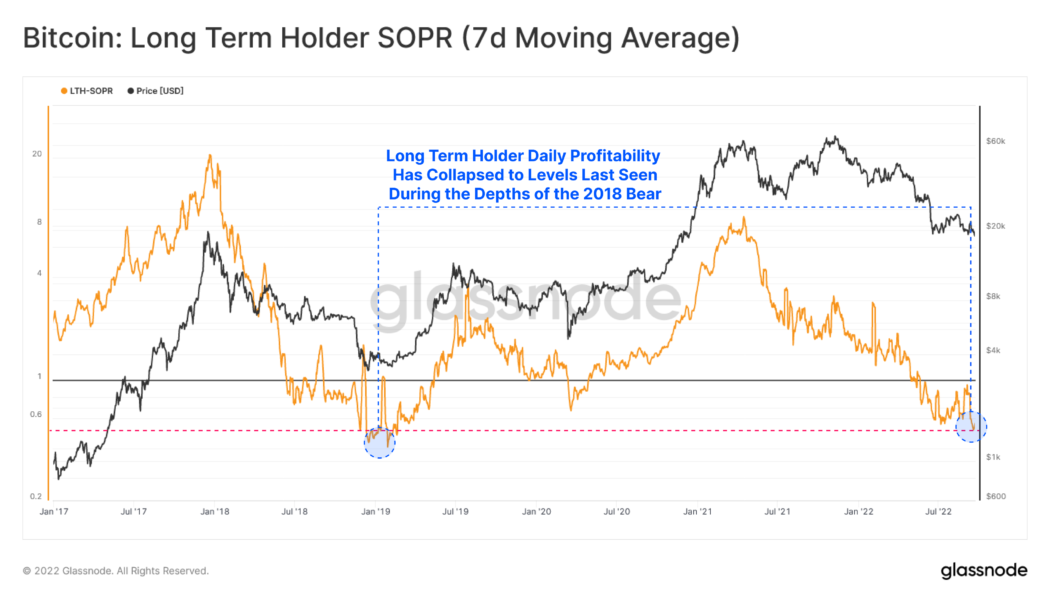

Bitcoin’s (BTC) long-term profitability has declined to levels last seen during the previous bear market in December 2018. According to data shared by crypto analytic firm Glassnode, BTC holders are selling their tokens at an average loss of 42%. Bitcoin long term holders. Source: Glassnode The Glassnode data indicate that long-term holders of the top cryptocurrency selling their tokens have a cost basis of $32,000, meaning the average buying price for these holders selling their stack is above $30,000. The current market downturn added to the declining profitability can be attributed to several macroeconomic factors. The BTC market still has a heavy correlation with the stock market, especially tech stocks, which are currently seeing an even bigger downtrend than crypto. The rising inflat...

Bitcoin sees first difficulty drop in 2 months as miners sell 8K BTC

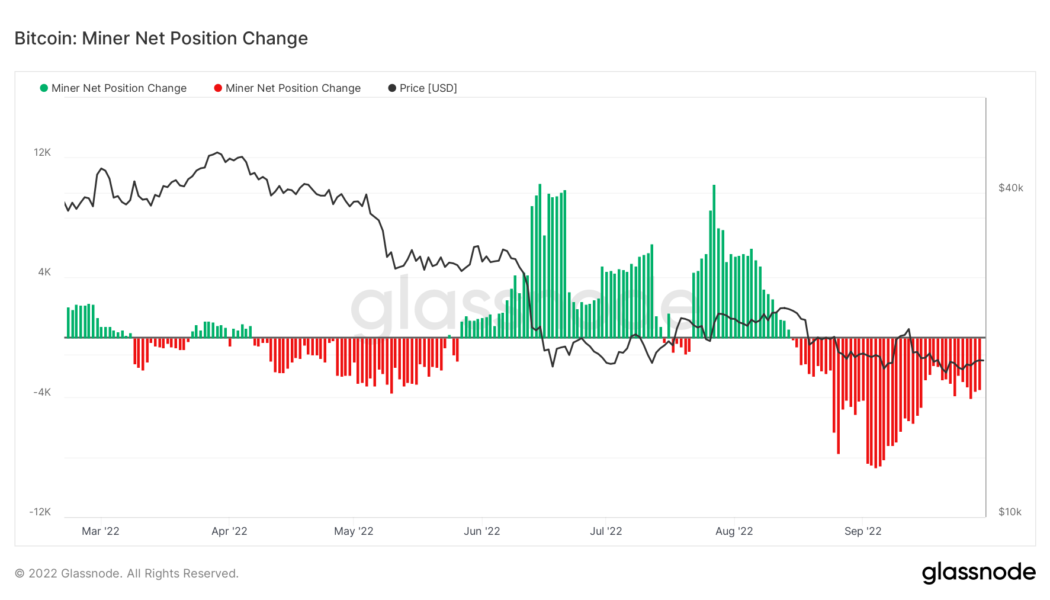

Bitcoin (BTC) miners remain under stress at current price levels as data shows large outflows from miner wallets returning. According to on-chain analytics firm Glassnode, monthly miner sales totaled up to around 8,000 BTC in September. Bitcoin miners see heavy sales In contrast to the June lows, when BTC/USD hit its current multi-year floor of $17,600, miners are currently selling considerable amounts of BTC. According to Glassnode, which tracks the 30-day change in miner balances, at the start of the month, miners were down a maximum 8,650 BTC over the month prior. Bitcoin miner net position change chart. Source: Glassnode While this subsequently reduced, taking into account changes in the BTC price, miners are still selling more than they earn on a rolling monthly basis. As of Sept. 29,...

