crypto blog

Coinbase stock falls 5% pre-Wall Street as Bitcoin price dip adds to Super Bowl woes

United States cryptocurrency exchange Coinbase (COIN) has seen its shares dive 5% pre-trading after a calamitous advertising debut at the Super Bowl 2022. Data from Cointelegraph Markets Pro and TradingView showed COIN preparing to open at $194.53 before Monday’s Wall Street open. Snowden: Coinbase crash “so very internet” The Super Bowl 2022 was an event to remember for crypto investors, with several of the exchange industry’s biggest names airing full-scale ad pitches. For Coinbase, however, the publicity quickly turned sour as the platform’s website and app both crashed following promises of a $15 giveaway made in the ad itself. @coinbase just saw more traffic than we’ve ever encountered, but our teams pulled together and only had to throttle traffic for a few minutes. We are now ...

UK taxman seizes NFTs in a $1.89 million tax fraud probe

The UK tax authority seized three NFTs in relation to suspected VAT fraud Three persons have been arrested in connection to the incident The HMRC cautioned against attempts to conceal assets using crypto The United Kingdom’s tax authority, Her Majesty’s Revenue and Customs (HMRC) has conducted an NFT seizure in a suspected event of VAT repayment fraud. According to a report first sent out by BBC, the HMRC confiscated three NFTs & $6,750 worth of other crypto assets and arrested three individuals with alleged involvement in the $1.89 million swindling attempt. The tax authority did not reveal the names of the individuals but said they used 250 illegitimate firms to conduct the suspected fraud. Following the apprehensions, the authorities have established an investigation into the f...

Netflix announces new series on Bitfinex hack involving 120,000 Bitcoin

Streaming and production giant Netflix will soon produce a documentary series on the infamous Bitfinex hack — one of the biggest financial crimes from 2016 stealing 119,756 Bitcoin (BTC) — worth $72 million at the time. The Netflix documentary will be centered around a New York-based couple and their link to laundering nearly 120,000 BTC tied to the crime. According to Netflix, the documentary will be directed by American filmmaker Chris Smith with Nick Bilton as the co-executive producer. The announcement read: “Netflix has ordered a documentary series about a married couple’s alleged scheme to launder billions of dollars worth of stolen cryptocurrency in the biggest criminal financial crime case in history.” The plot is based on two main characters — Ilya Lichtenstein and Heather M...

