crypto blog

Bitcoin lurks by $22K as US dollar falls from peak, Ethereum gains 20%

Bitcoin (BTC) hugged $22,000 on July 19 as macro conditions slowly turned to favor risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks, crypto rise as dollar weakens Data from Cointelegraph Markets Pro and TradingView showed BTC/USD cooling volatility immediately below the crucial 200-week moving average (WMA). The Wall Street open saw further gains for United States equities in the face of a declining U.S. dollar, which extended its retracement after hitting its latest two-decade peak. The U.S. dollar index (DXY) stood at around 106.5 at the time of writing, down 2.6% from the high seen July 14. For Bitcoin analysts, it was thus a case of wait and see as markets bided their time between buy and sell levels. $BTC / $USD – Update These are the op...

Technicals suggest Bitcoin is still far from ideal for daily payments

It is no secret that a vast majority of investors, both from the realm of traditional as well as crypto finance, view Bitcoin (BTC) as a long-term store of value akin to “digital gold.” And, while that may be the dominant narrative surrounding the asset, it is worth noting that in recent years the flagship crypto’s use as a medium of exchange has been on the rise. To this point, recently, the central bank of El Salvador revealed that its citizens living abroad have sent over $50 million in remittances to their friends and family. To elaborate, Douglas Rodríguez, president of El Salvador’s Central Reserve Bank, announced that $52 million worth of BTC remittances had been processed via the country’s national digital wallet service Chivo through the first five months of the year alone, markin...

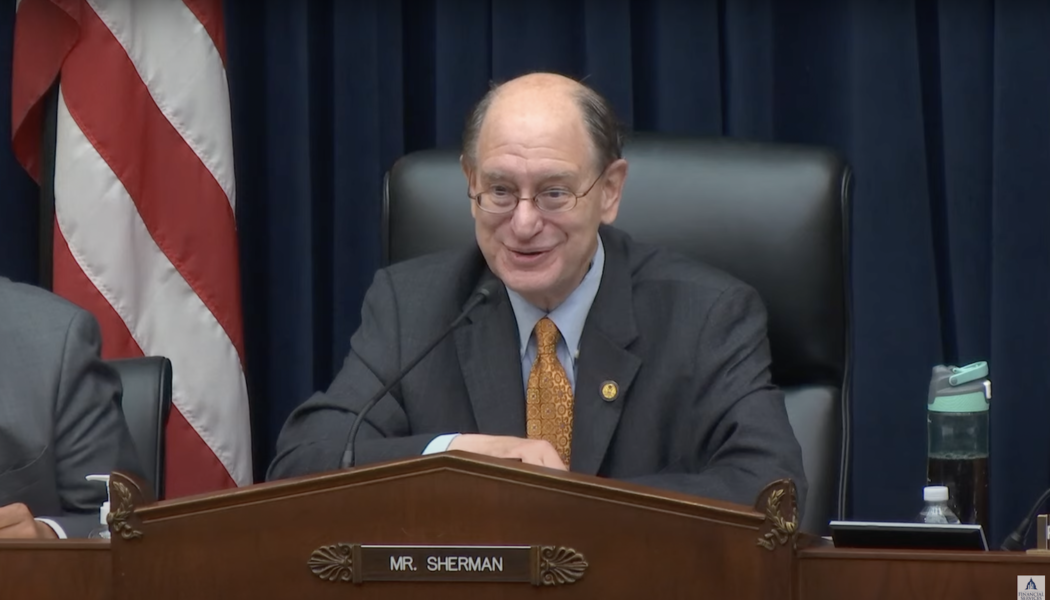

US lawmaker criticizes SEC enforcement director for not going after ‘big fish’ crypto exchanges

