crypto blog

Bitcoin struggles to flip $24K to support, but data shows pro traders stacking sats

Bitcoin (BTC) rallied on the back of the United States Federal Reserve’s decision to hike interest rates on July 27. Investors interpreted Federal Reserve chairman Jeremy Powell’s statement as more dovish than the previous FOMC committee meeting, suggesting that the worst moment of tight economic policies is behind us. Another positive news for risk assets came from the U.S. personal consumption expenditures price (PCE) index, which rose 6.8% in June. The move was the biggest since January 1982, reducing incentives for fixed income investments. The Federal Reserve focuses on the PCE due to its broader measure of inflation pressures, measuring the price changes of goods and services consumed by the general public. Additional positive news came from Amazon after the e-commerce giant re...

CoinFLEX announces staff cuts as part of measures to reduce costs by up to 60%

Cryptocurrency exchange CoinFLEX said it had downsized a “significant number” of team members in an effort to cut operating costs. According to a Friday blog post, CoinFLEX said it had cut some staff across “all departments and geographies” as part of measures to reduce the company’s costs by 50% to 60%. The majority of the remaining team members will focus on product and technology, and the exchange said it would consider scaling as “volume comes back.” “The intention is to remain right-sized for any entity considering a potential acquisition of or partnership opportunity with CoinFLEX,” said the exchange. On Saturday, CoinFLEX halted withdrawals after an unnamed party reportedly failed to meet a $47 million margin call. CEO Mark Lamb later took to Twitter to confirm rumors that CoinFLEX ...

Will the Bitcoin mining industry collapse? Analysts explain why crisis is really opportunity

Bitcoin mining involves a delicate balance between multiple moving parts. Miners already have to face capital and operational costs, unexpected repairs, product shipping delays and unexpected regulation that can vary from country to country — and in the case of the United States, from state to state. On top of that, they also had to contend with Bitcoin’s precipitous drop from $69,000 to $17,600. Despite BTC price being 65% down from its all-time high, the general consensus among miners is to keep calm and carry on by just stacking sats, but that doesn’t mean the market has reached a bottom just yet. In an exclusive Bitcoin miners panel hosted by Cointelegraph, Luxor CEO Nick Hansen said, “There’s going to definitely be a capital crunch in publicly listed companies or at least ...

