crypto blog

Cross-chain bridge RenBridge laundered $540M in hacking proceeds: Elliptic

Cross-chain bridges have been the target of more than a few hacks this year, but new data from blockchain analytics provider Elliptic alleges one has been used to launder over half a billion dollars in ill-gotten crypto assets. According to an Aug. 10 report, crypto bridge RenBridge has facilitated the laundering of at least $540 million in proceeds of crime since 2020 through a process known as chain hopping — converting one form of cryptocurrency into another and moving it across multiple blockchains. Elliptic said that decentralized cross-chain bridges provide “an unregulated alternative to exchanges for transferring value between blockchains.” Rogue states and hacker groups For the most part, cross-chain bridges or blockchain bridges are used for legitimate purposes, en...

Decentralized apps on Polygon hit 37,000, rocketing 400% this year

The number of decentralized applications (DApps) on Ethereum-scaling-platform Polygon has topped 37,000, marking a 400% increase since the start of 2022. The Polygon team shared the figures via an Aug. 10 blog post, which was sourced from partnered Web3 development platform Alchemy, noting that the figure represents the cumulative number of applications ever launched on both the testnet and mainnet. It also noted that the number of monthly active teams — a measure of developer activity on a blockchain — reached 11,800 at the end of July, up a whopping 47.5% from March. The project team also highlighted a breakdown of dApp projects which notably showed that “74% of teams integrated exclusively on Polygon, while 26% deployed on both Polygon and Ethereum.” Polygon’s EVM compatible ...

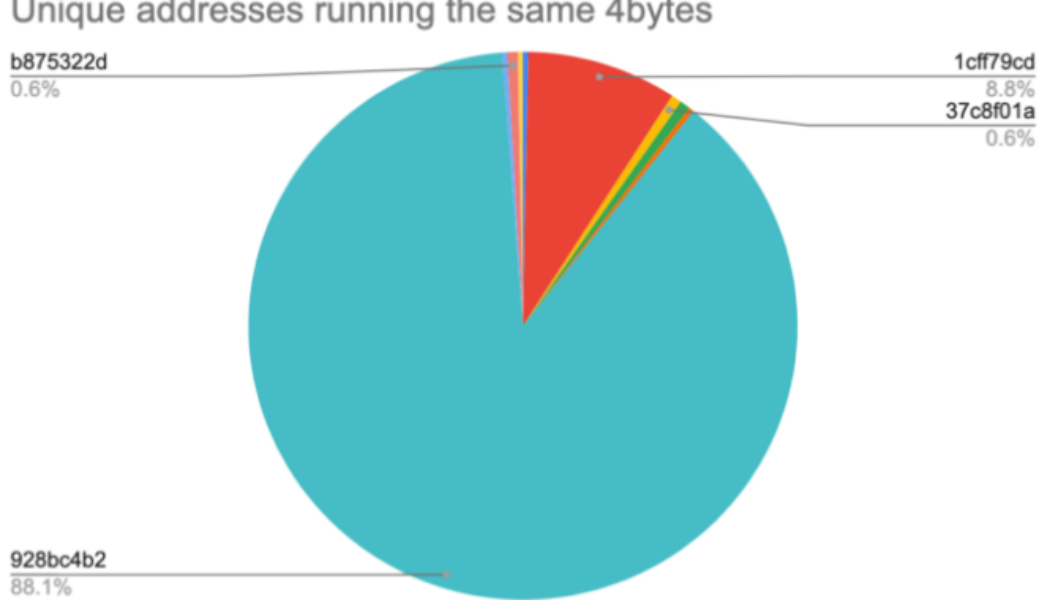

88% of Nomad Bridge exploiters were ‘copycats’ — Report

Close to 90% of addresses taking part in the $186 million Nomad Bridge hack last week have been identified as “copycats,” making off with a total of $88 million worth of tokens on Aug. 1, a new report has revealed. In an Aug. 10 Coinbase blog, authored by Peter Kacherginsky, Coinbase’s principal blockchain threat intelligence researcher, and Heidi Wilder, a senior associate of the special investigations team, the pair confirmed what many had suspected during the bridge hack on Aug. 1 — that once the initial hackers figured out how to extract funds, hundreds of “copycats” joined the party. Source: Coinbase According to the security researchers, the “copycat” method was a variation of the original exploit, which used a loophole in Nomad’s smart contract, allowing users to extract...