Brad Sherman, the congressperson who previously called for banning cryptocurrencies in the United States, criticized the Securities and Exchange Commission’s (SEC) approach to enforcement among major crypto exchanges. In a Tuesday hearing before the House Committee on Financial Services, Sherman said SEC enforcement director Gurbir Grewal needed to show “fortitude and courage” when pursuing securities cases against cryptocurrency exchanges in the United States. The lawmaker added that the SEC enforcement division had “gone after” XRP as a security, but not the crypto exchanges that processed “tens of thousands” transactions of the token. “If XRP is a security — and you think it is, and I think it is, why are these crypto exchanges not in violation of law and is it enough that the crypto ex...

artèQ (ARTEQ) Announces First Centralized Exchange Listing on BitMart

Vienna, Austria, 19th July, 2022, Chainwire Exciting news for crypto enthusiasts seeking to invest in NFT as an alternative asset class, artèQ token is getting its first listing on CEX. The artèQ NFT Investment Capital today announced its centralized exchange listing on BitMart. artèQ’s native utility token, $ARTEQ, will get listed for trading on BitMart, a leading crypto exchange with millions of users globally. As the first centralized exchange to list artèQ, BitMart lets users trade the ARTEQ/USDT pair. BitMart users can trade cryptocurrency instantly with an advanced security system and user-friendly interface. “artèQ is reaching a major milestone with its first centralized exchange listing on BitMart. This is a key part of our strategy to democratize access to digital assets as invest...

100X Bitcoin energy use would mean ‘absurd’ $20M BTC price — developer

A new contributor to the Bitcoin (BTC) energy debate says that 1 BTC would have to cost $20 million to use 100 times its current energy demands. In a Twitter debate on July 18, Sjors Provoost, a Bitcoin developer and author of “Bitcoin: A Work in Progress,” cast doubt on the largest cryptocurrency’s future energy use. Bitcoin could survive on “waste energy breadcrumbs” How much energy Bitcoin uses to survive has become a topic of friction which has gone from within the industry to global government. Throughout the process, Bitcoin proponents have complained that a combination of bias and lack of understanding of network principles are leading those in power to make incorrect conclusions about how and why Bitcoin uses the energy it does. While critics argue that Bitcoin must red...