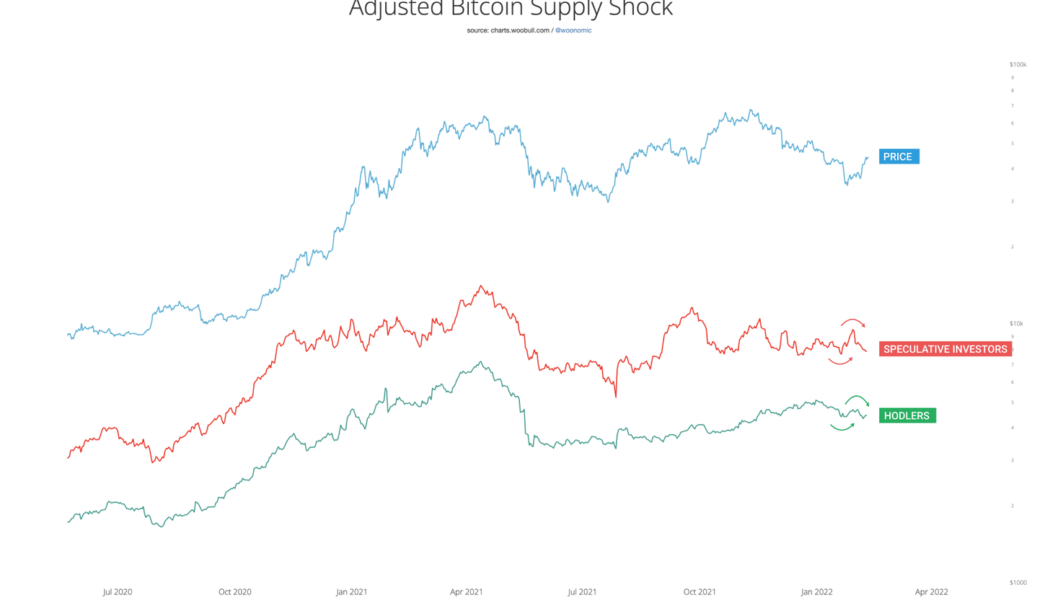

Bitcoin on-chain data hints at institutions ‘deploying capital’ at expense of ‘hodlers’

“Sophisticated passive buying” on Bitcoin (BTC) spot exchanges coincides with the trend of BTC leaving exchanges to cold storage. Adjusted Bitcoin supply shock. Source: Willy Woo The price recovery witnessed in the Bitcoin market across the last two weeks coincided with a rise in hodlers and speculative investors selling their coins, according to data provided by researcher Willy Woo. Nonetheless, BTC’s price ability to withstand the selling pressure meant there was buying pressure coming from elsewhere. As Cointelegraph reported earlier this week, so-called Bitcoin whales are accumulating BTC at current price levels. “This selling is contrasted by exchange data showing sophisticated passive buying on spot exchanges and movement of coins to whale-controlled wallets,...

Laundering via digital pictures? A new twist in the regulatory discussion around NFTs

On Feb. 6, the United States Department of the Treasury released a report under the headline “Study of the facilitation of money laundering and terror finance through the trade in works of art.” In fact, only a tiny fraction of the 40-page document is dedicated to the “Emerging Digital Art Market,” by which the department understands the market for nonfungible tokens, or NFTs. Still, even a brief mention of the emerging NFT space in this context can have major implications for the tone of the nascent regulatory debate with regard to the asset class. What the report said The overall tone of the report is hardly alarming for the NFT space: The document casually mentions the growing interest in the digital art market both from private investors and legacy institutional players such as a...

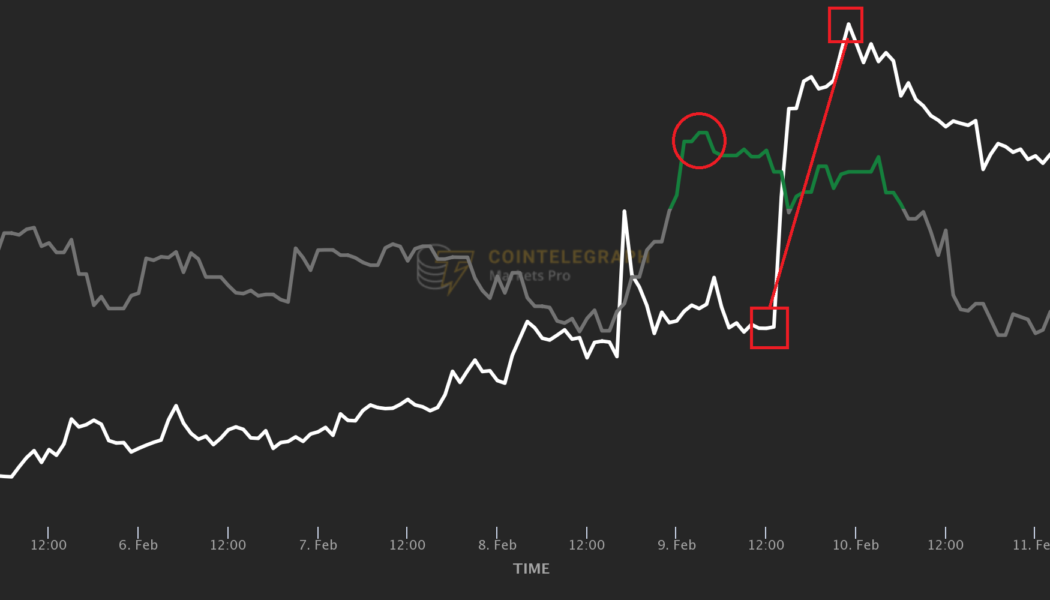

Here’s how traders got alerted to some of the biggest rallies of this week’s resurging market