DEX dev Uniswap Labs looks for new funding at unicorn valuation: Report

Major decentralized exchange (DEX) Uniswap is in the early stages of raising significant funds to further expand its decentralized finance (DeFi) offerings, according to a new report. Uniswap Labs, a DeFi startup contributing to the Uniswap Protocol, is engaging with a number of investors to raise an equity round of $100 million to $200 million, TechCrunch reported on Sept. 30. The startup is working with investors like Polychain and one of Singapore’s sovereign funds as part of the upcoming funding round, the report notes, citing two anonymous people familiar with the matter. According to the report, Uniswap would be valued at $1 billion, but the terms of the deal are subject to changes as the discussions around the round have not been finalized. The new funding reportedly aims to bring m...

Mainstream media sentiment shifts in favor of Bitcoin amid fiat currency woes

Despite USD bringing an onslaught to stocks, commodities and its rival currencies, BTC holds steady at the $19,000 to $20,000 mark, leaving mainstream media no choice but to put BTC into the headlines. American daily newspaper The New York Times highlighted BTC’s 6.5% increase in the last seven days and noted that this had caught the attention of crypto bulls and bears. Meanwhile, Fortune Magazine’s crypto outlet has also compared Bitcoin’s standout performance to other assets like the Japanese yen, Chinese yuan and gold, apart from the euro and pound. With fiat currencies like the euro and the Great British pound sterling failing to hold their ground against the United States dollar (USD), mainstream media outlets have started to put Bitcoin (BTC) into the spotlight for its st...

‘I’ve done nothing wrong’ — Lark Davis denies ‘pump-and-dump’ allegations

Crypto influencer Lark Davis has refuted new allegations from Twitter “on-chain sleuth” ZachXBT of shilling “low cap projects” to his audience “just to dump them shortly after.” Davis was responding to a Twitter thread posted by Zach on Sept. 29, containing allegations that he profited over $1.2 million through selling tokens from crypto projects which he was allegedly paid to promote without disclosing. In a 17-part thread, Zach pointed to eight examples of what is supposedly Davis’ crypto wallet receiving tokens from new crypto projects, with Davis subsequently tweeting or posting a video on them, and then selling the tokens shortly after. Speaking to Cointelegraph, Zach said he received requests from multiple people who lost money on the tokens shared by Davis asking to “take a closer l...

Texas, Vermont regulators object to Celsius stablecoin sale plan

State regulators from Texas and Vermont have filed a motion objecting to embattled crypto lender Celsius’ plans to sell off its stablecoin holdings. Separate motions from both regulators filed on Sept. 29 argue that there’s a risk the firm could use the capital to resume operating in violation of state laws. The filings come after a Sept. 15 notice from Celsius’ legal team asking the United States Bankruptcy Court for the Southern District of New York for permission to sell its stablecoin holdings, reportedly worth around $23 million. A hearing to accept or decline the motion will occur on Oct. 6. However, the move has not gone down well with the Texas State Securities Board (SBB), the Texas Department of Banking, and the Vermont Department of Financial Regulation, who filed obj...