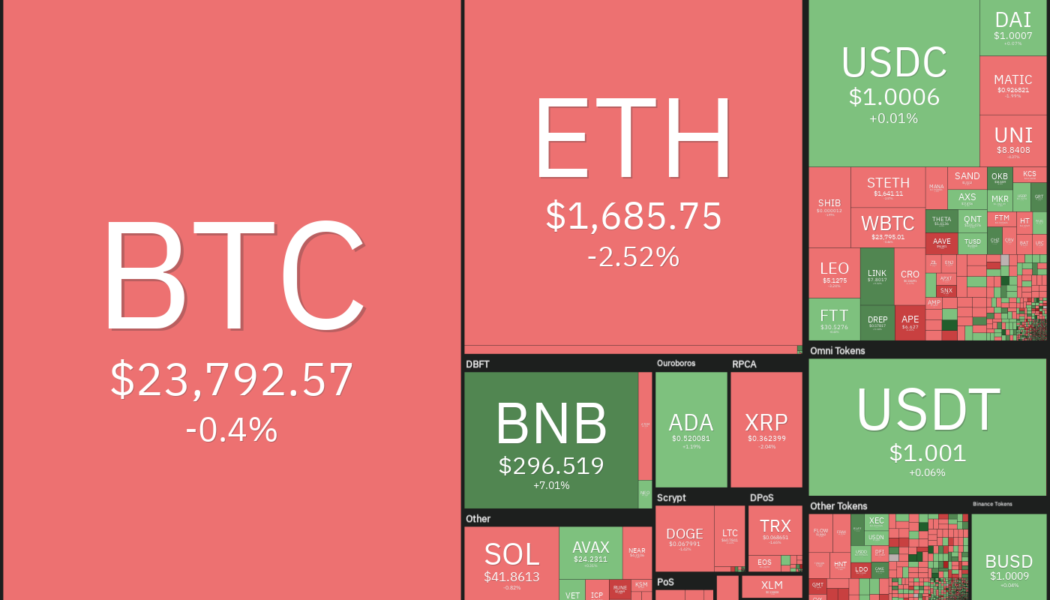

Price analysis 7/29: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

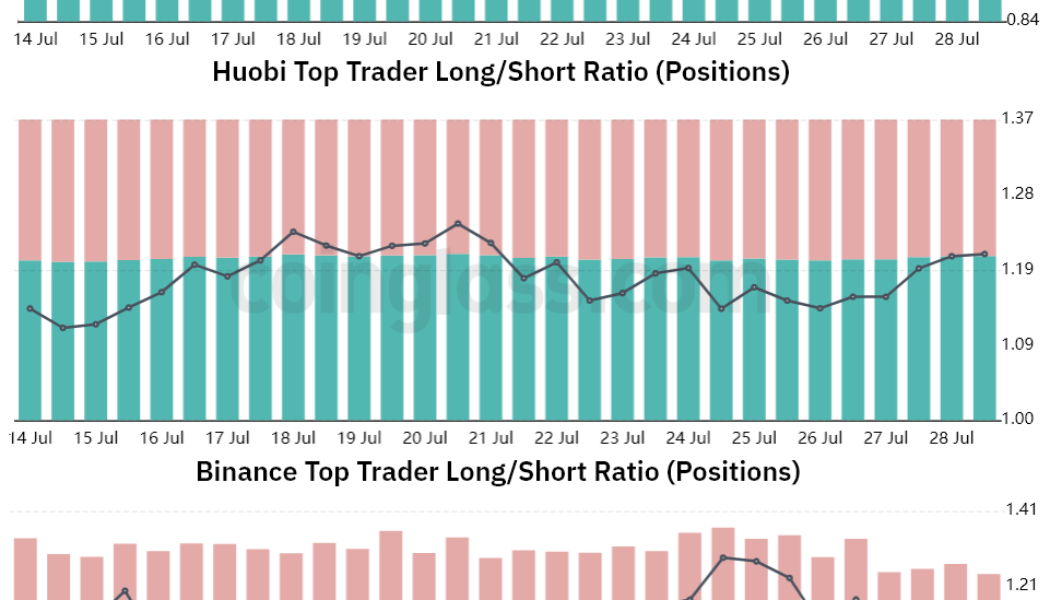

Bitcoin (BTC) hit a six-week high above $24,000 on July 29, extending its rally that picked up momentum after the United States Federal Reserve hiked rates by 75 basis points on July 27. If the rally sustains for the next two days, Bitcoin could be on target to close the month of July with gains of more than 20%, according to data from Coinglass. It is not only the crypto markets that have seen a post-Federal Open Market Committee (FOMC) rally. The U.S. equities markets are on track for big monthly gains in July. The S&P 500 and the Nasdaq Composite are up about 8.8% and 12% in July, on track to their best monthly gains since November 2020. Daily cryptocurrency market performance. Source: Coin360 The crypto and equities markets have risen in the expectation that the pace of rate hikes ...

Crypto Biz: Elon Musk: The ultimate crypto tourist

Elon Musk’s Tesla proved to be the ultimate paper hands after the electric vehicle maker sold 75% of its Bitcoin (BTC) holdings in the second quarter. I say, good riddance. The cult of personality isn’t good for Bitcoin, and neither is a technologist who treats the asset as his plaything. As far as we are aware, Musk hasn’t sold any of his personal Bitcoin stash and Tesla still has an estimated 10,800 BTC on its books. Still, the less we have to hear about Musk and Bitcoin, the better. In this week’s Crypto Biz, we chronicle Tesla’s sale of BTC, KuCoin’s fight against fake news and Cathie Wood’s sale of Coinbase stock. Tesla reports $64M profit from Bitcoin sale Tesla’s decision to sell most of its Bitcoin wasn’t as boneheaded as it appeared at first. The company scored a $64 million...

Chips bill provides for blockchain specialist position in White House science office

The United States House of Representatives passed the Chips and Science Act on Thursday by a vote of 243 to 187. The bill, which was introduced into the Senate over a year ago, provides grants and incentives to the semiconductor industry and encourages research. It also creates a blockchain and cryptocurrency specialist position in the White House Office of Science and Technology Policy (OSTP). The bill passed the Senate on Wednesday. It has an overall price tag of $280 billion, which includes $52 billion in grants and incentives for U.S. semiconductor manufacturers who face fierce competition from China, and $170 billion in incentives for research. It is expected to contribute to the easing of supply chain issues in the industry as well. ️ Good news from DC: the Chips Bill just app...

Deposits at non-bank entities, including crypto firms, are not insured — FDIC

The United States Federal Deposit Insurance Corporation, or FDIC, has issued an advisory informing the public it “does not insure assets issued by non-bank entities, such as crypto companies.” In a Friday notice, the FDIC advised banks in the U.S. that they needed to assess and manage risks in third-party relationships with crypto firms. The government agency said that while deposits at insured banks were covered for up to $250,000, no such protections applied “against the default, insolvency, or bankruptcy of any non-bank entity, including crypto custodians, exchanges, brokers, wallet providers, or other entities that appear to mimic banks.” “Some crypto companies have misrepresented to consumers that crypto products are eligible for FDIC deposit insurance coverage or that customers are F...

Semantics? Analysts unpack ‘technical recession’ as crypto markets recover

Data from the United States commerce department suggests America has entered a technical recession, but market analysts have highlighted key metrics that suggest investors are optimistic. The American economy shrunk for the second consecutive quarter, according to government data released on July 28, fitting the criteria for a technical recession. The Biden Administration maintains that the U.S. is not in a recession, highlighting low unemployment rates and other metrics that counter the argument. Mati Greenspan, founder & CEO of Quantum Economics, addressed the topic in his latest QE newsletter, noting a paradoxical effect between the GDP drop and a surge in stocks and other risk assets. He attributed this move to the US Federal Reserve’s decision to raise interest rates by 0.75%, whi...