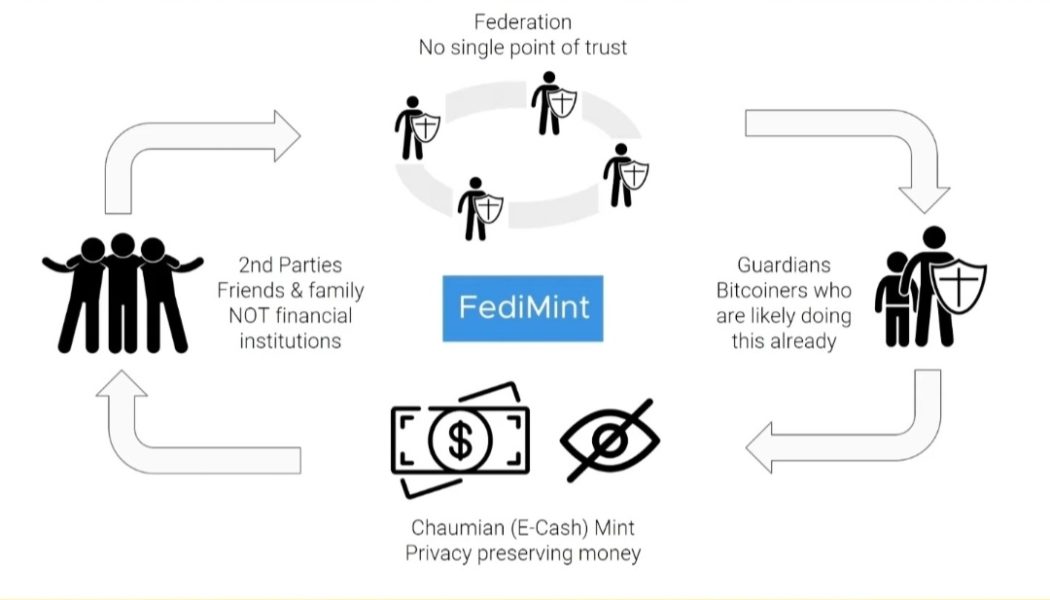

Bitcoin is for billions: Fedimint on scaling BTC in the global south

“Bitcoin is for billions, not billionaires,” a phrase first coined by investment researcher Lyn Alden, could soon become a reality, according to Fedimint. The protocol that aims to scale Bitcoin (BTC) while making it more private, has been buoyed by a $4.2 million seed round for the Fedi application. Cointelegraph spoke to Obi Nwosu, co-founder and CEO of Fedi, about the “incredible group of inspiring people who we are working with to support their activities to increase the freedoms of some of the most oppressed regions of the world,” and why the mobile app Fedi could solve issues related to scaling, custody and privacy. Lyudmyla Kozlovska, head of the Open Dialogue Foundation — which focuses on supporting people in post-soviet Europe — Farida Bemba Nabourema, a Togolese human right...

Circle CSO lays out policy principles for stablecoins in US

Dante Disparte, Circle’s chief strategy officer and head of global policy who has previously testified at congressional hearings, has called on United States lawmakers to balance the risks with developing a regulatory path for stablecoins. In a Monday blog post, Disparte named 18 principles Circle had established as part of its effort to shape stablecoin policy in the United States. Circle, the company behind USD Coin (USDC) with a reported $54 billion in circulation, highlighted privacy concerns, “a level playing field” between banks and non-banks over a U.S. dollar-pegged digital currency, how stablecoins can coexist alongside a central bank digital currency, and the need for regulatory clarity. “Harmonizing national regulatory and policy frameworks for dollar digital currencies advances...

3AC liquidators seek time, access to headquarters as Genesis, Algorand ties are untangled

The liquidators of failed crypto hedge fund Three Arrows Capital (3AC) have filed an application in the High Court of Singapore for a stay on claims against 3AC and access to the company’s Singapore headquarters. The liquidators said in the 1,157-page document that a court decision is needed in light of the number legal proceedings that may arise in the near future and the “virtual radio silence from the management/directors of the Company.” According to the July 9 application, the Singapore office may contain cold wallets or information on how to access 3AC trading accounts, which the liquidators want to access before any of it is removed or destroyed. The application lists previous unsuccessful efforts to obtain information from company directors Su Zhu and Kyle Davies and their represen...