This crypto winter wasn’t a very long one. Having briefly touched $34,000 in the second half of January, Bitcoin (BTC) is on its way up again, touching the $45,000 mark on Feb. 10. Many altcoins have been catching up as well and posting double-digit weekly returns. However, not all relief rallies were equally impressive. Is there a way for traders to pick the assets that are about to pull off the strongest rebounds? Luckily, bullish marketwide reversals tend to look similar in terms of both price movement and other variables that shape market activity: rising trading volumes, spikes of online attention to individual tokens, and the elevated sentiment of social media chatter around them. Furthermore, the conditions that underlie individual assets’ rallies in a resurging crypto market often ...

Weekly Report: Ether price could pull back to $1,700 as per Bloomberg’s February Crypto Report

Bloomberg analysts predict Ether to retreat to $1,700 before surging again Bybit exchange has announced a partnership with Cabital to bring more on-ramp integrations Canadian lawmaker tables bill to promote the growth of the cryptocurrency industry The cryptocurrency sector saw it all in the second week of February – from volatility in the market to major partnerships within the industry. Here is a rundown of the major stories that you might have missed Bloomberg analysts foresee Ethereum sliding back to $1,700 As markets struggle to recover from the January dump, Ethereum could not yet be out of the woods. A team of Bloomberg analysts has predicted that the second-largest crypto asset is likely to crash to $1,700, though the fundamentals are expected to remain unaffected. The Crypto Outlo...

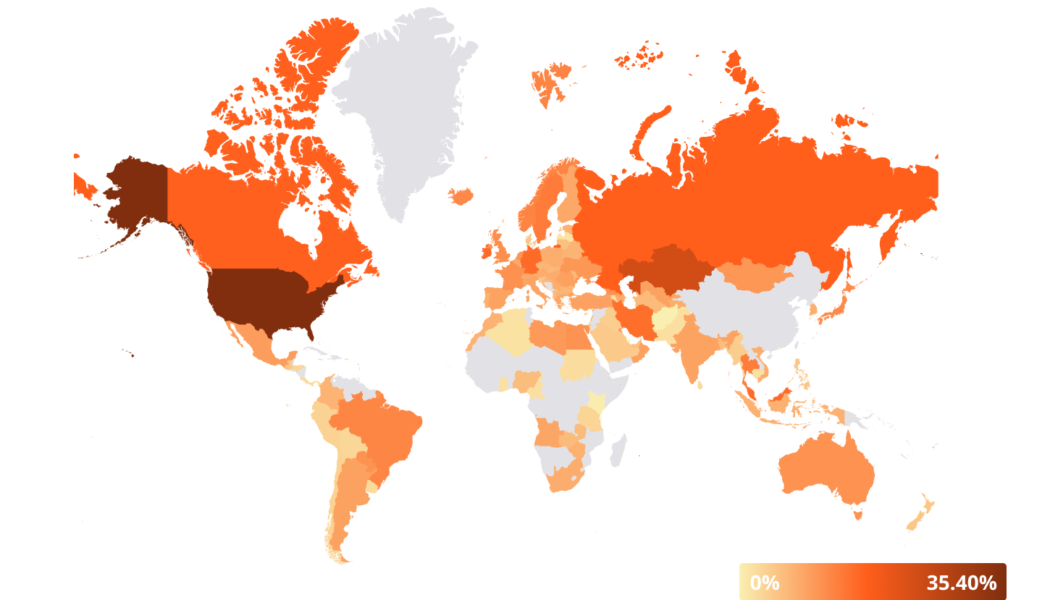

4 factors to consider when choosing an industrial-scale Bitcoin mining location

Large-scale miners are the dominant players in Bitcoin (BTC) mining — we should know because we are one. Having scaled up from a set of mining rigs in my dorm room, our team at Genesis Digital Assets has grown to over twenty industrial-scale mining farms across the globe in just eight years. Every quarter, we continue to scale and build more. You may think that because mining happens digitally, you can plant a farm anywhere in the world. And while you can mine Bitcoin from anywhere, having on-the-ground operations takes more thought than just setting up shop wherever you like. Whether you’re looking to start your own farm or scouting out farms to invest in, location is going to be the make-or-break factor of your mining operations. Because it’s such a new industry and there’s no handbook f...