What happens when 21 million Bitcoin are fully mined? Expert answers

When the last Bitcoin (BTC) is finally mined, the livelihood of miners who rely on block rewards as a source of income will be affected. Despite this, the future of mining stays promising, according to an expert in space. In a Cointelegraph interview, Mohamed El Masri, the founder of mining solutions provider PermianChain, talked about new players jumping into mining, the future of mining and what happens to mine profitability after the 21 millionth BTC is minted. El Masri highlighted that efficiency is a very important focus that new players in the space must take into consideration. Because mining profit depends on how efficient a mining operation is, the executive noted that efficiency brings down the cost of energy to a minimum. [embedded content] When asked about the future of t...

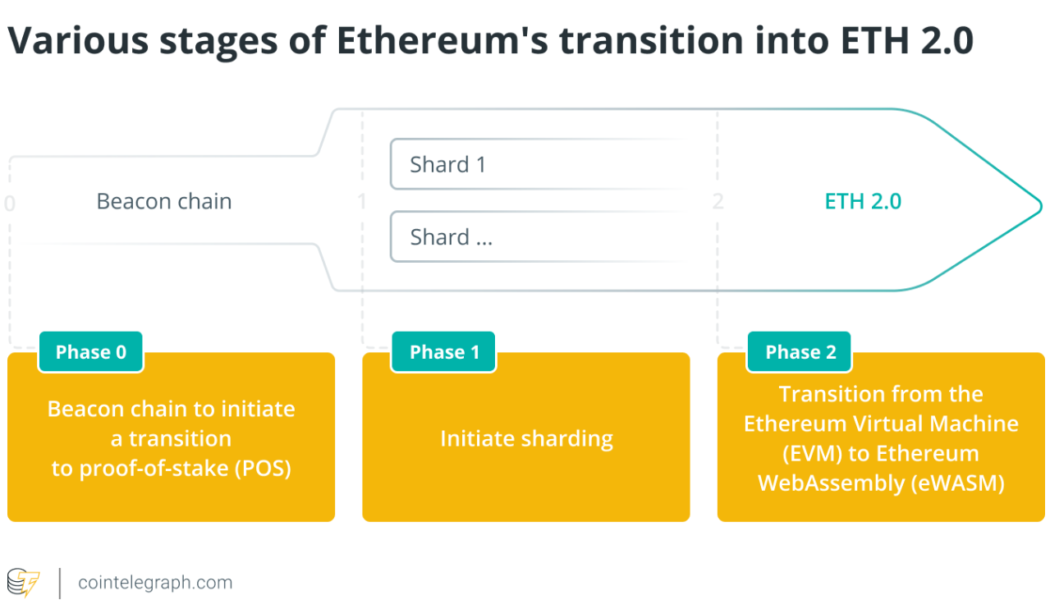

Ethereum Merge: How will the PoS transition impact the ETH ecosystem?

The Ethereum blockchain is on the verge of one of the most crucial technical updates since its inception, moving from proof-of-work (PoW) to proof-of-stake (PoS), also called Ethereum 2.0, or Eth2. Ethereum devs gave Sept. 19 as the perpetual date for the merger of the current PoW chain to the PoS chain. The Merge is expected to be deployed on the Goerli testnet in the second week of August. After the successful integration of the Goerli testnet, the blockchain will initiate the Bellatrix update in early August and roll out the Merge two weeks later. The discussion around the transition began with a focus on scalability, so Ethereum developers proposed a three-phase transformation process. The transition itself is nearly two years in the making, starting on December 1, 2020, with the...

New social apps want to help Bitcoiners connect in real life

Finding real love starts with Bitcoin (BTC). That’s according to the founders of Bitcoiner dating service The Orange Pill App and LoveisBitcoin. The services join a growing list of ways in which Bitcoin enthusiasts can meet, chat and now fall in love “IRL” (in real life.) But first, why do people who love Bitcoin need to connect with others who are “orange-pilled?” For George Saoulidis, cofounder of LoveisBitcoin, Bitcoiners need a dating service because money shapes our lives more than we realize: “Issues can and do arise if time preferences diverge a lot. Part of the orange-pilling process makes you see through the marketing and the propaganda to distinguish what is truly valuable: Experiences, family, friendships.” Part of the Bitcoin ethos is having a lower time preference, and not suc...

Solana Spaces store to bring 100K people to Solana per month — CEO Vibhu Norby

Solana Spaces CEO Vibhu Norby said the new physical Solana stores will introduce up to 100,000 people per month to the Solana ecosystem, while also signalling plans to open a virtual storefront in the near future. Utilizing a grant from the Solana Foundation, the first Solana Spaces shop opened in the swanky Hudson Yards New York shopping center on July 28. Addressing the community in a impromptu Twitter AMA on launch day, Norby explained the store is meant to teach new users about how to use Dapps, and noted that it would be introducing thousands of people into the Solana blockchain. “I don’t think people realize this but we’re going to bring 50 to 100,000 people into Solana every month through these stores — and that’s just this year.” Speaking to Cointelegraph in a phone interview...