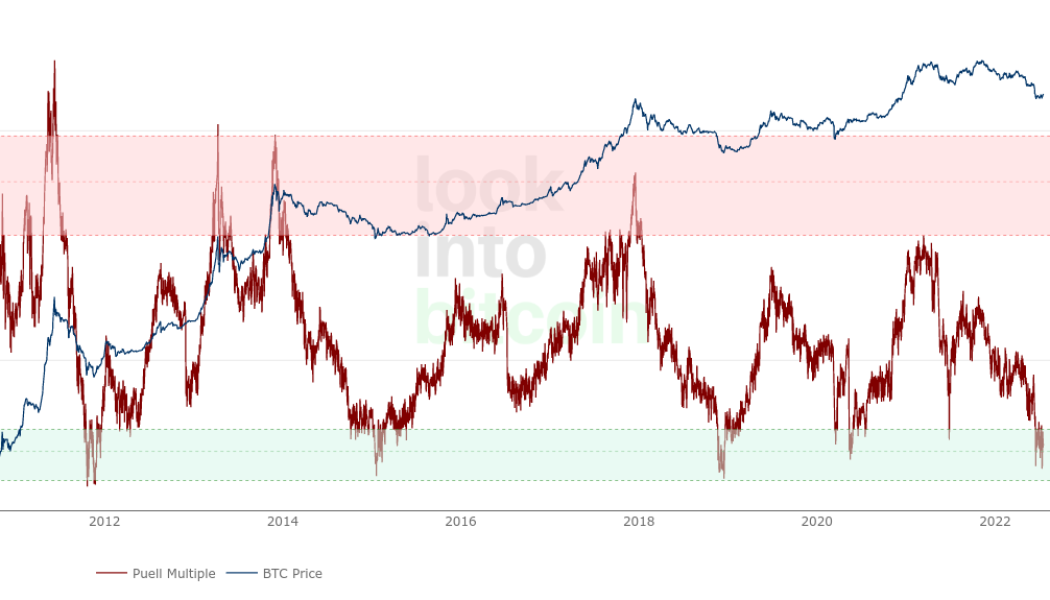

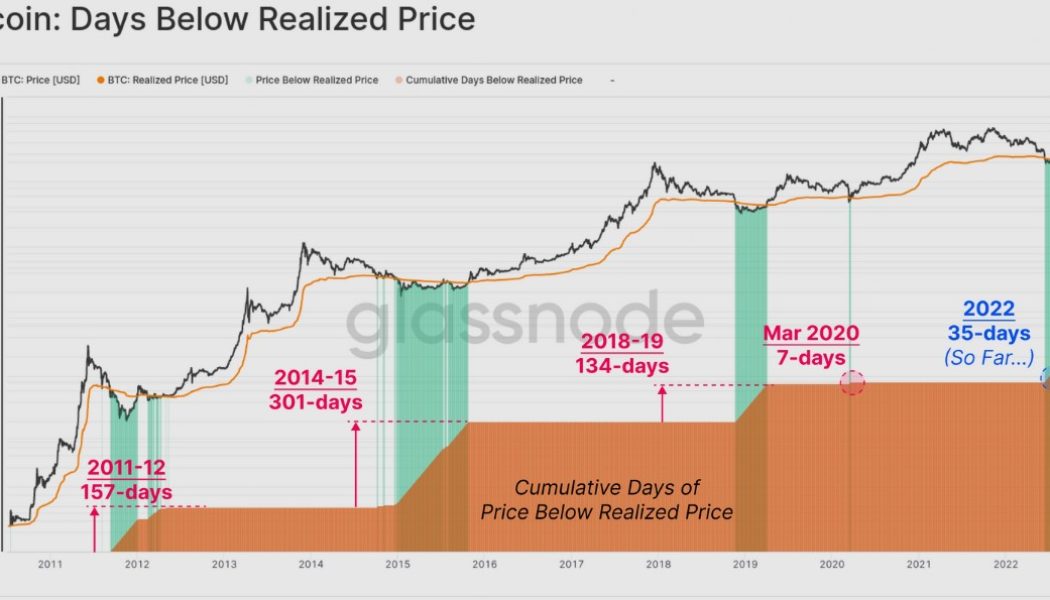

Data points to a Bitcoin bottom, but one metric warns of a final drop to $14K

“When will it end?” is the question that is on the mind of investors who have endured the current crypto winter and witnessed the demise of multiple protocols and investment funds over the past few months. This week, Bitcoin (BTC) once again finds itself testing resistance at its 200-week moving average and the real challenge is whether it can push higher in the face of multiple headwinds or if the price will trend down back into the range it has been trapped in since early June. According to the most recent newsletter from on-chain market intelligence firm Glassnode, “duration” is the main difference between the current bear market and previous cycles and many on-chain metrics are now comparable to these historical drawdowns. One metric that has proven to be a reliab...

RUNE Pumps 18% as THORChain deactivates non-native tokens

Cross-chain exchange and proof-of-bond network THORChain has finally activated the killswitch that will progressively wind down support of the BEP-2 and ERC-20-based variants of the RUNE token. BNB.RUNE, and ETH.RUNE, also known as IOU Tokens, are being swapped out for the upgraded and completely native RUNE token after THORChain’s long-awaited mainnet late last month. Moving forward, these tokens will progressively lose their value over the next 12 months as the project aims to foster adoption of its fully unified variant of RUNE, enabling stronger asset interoperability. Users who hold their IOU Tokens on centralized changes will have their tokens automatically upgraded to the new native RUNE. Those who keep their tokens in private wallets must create a new wallet supported by THOR...