Crypto exchange Hotbit says it froze customer funds due to alleged criminal ties of formal employee

On Thursday, cryptocurrency exchange Hotbit said it “suspended trading, deposit, withdrawal and funding functions,” with no timeframe for resumption. In explaining the decision, Hotbit stated: “A former Hotbit management employee who left in April this year was, unbeknownst to Hotbit, involved in a project in 2021 that law enforcement authorities now think is suspected of violating criminal laws. As a result, a number of Hotbit senior managers have been subpoenaed by law enforcement since the end of July and are assisting in the investigation. Furthermore, law enforcement has frozen some funds of Hotbit, which has prevented Hotbit from running normally.” The firm further claims that the remainder of its employees are not involved in the project and possess no knowle...

SBI Group reports investee getting CFTC approval for OTC derivatives trading in US

The United States subsidiary of electronic trading platform developer Clear Markets has reportedly received approval from the Commodity Futures Trading Commission, or CFTC, to offer over-the-counter crypto derivatives products with physical settlement. In a Tuesday notice, SBI Holdings — a stakeholder of Clear Markets — said the CFTC had approved the U.S. subsidiary operating a Swap Execution Facility, in which it plans to offer derivatives trading for U.S. dollar and Bitcoin (BTC) pairs. The Japan-based financial services company said its market maker planned to expand its trading partners in the United States following pilot transactions on Clear Markets. SBI Holdings announced it had acquired a 12% stake in Clear Markets in August 2018, which it planned to increase in the future. At the...

Wealth managers and VCs are helping drive institutional crypto adoption — Wave Financial execs

Two executives at Wave Financial, an asset management firm providing bespoke strategies to high-net-worth individuals and entities, have reported seeing increased institutional demand for crypto products amid the bear market. Speaking to Cointelegraph at the Blockchain Futurist Conference in Toronto on Wednesday, Wave Financial’s head of business development Mike Jones said institutional investment in crypto could be driven by the high end of wealth management firms including Morgan Stanley, Merrill Lynch and Goldman Sachs looking for ways to allow their clients to get exposure to the space. Jones cited the example of BlackRock partnering with Coinbase on Aug. 4, a move that will give users of the asset manager’s institutional investment management platform Aladdin access to crypto trading...

TORN price sinks 45% after U.S. Treasury sanctions Tornado Cash — Rebound ahead?

Tornado Cash (TORN) has lost almost half its market valuation two days after being slapped with sanctions by the U.S. Treasury Department. The department accused Tornado Cash, a crypto mixer platform, of laundering more than $7 billion in cryptocurrencies, including a stash of $455 million allegedly stolen by North Korea-based hackers. Immediate reactions were followed by U.S.-based crypto companies, including Circle and Coinbase. In a controversial move, the popular crypto firms blocked the movements of their jointly-issued stablecoin USDC tied to Tornado Cash’s blacklisted smart contracts. TORN price drops 45% The news prompted traders to limit their exposure to TORN, Tornado Cash’s native token. On the daily chart, TORN’s price has slipped by approximately 45...

Blockchain’s environmental impact and how it can be used for carbon removal

Climate change has become an important issue over the years due to concerns over environmental changes caused by the emission of greenhouse gasses into the atmosphere. Conversations have even reached the crypto space, and blockchain technology is being considered a potential tool to reduce carbon emissions. Cryptocurrencies like Bitcoin (BTC) and Ether (ETH) that use the proof-of-work (PoW) mining algorithm have come under scrutiny due to their alleged energy expenditure. To see where this scrutiny comes from, it first needs to be known how much energy is used when mining PoW cryptocurrencies. Unfortunately, estimating the amount of energy necessary to mine Bitcoin and other PoW cryptocurrencies cannot be calculated directly. Instead, it can be estimated by looking at the network’s ha...