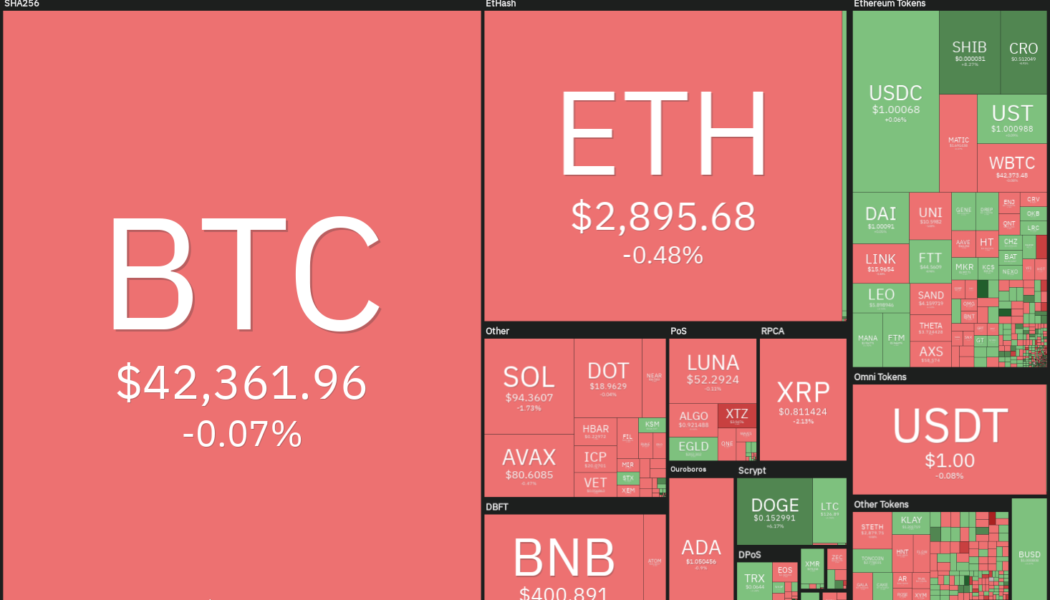

Top 5 cryptocurrencies to watch this week: BTC, XRP, CRO, FTT, THETA

Bitcoin (BTC) has given back some of its recent gains, but on-chain data resource Ecoinometrics said that whales are accumulating because they believe the price is attractive from a long-term perspective. On the downside, analyst Willy Woo believes that $33,000 is a strong bottom for Bitcoin. Popular Twitter trader Credible Crypto citing data from PlanC said that the odds of Bitcoin declining below $30,000 are poor. Crypto market data daily view. Source: Coin360 Fidelity Digital Assets Head of Research Chris Kuiper believes that Bitcoin’s downside risk could be minimal when compared to other digital assets, but it could rally substantially if it manages to replace gold as a store of value. Could Bitcoin and altcoins stage a recovery after the recent pullback? Let’s study th...

Injective Protocol (INJ) rallies 100%+ after launching cross-chain support for Cosmos

Trading perpetual futures contracts in decentralized apps is a crypto sub-sector ripe for growth, especially as discussions of regulation, taxation and mandatory KYC at centralized exchanges continue to take place. One DEX platform that has begun to gain traction is Injective (INJ), an interoperable layer-one protocol designed to facilitate the creation of cross-chain Web3 decentralized finance (DeFi) applications. Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $3.91 on Feb. 3, the price of INJ has rallied 157.8% to a daily high of $10.08 on Feb. 11 amidst a 1,756% spike in its 24-hour trading volume to $306 million. INJ/USDT 1-day chart. Source: TradingView Three reasons for the spike in demand for INJ include the addition of support for new assets i...