BlackRock’s newest ETF invests in 35 blockchain-related companies

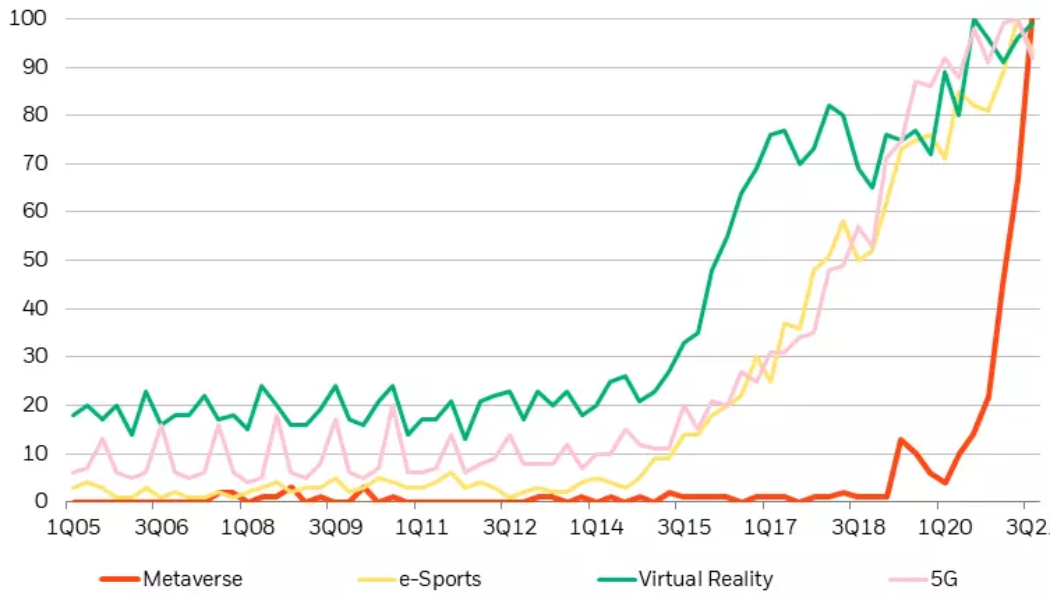

BlackRock, the world’s largest asset manager, has just launched a new exchange-traded fund (ETF) providing European customers with exposure to the blockchain industry, while reports indicate a Metaverse-focused ETF may be on the way. The new blockchain ETF launched on Sept. 27 is called the iShares Blockchain Technology UCITS ETF (BLKC). BlackRock said 75% of its holdings consist of blockchain companies such as miners and exchanges, while the other 25% are companies that support the blockchain ecosystem. The fund includes 35 global companies out of a total of 50 holdings, which also includes fiat cash and derivatives, but does not directly invest in cryptocurrencies. BLKC marks the latest of a series of moves into the digital assets space for BlackRock, with the m...

Researchers allege Bitcoin’s climate impact closer to ‘digital crude’ than gold

The Bitcoin (BTC) bashing has continued unabated even in the depths of a bear market with more research questioning its energy usage and impact on the environment. The latest paper by researchers at the department of economics at the University of New Mexico, published on Sept. 29, alleges that from a climate-damage perspective, Bitcoin operates more like “digital crude” than “digital gold.” The research attempts to estimate the energy-related climate damage caused by proof-of-work Bitcoin mining and make comparisons to other industries. It alleges that between 2016 and 2021, on average each $1 in BTC market value created was responsible for $0.35 in global “climate damages,” adding: “Which as a share of market value is in the range between beef production and crude oil burned as gasoline,...

US lawmaker hints at calling for Republican votes in 2022 midterms over crypto policies

North Carolina Representative Patrick McHenry may have used his virtual appearance at a cryptocurrency conference as a soapbox to call for votes in the 2022 United States midterm elections. In a prerecorded message for the attendees of the Converge22 conference in San Francisco on Sept. 29, McHenry suggested that the goal of a “clear regulatory framework” for digital assets could drive U.S. lawmakers to develop legislation. The Republican lawmaker used terms including “bipartisan consensus” and support from both major political parties over certain regulatory frameworks related to digital assets and stablecoins before seemingly encouraging crypto users to vote red in the next election. “To ensure that these technologies flourish here in the United States, we need to provide regulatory clar...

Why this tiny country is adopting the Bitcoin Lightning Network

Cointelegraph reporter Joe Hall visited the country of Gibraltar to explore Bitcoin (BTC) adoption on “The Rock,” as the peninsula is known locally, and how the adoption of Bitcoin for shopping in the territory is impacting business. The visit was also an opportunity to visit Xapo Bank, the world’s first private financial institution to combine traditional banking with Bitcoin. Coinbase acquired its custody business in 2019, making the American exchange the largest crypto custodian in the world. The British Overseas Territory of Gibraltar is known for its pioneering crypto regulations, support for blockchain development and Bitcoin adoption, with many retail businesses using the Lightning Network — a layer-two network that enables off-chain transactions — to accept Bitcoin as payment...

Crypto Market Integrity Coalition inducts 8 new members, plans training

The Crypto Market Integrity Coalition (CMIC) announced the induction of eight new members, the organization announced on Sept. 29. The organization, which now has 38 members who have all taken a pledge to uphold market integrity and efficiency, describes itself as such: “CMIC […] gives a unified voice to the crypto industry’s commitment to continually improving market integrity and collaboration with regulators.” According to its statement, CMIC is also developing market integrity training for digital asset markets to help compliance professionals counter manipulation. The new CMIC members are digital asset trust and security company BitGo, crypto exchange Bittrex, blockchain analytics platform Crystal Blockchain, fintech firms FinClusive and Oasis Pro Markets, Web3 risk mitigation p...

Judge orders SEC to turn Hinman documents over to Ripple Labs after months of dispute

Ripple Labs scored a victory in its continuing legal battle with the United States Securities and Exchange Commission (SEC) on Sept. 29 as U.S. District Court judge Analisa Torres ruled to release the documents written by former SEC corporation finance division director William Hinman. The documents predominantly relate to a speech Hinman delivered at the Yahoo Finance All Markets Summit in June 2018. Hinman stated in his speech that Ether (ETH) was not a security. Ripple Labs considers the speech a key piece of evidence the case the SEC has brought against it alleging sales of Ripple’s XRP violated U.S. securities laws — though time has yet to tell whether it will be as meaningful as the company suggests. The circumstances surrounding the speech and Hinman’s actions leading up to it...