Curve Finance exploit: Experts dissect what went wrong

Decentralized finance protocols continue to be targeted by hackers, with Curve Finance becoming the latest platform to be compromised after a domain name system (DNS) hijacking incident. The automated market maker warned users not to use the front end of its website on Tuesday after the incident was flagged online by a number of members of the wider cryptocurrency community. While the exact attack mechanism is still under investigation, the consensus is that attackers managed to clone the Curve Finance website and rerouted the DNS server to the fake page. Users who attempted to make use of the platform then had their funds drained to a pool operated by the attackers. Curve Finance managed to remedy the situation in a timely fashion, but attackers still managed to siphon what was origi...

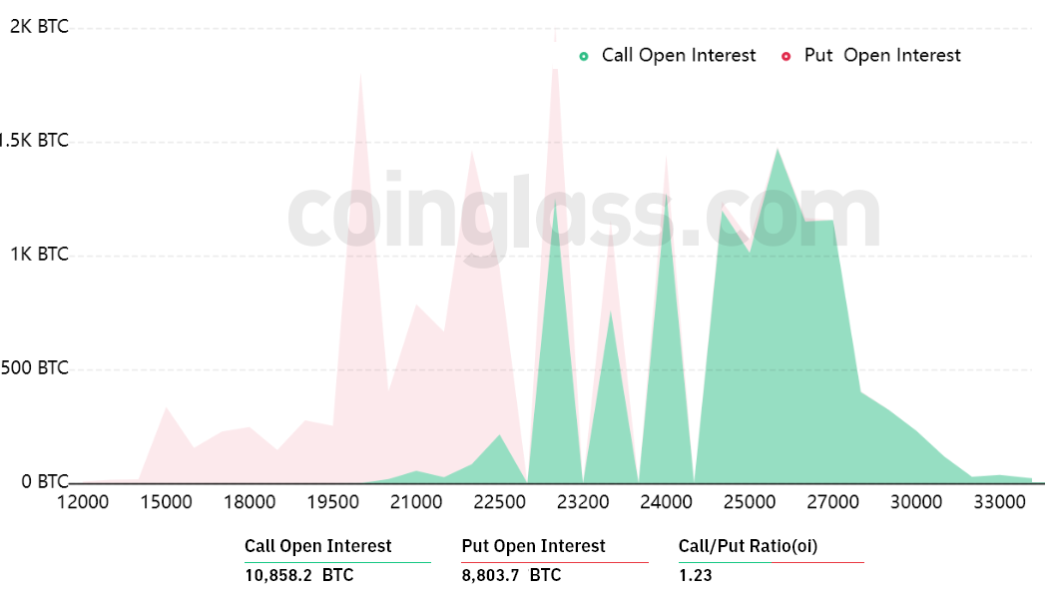

Bitcoin price sees $24K, Ethereum hits 2-month high as US inflation shrinks

Bitcoin (BTC) regained $24,000 but failed to hit new multi-month highs on Aug. 10 as United States inflation appeared to be slowing. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView CPI cuts risk assets much-needed slack Data from Cointelegraph Markets Pro and TradingView confirmed hourly gains of around $1,000 after U.S. Consumer Price Index (CPI) data for July showed a slowdown versus the previous month. While managing $24,179 on Bitstamp, BTC/USD nonetheless did not attract enough momentum to challenge levels from the day prior. Nonetheless, relief among traders was palpable, as declining inflation should signal to the Federal Reserve that less aggressive interest rate hikes are necessary going forward. This, in turn, should reduce pressure on risk assets, includin...

Coinbase posts $1.1B loss in Q2 on ‘fast and furious’ crypto downturn

Crypto exchange giant Coinbase has cited a “fast and furious” downturn of the crypto markets as the reasons behind a staggering $1.1 billion net loss in the second quarter of 2022, which also saw trading volume and transaction revenue tumbling. It’s the second consecutive quarter of loss for the crypto company and the largest loss since its listing on the Nasdaq Stock Exchange (Nasdaq) in April 2021. The results, which also missed analyst expectations, were shared in a Q2 2022 Shareholder Letter from Coinbase on Aug. 9, stating: “The current downturn came fast and furious, and we are seeing customer behavior mirror that of past down markets.” Coinbase said that Q2 was a “tough quarter” with trading volume falling 30% and transaction revenue down 35% seque...