Love in the time of crypto: Does owning cryptocurrency make daters more desirable?

Cryptocurrency has become one of the most widely discussed topics of 2022. As such, it shouldn’t come as a surprise that mentioning “crypto” in an online dating profile may generate additional attention. A newstudy from brokerage firm eToro found that 33% of Americans who were surveyed would be more likely to go on a date with someone who mentioned crypto assets in their online dating profile. Out of the 2,000 adult residents in the United States between the ages of 18 and 99 surveyed, more than 40% of men and 25% of women indicated that their interest in a potential date is stronger when crypto is written on a dating profile. Crypto: What’s love got to do with it? Callie Cox, U.S. investment analyst at eToro, told Cointelegraph that the findings from eToro’s inaugural “Crypto & ...

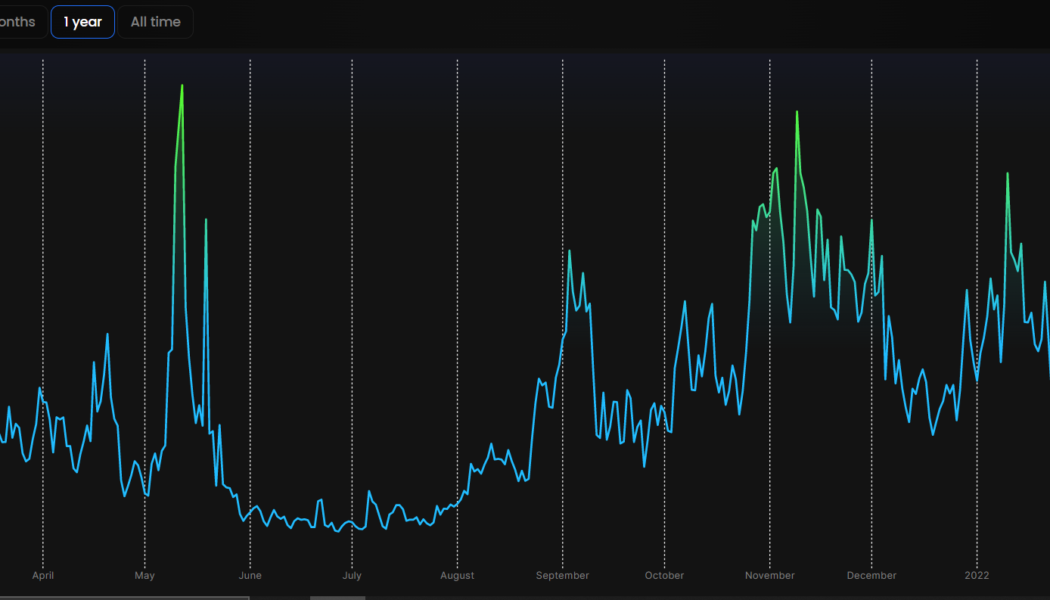

Ethereum’s average and median transaction fee slip, lowest in six months

The infamous transaction fees of the Ethereum (ETH) ecosystem underwent a decremental phase from Jan. 10 to record the lowest average and median fees of $14.17 and $5.67 — lowest since September 2021. Data from Blockchair shows that the average transaction fee of ETH in January was $53.03, which at its peak was $70.83 back in May 2021. Just within a month, the average fees saw an almost 73.3% decline as evidenced by the following chart. Additionally, the resultant median transaction fee also witnessed an 81.02% drop from January’s $29.88. In the last six months, ETH’s median transaction fee was seen lowest in September at $6.26. Interestingly enough, the transaction count of the Ethereum network has also come down to numbers that were last seen back in early 2019. Blockchair data sho...